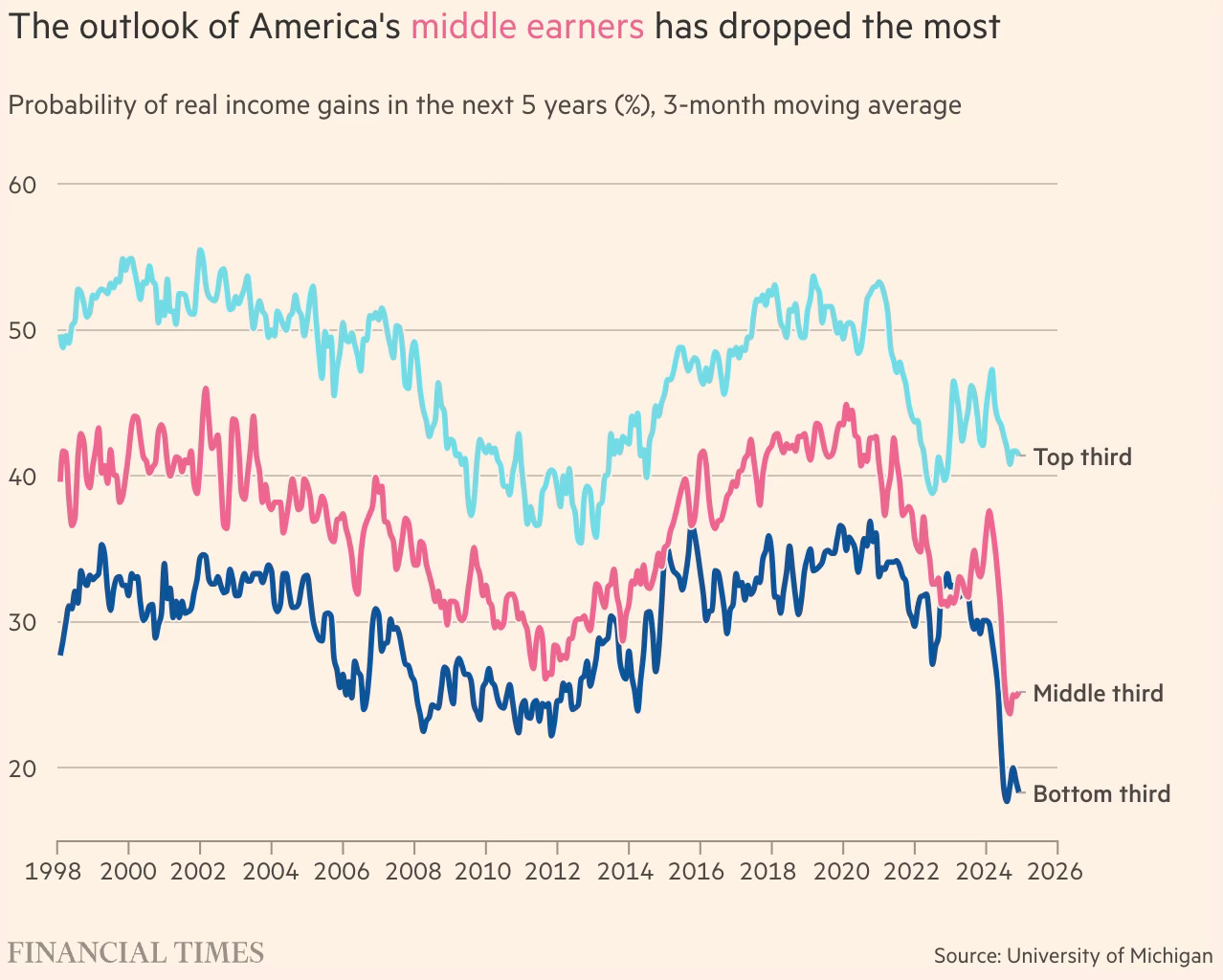

If one person is to get richer, someone else must get poorer. If China is doing well, then the US must logically be doing badly. Jobs go either to the native born, or to foreigners... a zero-sum thinker tends to be in favour of more redistribution and in favour of affirmative action — traditionally leftwing policies — but also in favour of strict immigration rules. Rightwing populists also think affirmative action is important, they just think it’s important and wrong... Stantcheva’s work strongly suggests that zero-sum thinking isn’t some sort of senseless blind spot. When people see the world in dog-eat-dog terms, they usually have a reason. Young people in the US tend to see the world as zero sum, reflecting the fact that they have grown up in a slower-growth economy than those born in the 1940s and 1950s. A similar pattern emerges across countries: the higher the level of economic growth a person grew up with, the less likely they are to see the world in zero-sum terms. People whose ancestors were enslaved, forced on to reservations or sent to concentration camps are more likely to see the world in zero-sum terms.

