The impact of AI on the economy, especially on the labour market, is most likely to be the defining political economy issue of this generation.

In this context, it is useful to understand the trajectory of the evolution of jobs with technological changes over the last century or so. Daron Acemoglu and Pascual Restrepo have shown that roughly half of America’s employment growth between 1980 and 2010 came from the creation of entirely new occupations. They argue that the automation effect of the displacement of workers is offset by the reinstatement effect arising from the creation of new occupations.

David Autor, Caroline Chin, and Anna Salomons have a paper which examined the substantive content of emerging job categories (or new work) over the 1940-2018 period in the US, where it comes from, and its effect on labour demand. Augmentation innovations are those that increase capabilities, quality, variety, or utility of the outputs of occupations, thereby generating new demands for worker expertise and specialisation. They constructed a database of new job titles linked both to US Census microdata and to patent-based measures of occupations’ exposure to labour-augmenting and labour-automating innovations.

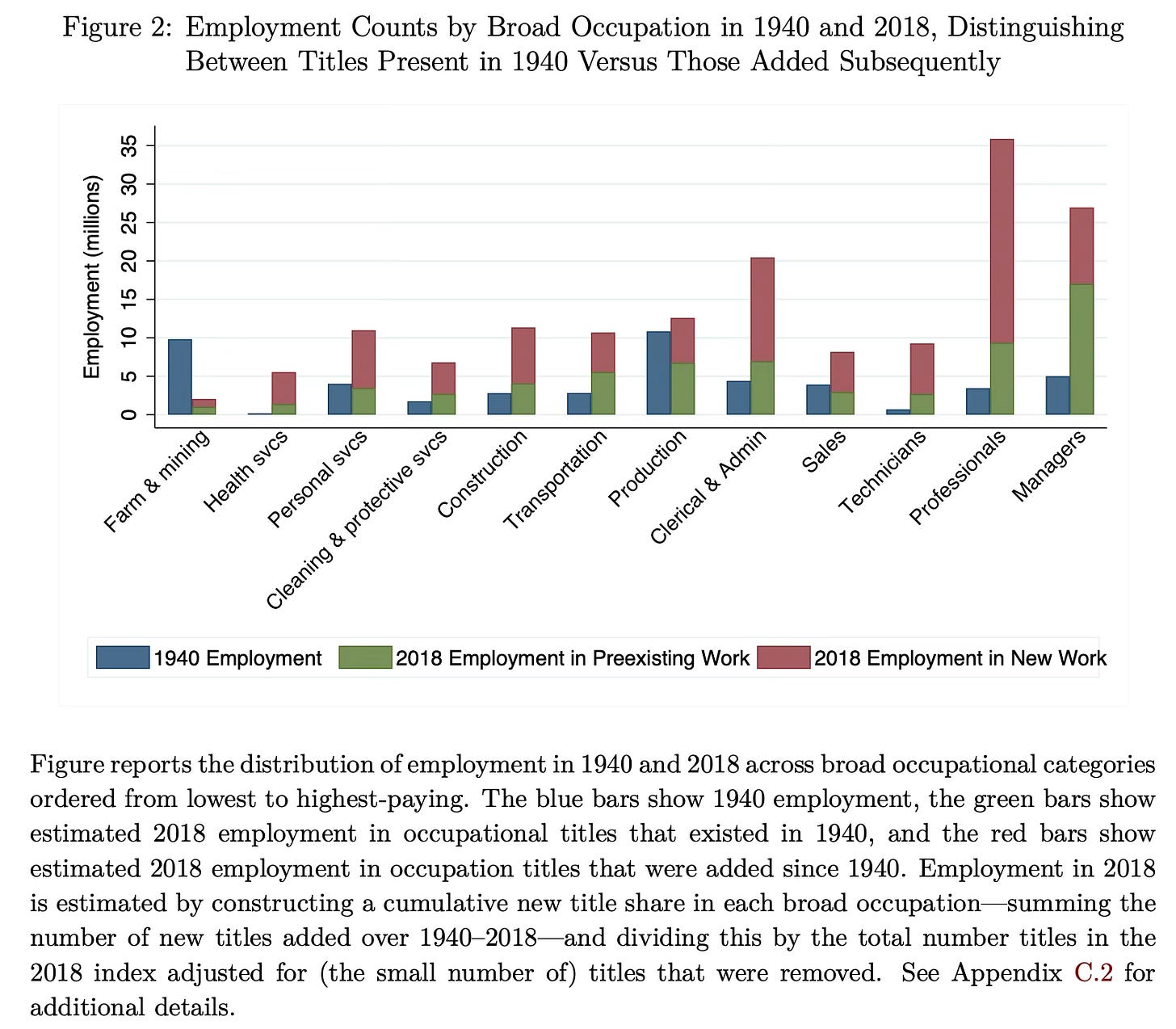

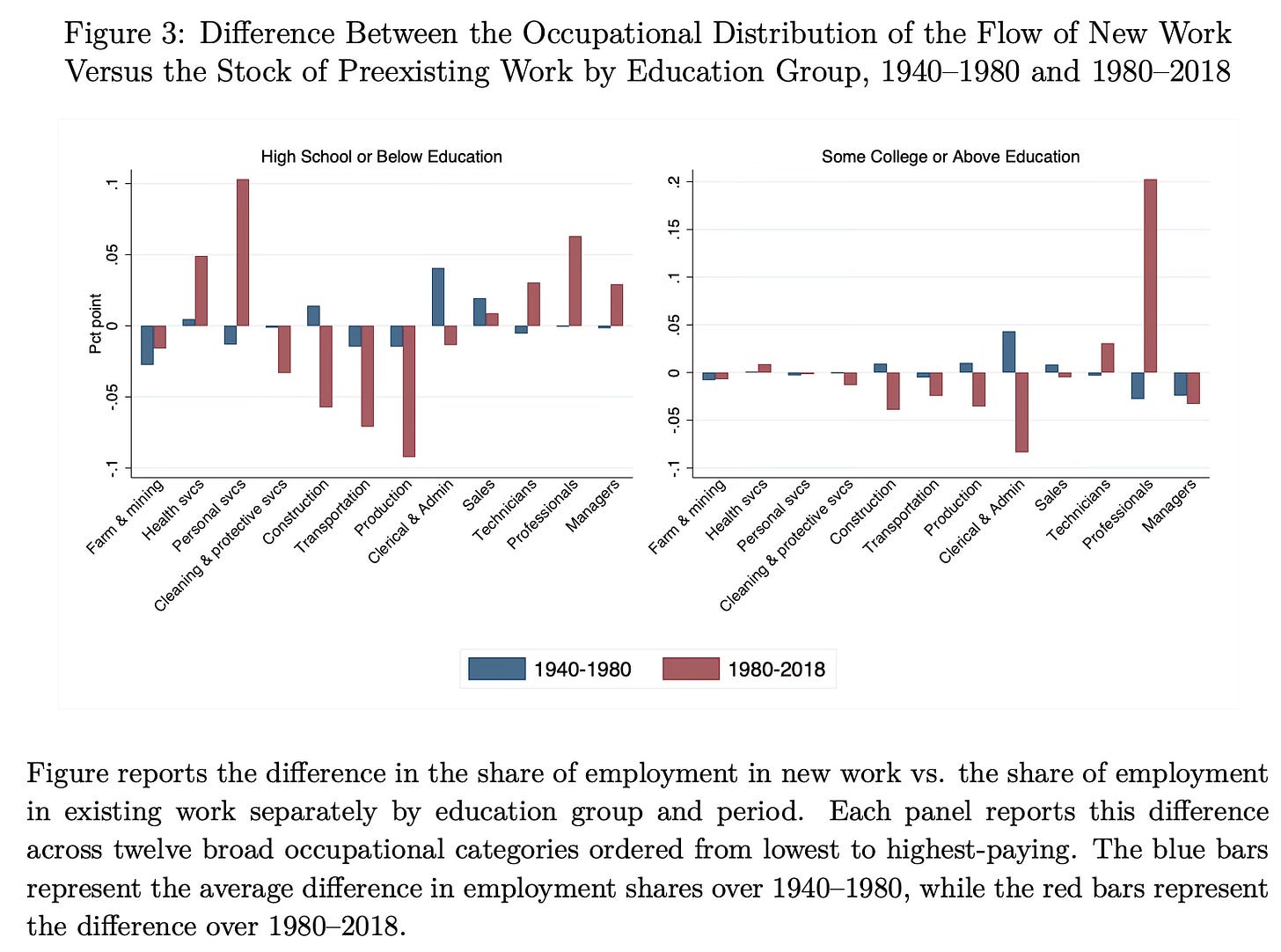

We find, first, that the majority of current employment is in new job specialties introduced after 1940, but the locus of new work creation has shifted—from middle-paid production and clerical occupations over 1940–1980, to high-paid professional and, secondarily, low-paid services since 1980. Second, new work emerges in response to technological innovations that complement the outputs of occupations and demand shocks that raise occupational demand; conversely, innovations that automate tasks or reduce occupational demand slow new work emergence.

