As I blogged earlier, in recent years, on the back of the surging demand for ores and minerals, the Australian economy has been showing signatures of resource mis-allocation, popularly described as the "Dutch Disease".

The boom in commodity prices has resulted in the Australian dollar surging against the US dollar.

The country's terms of trade, the price of its exports relative to imports, have risen sharply. This has made its tradeable sector more attractive, since it fetches more domestic currency for the same volume of exports.

The strong exchange rate has boosted the commodities mining sector, but at the cost of non-mining tradeable sectors like tourism and manufacturing. Mining, though just 10% of the economy, is estimated to suck up nearly 70% of total capital expenditure across the economy. These trends are starkly reflected in the respective contributions of each to the national economic growth.

Substack

Sunday, December 30, 2012

Saturday, December 29, 2012

The Great Recession and World Economy in a graphic

Times has this graphic that captures the performance of the major world economies and their equity markets over the past five years.

Friday, December 28, 2012

Nudging to prevent losing your phone

The Ciago iAlert and Cobra Tag are Bluetooth keychain fobs that communicate with your iPhone or Android phone. Once you’re 30 feet away from the phone, the keychain starts beeping, as though to say, “You’re leaving your $200 phone behind, you idiot!” It works the other way, too; the phone beeps if you leave your keys behind.(HT: Pogie Awards NYT)

Thursday, December 27, 2012

India's coal crisis is a political problem

MR points to this graphic which captures the widening demand-supply mismatch in coal availability for power generators.

This blog has been a strong advocate of electricity deficit being arguably India's biggest growth constraint. The widening mismatch, for whatever reasons, should be addressed with the highest priority. But that is easier said than done.

While the state-owned coal mining monopoly, Coal India Limited (CIL), should its share of the blame for the current crisis, the major problems lie beyond mining per se. The three most critical problems facing the sector are lack of rail transportation facilities, and difficulties in land acquisition and environmental clearance for expansions and new projects. We therefore have a situation where even the mined coal is stuck up at pithead for lack of adequate transportation facilities and capacity addition projects are delayed inordinately.

The conventional wisdom on addressing India's coal crisis is to open up coal mining for private exploitation. But this argument fails to appreciate the aforementioned underlying reasons. Though the private sector would be effective at mining coal, the problems of transportation, land acquisition and environmental approvals would remain. Its resolution lies in the political and social realm.

Land acquisition and environmental clearances are essential for both laying rail transport lines and establishing new projects. In the prevailing social and political climate, where populist rhetoric and media trials shape the mainstream discourse, both these issues present extremely difficult, increasingly insurmountable, challenges.

The private sector will be even less capable of addressing these non-mining challenges. In fact, private involvement is likely to vitiate the environment and make its resolution even more difficult. It is no wonder that the coal blocks allocated for captive power generation remained mostly unexploited. Governments cannot afford to be seen to be supporting private participants in "dispossessing" poor people and "damaging the environment". Nor would the private sector agree to policies like provision of employment to land losers, long used by the CIL to buy-out local opposition to its projects.

All this means that India's coal crisis can be resolved only through a mature political process. A reasonably generous relief and rehabilitation (R&R) policy, which enjoys bipartisan political support, has to form the centerpiece of any such process. In its absence, no government - whether the Congress or BJP or a third front - will be able to effectively address the problem.

The million-dollar problem then is to achieve a political consensus on such policies. Coal mining is just one of the areas where bipartisan political support is sine-qua-non for any progress. Unfortunately, this looks likely to remain an elusive goal in the current political environment.

This blog has been a strong advocate of electricity deficit being arguably India's biggest growth constraint. The widening mismatch, for whatever reasons, should be addressed with the highest priority. But that is easier said than done.

While the state-owned coal mining monopoly, Coal India Limited (CIL), should its share of the blame for the current crisis, the major problems lie beyond mining per se. The three most critical problems facing the sector are lack of rail transportation facilities, and difficulties in land acquisition and environmental clearance for expansions and new projects. We therefore have a situation where even the mined coal is stuck up at pithead for lack of adequate transportation facilities and capacity addition projects are delayed inordinately.

The conventional wisdom on addressing India's coal crisis is to open up coal mining for private exploitation. But this argument fails to appreciate the aforementioned underlying reasons. Though the private sector would be effective at mining coal, the problems of transportation, land acquisition and environmental approvals would remain. Its resolution lies in the political and social realm.

Land acquisition and environmental clearances are essential for both laying rail transport lines and establishing new projects. In the prevailing social and political climate, where populist rhetoric and media trials shape the mainstream discourse, both these issues present extremely difficult, increasingly insurmountable, challenges.

The private sector will be even less capable of addressing these non-mining challenges. In fact, private involvement is likely to vitiate the environment and make its resolution even more difficult. It is no wonder that the coal blocks allocated for captive power generation remained mostly unexploited. Governments cannot afford to be seen to be supporting private participants in "dispossessing" poor people and "damaging the environment". Nor would the private sector agree to policies like provision of employment to land losers, long used by the CIL to buy-out local opposition to its projects.

All this means that India's coal crisis can be resolved only through a mature political process. A reasonably generous relief and rehabilitation (R&R) policy, which enjoys bipartisan political support, has to form the centerpiece of any such process. In its absence, no government - whether the Congress or BJP or a third front - will be able to effectively address the problem.

The million-dollar problem then is to achieve a political consensus on such policies. Coal mining is just one of the areas where bipartisan political support is sine-qua-non for any progress. Unfortunately, this looks likely to remain an elusive goal in the current political environment.

Monday, December 24, 2012

The global youth unemployment crisis

The co-existence of large youth unemployment rates and labor market shortages, symptomatic of labor markets across the world, is a classic market failure. Econ 101 teaches us that job seekers and education service providers would respond to the market signals generated by employers and acquire the skills required to clear the labor market. But in the real world, there is apparently a massive co-ordination failure between employers, education providers, and job-seeking youth.

The McKinsey and Company have a timely report (pdf here) on this issue, where they examined more than 100 education-to-employment initiatives in 25 countries and surveyed employers, youth, and education providers from nine countries, including India. It points to a twin global crisis - "high levels of youth unemployment and a shortage of people with critical job skills". It writes,

As the report points out, the massive pool of unemployed youth represents not just a gigantic pool of untapped talent; it is also a source of social unrest and individual despair. It writes,

Building a reliable and upto date database is easier said that done, especially given the dynamic nature of the job skills requirements. However, any meaningful effort to address this has to involve greater co-ordination between employers and post-secondary education service providers. The market mechanism may ultimately respond by forcing employers who face severe labor shortages to work more closely with education providers. However, a more promising approach will be for governments to play an important role in bridging this information gap and become the market facilitator.

The survey finds that the best education-to-employment programs across the world are characterized by close relationship between employers and education providers - the former helps design the curricula and students spend nearly half their training on a job site. Further, employers commit to hire youth before they are enrolled in a program to build their skills.

Though the report briefly touches on the issue of employers uninterested in investing in skills development, except specialized skills, for not being able to capture its full value. They realize that employees would benefit more and trained employees are more likely to move elsewhere in search of better opportunities. In other words, the social value of the skills training exceeds its private value for the employer. In fact, the social gains go beyond even the private gains to the individual employee. It contributes towards mitigating labor market frictions which constrains investment and keeps large numbers of people unemployed.