2. Early takeaways from the UK-US trade deal. The main theme is the UK's commitment to ensure that Chinese manufactured goods don't enter the US through the UK. The text of the agreement is here.

The tariff reductions on UK exports will depend on the findings of the US Section 232 investigations (to determine whether and how specific imports affect US national security). It argues that the the United Kingdom will work to promptly meet U.S. requirements on the security of the supply chains of steel and aluminum products intended for export to the United States and on the nature of ownership of relevant production facilities.

3. China's weaponsisation of its manufacturing dominance should be seen as part of a long-drawn-out conscious strategy. Sample this from Xi Jinping (the speech here).

Chinese leaders must “tighten international production chains’ dependence on our country, forming a powerful capacity to counter and deter foreign parties from artificially disrupting supplies” to China, Mr. Xi said in his speech to the Central Financial and Economic Affairs Commission in 2020.

The Chinese language original version of the speech appeared to have a more threatening tone.

"We should increase the dependence of international supply chains on China and establish powerful retaliatory and menacing capabilities against foreign powers that would try to cut supplies."

4. Interesting long read on the late French philosopher, Rene Girard, who has emerged as an ideologue for those currently ruling the US. His central contribution is the idea of "mimetic desire".

Girard is best known for his theory of “mimetic desire”, the idea that humans don’t desire things in and of themselves, but out of a wish to imitate and compete with others. On the back of this insight, the writer built a distinctive anthropology, borrowing from and contest-ing the theories of Nietzsche and Freud... Girard’s first book, Deceit, Desire and the Novel (published in French in 1961), which describes how Don Quixote, Madame Bovary and characters from Stendhal, Proust and Dostoyevsky come to desire things because others already want them. “Man is the creature who does not know what to desire, and he turns to others in order to make up his mind,” he wrote. The fact that desires are borrowed means they are necessarily competitive. If you desire your neighbour’s husband, you have to contend with your neighbour in order to get what you want — or what you think you want. Mimetic desire leads to fruitless competition, unhappiness and even violence... Over the past half-century, mimetic desire has been Girard’s chief legacy, not only in humanities departments but also, increasingly, among Silicon Valley entrepreneurs and east London brand managers. Inducting Girard into the Académie Française in 2005, the philosopher Michel Serres called him “the Darwin of the human sciences”.

He also came up with a set of ideas on scapegoating and how it impacts politics.

His second book, Violence and the Sacred, published in 1972 and perhaps the most influential of all his work, describes how human societies enter into periods of crisis in which competition becomes unbearable. The solution, Girard claimed, is a violent act of scapegoating. The scapegoat has certain recurrent features: they are a foreigner, someone with a disability or a person in a position of authority. Such acts are then commemorated in the founding myths of cultures, myths in which the scapegoat becomes deified... Girard rarely used contemporary case studies, preferring to find his evidence in ancient literature, scripture and anthropology, but his view on lynchings ancient and modern was unambiguous: they were unconscionable. The insistence that the scapegoat was innocent would become a justification of Girard’s faith as well as the basis for a darkly pessimistic vision of politics later taken up by both Vance and Thiel. Girard’s next book, Things Hidden Since the Foundation of the World, published in 1978, argues that Christianity had revealed the hidden truth of the scapegoat mechanism. By insisting on their saviour’s innocence, Christians had deconstructed the “primitive” belief in the scapegoat’s guilt. It is for this defence of Christianity that Girard has been called a modern Church Father.

5. After scorning and abhorring arms manufacturing for decades, buoyed by a punishing industrial slowdown and the commitment to much higher defence spending due to the growing unreliability of the US defence umbrella, the German Mittelstand are taking to the defence industry with some vengeance. Thanks to the legacy of industrial co-operation with the Nazis, arms making had become taboo in Germany.