Third, although flows of augmentation and automation innovations are positively correlated across occupations, the former boosts occupational labour demand while the latter depresses it… Employment and wagebills grow in occupations exposed to augmentation innovations and contract in occupations exposed to automation innovations… augmentation innovations increase occupational wagebills by boosting both employment and wages suggests that ‘new work’ may be more valuable than ‘more work’—plausibly because new work demands novel expertise and specialization that (initially) commands a scarcity premium… we establish that the effects of augmentation and automation innovations on new work emergence and occupational labour demand are causal. Finally, our results suggest that the demand-eroding effects of automation innovations have intensified in the last four decades while the demand-increasing effects of augmentation innovations have not.

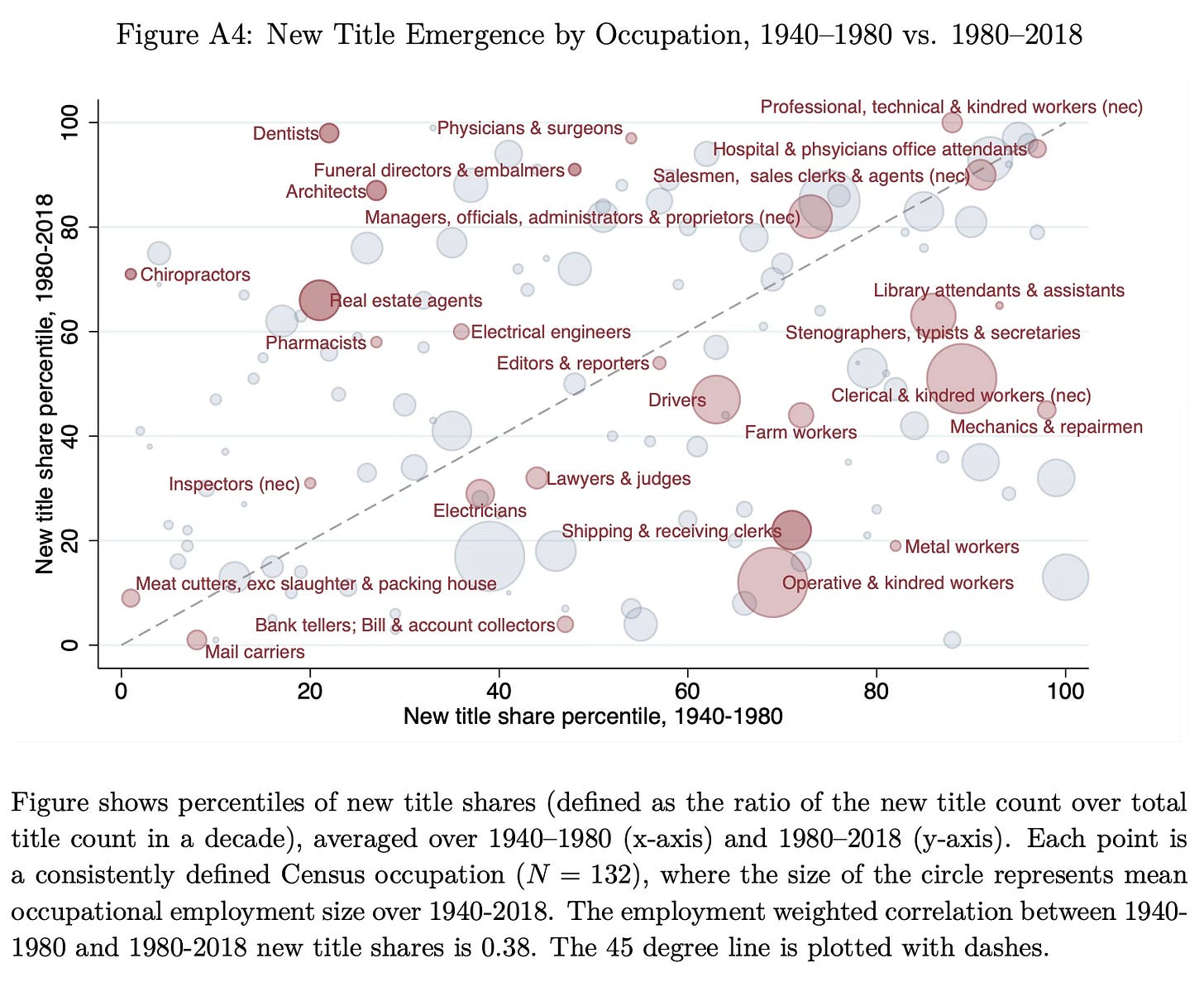

Routine task-intensive occupations gained substantial new titles between 1940-80, and few between 1980-2018.