This does give skills training the nature of a public good, as much as education in general. It is therefore appropriate that governments finance, atleast partially, the cost of such post-secondary education-to-employment training. Some state governments in India have tried to address this through placement-linked jobs training programs, whereby government pays private institutions for short-term skills development trainings to unemployed youth in return for guaranteeing them employment. However, in the absence of close relationship between the training agencies and employers these programs, which are mostly short-term and academic inputs focused, have been largely failures. But they provide important pointers on the way forward.

The McKinsey and Company have a timely report (pdf here) on this issue, where they examined more than 100 education-to-employment initiatives in 25 countries and surveyed employers, youth, and education providers from nine countries, including India. It points to a twin global crisis - "high levels of youth unemployment and a shortage of people with critical job skills". It writes,

In the OECD countries, more than one in eight of all 15- to 24-year-olds are not in employment, education, or training (NEET). Around the world, the ILO estimates that 75 million young people are unemployed. Including estimates of underemployed youth would potentially triple this number... Across the nine countries, 43% of employers surveyed agreed that they could find enough skilled entry-level workers... The McKinsey Global Institute estimates that by 2020 there will be a global shortfall of 85 million high- and middle-skilled workers.

As the report points out, the massive pool of unemployed youth represents not just a gigantic pool of untapped talent; it is also a source of social unrest and individual despair. It writes,

If young people who have worked hard to graduate from school and university cannot secure decent jobs and the sense of respect that comes with them, society will have to be prepared for outbreaks of anger or even violence. The evidence is in the protests that have recently occurred in Chile, Egypt, Greece, Italy, South Africa, Spain, and the United States (to name but a few countries). The gap between the haves and the have-nots in the OECD is at a 30-year high, with income among the top 10 percent nine times higher than that of the bottom 10 percent.The report argues that the biggest problem with bridging the labor market mismatch is the lack of data on "the skills required for employment or on the performance of specific education providers in delivering those skills". It writes,

Clearly, employers need to work with education providers so that students learn the skills they need to succeed at work, and governments also have a crucial role to play. But there is little clarity on which practices and interventions work and which can be scaled up. Most skills initiatives today serve a few hundred or perhaps a few thousand young people; we must be thinking in terms of millions. Why don’t we know what works (and what does not) in moving young people from school to employment? Because there is little hard data on the issue... This deficiency makes it difficult to even begin to understand which skills are required for employment, what practices are the most promising in training youth to become productive citizens and employees, and how to identify the programs that do this best.

Building a reliable and upto date database is easier said that done, especially given the dynamic nature of the job skills requirements. However, any meaningful effort to address this has to involve greater co-ordination between employers and post-secondary education service providers. The market mechanism may ultimately respond by forcing employers who face severe labor shortages to work more closely with education providers. However, a more promising approach will be for governments to play an important role in bridging this information gap and become the market facilitator.

The survey finds that the best education-to-employment programs across the world are characterized by close relationship between employers and education providers - the former helps design the curricula and students spend nearly half their training on a job site. Further, employers commit to hire youth before they are enrolled in a program to build their skills.

Though the report briefly touches on the issue of employers uninterested in investing in skills development, except specialized skills, for not being able to capture its full value. They realize that employees would benefit more and trained employees are more likely to move elsewhere in search of better opportunities. In other words, the social value of the skills training exceeds its private value for the employer. In fact, the social gains go beyond even the private gains to the individual employee. It contributes towards mitigating labor market frictions which constrains investment and keeps large numbers of people unemployed.

This does give skills training the nature of a public good, as much as education in general. It is therefore appropriate that governments finance, atleast partially, the cost of such post-secondary education-to-employment training. Some state governments in India have tried to address this through placement-linked jobs training programs, whereby government pays private institutions for short-term skills development trainings to unemployed youth in return for guaranteeing them employment. However, in the absence of close relationship between the training agencies and employers these programs, which are mostly short-term and academic inputs focused, have been largely failures. But they provide important pointers on the way forward.

Saturday, December 22, 2012

Evidence-based policy making – Missing the woods for the trees?

There is no denying that evidence should inform public

policy design. However, it may be a matter of debate as to what constitutes

evidence and how it should inform the policy design process. There may also be

a need to revisit the interpretation of “external validity” of research

findings beyond its current locational - geographical, social, and cultural -

context.

Conventional wisdom on evidence-based policy making predominantly

views “evidence” as emerging from a process of scientific research. Even within

research, in recent years there has been a trend to seek evidence from field

experiments, preferably randomized control trials. This approach provides

limited space for “priors”, especially those drawn from a source with “less

than objective” underpinnings, in policy design. Indeed, in an ideal world the

entire policy edifice should be constructed on the objectivity of experimentally

exposed scientific wisdom.

External validity of experimental research is

generally viewed in terms of its replicability in “other environments”. Critics

of experimental research view this as its Achilles heel. But even before we come

to other environments, there are concerns about its replicability within the same

environment, when scaled up.

Can we afford the “luxury” of an ideal policy

design, informed by rigorous experimental evidence? Is there no rigorous and

objective enough process of consolidating “priors” in development research?

More importantly, are “research findings” any more unbiased and objective than

other sources of similar knowledge? Are the findings of a field experiment

readily amenable to being scaled up, even in the same environment, without

considerable dilution of its final effect?

Specifically, I have two important points for

consideration. One, the process of experimental research driven evidence discovery

overlooks the, often equally rigorous, evidential value of institutional knowledge

latent in communities and public systems. Two, such research findings,

especially experimental results, present sanitized outcomes, whose replication

when scaled-up under less-sanitized, real-world conditions are questionable. Let

me illuminate both these in some more detail.

The vast body of mightily impressive experimental

research from the past two decades reveals several important insights,

statistically rigorously validated, about the development process. But there is

little by way of knowledge or insights that were not already available as

institutional wisdom. Therefore, and especially given the huge amount of money

and effort that has gone into obtaining this knowledge through experimental

research, it is appropriate that we question as to whether the same could have

been learnt in a more cost-effective manner from the latent institutional

wisdom.

I see several benefits from a process of discovering

institutional wisdom. One, it is likely to shorten the knowledge discovery

cycle, besides lowering its cost. Second, unlike the fragmented nature of knowledge

that emerges from the inherently restrictive, mostly single-issue based experimental

research, a knowledge discovery process is more likely to reveal a more

comprehensive and organic understanding of the underlying problem. Third, it is

also likely to reconcile the dissonance between logical and theoretical

consistency and implementational difficulties which characterize a large body

of experimental research.

Fourth, the discovery of latent institutional

knowledge through a consultative process would, by keeping the stakeholders

involved, increase the likelihood of it being willingly embraced by them. This

stands in contrast to the obvious disconnect between experimental research and

its audience within public systems, which prevents its ready adoption. Fifth,

this strategy is likely to create a body of replicable heuristics which can be

used to reveal latent knowledge in different socio-economic settings. This

becomes especially important given the highly context-specific nature of policy

and implementation framework design, a reason that weakens the external

validity of any experimental finding.

