Though the RBI left the policy rates and the CRR in tact, its decision to raise SLR to 25% of Net Demand and Time Liabilities (NDTL), lower export credit refinance amounts, increase the provisioning requirement for advances to real estate sector and close certain temporary liquidity windows are clear declaration of intent that a calibrated and sequenced exit from the loose money policy is underway. Many of these decisions, including the SLR increase (the actual investments in government securities is beyond 26%), is likely to have minimal effect on the actual liquidity situation and is more a signal to anchor inflationary expectations.

Further, as the RBI Governor pointed out, even without any further repo rate cuts, the banks have enough room to lower their lending rates. An indicator of the delayed transmission of credit policy signals is the continuing reduction in lending rates by many banks.

However, the practice of sub-BPLR lending (to preferred and larger clients), unchanged higher small savings rates, and the high cost of old deposits will continue to hold back banks from responding effectively to monetary policy signals.

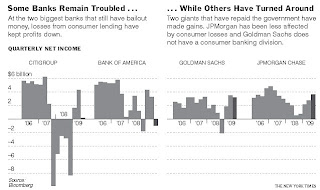

Credit growth indicators appears to show that demand-pull inflation should not be a worry. As the RBI's weekly statistical statement released on October 23 says, bank credit growth fell to a 12 year low of 10.8% as on October 9, sharply down from 29.5% in the same period last year. Even assuming a pick-up in credit growth in the next few busy season months, the credit growth rate for 2009-10 is going to fall well short of the 23% for last fiscal, and even short of the RBI's revised figure of 18% for 2009-10. Further, private consumption spending shows no signs of picking up despite the recent lowering of lending rates. Interestingly, food credit has contracted so far this fiscal compared to last year.

Credit demand continues to remain subdued among both businesses and consumers. And interest rate hike expectations appear to have already taken hold of businesses. In expectation of higher interest rates, businesses have been trying to trim their bank loan liabilities and thereby ease their future interest costs.

However, in an encouraging sign and an indicator of the increasing breadth of the Indian financial markets, while bank credit growth remains subdued, normalcy appears to have been restored in the larger market for financing business investments. The buoyant equity markets have contributed substantially to this improvement. Businesses have been relying on non-bank sources - mutual fund redemptions, equity market placements, CP etc - to raise funds - raising Rs 1,21,158 Cr through corporate bonds and equities in April-August 2009, against Rs 41,270 Cr in the same period last year. However, many of these sources are unlikely to remain active once the investments parked in these instruments by businesses are drained off.

The uptick in inflation is driven by an increase in food prices, which are a manifestation of the supply-side constraints arising from the delayed and poor monsoon and global demand-supply imbalances. In any case, as the graphic below indicates, the volatility in headline weekly WPI-based inflation (as opposed to core inflation, which strips out the food and fuel components) cannot become the basis for any meaningful monetary policy decisions.

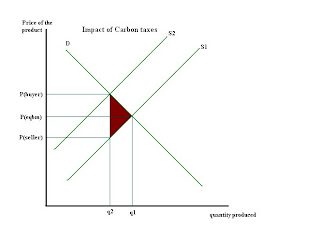

Raising rates will do little to achieve the objective of lowering foodgrain prices. They will require deploying a variety of other policy instruments, including increasing imports and more aggressive declogging of the social safety net delivery mechanisms. In so far as inflation is concerned, in a cost-push inflation scenario, monetary policy can at best help in anchoring inflationary expectations and preventing them getting embedded too deeply into the economy.

Inflation concerns (RBI expects inflation to be 6.5% by March 2010) alone cannot dictate interest rate decisions now. The RBI cannot afford to keep ignoring the substantial appreaciation (against the dollar) that rupee has undergone in the past few weeks and its impact on the competitiveness of Indian exports. The surge in capital inflows ($42 bn so far, against $9.1 bn for the entire last fiscal) into our equity markets over the past six months too has contributed to making the rupee dearer.

In the circumstances, any increase in rates now will only increase the inflows (a possible dollar carry trade) and the upward pressure on rupee. As a recent Financial Express op-ed explained, the RBI will be forced into making the Impossible Trinity trade-off if it has to maintain monetary policy autonomy.

The RBI Governor has recently stressed that the Bank remains committed to pursuing a three-pronged strategy of aiming at price stability, economic growth, and financial stability. The combination of a massive surge in capital inflows, a banking sector awash with liquidity and low interest rates are a recipe for resource mis-allocation and development of asset bubbles (as experienced by the equity markets since March and is beginning in the real estate market). In the circumstances, while balancing the need to keep the economy recovery intact without stoking off inflationary rpessures, it is also important that the RBI pay attention to financial market stability in its monetary policy decisions. The second quarterly credit policy review may be seen as a step in this direction.