What most stands out from this figure is the shifting fortunes of routine task-intensive occupations—both blue-collar occupations such as operative and kindred workers, metal workers, and mechanics; as well as white-collar occupations such as shipping and receiving clerks; stenographers, typists, and secretaries; bank tellers and bill and account collectors; and library attendants and assistants.

So what does this all mean for the labour market in the times of AI? In a much discussed essay, Dario Amodei, CEO of Anthropic, sounds alarm that AI could displace half all white collar jobs in 1-5 years.

The pace of progress in AI is much faster than for previous technological revolutions. For example, in the last 2 years, AI models went from barely being able to complete a single line of code, to writing all or almost all of the code for some people—including engineers at Anthropic. Soon, they may do the entire task of a software engineer end to end… it just implies the short-term transition will be unusually painful compared to past technologies, since humans and labor markets are slow to react and to equilibrate... AI will be capable of a very wide range of human cognitive abilities—perhaps all of them. This is very different from previous technologies like mechanized farming, transportation, or even computers. This will make it harder for people to switch easily from jobs that are displaced to similar jobs that they would be a good fit for…

AI is increasingly matching the general cognitive profile of humans, which means it will also be good at the new jobs that would ordinarily be created in response to the old ones being automated… Across a wide range of tasks, AI appears to be advancing from the bottom of the ability ladder to the top. For example, in coding our models have proceeded from the level of “a mediocre coder” to “a strong coder” to “a very strong coder.” We are now starting to see the same progression in white-collar work in general… AI, in addition to being a rapidly advancing technology, is also a rapidly adapting technology… Early in generative AI, users noticed that AI systems had certain weaknesses… But pretty much every such weakness gets addressed quickly— often, within just a few months.

However, in a recent issue, The Economist disputed such alarming prognostications.

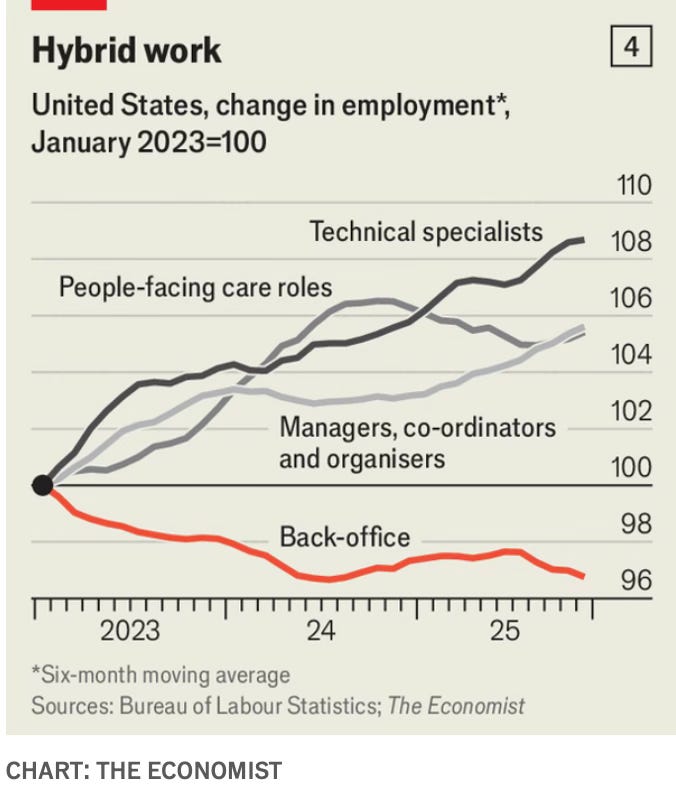

We analysed employment and wage trends across more than 100 large white-collar occupations in America since the second half of 2022. Employment across the sample has risen by 4% and real wages by 3%. To get a sense of AI’s impact on different roles, we used occupational descriptions to classify white-collar roles into four groups depending on the bundles of tasks involved: technical specialists, managers and co-ordinators, care workers, and back-office employees. We then tracked employment in each group starting in late 2022, using six-month moving averages.