Sixth, the internal dynamics generated by such a

process is itself likely to lay the “environmental” foundation for a successful

scale-up. A social consultative process of unraveling latent knowledge

typically generates unintended positive spill-overs that can potentially both

weaken change opposing factors and strengthen administrative capability. Finally,

an experimental research based knowledge discovery, which limits “priors”,

opens up too many policy threads and becomes an exercise in the search for the

ideal policy design. In contrast, a knowledge discovery process helps finalize

a robust enough second-best policy framework design and leaves open those still

uncertain threads to be identified or validated by experimental research.

The absence of any discussion about such a latent

knowledge discovery process is surprising since deep-dive problem-solving

through interviews, focus group discussions, observations, surveys, and so on,

is the staple of modern consulting industry. If such evidence is rigorous

enough for businesses before they undertake make-or-break investment decisions

involving billions of dollars, why would they be any different for governments?

And businesses use such evidence to decide on decisions involving human

preferences and in aligning human incentives to their commercial interests.

How would the process of arriving at a strategy to

sell cheap shampoo satchets to poor people be dramatically different from one

for selling mosquito nets or chlorine tablets to the same category of people? Is

the process of devising a strategy by private financial institutions to attract

deposits of low income people any different from that aimed at increasing

savings among the same people? For that matter, is there any radical difference

between a commercial strategy to induce positive responses from the market at

the “bottom of the pyramid” and one that seeks to get the same target group to

respond to similar incentives for their own welfare?

This brings to my second concern about the extant

methodology of experimental research. My concern arises from three directions.

One, there is a big difference between implementing a program on a pilot basis

for an experimental study and implementing the same on scale. In the former,

the concentrated effort and scrutiny of the research team, the unwitting greater

over-sight by the official bureaucracy, and the assured expectation, among its

audience, that it would be only a temporary diversion, contributes to

increasing the effectiveness of implementation. Two, is the administrative

system capable of implementing the program so designed, on scale? Finally,

there is the strong possibility that we will end up implementing a program or

intervention that is qualitatively different from that conceived experimentally.

It is one thing to find considerable increases in

teacher attendance due to the use of time-stamped photographs or rise in safe

water consumption from the use of water chlorination ampules when both are implemented

over a short time horizon, in microscopic scale, and under the careful guidance

and monitoring of smart, dispassionate, and committed research assistants. I am

inclined to believe that it may be an altogether different experience when the

same is scaled up over an entire region or country over long periods of time

and with the “business as usual” minimal administrative guidance and

monitoring. And all this is leaving aside its unanticipated secondary effects. In

fact, far from implementing an intervention which is tailored based on rigorous

scientific evidence, we may actually end up implementing a mutilated version

which may bear little resemblance to the original plan when rolled out at the

last mile.

I believe that evidence-based research has a

critical role to play in development policy design. But it should complement a

process of discovering latent institutional knowledge, through something

resembling a scientific problem- solving approach. Experimental research should

be used to tie-up the loose ends that arise from the former exercise. A

marriage of the two should be the way forward in evidence-based policy design.

Tuesday, December 18, 2012

The new North-South divide - Water?

I am struck by the remarkably neat north-south stratification in this map of global water demand and availability, both in terms of physical supply and access to populations. The entire southern hemisphere is water stressed, in sharp contrast to the entire north which has enough to meet its demand.

In much of Africa and Latin America, and parts of India and China, though availability may not be a problem, access remains poor. But it is in North Africa, Middle East, and Central Asia, where availability is itself a problem, conflicts centering around water bodies are most likely. Already, water sharing from the Nile, Tigris-Euphrates-Jordan Rivers, and Aral Sea are the source of geo-political tensions.

However, there may be another reason why water may be an important source of geo-political conflicts. It is not that people will be fighting for drinking water. In fact, as this latest OECD forecasts indicate, domestic consumption will be dwarfed by other industrial uses of water. Even the demand for agricultural consumption is estimated to decline. But demand from manufacturing sector and power generation (especially from water intensive renewable solar and thermal generators) is estimated to form nearly half the global demand for water by 2050.

Since a large share of this demand is going to come from the Northern hemisphere, the sharp geographical water-divide will invariably suck in the richer nations too.

In much of Africa and Latin America, and parts of India and China, though availability may not be a problem, access remains poor. But it is in North Africa, Middle East, and Central Asia, where availability is itself a problem, conflicts centering around water bodies are most likely. Already, water sharing from the Nile, Tigris-Euphrates-Jordan Rivers, and Aral Sea are the source of geo-political tensions.

However, there may be another reason why water may be an important source of geo-political conflicts. It is not that people will be fighting for drinking water. In fact, as this latest OECD forecasts indicate, domestic consumption will be dwarfed by other industrial uses of water. Even the demand for agricultural consumption is estimated to decline. But demand from manufacturing sector and power generation (especially from water intensive renewable solar and thermal generators) is estimated to form nearly half the global demand for water by 2050.

Since a large share of this demand is going to come from the Northern hemisphere, the sharp geographical water-divide will invariably suck in the richer nations too.

Thursday, December 13, 2012

The revolving door and business-politics links

The conventional wisdom on business interests influencing policy making has been one of purchasing such influence through lobbying or outright bribery. However, there is growing evidence, from across the world, that business interests may be more directly integrated into the decision making process by a revolving door between business and politics.

Businessmen enter politics either by contesting elections, made easier by the fact that modern elections are extremely expensive, or be appointed to important posts. While the former may be the more commonplace way in developing countries, the latter may be the more likely entry point in developed countries.

In an excellent recently released study, Simon Luechinger and Christoph Moser use both quantitative and qualitative data to examine Senate-confirmed US Defense Department appointments of six Presidential administrations. Specifically, they observed the effect of these appointments on the stock market prices of the companies which were linked to the appointees. Given the importance of such connections in defense department, where procurements are important, they find,

In India, links between business and politics has been more direct, with a large number of businessmen entering politics through elections and backdoor, through the Rajya Sabha. However, the trend of businessmen being appointed to important nominated posts are very small. It is just as well. The example of KV Kamath, who was once being considered for the post of RBI Governor, and who has since been continuously demanding lowering interest rates despite the embedded inflationary expectations, clearly revealing his entrenched preferences, does little to inspire any confidence.

Businessmen enter politics either by contesting elections, made easier by the fact that modern elections are extremely expensive, or be appointed to important posts. While the former may be the more commonplace way in developing countries, the latter may be the more likely entry point in developed countries.

In an excellent recently released study, Simon Luechinger and Christoph Moser use both quantitative and qualitative data to examine Senate-confirmed US Defense Department appointments of six Presidential administrations. Specifically, they observed the effect of these appointments on the stock market prices of the companies which were linked to the appointees. Given the importance of such connections in defense department, where procurements are important, they find,

According to the results, investors clearly expect firms to profit from their political connections. The one- and two-day average cumulative abnormal returns amount to 0.82% and 0.84%. These estimates are not driven by important observations, volatile stocks, or industry-wide developments, and placebo events yield no effects. Effects are larger for top government positions and less anticipated announcements, i.e., announcements for which the actual nominee was not rumoured to be the main candidate. Figure below displays the baseline results and the results for the less anticipated events together with the temporal pattern of average cumulative abnormal returns for the four trading weeks prior to and after the announcement day.

