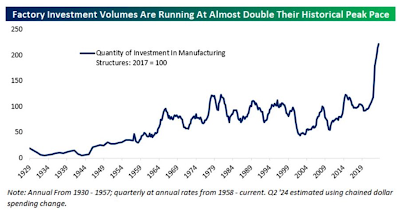

1. For those sceptical of industrial policy, this graphic appears to show a stunning transformation.

2. Interesting news that NIIF is backing an electricity smart meter solutions provider, IntelliSmart Infrastructure Pvt Ltd. Established in 2019 as a JV between NIIF and EESL, it's a digital solutions provider for power utilities smart meter networks.

I struggle to understand why NIIF should be using its scarce capital to finance such investments. The only reason I can imagine is that it wants to build a small portfolio of good bets that can entice other investors to put money in the funds sponsored by NIIF. But it's crucial for NIIF to ensure that such bets do not detract from the main purpose of de-risking investments in difficult or emerging infrastructure sectors.

3. Contrasting tales of two central banks. Prompted by concerns of weakening yen, Bank of Japan raised interest rates for only the second time since 2007.

The depreciating yen is the dynamic driving the BoJ's monetary policy actions.

The Bank of Japan has faced growing pressure this year to raise rates. Japan’s historically low interest rates — meant to encourage inflation during long periods when prices were barely growing — have weakened the yen. The low rates pushed some investors to seek higher returns overseas, particularly in the United States, where rates are much higher. The weakened yen has effectively bifurcated Japan’s economy: Large international corporations have benefited, while consumers and smaller domestic businesses have been squeezed. But warning signals flashed about diminished domestic consumption, and Japan has spent tens of billions of dollars this year buying yen to stabilize the currency...Over the past two decades, policymakers in Japan had largely aimed to stimulate the economy by raising inflation and keeping the yen weak. A devalued currency inflates the earnings of Japan’s big exporters and makes Japanese products more competitively priced abroad. For consumers, however, the yen’s decline has exacerbated already high prices, making imports such as food and fuel more expensive. Rising costs and the expectation of continued high prices have led consumers to cut back on spending. Smaller businesses have been squeezed by both reduced demand and increased costs.

But the week may be remembered more for the beginning of the reversal of the Great Tightening by central banks since 2020. The Bank of England cut rates for the first time since March 2020 by 25 basis points, and while the Fed did not cut rates, it has all but signalled its first rate cut in September. The ECB had cut rates in June.

4. Surprising that even as the government's capex is rising, that of PSUs has been declining.

It should be a matter of concern that despite the rising profits and astronomical stock valuations, PSU investments are declining.

As a reflection of the absurdity of the valuations - the BHEL's valuation imply it executing 25 GW of annual thermal capacity in perpetuity; or Cochin Shipyars delivering 9-13 aircraft carriers (US has 11 and China 3)!

5. This is a stunning statistic - the US consumer accounts for over a sixth of the global output!

Consumer goods companies have been in the centre of the inflationary wave that washed over the US in the past three years. Emerging from the pandemic, they faced tangled supply lines, soaring energy prices and a strong labour market that emboldened workers to demand higher wages. Most moved decisively to raise prices, contributing to increases of more than a quarter for groceries, consumer goods and restaurant food since 2019, according to government statistics. The companies’ sales, and in many cases profits, rose in tandem. Consumers in the US also helped feed the wave. Flush with excess savings thanks to the lockdowns and government stimulus payments of the pandemic, and then buttressed by the strong labour market, many households continued to spend freely even as goods prices rose. Even poorer households, usually the first victims of inflation, managed to keep up as wages rose faster than the inflation rate at lower income tiers. Now consumption is faltering. The shift has important implications for the largest economy in the world, two-thirds of which is driven by consumer spending.

6. Indonesia is an important pathway to break the Chinese stranglehold on the EV industry.

About 80 to 82 per cent of its battery-grade nickel output is expected to come from majority Chinese-owned producers this year, according to Benchmark Mineral Intelligence. This stems from Jakarta banning nickel ore exports in 2020 to force processors and battery makers to invest in the country. Chinese companies came forward quickly with billions of dollars. The investments have transformed the economy and made the nation a critical player in the global EV transition. Indonesia accounts for 57 per cent of global refined nickel production, and its share is forecast to rise to 69 per cent by the end of the decade, according to BMI. Only a handful of foreign companies that are not Chinese operate in the Indonesian nickel industry. Vale Indonesia has partnered with carmaker Ford on equity investments in a nickel smelter and is in talks with Stellantis about another smelter. China’s Huayou Cobalt is a partner in both projects.

7. As Olympics enters the Athletics week, John Burn-Murdoch has an excellent article on how the latest technology is impacting track events. In particular, the times in long-distance and track events have compressed rapidly after the introduction respectively of the super shoes in 2016 and super spikes later.