Roles that combine technical expertise with oversight and co-ordination have enjoyed the biggest gains. Employment among project managers and information-security experts has risen by 30% or so. Other occupations which combine deep expertise in maths-related fields with problem-solving are also thriving. So are jobs which involve interpersonal care work and those which demand judgment and co-ordination. Only routine back-office work has shrunk. Over the past three years or so the ranks of American insurance-claims clerks have shrunk by 13% and those of secretaries and admin assistants by 20%.

It also finds AI generating all-new jobs - data annotators, forward-deployed engineers, chief AI officers, and mainly those without settled names (“other occupations”).

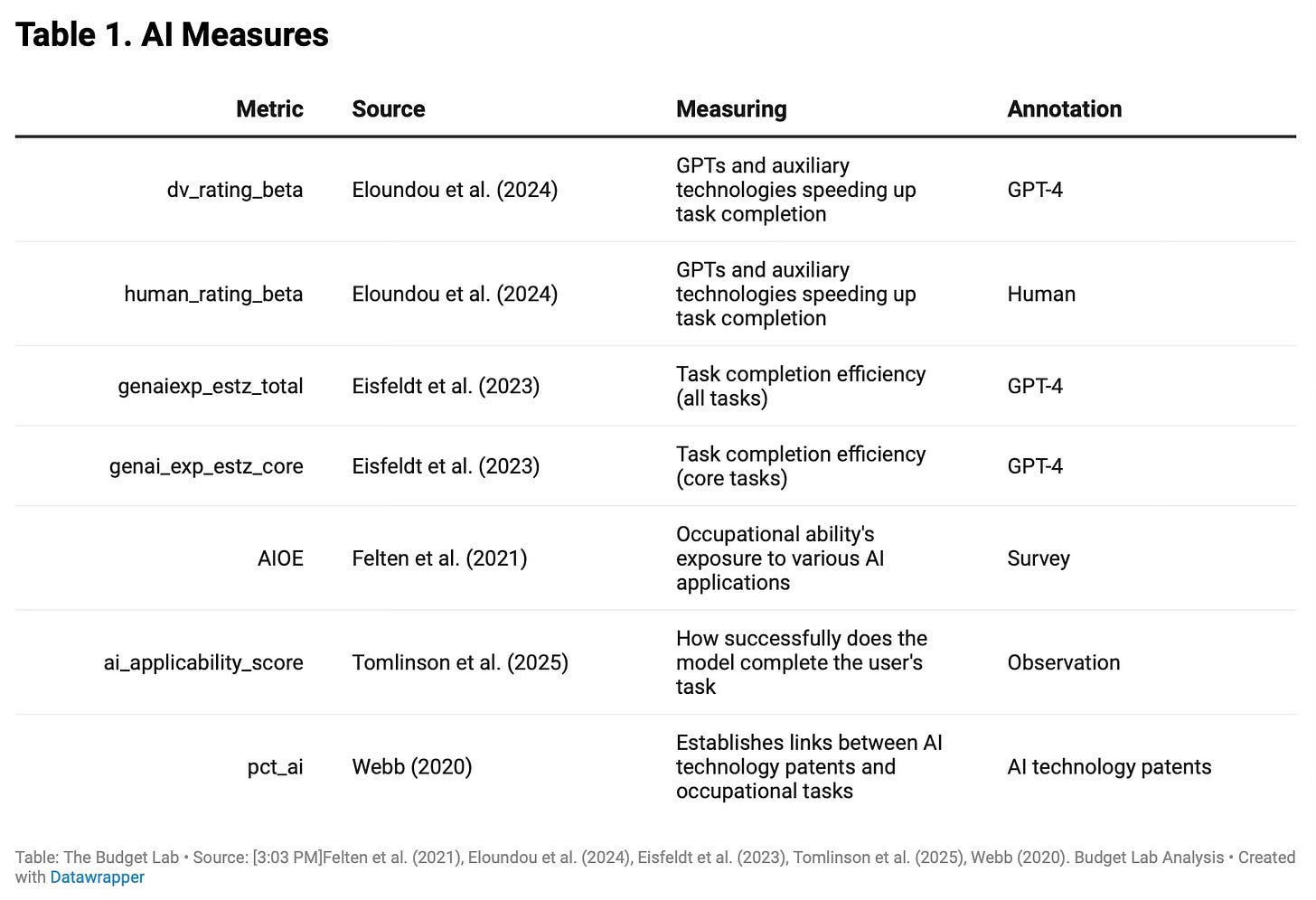

On the impact of AI on jobs, the Yale Budget Lab has a meta-study that compares evidence from across studies. It uses seven different measures of occupation-level AI exposure calculated by researchers and urges caution in reading too much into the findings. These measures are based on human and AI assessments of whether a job’s constituent tasks can theoretically be performed by an LLM, linking tasks with AI-related patents, and using real-world data on how LLMs are being used to carry out particular work-related tasks.