In India, links between business and politics has been more direct, with a large number of businessmen entering politics through elections and backdoor, through the Rajya Sabha. However, the trend of businessmen being appointed to important nominated posts are very small. It is just as well. The example of KV Kamath, who was once being considered for the post of RBI Governor, and who has since been continuously demanding lowering interest rates despite the embedded inflationary expectations, clearly revealing his entrenched preferences, does little to inspire any confidence.

Friday, December 7, 2012

Gift giving to influence decision making

Ulrike Malmendier and Klaus Schmidt have a very appropriate working paper on the corrosive effects of official gift transactions. They outline the problem,

The close links between public officials and corporate interests is in no small measure underpinned by the psychological bonds established through gift-giving. As I have blogged earlier, human beings form rational expectations based on the social environment in which they work. Public officials, new to a particular office, internalize the expectation of being offered gifts either from the precedents of gift-giving established in that office or from observing their peer group elsewhere.

Furthermore, these expectations form a slippery slope that leads straight down the path to outright corruption. What starts off with accepting routine and small gifts, soon snowballs into accepting expensive gifts and demanding gratification in return for a favor. This process is furthered by the gift-giver who immediately capitalizes on the expectations formed within the official and fulfills his urges. A Mont Blanc pen soon gives way to a family holiday at an exotic foreign location or new year jewelry gifts for the family. With time, even this gives way to offers to finance the child's higher education at a foreign university or an apartment at a prime location. The noose tightens and the public official soon gets anchored within the cross-hairs of the corporate interest.

There are no easy solutions. Banning all gifts is not practical given the difficulty of its enforcement. Moral suasion and the creation of an environment that discourages, even stigmatizes, such gift taking is the only sustainable way to address it.

In a typical scenario, a procurement manager receives gifts (ranging from small “tokens of appreciation” such as pens or coffee mugs to precious bottles of wine or event tickets) from a supplier, who hopes to get favorable treatment relative to his competitors, even if his competitors offer better or cheaper products. Similarly, politicians and regulators receive gifts or campaign contributions from lobbyists trying to affect their decisions in favor of special interest groups. In both examples the recipient of the gift makes a decision on behalf of a “client” who is often anonymous: the shareholders of the procurement manager and the general public... a physician may prescribe more drugs of a pharmaceutical company after attending a conference sponsored by that company because he wants to get more sponsoring in the future or because of scientific information provided at the conference... Such practices have raised concerns – and stirred a regulatory debate – about the influence of gifts. Gift giving has been blamed as a major contributor to weak corporate governance, to the dramatic rise of health care costs, and to wasteful pork barrel politics.And they find that even small gifts have outsized negative externalities,

In a series of experiments, we show that, even without incentive or informational effects, small gifts strongly influence the recipient’s behavior in favor of the gift giver, in particular when a third party bears the cost. Subjects are well aware that the gift is given to influence their behavior but reciprocate nevertheless. Withholding the gift triggers a strong negative response... We also show that disclosure and size limits are not effective in reducing the effect of gifts, consistent with our model... The main contribution of our paper is to show that there is an additional and powerful effect of the gift per se. Subjects reciprocate to (small) gifts even if there are no monetary incentives for doing so and if the gift does not convey positive information about the product. The laboratory setting allows us to exclude future interaction, informational content, or any (other) monetary incentives as explanations for such a response. We show a significant effect even for small-scale gifts that amount to little compared to the income of the recipient. We also find that the effect is significantly stronger when it comes at the expense of a third party, compared to the classic gift exchange situation with two parties.Their central finding is simple, "If a gift is given the decision maker tends to favor the gift giver; if no gift is given the decision maker tends to discriminate against him, both at the expense of the third party". The most pernicious effect of this practice comes in gifts given to public officials and health care professionals. The former comes at the cost of the public resources while the latter at the cost of the patients undergoing treatment. Such practices are widespread and not confined to just developing countries.

The close links between public officials and corporate interests is in no small measure underpinned by the psychological bonds established through gift-giving. As I have blogged earlier, human beings form rational expectations based on the social environment in which they work. Public officials, new to a particular office, internalize the expectation of being offered gifts either from the precedents of gift-giving established in that office or from observing their peer group elsewhere.

Furthermore, these expectations form a slippery slope that leads straight down the path to outright corruption. What starts off with accepting routine and small gifts, soon snowballs into accepting expensive gifts and demanding gratification in return for a favor. This process is furthered by the gift-giver who immediately capitalizes on the expectations formed within the official and fulfills his urges. A Mont Blanc pen soon gives way to a family holiday at an exotic foreign location or new year jewelry gifts for the family. With time, even this gives way to offers to finance the child's higher education at a foreign university or an apartment at a prime location. The noose tightens and the public official soon gets anchored within the cross-hairs of the corporate interest.

There are no easy solutions. Banning all gifts is not practical given the difficulty of its enforcement. Moral suasion and the creation of an environment that discourages, even stigmatizes, such gift taking is the only sustainable way to address it.

Wednesday, December 5, 2012

Sunk cost effect and the politics of large military projects

The Times has a nice story that captures the troubles facing the F-35 Joint Strike Fighter plane, being developed for the Pentagon by Lockheed Martin since late 2001. The article describes growing frustration in Pentagon about perceived delaying tactics of the contractor and persistent technological flaws, including limited range. The plane, which was thought to become the Chevrolet of the skies, was to have 70-80% common parts and be used by all the three wings of the military.

In its 12th year of development, the badly delayed stealth technology based fighter jet which is supposed to replace the workhorse F-16, is already the most expensive military weapons system in history. With full production not expected till atleast 2019, the plane is estimated to cost the Pentagon a whopping $396 bn if the Pentagon sticks to its original plans to build 2443 jets by late 2030s. That would be four times as much as any other weapons system and with operational maintenance it is estimated to cost another $1.1 trillion. The cost of one plane has doubled from $69 million in 2001 to $137 now.

The program was pushed through in a hurry, despite widespread cautionary advise, in the aftermath of the September 2001 attacks. Now, with the rising costs and inordinate delays, questions are naturally being raised about the program. The Times points to two interesting reasons why the size of the program may have created a dynamics that makes it virtually impossible to limit, leave alone junk, the program. It writes

In its 12th year of development, the badly delayed stealth technology based fighter jet which is supposed to replace the workhorse F-16, is already the most expensive military weapons system in history. With full production not expected till atleast 2019, the plane is estimated to cost the Pentagon a whopping $396 bn if the Pentagon sticks to its original plans to build 2443 jets by late 2030s. That would be four times as much as any other weapons system and with operational maintenance it is estimated to cost another $1.1 trillion. The cost of one plane has doubled from $69 million in 2001 to $137 now.

