There were two important industrial policy decisions taken by the US government last week that underline its commitment to securing the supply chains for critical minerals. They also offer important lessons about the direction of industrial policy in general.

In the first, the US plunged into the rare earths industrial policy by taking a direct stake in a private rare earths firm and setting a price floor for its output.

The Pentagon last week said it had become the largest shareholder in MP Materials, operator of the Mountain Pass facility in California, which sent shockwaves through the industry and drove the company’s shares to record highs. The US government committed $400mn of direct investment in the Las Vegas-based company and guaranteed a decade-long price floor for its output at nearly double the current market rate. MP, led by founder James Litinsky, is also building a domestic magnet manufacturing facility… The arrangement is part of the White House’s drive to break the Chinese dominance of critical minerals and strengthen the domestic supply chain. It is rare for the government to make direct investments in businesses, and critics argue this deal went too far... Rare earths are vital to modern manufacturing and to the magnets used in high-tech industries, from electric cars to fighter jets. Low market prices have deterred western rare earth projects from coming online.

... the US government had overnight become the dominant “influence” in the market for the rare earth neodymium-praseodymium (NdPr oxide). The price floor for NdPr, which is used in magnets, has been set at $110 a kilogramme, almost double the current market price of about $60. The guarantee covers all the NdPr that MP would produce over 10 years… MP does not currently make magnets at commercial scale, but the US has also guaranteed to buy roughly 7,000 tonnes of magnets annually for a decade that the company would produce using its own NdPr at the as-yet unbuilt facility. Industry veterans say this volume far exceeded US defence demand. Despite industry unease, the rare earths agreement has drawn bipartisan support in Washington.

In the second decision, the US announced anti-dumping duties of 93.5% on the imports from China of anode active materials (graphite), a mineral vital to batteries in EVs. This increases the total US tariffs on Chinese graphite to 160%, and comes on top of the US Energy Department’s $750 million loan last year to the Australian company Novonix to construct the largest synthetic graphite factory in North America at Chattanooga.

Anodes are widely regarded as the most difficult part of the battery for the west to reduce its dependence on China, due to low prices and the near-complete dominance of Chinese groups over global supply. Chinese companies accounted for 95 per cent of the global anode market in the first five months of 2025, with South Korean companies, led by Posco and Daejoo, accounting for 2.7 per cent, and Japanese makers for 2 per cent, according to market information provider SNE Research. Tim Bush, a Hong Kong-based battery analyst at UBS, said efforts in Asia and North America to build a non-Chinese anode supply chain had been “undermined by US automakers’ unwillingness to underwrite the costs”. That reflects, in part, scepticism among battery and electric vehicle producers about the ability of North American producers to supply the battery-grade graphite they require.

The tariffs undoubtedly come at a significant incremental cost to the US consumers.

Given the current paucity of non-Chinese anode suppliers, the additional import costs are likely to sting Asian battery providers, including those serving American EV manufacturers such as Tesla, General Motors and Ford, with the extra costs potentially passed on to US consumers. An average EV battery contains 50 to 100 kilogrammes of graphite, meaning the new tariffs could deprive battery and EV makers of up to 20 per cent of the value of generous federal production credits that were introduced by the Biden administration and which survived the recent passage of President Donald Trump’s “One Big Beautiful Bill”.

Incidentally, the US decision comes even as China finalised new restrictions on the export of technologies essential for making cutting-edge lithium iron phosphate (LFP) batteries, which have a low-cost chemistry composition.

What do these two examples inform us about the emerging trends in industrial policy?

The earliest industrial policy actions were regulatory, primarily in the form of infant industry protection measures, by way of outright bans and prohibitive tariffs. Industrial policy of the kind pursued by the East Asian economies has focused on capital subsidies and fiscal concessions aimed at firms. The Chinese expanded their boundaries further with economy-wide subsidies, cheap capital, regulations like hukou that assured a supply of cheap labour, economies of scale from operating in a massive market, and generally provided capital subsidies and fiscal concessions on a scale never before seen. The result is that global manufacturing sectors are either overwhelmingly dominated by their manufacturers or they far outcompete their peers from other countries.

This China problem means that traditional industrial policy instruments deployed by the East Asian economies are hardly sufficient. No country, except perhaps the US and that too only in certain sectors, can outspend the Chinese.

There’s a chicken-and-egg problem. There’s very little or no domestic manufacturing of good quality. Domestic manufacturers cannot match the very low prices of Chinese imports. In the absence of an assured domestic market, no investor or firm is willing to put money. This gridlock perpetuates Chinese dominance. It must be broken.