Its headline findings:

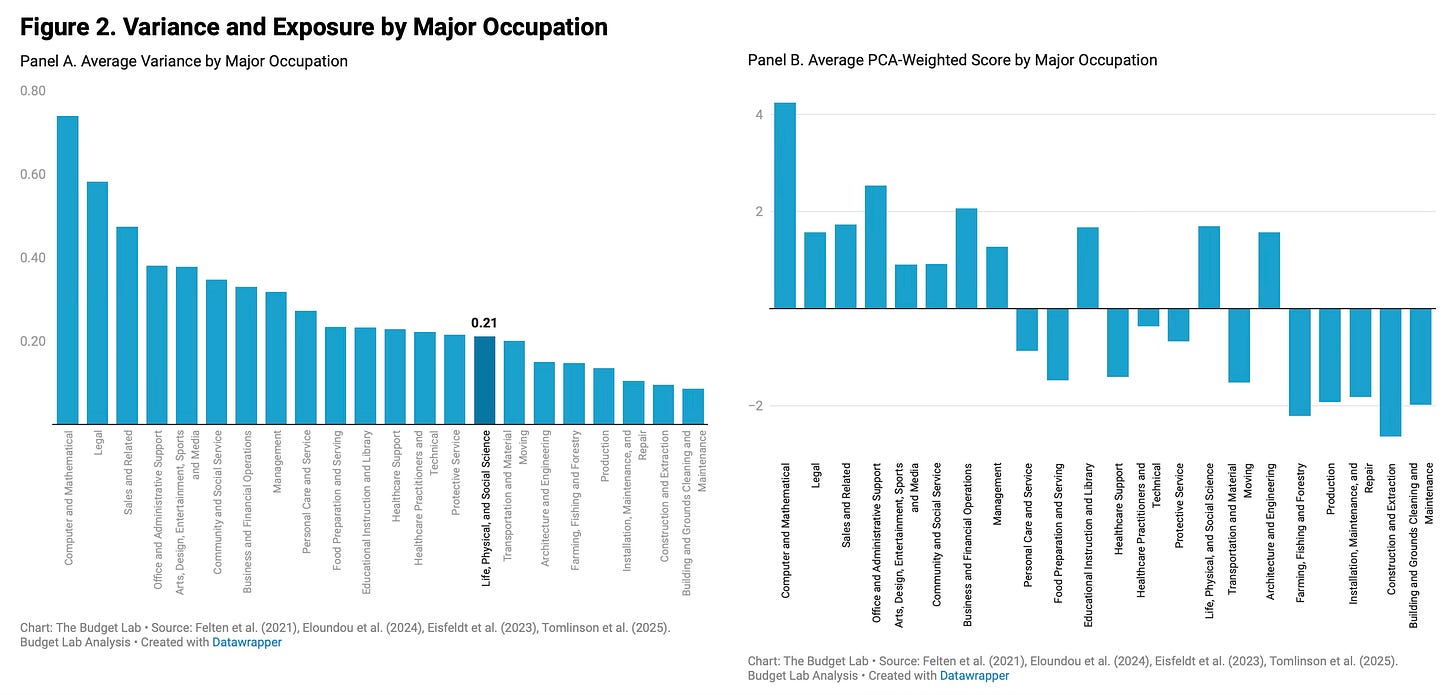

AI exposure metrics broadly agree with each other, but they disagree with each other more on highly exposed occupations. The key point of disagreement between different AI exposure metrics is in the magnitude of exposure, not whether an occupation is exposed. Occupational exposure to AI is not indicative of a jobs AI will automate out of existence. Rather, it indicates places in the labor market where AI could have an impact.