The program was pushed through in a hurry, despite widespread cautionary advise, in the aftermath of the September 2001 attacks. Now, with the rising costs and inordinate delays, questions are naturally being raised about the program. The Times points to two interesting reasons why the size of the program may have created a dynamics that makes it virtually impossible to limit, leave alone junk, the program. It writes

Todd Harrison, an analyst at the Center for Strategic and Budgetary Assessments, a research group in Washington, said Pentagon officials had little choice but to push ahead, especially after already spending $65 billion on the fighter. “It is simultaneously too big to fail and too big to succeed,” he said. “The bottom line here is that they’ve crammed too much into the program. They were asking one fighter to do three different jobs, and they basically ended up with three different fighters.”Further, the production of the fighter plane was rushed through in 2007 even before flight tests had begun, forcing a leading Pentagon official to describe this as an "acquisition malpractice". Further, the military's own scientific experts were kept away from the development process, giving Lockheed a freehand with the technology development. As subsequent events have shown, the technological flaws have proven difficult to fix. The Times reports about the politics behind this move,

The willingness to “roll the dice” reflected the peculiar incentives at the Pentagon, where rushing into production creates jobs and locks in political support, even if it allows programs to drift into trouble. Lockheed and its suppliers on the F-35 employ 35,000 workers, with some in nearly every Congressional district.

The Pentagon clearly faces a big challenge with the management of the project. It now realizes that even if the contractor reneges on future deadlines, as is most likely to happen, it can do precious little to force them to comply. The sunk cost effect, whereby billions have already been spent, will deter the Pentagon from limiting the scope of the program. Both parties also realize that starting a new weapons system program now will take decades and unrealistic, especially given that the existing fighters are close to being grounded. Both parties also realize that given the large numbers of jobs created in its development, any effort to prune it down will raise strong political opposition. Further, cutting high-profile military programs will always raise the bogey of compromising national security. In any case, the biggest winner is Lockheed Martin, which has found an excellent opportunity to bleed the American tax payer for atleast the next three decades.

The Times article is not clear on who is to blame for this misadventure, nor does it try to explore the motivations behind these apparently questionable decisions. It is naive to expect that these decisions were taken purely with good intentions and in the haste to get the new fighter jet flying. Such stories are commonplace in weapons market, especially in many developing countries. However, in all these places, the shadow of corruption and rent-seeking would loom large with all such deals. It will be surprising if the same were not true with F-35 fighter jet.

Sunday, December 2, 2012

Analyzing the Turkish Economy

Turkey has been one of the most impressive economic

growth stories outside India and China over the last decade. But, like all

others, it too could not avoid the contagion effects of the Great Recession,

suffering a sharp economic contraction in 2009. However, it recovered

spectacularly in the aftermath of the Great Recession, growing at 9.2% and 8.5%

in 2010 and 2011 respectively. The flip side of this impressive growth has been

a build-up of dangerous signals elsewhere in the economy. As The Economist warned in mid-2011, signatures of overheating were evident everywhere in the

Turkish economy.

Capital inflows from the core economies of Europe increased, encouraged by the strong economic growth signals coming from the country. The IMF’s Consultation Paper writes,

Business inventories have been rising and capacity utilization has been rising across the private sector. These headline inflationary pressures have been integrated into the broader economy, as reflected in the rising core inflation. Inflationary pressures have been boosted by the cumulative 30% nominal depreciation the Turkish lira has undergone since November 2010.

The central bank’s pro-cyclical policies too may have contributed to the inflationary pressures getting unhinged. Once Turkey opened its dialogue with European Union for membership in early 2005, investors formed expectations of its eventual entry into the Union and the implicit European guarantees that come with membership. Turkish government bond yields fell and capital inflows surged. The Turkish central bank has amplified this trend by embracing an extended period of monetary accommodation, and has kept its repo rates at record low rates.

This trend is similar to that with the case of the peripheral European economies in mid-nineties after the decision to join thesingle currency was announced. As happened there, capital inflows into the Turkish economy, to finance consumption and investment has surged. The rising wages and resultant decline in Turkish external competitiveness has the trademark signature of what happened to the peripheral European economies like Greece and Portugal.

In order to re-balance its economy, Turkey needs to immediately address its twin imbalances. As the Salter-Swan model indicates, the economy needs to get back to A. This has to be achieved by re-balancing the internal sector, by cooling down economic growth and rectifying the resource mis-allocation away from the non-tradeable sector. This can be done by the central bank reversing its accommodatory policies and raising interest rates. This will slow down credit growth and thereby lower consumption and investment.

More fundamentally, the increasing prices for the

non-tradeables (as reflected in the inflationary pressures) will dampen demand

and contribute towards shifting economic activity away from non-tradeables. The

higher Pn, ratio of price of non-tradeable and tradeable goods, will boost export activity. The economy will move up in the

Salter-Swan model from B to C. If the central bank allows the Turkish lira to

depreciate further, it will contribute towards raising Turkey’s external

competitiveness.

As indicated in the IMF 2011 Consultation Paper, the

external and internal balances have been casualties of the recovery. Its rapid

growth concealed disturbing structural imbalances which had crept into the

economy during the period of sustained growth. The rapid economic growth was

built on the foundations of spurt in private investment, household consumption and imports. This graphic constructed from Eurostat indicates the surge in private investment and imports in the 2010-11 period.

Capital inflows from the core economies of Europe increased, encouraged by the strong economic growth signals coming from the country. The IMF’s Consultation Paper writes,

Loans to the private sector grew by around 40 percent y-on-y during Q4 2010 to Q2 2011, to reach 48 percent of GDP. This reflected the historically-low interest rate environment and banks’ intense competition for market share. Lending was especially rapid to households (for general purpose and housing loans) and to small- and medium-sized firms due to strong demand and higher profit margins on these loans. With the increase in resident’s deposits - previously banks’ main funding source - falling far short of the increase in lending, banks’ average loan-to-deposit ratio jumped from 76 percent at end 2009 to near 95 percent in mid-2011. To expand loans, during the first nine months of 2011, banks relied on financing sourced from abroad to the same extent as residents’ deposit growth.

As credit growth boomed, inflationary pressures

became unhinged. Unemployment rate declined and the labor market tightened. Wages have risen sharply over the past three years. The

rise in wages has also adversely affected the country’s external economic

competitiveness. This has adversely affected exports, as reflected in the

slowdown in exports, despite increased economic activity.

Business inventories have been rising and capacity utilization has been rising across the private sector. These headline inflationary pressures have been integrated into the broader economy, as reflected in the rising core inflation. Inflationary pressures have been boosted by the cumulative 30% nominal depreciation the Turkish lira has undergone since November 2010.

The central bank’s pro-cyclical policies too may have contributed to the inflationary pressures getting unhinged. Once Turkey opened its dialogue with European Union for membership in early 2005, investors formed expectations of its eventual entry into the Union and the implicit European guarantees that come with membership. Turkish government bond yields fell and capital inflows surged. The Turkish central bank has amplified this trend by embracing an extended period of monetary accommodation, and has kept its repo rates at record low rates.

This trend is similar to that with the case of the peripheral European economies in mid-nineties after the decision to join thesingle currency was announced. As happened there, capital inflows into the Turkish economy, to finance consumption and investment has surged. The rising wages and resultant decline in Turkish external competitiveness has the trademark signature of what happened to the peripheral European economies like Greece and Portugal.

In many respects, Turkey’s macroeconomic situation

is typical of developing countries which experience such positive shocks.

Access to cheap capital often tends to increase credit growth, boost consumption,

raise imports, and spur investment activity. All these make the non-tradeable

sector more attractive, raising investment and supply. This often comes at the

expense of the tradeable sector. As the economic growth exceeds its potential

output, inflationary pressures get unleashed.