Accordingly, the US government's decisions to invest public funds and assure a floor price (for rare earths), and raise prohibitive tariffs and give state loans (for synthetic graphite) go beyond traditional industrial policy. It effectively creates a market that can support domestic manufacturing. But this comes at a higher cost (of production compared to the Chinese imports), which is passed on to the domestic consumers who must pay higher prices.

There are lessons for India. Traditional industrial policy must be complemented with market-making policies. Policies must be tailored to leverage the attractions of India’s massive market to incentivise domestic manufacturing. Apart from prohibitive tariffs and other barriers, this can be successful only with a mandate to purchase domestic produce.

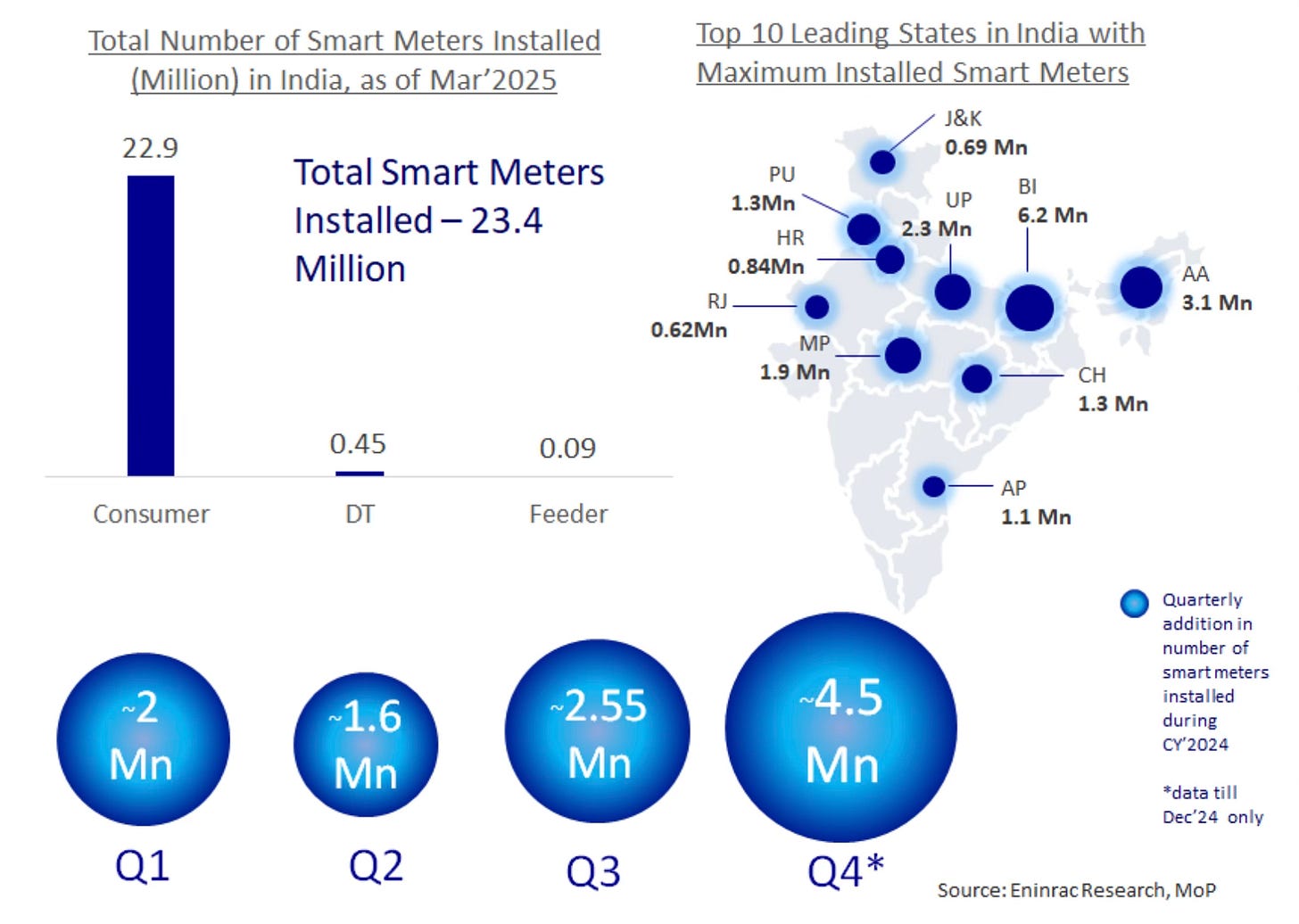

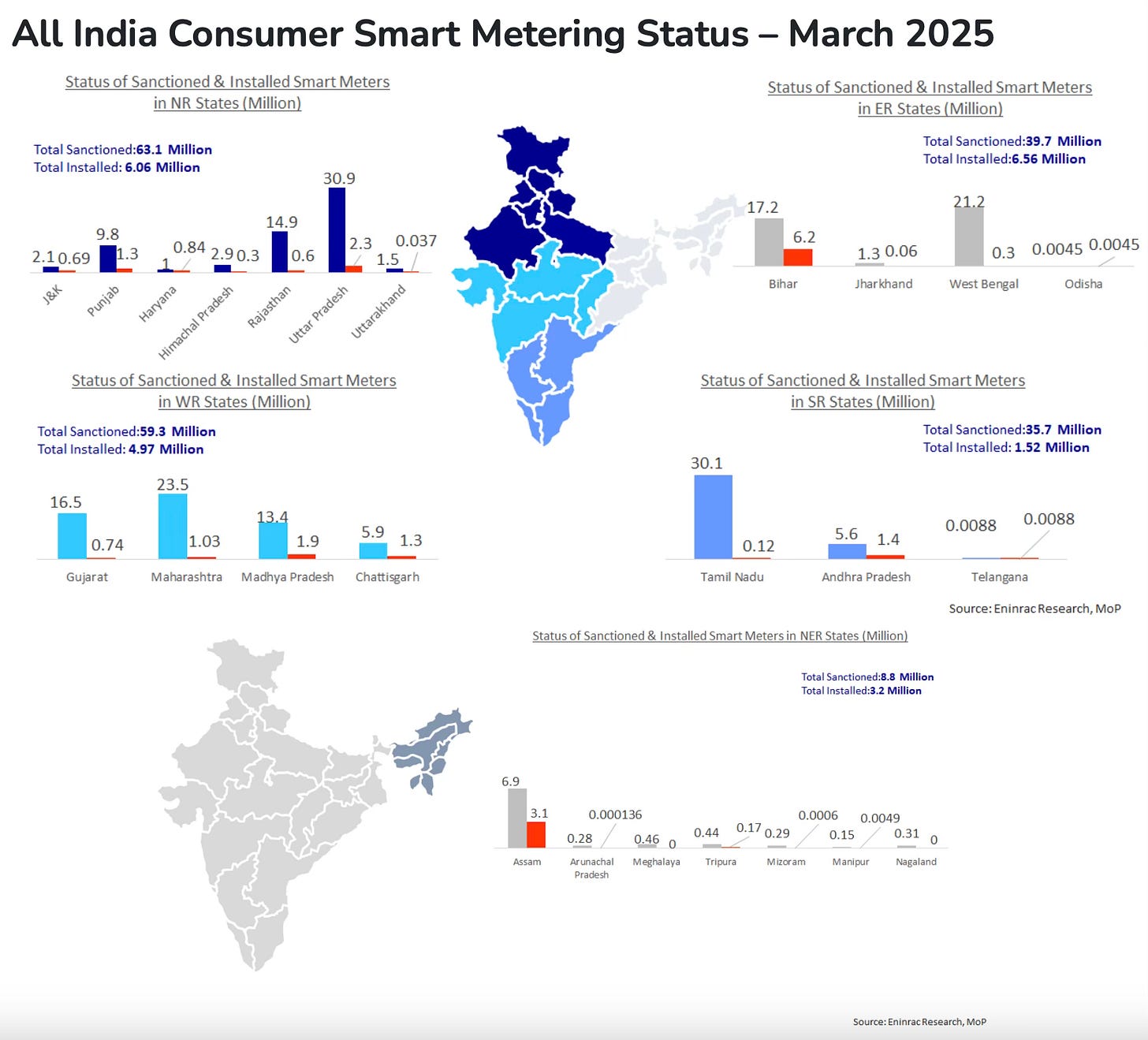

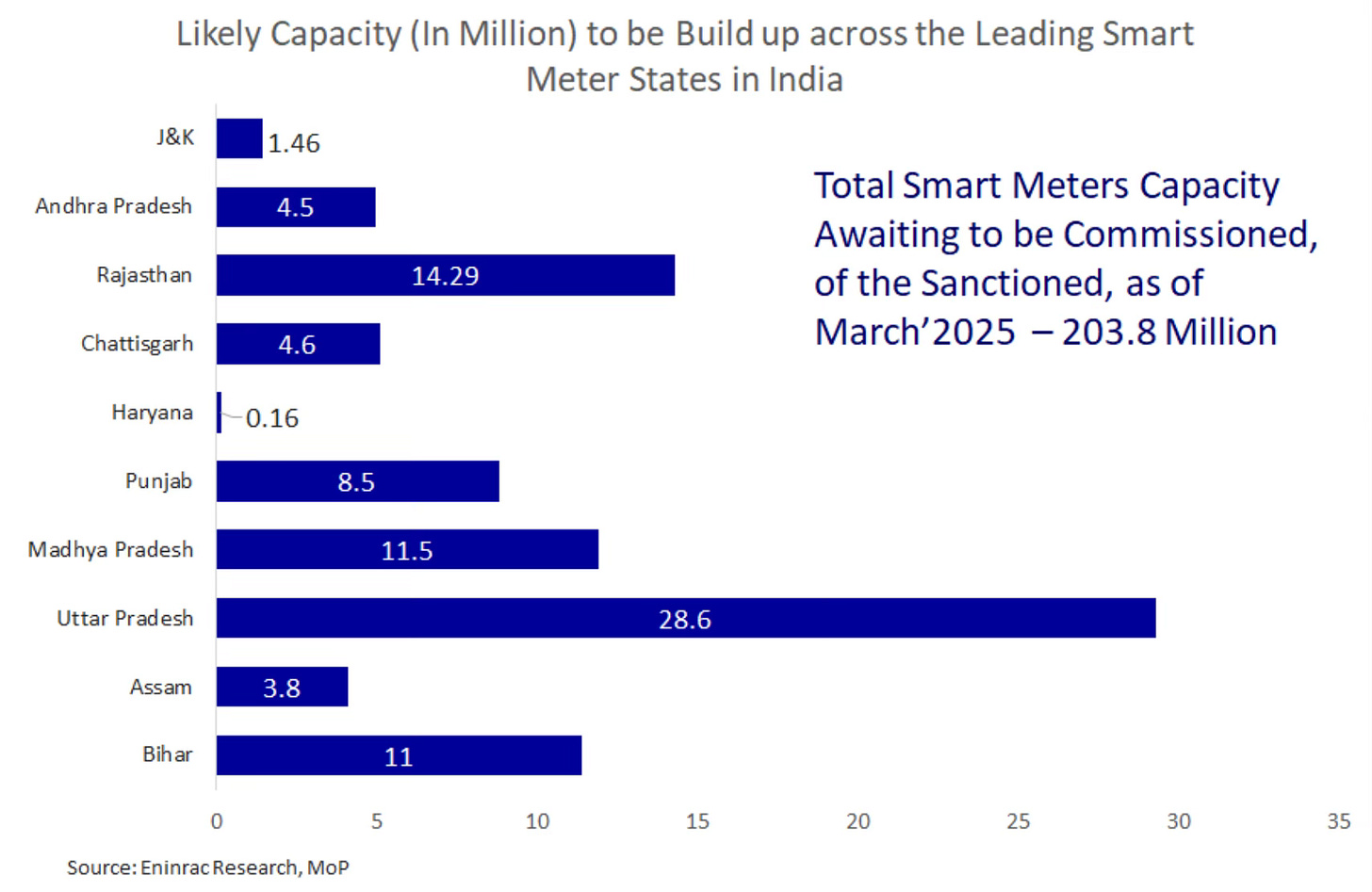

There are several product markets where market-making levers are available to the government. They include solar power and smart meters (where state-owned discoms are the monopsony buyers), telecom equipment (which are B2B markets), surveillance