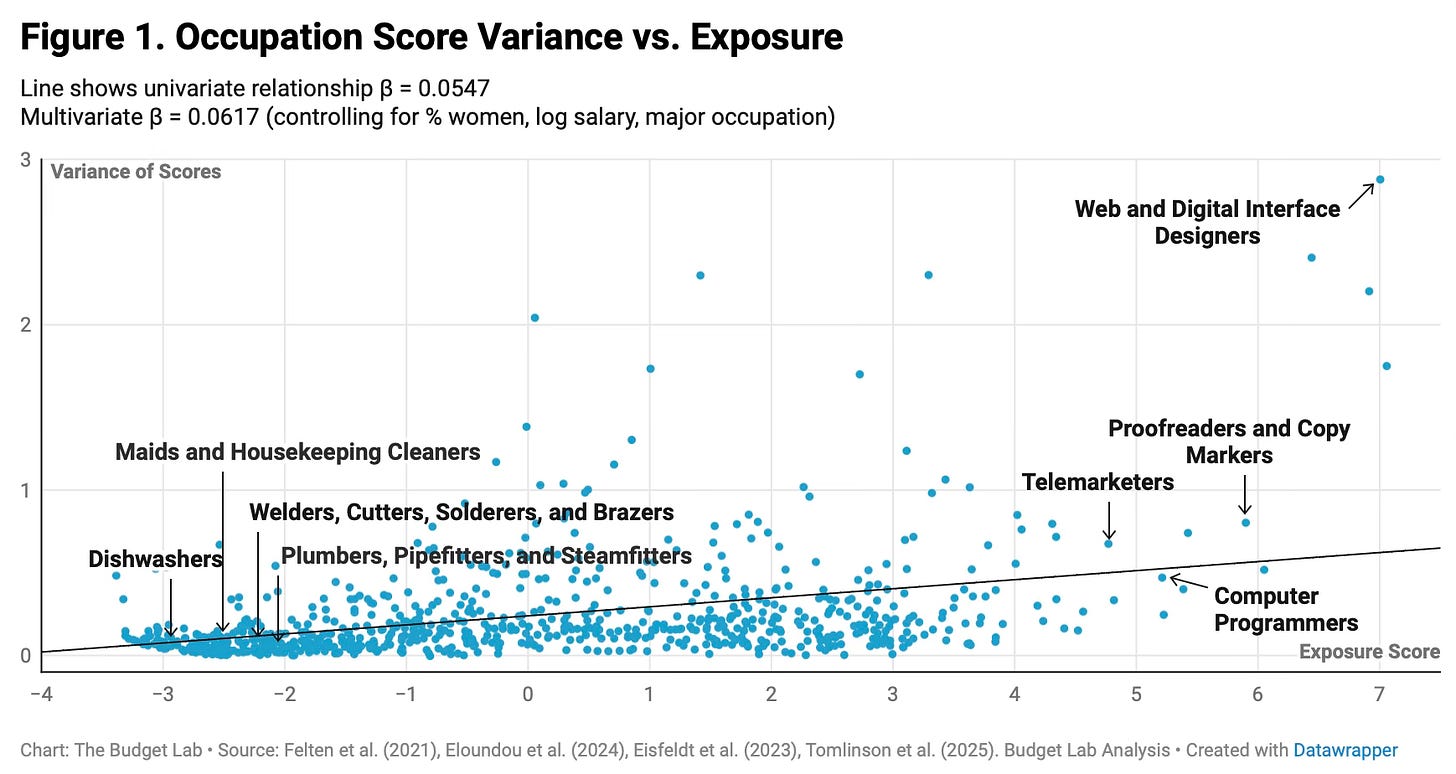

The study uses each occupation’s exposure and variance across the various scores, with low variance pointing to a consensus on exposure. They regressed the two and found greater disagreement for highly exposed occupations, “driven more by how much an occupation is exposed more than whether it is exposed.”

Clearly, occupations focused on computational, text-based, or administrative work tend to have both higher variance and higher average exposure, whereas manual fields like construction and maintenance have lower disagreement and variance.

The high degree of variance and disagreements point to the perils of forming opinions on the trajectory of AI’s evolution and its impact on the labour market. The meta-study urges caution in drawing conclusions “about where AI disruption to the labor market could be going”.

John Burn-Murdoch and Sarah O’Connor in the FT point to a few perspectives that are important while considering the impact of AI. Specifically, they point to the nature of the AI exposure and the regulation of AI adoption.