In the Salter Swan model of macroeconomic balance, the Turkish economy stands

at the point indicated by B. In the aftermath of the 2008-09 crisis, the

economy recovered smartly on the back of a mixture of public spending, public

consumption, and private investment. External capital inflows contributed

significantly to this financing this trade. However, all of these policies and

resultant effects pushed the economy from A to B, causing both external and

internal imbalances. The internal imbalance is reflected in the overheating

economy. The external imbalance is manifested in the rising and unsustainable

current account deficit.

In order to re-balance its economy, Turkey needs to immediately address its twin imbalances. As the Salter-Swan model indicates, the economy needs to get back to A. This has to be achieved by re-balancing the internal sector, by cooling down economic growth and rectifying the resource mis-allocation away from the non-tradeable sector. This can be done by the central bank reversing its accommodatory policies and raising interest rates. This will slow down credit growth and thereby lower consumption and investment.

The devaluation will help restore the economy’s

external balance, over time, through three effects. First, the higher exchange

rate will increase the competitiveness of Turkish exports and boost it. Second,

the real balance sheet effect will contribute towards reducing imports. Third,

in the absence of exchange rate stabilization policies and sterilization, the

monetary approach to balance of payments effect tells us that the economy will

re-balance by lowering the money supply. The LM curve in the IS-LM model will be

pushed back to its long-run equilibrium. This corresponds to the movement from

C to A in the Salter –Swan model.

It is imperative that Turkey address its internal and external imbalance problems at the earliest, failing which there could be the possibility of it slipping down the same path as Greece.

Thursday, November 29, 2012

America's shale gas boom in a graphic

The recent discoveries and frenetic pace of exploration of shale gas reserves has prompted claims that it will usher in a renaissance in US manufacturing. Shale gas production in the United States has more than doubled since 2010 and natural gas prices have fallen steeply. This graphic captures this spectacular trend.

Whether it revives US manufacturing or not, these developments are certain to impact the global energy geo-politics.

Whether it revives US manufacturing or not, these developments are certain to impact the global energy geo-politics.

It's the health care, stupid!

Amidst all talk of the looming fiscal cliff, the CBO has this excellent graphic (via Wonkblog) that captures the source of America's anticipated future fiscal troubles.

In fact, all the increases are going to come from health care. Social security is largely forecast to remain at the same level, while the rest (defense, education, infrastructure etc) are estimated to actually decline. The graphic assumes business as usual fiscal policy.

In fact, all the increases are going to come from health care. Social security is largely forecast to remain at the same level, while the rest (defense, education, infrastructure etc) are estimated to actually decline. The graphic assumes business as usual fiscal policy.

Sunday, November 18, 2012

Effect of central bank independence in a graphic

In light of media reports of deepening divide between the Reserve Bank of India (RBI) and the Finance Ministry, a reminder about the importance of independent central banks may be appropriate. A couple of years back, Ben Bernanke pointed to the example of UK's decision to grant independence to the Bank of England (BoE) to drive home the point.

In May 1997, the BoE's charter was revised and it was re-born as an independent central bank. The impact of this on the yields of UK's long term government securities was spectacular. It nearly halved over the year. Here is a graphic from the excellent Fred that captures this change.

This alone should be reminder to those at the North Block when they appoint the successor to Dr Subba Rao next year. The hard won credibility of the RBI can be squandered in one moment of madness.

In May 1997, the BoE's charter was revised and it was re-born as an independent central bank. The impact of this on the yields of UK's long term government securities was spectacular. It nearly halved over the year. Here is a graphic from the excellent Fred that captures this change.

This alone should be reminder to those at the North Block when they appoint the successor to Dr Subba Rao next year. The hard won credibility of the RBI can be squandered in one moment of madness.

Friday, November 16, 2012

More evidence of market failure in healthcare services

Health care is not broccoli. More evidence comes from this graphic that compares the cost of procuring hip replacement surgeries for public insurers and for those purchasing directly from the market place.

While some differential is to be expected between wholesale and retail purchases of broccoli, there is little justification for a 150% mark-up in the private (read competitive and free) market.

Update 1 (19/3/2013)

Excellent graphics from Time highlighting the state of health care in the US. Two graphics stand out.

While some differential is to be expected between wholesale and retail purchases of broccoli, there is little justification for a 150% mark-up in the private (read competitive and free) market.

Update 1 (19/3/2013)

Excellent graphics from Time highlighting the state of health care in the US. Two graphics stand out.

Wednesday, November 14, 2012

The moral hazard with a Greek debt write-down

As the severity of Greece's solvency crisis looms large, calls for writing off atleast a part of the Greek public debt, three-fourths of which are now held by sovereign creditors, has been mounting. Any decision to write off Greece's public debt, especially from sovereign creditors, is likely to have strategic implications at multiple levels. It is not a simple case of a one-time financial write-down, but has moral hazard and expectations forming consequences. There are three immediate implications that come to the fore.

1. How will Greece itself respond to the write-down? More specifically, will it reduce the pressure on Greek politicians to undertake the harsh structural adjustment decisions that are necessary to complement any debt write-down and get the growth back on sustainable path? Greece's is a democracy and its commitment record, even in the past three years, to push ahead with these bitter measures is questionable.

2. How will this be interpreted by the other countries similarly placed and by those who face debt crisis in future? In particular, Ireland, maybe even the other PIIGS? Will this encourage them into following the Greece path? How will this be interpreted by developing countries, atleast some of whom are likely to face similar circumstances in the foreseeable future? The expectations formed by this decision will have consequences for a generation.

3. Most importantly and with immediate implications, what message will sink into the bond markets? In particular, since the longer term prospects of existing debt improves with a partial sovereign debt write-off, will bond markets react by increasing the pressure on the bonds (widening spreads and increasing prices of CDS) of other similarly placed countries, thereby precipitating a deep enough liquidity crisis that would force the EU into another partial write-down. The fact that Italy and Spain, both stand at the precipice, makes this possibility calamitous.

In the final analysis, the strong moral hazard concerns associated with such decisions, make any debt write-downs a deeply strategic decision. Germany's desire to drag the strategic bargaining game with Greece and its creditors as long as possible in the hope of squeezing out as much restructuring commitments (from Greece) and concessions (from investors and creditors) as possible while simultaneously minimizing the moral hazard consequences is therefore understandable. Those criticizing it as mindless is doing more out of despair and hope than after weighing its strategic consequences.

1. How will Greece itself respond to the write-down? More specifically, will it reduce the pressure on Greek politicians to undertake the harsh structural adjustment decisions that are necessary to complement any debt write-down and get the growth back on sustainable path? Greece's is a democracy and its commitment record, even in the past three years, to push ahead with these bitter measures is questionable.

2. How will this be interpreted by the other countries similarly placed and by those who face debt crisis in future? In particular, Ireland, maybe even the other PIIGS? Will this encourage them into following the Greece path? How will this be interpreted by developing countries, atleast some of whom are likely to face similar circumstances in the foreseeable future? The expectations formed by this decision will have consequences for a generation.