Interestingly, women tend to get a bigger boost than men from these shoes.But the advances in shoe technology have one crucial difference to the other technological tweaks that have modernised sports over the years. The benefits are not evenly distributed among competitors — even for those wearing the same shoes. The default comparison for sports in which engineering exerts a growing influence is Formula One, where the car plays an outsize role in determining the results and the sporting contest is between teams, not individuals. But in the case of F1 the same car would provide the same boost to different drivers. With super shoes, however, some runners get huge boosts while others find the cutting-edge footwear knocks them off their stride. Study after study has found that this variation between “hyper-responders” — those whose physiology or running style combines with the shoes to maximum benefit — and “non-responders” spans several percentage points. In races that are typically decided by much less than half a percentage point, that can be the difference between gold medal and also-ran. This variation in the advantage conferred by the shoes is akin to a new F1 racing car that is able to help left-handed people drive faster while slowing down right-handed drivers.

And this poses a big problem for the Olympic track events.

The result is that over the next week, we won’t really know whether the competitors with the fastest times are the fastest runners, or the fastest runners-plus-a-particular-pair-of-shoes. As sports scientist Ross Tucker puts it, it’s not only possible but likely that if you took two elite athletes each wearing a different pair of elite shoes, and swapped their footwear, you would get a different race result.

The controversy over the super shoes mirrors that with the use of the LZR full-body swim suits, that were subsequently banned.

Ahead of the 2008 Olympics in Beijing, Speedo introduced its LZR swimsuit, developed with assistance from NASA. The space agency noted that 25 world records in swimming were set during the Beijing 2008 Olympic Games, and that 23 were set by athletes wearing the LZR. The Olympics now calls those games "a moment when technology went too far." In a June post, the Olympics explained that the "super-suits" made of polyurethane or other non-textile materials were banned because they were seen to provide a greater advantage to larger athletes. In 2009, Michael Phelps — who won a record eight medals in 2008 in Beijing — missed out on two finals and barely qualified for a third as he swam in an old-style swimsuit. Reports from the time show that most other swimmers he competed against used faster, high-tech suits. FINA, now known as World Aquatics, in 2009 decided to ban the use of swimsuits with polyurethane during competitions. The rules, requiring textile-only fabric suits, went into effect in 2010. The guidance also says men's swimsuits "shall not extend above the navel nor below the knee and for women shall not cover the neck or extend past the shoulders nor shall extend below the knee."

8. The FT has an article that draws attention to the massive capex of the Big Tech companies as they pursue their AI-related endeavours.

Microsoft, Alphabet, Amazon and Meta all revealed massive increases in spending in the first six months of 2024 — totalling $106bn — in their latest quarterly earnings reports, as their leaders brushed off stock market jitters to pledge further investment hikes over the next 18 months… Their collective forecasts mean Big Tech’s AI-related investment could more than double by year-end. Analysts at Dell’Oro Group now expect as much as $1tn could be channelled into infrastructure such as data centres within five years, even though the companies have so far failed to convince investors that their customers are prepared to spend big on AI products and services…

Zuckerberg estimated the amount of computing power required to train its next large language model would be “almost 10 times more” than the previous version, even while conceding that it would be “years” before some of its AI features, such as its Meta AI chatbot, made any money “by themselves”. “In tech when you are going through transitions like this . . . the risk of underinvesting [in AI] is dramatically higher than overinvesting,” said Google chief executive Sundar Pichai. After Google’s parent Alphabet last week reported a 90 per cent surge in capital spending in the first two quarters of 2024 to $25bn, Microsoft on Tuesday responded with a 78 per cent increase to $33bn. Amazon’s investments in property and equipment during the first half of the year — which includes spending for its vast ecommerce and logistics network — jumped 27 per cent to $32.5bn, it disclosed on Thursday…

Much of the investment from Big Tech groups is going towards buying land and constructing new data centres for their cloud computing businesses. Huge sums are also being spent on hardware including the specialised clusters of chips — mainly made by Nvidia — needed to train and run large language models that underpin chatbots. Demand for cloud services has surged as companies trial generative AI services to automate processes and improve productivity, even if most of those experiments are yet to be put into full production. Meanwhile, start-ups like OpenAI, Anthropic, Elon Musk’s xAI and France’s Mistral are competing for scarce computing resources to train ever more advanced LLMs… The tech-dominated Nasdaq 100 index has climbed by around 70 per cent since the start of 2023, when AI fervour first began to take hold, making Apple, Microsoft, Nvidia, Alphabet and Amazon the five largest public companies in the world.

The big difference between the telecoms bubble at the turn of the century is that these companies have very profitable ongoing businesses and massive cash surpluses to afford such investments.

No comments:

Post a Comment