It is more than 20 years since David Autor and his co-authors argued convincingly that, like the waves of technological change that came before, computerisation threatens jobs where workers are mainly performing tasks to meet a specification, but is a complement to those who determine the specification. Viewed through this lens, the AI revolution may pose less risk to (or even benefit) a software developer who exercises considerable autonomy over what they work on and how they do it, than to a warehouse worker who loses out to a new generation of AI-enhanced robots, or a retail sales assistant whose store is closed as technology drives ever more commerce away from brick and mortar stores and onto the web…

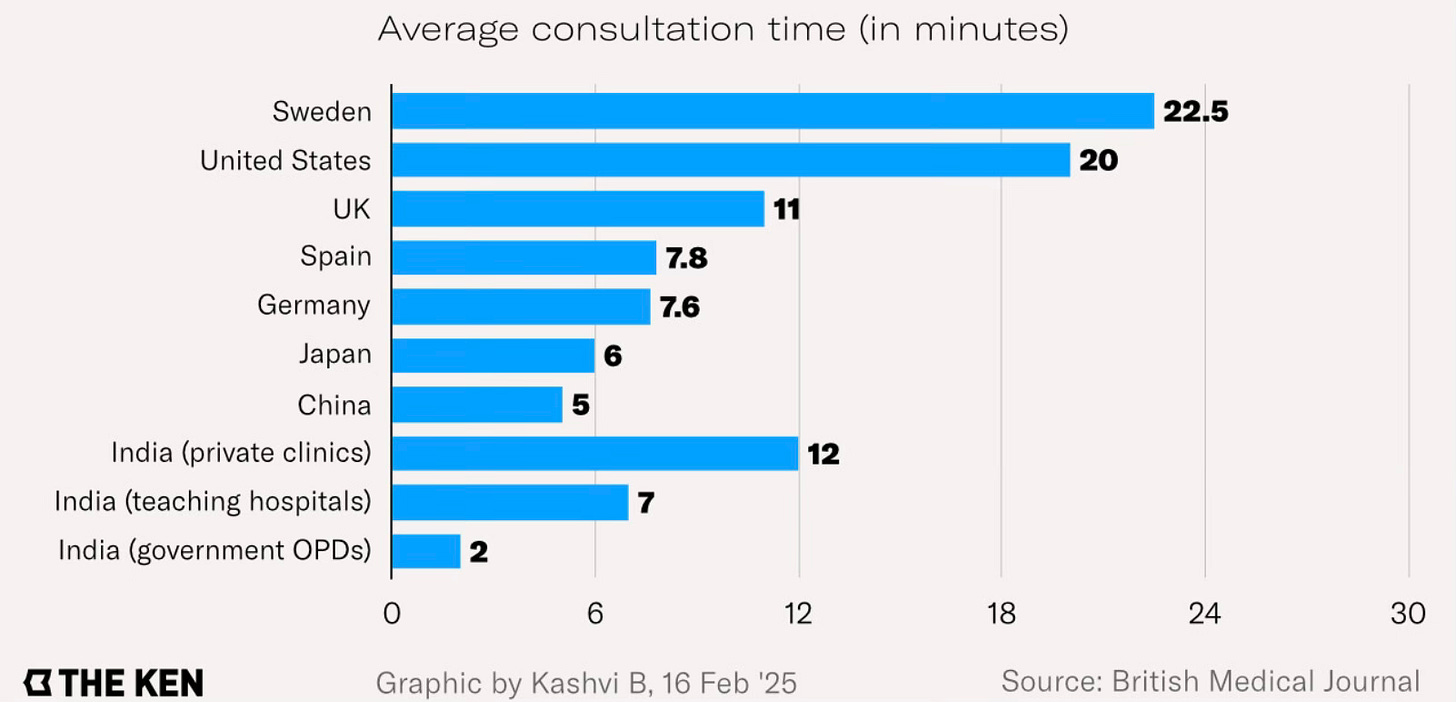

Or consider the role of regulation. As we have written previously, AI models can now evaluate medical scans more accurately than experienced radiologists, but regulatory barriers and insurance policies have made it virtually impossible for fully autonomous systems to be used. Meanwhile, laws have sprung up across the US prohibiting AI tools that “provide services that constitute the practice of professional mental or behavioral healthcare (such as therapy)”. Whatever one’s views on the rights or wrongs of these particular cases, they are clear demonstrations that vulnerability to occupational displacement in the age of AI comes down to far more than “Is AI capable of performing the tasks that make up your job?”

In conclusion, on the overall likely impact, the central questions revolve around three trends - labour automation (associated displacement), labour augmentation (and associated redeployment), and the emergence of new work categories. What will be the relative impacts of the three? Will the first far exceed the second and third? Or will they offset the first? What will be the pace of the first? Will the second and third lag the first significantly?

It is impossible to answer any of these with a degree of confidence. We may only be able to wait and watch how the trends play out and respond accordingly.