3. Most importantly and with immediate implications, what message will sink into the bond markets? In particular, since the longer term prospects of existing debt improves with a partial sovereign debt write-off, will bond markets react by increasing the pressure on the bonds (widening spreads and increasing prices of CDS) of other similarly placed countries, thereby precipitating a deep enough liquidity crisis that would force the EU into another partial write-down. The fact that Italy and Spain, both stand at the precipice, makes this possibility calamitous.

In the final analysis, the strong moral hazard concerns associated with such decisions, make any debt write-downs a deeply strategic decision. Germany's desire to drag the strategic bargaining game with Greece and its creditors as long as possible in the hope of squeezing out as much restructuring commitments (from Greece) and concessions (from investors and creditors) as possible while simultaneously minimizing the moral hazard consequences is therefore understandable. Those criticizing it as mindless is doing more out of despair and hope than after weighing its strategic consequences.

Sunday, November 11, 2012

Greece's "shadow economy" problem

One of the biggest challenges for the Greek government is to uncover its massive "shadow economy", which forms nearly a quarter of the GDP. Addressing this is critical for increasing tax revenues that are essential for Greece's recovery from a crisis that threatens to ruin a generation.

Friday, November 9, 2012

Is Bangladesh the most impressive social development story of the last two decades?

The Economist has this graphic that captures the stunning progress made by Bangladesh in improving its social indicators since 1990. The improvements in infant and maternal mortality rates, immunization, and female literacy should rank among the best improvements achieved by any large sized country in such a short period of time. The contrast with India, which experienced a quadrupling of its percapita income in the same period, but achieved far less progress with social indicators, is instructive.

The Economist is spot on in its assessment,

The most dramatic period of improvement in human health in history is often taken to be that of late-19th-century Japan, during the remarkable modernisation of the Meiji transition. Bangladesh’s record on child and maternal mortality has been comparable in scale.This is a very impressive achievement, especially given that Bangladesh with a population of more than 150 million is no small country. The fact that it was achieved without proportionate improvements in income levels and alongside extreme poverty runs contrary to much of mainstream thinking that social development follows economic growth.

The Economist points to the role of NGOs, in particular the iconic NGO BRAC (Bangladesh Rehabilitation Assistance Committee) in Bangladesh's progress,

The real magic of Bangladesh, though, was not microfinance but BRAC — and NGOs more generally. The government of Bangladesh has been unusually friendly to NGOs... BRAC is now the largest NGO in the world by the number of employees and the number of people it has helped (three-quarters of all Bangladeshis have benefited in one way or another)... BRAC does practically everything. In the 1980s it sent out volunteers to every household in the country showing mothers how to mix salt, sugar and water in the right proportions to rehydrate a child suffering from diarrhoea. This probably did more to lower child mortality in the country than anything else. BRAC and the government jointly ran a huge programme to inoculate every Bangladeshi against tuberculosis. BRAC’s primary schools are a safety net for children who drop out of state schools. BRAC even has the world’s largest legal-aid programme: there are more BRAC legal centres than police stations in Bangladesh...

BRAC is a sort of chaebol (South Korean conglomerate) for social development. It began with microcredit, but found its poor clients could not sell the milk and eggs produced by the animals they had bought. So BRAC got into food processing. When it found the most destitute were too poor for micro-loans, it set up a programme which gave them animals. Now it runs dairies, a packaging business, a hybrid-seed producer, textile plants and its own shops—as well as schools for dropouts, clinics and sanitation plants.Though the role and contribution of BRAC and other NGOs was huge, it is undeniable that such progress could not have been made without active role of the government. India, more than anyone else, has the most to learn from Bangladesh. Why has East Bengal, which is much more poorer and with a much more dysfunctional administrative system, managed to achieve so much more than West Bengal? What explains the massive differential in achievements, despite similar baseline figures, on both sides of the Indo-Bangladesh border?

Thursday, November 8, 2012

China - The construction contractor to the world?

Nothing exemplifies the spectacular rise of China better than its mega construction projects - roads and bridges, high speed railways, irrigation projects, and massive townships. In addition to being the factory of the world, China is rapidly emerging as the construction contractor to the world. Chinese firms have become extremely proficient in taking up large scale construction projects in infrastructure sectors like transport, electricity, and telecommunications at cheaper prices and completing them well within time.

It should therefore come as no surprise, as The Economist points out, that all the top three construction companies in the world are Chinese, a radical shift from 2003 when there was no Chinese firm in the top ten.

Predictably, Chinese firms are now aggressively bidding for construction contracts across the world. An important factor in the the success of China's strategic diplomacy in Africa, Latin America and the Caribbean, through offering them financial assistance to establish infrastructure facilities, has been the effectiveness of these large contractors. Once the agreement is signed, these contractors arrive with labour, materials and equipments, and execute the work in extremely challenging conditions in record time and at very low cost.

Evidently these Chinese firms have over a very short time managed to overcome the steep learning curve generally associated with managing the execution of large construction contracts in difficult conditions. In many respects, these large contractors have perfected a construction contractor model, which has striking similarities with its manufacturing sector. In both cases, Chinese firms have developed the capacity to mobilize large quantities of inputs and labour and manage them in the most cost-effective manner to meet highly ambitious targets and deadlines. It is something Indian firms would do well to learn and emulate.

It should therefore come as no surprise, as The Economist points out, that all the top three construction companies in the world are Chinese, a radical shift from 2003 when there was no Chinese firm in the top ten.

Predictably, Chinese firms are now aggressively bidding for construction contracts across the world. An important factor in the the success of China's strategic diplomacy in Africa, Latin America and the Caribbean, through offering them financial assistance to establish infrastructure facilities, has been the effectiveness of these large contractors. Once the agreement is signed, these contractors arrive with labour, materials and equipments, and execute the work in extremely challenging conditions in record time and at very low cost.

Evidently these Chinese firms have over a very short time managed to overcome the steep learning curve generally associated with managing the execution of large construction contracts in difficult conditions. In many respects, these large contractors have perfected a construction contractor model, which has striking similarities with its manufacturing sector. In both cases, Chinese firms have developed the capacity to mobilize large quantities of inputs and labour and manage them in the most cost-effective manner to meet highly ambitious targets and deadlines. It is something Indian firms would do well to learn and emulate.

Wednesday, November 7, 2012

Is the impact of NREGS on farm wages more nuanced?

Livemint points to an interesting finding from a study of farm wages and farm productivity that questions the conventional wisdom that the National Rural Employment Guarantee Scheme (NREGS) has increased rural wages and affected agriculture production. Kanika Mahajan writes,

So what is the story? Why has agriculture productivity increased during the latest period? What's the contribution of NREGS to this, if any? Is the increase in farm wages concealed somewhere? A satisfactory assessment of these trends will require more data and their analysis.

But as the author herself indicates, one plausible mechanism would be through the assets created under the NREGS. A large share of NREGS works were irrigation related ones like water harvesting structures and field channels. These works, even if semi-permanent and of poor quality, are certain to have increased the water availability for significant acreage. Is this showing up in the productivity figures?

In any case, if this is true, it only means that farm productivity has increased due to better inputs and not increased labour productivity. In fact, the lower increase in wages in the latest period could even point to a slowdown or even reduction in labour productivity. Is there a causal role for NREGS in this trend? Is it the case that the more productive workers have preferred the more remunerative NREGS work to farm labour? Further, the figures also does not say anything about the non-farm rural wages, leave alone wages in other areas.