cameras and drones (which, while sold to consumers, also have a dual-use/security aspect). In these products, there’s a case for public policy to either mandate sales of domestic manufactured goods, or mandate a minimum domestic content, or raise disability bridging tariffs. Given the nature of these products and the volumes required, they are an unprecedented opportunity to catalyse a domestic ecosystem that covers the entire value chain involving component manufacturing, chip design, product design, and product manufacturing. Taken together, they have the potential to catalyse a serious deepening and broadening of India’s manufacturing base.

However, in many products, Indian manufacturers will not be able to meet the domestic demand and that too with quality. Further, the domestically made goods will come at a much higher price. This gridlock can be broken only gradually.

A prudent strategy would be to phase in the domestic purchases and domestic content requirements gradually. For example, the domestic manufactured equipment requirement can start with at least 5-10% in the first year, going on to 50-75% over five to seven years. Similarly, domestic content requirements can be progressively increased over time. Apart from facilitating the emergence of strong domestic manufacturing bases in these products, such phasing will also enable the domestic firms buying and selling these products to at least partially mitigate the high costs of domestic manufacturers.

Such measures will invariably generate opposition from trade partners and likely violate WTO commitments. However, it appears that there is no other alternative.

There’s a paradox with liberalised trade regimes. It’s like the bullies who favour the status quo. The US and the West created the WTO to institutionalise the prevailing global economic balance in their favour. The Chinese overcame this imbalance and turned it to their advantage. It’s therefore natural that they are now the most vocal supporters of the WTO.

The WTO status quo is not in the interests of a country building its manufacturing base. The Chinese largely ignored the WTO regulations while building up its manufacturing industry, while enormously benefiting from the global market access it provided. This hard reality must be recognised while pursuing industrial policy.