6. Indians are the largest content consumers in the digital world, but does not rank among the top 7 content creators.

The Japanese content industry — including gaming, publishing, movies TV and animation — saw overseas sales triple during the past decade, to an estimated ¥5.8tn in 2023. “The export value of the content industry is bigger than the steel, petrochemicals and semiconductor sectors,” says Minoru Kiuchi, the country’s economic security minister and the man now in charge of its anime and manga strategy. The government now wants to push even harder, Kiuchi says, increasing overseas content sales to ¥20tn by 2033. Yet previous efforts to reap the proceeds domestically have struggled. In 2013, the government launched an initiative called Cool Japan, which funded an ill-fated anime streaming platform called Daisuki that aimed to rival the likes of Netflix. Cool Japan has been relaunched multiple times — most recently last year, with greater emphasis on subsidising better working conditions, combating piracy and promoting overseas expansion.

If Japan succeeds in boosting the economic clout of its entertainment industry, then anime, manga and other sources of valuable IP could help offset the effects of the country’s declining population and vulnerable industrial base.

The article is a good short history of the emergence of manga comics and anime cartoons, and how since the pandemic it has gone global.

It is a case study in institutional compromise. The Resolution Professional acted more as a passive bystander than a statutory officer. The CoC, far from being a sentinel of creditor interests, capitulated to a flawed plan and later defended it in Court with shifting arguments. The NCLT and NCLAT, expected to be guardians of due process, failed to check even the most basic procedural violations, including eligibility criteria, payment timelines, and the resolution applicant’s bona fides... The Supreme Court invoked Article 142 to direct BPSL’s liquidation. While this may be legally tenable, one is compelled to ask: could this power have been better used to restore legality without derailing an otherwise successful business revival?Substantively, JSW has already paid substantial sums to creditors, restarted operations, and brought BPSL back into the industrial fold. Was it not possible to preserve this progress by correcting procedural anomalies, imposing penalties, or directing compliance retrospectively? Couldn’t the Court have modified the Plan to align with the IBC instead of nullifying it entirely? This verdict may inadvertently send a chilling message to global investors that in India, even resolution plans implemented over 7- 8 years may be overturned due to procedural infirmities, regardless of real-world success. With the world watching India’s insolvency ecosystem as a key plank in its “ease of doing business” pitch, the implications are serious.

In this context, MS Sahoo makes an important point.

If irregularities are discovered post-facto, those responsible must face swift and stringent civil, regulatory, or criminal consequences. However, the underlying transaction must remain undisturbed. This principle of punishing the wrongdoer without unsettling the transaction is firmly embedded in securities jurisprudence. Trades executed on stock exchanges are never reversed, nor are public issues unwound, even if grave irregularities are discovered post-facto... It is time the law, policy, and institutions recognised the finality of commercial transactions, which should form the bedrock of all economic regulatory frameworks. The legal architecture should enable rigorous oversight to prevent and deter misconduct and hold wrongdoers accountable. However, such oversight must be disentangled from the validity of commercial transactions once they have been lawfully approved or deemed approved.

8. Shifting market expectations on tariffs

There is an emerging view that Trump’s tariff climbdown will ultimately bring US duty rates closer into line with his campaign plans; 10 to 20 per cent for most countries, and 60 per cent for China. Given all the tariff twists and turns over the past few weeks, markets might be forgiven for thinking that’s a good outcome. But prior to the president’s inauguration, that was most analysts’ worst-case scenario.

9. Trump tariffs and their impact on the US Dollar is helping indebted developing countries.

In practice, and purely by accident, Trump’s tariff wars have created a surprisingly benign environment for emerging markets. Although no one could claim with a straight face that he is judiciously managing the exchange rate lower as part of some fantastical “Mar-a-Lago Accord”, the dollar has weakened, benefiting EMs that borrow in the US currency. The traditional perverse effect whereby risk aversion arising from eccentric US policymaking actually causes a flight to safety and strengthens the dollar has so far been absent. The net effect of a shambolic trade strategy and weakening growth has also been to reduce US Treasury yields, similarly supporting capital flows to higher-yield markets elsewhere. The spread of EM bond prices over US bonds, which typically rises at times of financial market stress and uncertainty, has remained well contained.

10. UK minimum wages now match those of some white collar entry level workers.

For the first time in any free trade agreement (FTA), India has agreed to slash car import duties, open up its vast government procurement market to a foreign country, and weaken its patent regime under external pressure... India’s decision to slash car import duties from 100 per cent to 10 per cent — even with quotas — is a first in any trade deal. The cuts also cover electric and hybrid cars where Indian industry is just beginning to grow. India will soon receive requests from the European Union, the United States, Japan, and South Korea, demanding equal or deeper tariff cuts...