Update 1 (1/12/2013)

Livemint has this nice graphic on rise of rural wages across India.

While it is difficult to draw causal relationship with NREGS, its impact is undoubted. Will be interesting to examine the correlation between the penetration of NREGS (say, in terms of average mandays of rural jobs created per person) and the rise in wages.

The annual wage growth rate for men working in agriculture being 3.1% in the most recent period (2004-09) compared with just 1.8% in the previous period (1999-2004). The difference is even starker for women at 5% annual growth for 2004-2009 and a meagre 1.2% for 1999-2004... But these figures cannot be analysed in isolation. They must be looked at under the light of changing agricultural conditions across the two periods... the increase in foodgrain yield in 2004-2009 of 2.5% per year, while it was at a record low level of 0.1% per year during 1999-2004... The net increase in men’s agricultural wages (subtracting the foodgrain yield growth rate from real agricultural wage growth rate) stands at 1.7% for the period of 1999-2004 and 0.6% for 2004-2009. Thus, 2004-2009 effectually experienced a lower rate of increase in agricultural wages once the growth rate in yield is netted out... at the all India level, growth in net female agricultural wages is a modest 2.4% in 2004-2009 in comparison with the 1.1% in the 1999-2004.

So what is the story? Why has agriculture productivity increased during the latest period? What's the contribution of NREGS to this, if any? Is the increase in farm wages concealed somewhere? A satisfactory assessment of these trends will require more data and their analysis.

But as the author herself indicates, one plausible mechanism would be through the assets created under the NREGS. A large share of NREGS works were irrigation related ones like water harvesting structures and field channels. These works, even if semi-permanent and of poor quality, are certain to have increased the water availability for significant acreage. Is this showing up in the productivity figures?

In any case, if this is true, it only means that farm productivity has increased due to better inputs and not increased labour productivity. In fact, the lower increase in wages in the latest period could even point to a slowdown or even reduction in labour productivity. Is there a causal role for NREGS in this trend? Is it the case that the more productive workers have preferred the more remunerative NREGS work to farm labour? Further, the figures also does not say anything about the non-farm rural wages, leave alone wages in other areas.

Update 1 (1/12/2013)

Livemint has this nice graphic on rise of rural wages across India.

While it is difficult to draw causal relationship with NREGS, its impact is undoubted. Will be interesting to examine the correlation between the penetration of NREGS (say, in terms of average mandays of rural jobs created per person) and the rise in wages.

Friday, November 2, 2012

Second best policy frameworks to mitigate corruption

I have a new column, Governance Agenda, in Pragati which this time talks about second best policy frameworks in corruption.

Thursday, November 1, 2012

The TBTF subsidy and banking economies to scale

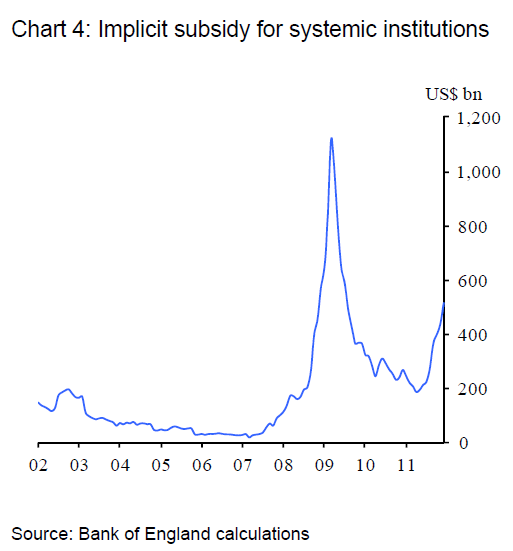

Andrew Haldane has put a figure on the "too-big-to-fail subsidy" - the cheap borrowing costs of the world's largest financial institutions in view of the widespread belief among investors that, even with clear resolution and bankruptcy regulations, their governments will not allow them to fail. The subsidy, he says, amounts annually to a whopping $700 bn.

He, like many others - Vickers Report in UK, Volcker Rule in US, and Liikanen Report of the EU - believe that proposals to ring-fence economically crucial activities, like deposits and payments, from riskier trading and investment banking activities are not likely to have the desired stabilizing effect. They point to the complex nature of these activities and the difficulty of regulators being able to enforce safeguards and restrictions. In the circumstances, they argue that nothing short of complete segregation of the two retail and commercial banking and investment banking activities would suffice. They also advocate overall assets-capital ratio, far higher than the 3% suggested by the Basel III Committee, for deposit taking financial institutions.

However, there are others like Simon Johnson (also here), who argue that even the re-introduction of the Glass-Steagall Act will not suffice and call for an end to universal banking. They feel that the only way out is to break up the TBTF institutions, even arguing that the social and private benefits of TBTF banks are illusory. Rejecting the findings of certain studies that there are scale economies associated with banks, Andrew Haldane says,

Former Citigroup Chief Executive Sanford Weill too recently called for separating investment banking from deposit taking banking. Haldane has been among those suggesting an overall cap on bank size as a share of GDP.

Update 1 (28/3/2014)

An IMF study finds that the overall funding cost advantage of systemically important financial institutions (SIFIs) was 80 basis points in 2009. Another study by New York Fed finds that the five largest US banks paid on average a third of a percentage point less on top rated debt than smaller rivals.

He, like many others - Vickers Report in UK, Volcker Rule in US, and Liikanen Report of the EU - believe that proposals to ring-fence economically crucial activities, like deposits and payments, from riskier trading and investment banking activities are not likely to have the desired stabilizing effect. They point to the complex nature of these activities and the difficulty of regulators being able to enforce safeguards and restrictions. In the circumstances, they argue that nothing short of complete segregation of the two retail and commercial banking and investment banking activities would suffice. They also advocate overall assets-capital ratio, far higher than the 3% suggested by the Basel III Committee, for deposit taking financial institutions.

However, there are others like Simon Johnson (also here), who argue that even the re-introduction of the Glass-Steagall Act will not suffice and call for an end to universal banking. They feel that the only way out is to break up the TBTF institutions, even arguing that the social and private benefits of TBTF banks are illusory. Rejecting the findings of certain studies that there are scale economies associated with banks, Andrew Haldane says,

But this finding is based on estimates of banks’ funding costs which take no account of the implicit subsidy associated with too-big-to-fail. Removing this subsidy raises banks’ funding costs, lowers estimates of bank value-added and thereby reduces measured economies of scale. Once an allowance is made for the implicit subsidy, the picture changes dramatically. There is no longer evidence of economies of scale at bank sizes above $100 billion. If anything, there is now evidence of diseconomies which rise with bank size, consistent with big banks becoming “too big to manage”.

Former Citigroup Chief Executive Sanford Weill too recently called for separating investment banking from deposit taking banking. Haldane has been among those suggesting an overall cap on bank size as a share of GDP.

Update 1 (28/3/2014)

An IMF study finds that the overall funding cost advantage of systemically important financial institutions (SIFIs) was 80 basis points in 2009. Another study by New York Fed finds that the five largest US banks paid on average a third of a percentage point less on top rated debt than smaller rivals.

Subscribe to:

Posts (Atom)