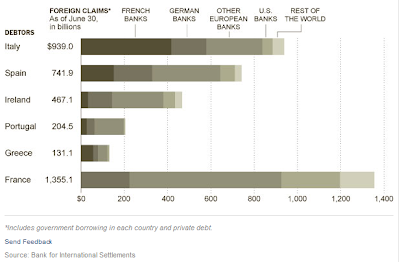

One of the most contentious debates surrounding the sovereign debt crisis in Europe is that about the institutional mechanism to provide the necessary liquidity support to the embattled economies.

The European Central Bank (ECB) is not empowered to provide the unconventional monetary policy actions that the Fed did in the US and thereby

backstop losses and unfreeze credit markets as a lender of last resort. Further, there is strong ideological and political opposition to printing money to buy the debts of individual members for fear of stoking inflation.

Therefore, as a compromise, the Eurozone leaders had established the European Financial Stability Fund (EFSF) to provide financial assistance to these governments. The IMF joined hands with the EFSF in structuring a first round of Eurozone financial stabilization fund of 440 m Euros.

Its mandate and firepower was designed with the objective of rescuing Greece, Ireland and Portugal. However, now with the turmoil spreading to Italy, Italian bond yields crossing the seven percent mark, and the country facing the danger of losing market access, the stabilization fund clearly looks under capitalized. A "big bazooka"

appears necessary.

There is also a growing realization, given the magnitude of market uncertainty surrounding the Eurozone, that the current liquidity crunch being faced by otherwise sound economies like Italy (and maybe France later) could turn into a solvency crisis. And if this happens to the country with the fourth largest public debt, it will be the final nail in the Euro project and have devastating consequences for the world economy itself. The frantic search for possible solutions to provide adequate liquidity cover for Italy is understandable.

Nouriel Roubini writes,

"Once a country that is illiquid loses its market credibility, it takes time – usually a year or so – to restore such credibility with appropriate policy actions. Therefore unless there is a lender of last resort that can buy the sovereign debt while credibility is not yet restored, an illiquid but solvent sovereign may turn out insolvent. In this scenario sceptical investors will push the sovereign spreads to a level where it either loses access to the markets or where the debt dynamic becomes unsustainable. So Italy and other illiquid, but solvent, sovereigns need a 'big bazooka' to prevent the self-fulfilling bad equilibrium of a run on the public debt. The trouble is, however, that there is no credible lender of last resort in the eurozone."

One option which has found favor with a number of opinion makers but has been rejected by Germany and the ECB is to issue Eurobonds. It is argued that such bonds, issued initially through the EFSF, could simultaneously solve two problems. One, it would help raise the cash required to refinance the debts of countries finding it difficult to access the debt market. Second, it could complement the German bund and provide an alternative risk-free investment avenue. Such assets can help stabilize the financial markets by providing investment avenues for institutional investors to rebalance their portfolios as they exit the struggling peripheral economy bonds.

In an

FT article, Wolfgang Münchau has rejected the notion of leveraging the EFSF to purchase Italian and other PIIGS debt. He describes his Eurobond proposal,

"The EFSF could announce that it would make unlimited purchases of national sovereign bonds to keep their spreads under an agreed cap – say 2 per cent for 10-year bonds. The European Central Bank would refinance the EFSF for as long as it takes. Once the Eurobonds are in place, EFSF liabilities would simply be transformed into Eurobonds. This would not constitute an illegal monetisation of debt, as long as the endgame for the EFSF is credible."

But there are strong reasons to cast doubts on success with the Eurobond plan. For a start, the issuance of Eurobonds would require changes to the Treaty itself. Before that could happen, it would have to overcome entrenched opposition in Germany. Further, it will consume valuable time. After this even if it arrives, it may be too late to save the monetary union.

In any case, monetary policy support is only one side of the policy requirement spectrum. Another formidable challenge facing the new Italian government involves the fundamental restructuring of the economy, especially its labor market. The country has lost labor cost competitiveness against Germany by more than 50% since the mid-nineties. The reforms required include dismantling the

two-tier jobs market, which protects the jobs of older workers in dying industries but traps youngsters in temporary work; and the industry-wide wage bargains that mean businesses cannot match wages to productivity. The

closed-shop professions and trades, and the mircro-sized family businesses, are a barrier to innovation and efficiency. The business landscape which is dominated by small firms should accommodate more bigger sized firms. The pension system should be further reformed and a clampdown on tax evasion enforced.

However, as

Nouriel Roubini writes, structural reforms like raising taxes, cutting spending and getting rid of inefficient labour and capital during structural reforms have a negative effect on disposable income, jobs, aggregate demand and supply. The recessionary deflation that Germany and the ECB are imposing on Italy and the other periphery countries will make the debt more unsustainable. He feels that there can be only one denouement,

"Even a restructuring of the debt – that will cause significant damage and losses to creditors in Italy and abroad – will not restore growth and competitiveness. That requires a real depreciation that cannot occur via a weaker euro given German and ECB policies. It cannot occur either through depressionary deflation or structural reforms that take too long to reduce labour costs.

So if you cannot devalue, or grow, or deflate to a real depreciation, the only option left will end up being to give up on the euro and to go back to the lira and other national currencies. Of course that will trigger a forced conversion of euro debts into new national currency debts...

Only if the ECB became an unlimited lender of last resort and cut policy rates to zero, combined with a fall in the value of the euro to parity with the dollar, plus a fiscal stimulus in Germany and the eurozone core while the periphery implements austerity, could we perhaps stop the upcoming disaster."

Even without going into any of these, the details of sustainably financing and paring down its massive public debt of €1,900bn (120% of GDP) is frightening. This problem, difficult in normal times, is amplifed by a weak economy (it is the only major economy where

per-capita GDP declined annually in the 2001-10 period) and severe austerity measures. Though much of its debt is short-term, as much as €350 bn of debt comes due next year. An

FT article argues that any increase in bond yields (and therefore cost of capital) will weaken the economy and deepen the debt crisis,

"The impact of crisis interest rates is likely to increase the annual debt burden by less than 1 per cent of GDP next year, compared to what would happen with 'normal' interest rates... With medium term nominal GDP growth likely to be in the doldrums at 2 per cent per annum, interest rates at 6.5 per cent would mean that Italy needs to run a primary surplus of 5.5 per cent of GDP indefinitely in order to stabilise its debt/GDP ratio at 120 per cent."

In simple terms, if Italy is to make a significant dent on its public debt problem, it will have to pull off reforms that ease the economy into a growth path that can create a primary budget surplus of over 5% of GDP for several successive years. And all this with a depressed economy, weakness among major trading partners, and a severe bout of austerity. As the FT writes, "If such a large fiscal consolidation can be achieved in the teeth of a recession, it will be very impressive, to say the least".

Update 1 (28/11/2011)

Wolfgang Munchau offers a three pronged approach to resolving the Eurozone crisis. First, aggressive intervention by ECB to provide massive temporary short-term liquidity and unlimited guarantee of a maximum bond spread or a backstop to the EFSF. Second, end the current process of cross-broder national guarantees and float joint-and-several liability eurozone bonds of credible size. Third, a fiscal union.