Around 40,000 high-value Indian government contracts will now be open to UK companies, covering transport, green energy, and infrastructure sectors. One of the most problematic provisions is that UK firms will be treated as “Class 2” local suppliers if just 20 per cent of their product value originates in the UK. This grants UK firms the same procurement preference previously reserved for Indian suppliers with 20–50 per cent domestic content. It allows them to use up to 80 per cent Chinese or European inputs while still benefiting from local supplier status in India. UK companies will also have access to India’s central e-procurement portal, making tracking and winning public contracts easier... India has, for the first time in any FTA, agreed to rules that go beyond its obligations under the WTO’s Agreement on Trade-Related Aspects of Intellectual Property Rights. This threatens not only access to affordable medicines within India but also its global leadership as a supplier of generic drugs to developing countries. This move hands over a big win to global pharma giants.

12. It's the uncertainty that kills. John Coates writes,

What happens if you go up and over that cortisol curve? Then you start to change. In our studies we found that prolonged volatility elevated cortisol chronically and caused traders to become dramatically more risk-averse. The masters of the universe turned timid (potential pushovers in bonus — or tariff — negotiations). Here again we can see a biological mechanism driving macro events: during a bear market, the higher volatility increases risk aversion, which causes more selling and even more volatility and risk aversion, in a runaway chain reaction that ends in a crash. Uncertainty has this power. Uncertainty over whether something nasty might happen can be more stressful than the nasty thing itself. Experiments have shown this. Imagine you are exposed to something mildly unpleasant, like brief blasts of white noise; but the blasts come at predictable time intervals, say once every two minutes. Between blasts you have downtime and need not brace yourself against the noise. In this timing regime, your stress hormones would probably be only slightly elevated. But now imagine the intervals fluctuate, making it more difficult to predict when to brace yourself, so you brace for longer periods of time. Now your stress hormones begin to rise. As the intervals become random and cannot be predicted, cortisol levels reach a maximum. Under each timing regime, you have been subjected to an identical amount of noise. But your cortisol levels increased with the uncertainty of the timing.My colleagues and I observed this effect in traders: their cortisol did not track their profits and losses but rather the variance of their returns. This effect was also observed during the second world war. German soldiers on the front lines during the Battle of Stalingrad faced constant attack, while soldiers manning supply lines faced danger less frequently but more unpredictably, and it was here, behind the front lines, that they suffered a higher incidence of gastric ulcers. So uncertainty over when something nasty is going to happen to you, such as losing money, or a bandage being ripped off, can be more stressful than the actual event. It is the not-knowing when it will happen that keeps us on edge, keeps us revving our engine. In fact, we hate being kept in a state of uncertainty. Some macabre experiments conducted in the 1970s found that animals — and humans too, presumably — will accept four times more aversive stimuli if they are delivered predictably rather than unpredictably.

This has relevance to policy making

This stress biology could be harnessed by policymakers. Central banks, for example, could use uncertainty, as does Ref #2, to control the financial markets, and to deflate bubbles by increasing risk aversion. Paul Volcker, chair of the Federal Reserve from 1979-87, understood this power, and possessed the knack to scare the pants off the financial markets. Part of that fear stemmed from his tendency to move interest rates enormously, in the early 1980s raising the Fed funds rate to 20 per cent. But he also kept the market guessing as to when he would act, and by how much. Street wisdom says do not fight the Fed, and no one did with Volcker lurking in the hood. Today, the Fed could veil its activities with a similar uncertainty as a means of calming market exuberance, even cooling an inflationary economy, and all without raising rates. In fact, a deft application of uncertainty could well drive investors into Treasury bonds, thereby lowering long-term interest rates and reducing the debt burden. Since Volcker’s time, however, central banks everywhere have relinquished uncertainty, one of their most potent weapons, in favour of a policy called forward guidance, which involves communicating clearly their intentions, in other words reducing uncertainty. Not surprisingly, this namby-pamby policy has failed utterly in taming the wild beast that is irrational exuberance. To control the market you need to corral its animal spirits, and uncertainty has more than enough power to do so.

This is important since for all his unpredictability, it's emerging that there's one big predictability with Trump policies - they'll not cross a threshold laid down by the markets. In other words, there's an emerging Trump put to the downside risk with US equity markets. It's no surprise that the markets have responded to the temporary truce with China by rebounding in a manner that makes one feel that the whole issue is now settled. The market reaction was stunning. Wall Street had the biggest one-day gain in five years.