1. MS Sahoo has a very good explainer of the recent Supreme Court order in Dilip B Jiwrajka Vs UoI and others) where it disposed a batch of 384 petitions affirming the constitutionality of provisions of the Insolvency and Bankruptcy Code that includes the personal guarantors to corporate debtors (PGCD) in the resolution process. In one stroke, it expedites the disposal of over 2000 applications pending for initiation of insolvency resolution of PGCDs with an underlying debt of Rs 1.64 trillion.

Desperate and unscrupulous debtors have litigated every major provision of the IBC like related party transactions and personal guarantees to retain their control over their firms.

The insolvency resolution process for PGCDs facilitates negotiation of a repayment plan, under the supervision of a resolution professional. Upon the failure of the plan, the parties are entitled to initiate a bankruptcy process. This process entails the sale of the assets of the PGCD, leaving a single dwelling unit of value up to Rs 10 lakh in rural areas/ Rs 20 lakh in urban areas, and some other essential assets. Until the process is complete, the PGCD suffers from certain disqualifications, such as acting as a public servant or being elected to a public office. These provisions are, however, benign compared to those in the erstwhile individual insolvency enactments.

The IBC process requires retrieving the value lost by the CD as well as the PGCDs through irregular transactions. This occasionally invites legal action against the promoters/ PGCDs. Some promoters-cum-PGCDs, who have defaulted, or wish to default, have been repeatedly challenging different IBC provisions, on some excuse or another, to evade the IBC process and its consequences... a CD may seek credit to commence a business. A creditor, however, may not extend credit to such a CD, as it is yet to have a business. It may be willing to extend credit if promoters guarantee to repay it if the CD gets into stress. If recourse to the guarantors is not available, the guarantee loses meaning and significance. No creditor would lend on a guarantee; consequently, both business and credit markets would suffer.

2. India and China's energy consumption in perspective.

Industry — which includes production of iron, steel, cement, chemicals, oil and gas — remains one of the hardest sectors to clean up. It also often gets overlooked in climate discussions. But industrial emissions are currently expected to soar in the decades ahead... cement manufacturing alone is expected to produce twice as many emissions for the rest of the century as all of the world’s cars combined.

4. Good story on the challenges Foxconn faces in manufacturing iPhones in India at its facility in Sunguvarchatram in Tamil Nadu.

In China, Foxconn demands long days, high targets, and minimal delays and mistakes — all of which proved difficult, if not impossible, to replicate in India. The stress clearly took a toll on the company’s local workforce... China’s one-party system goes to great lengths on Foxconn’s behalf, investing billions of dollars to help set up factories, subsidize energy and shipping, and recruit and bus in workers during labor shortages. Independent unions are banned in China. In India, Apple’s suppliers have to contend with local policymakers, landowners, and labor groups. The country lacks China’s vast network of material and equipment makers, who compete for Apple orders by cutting their own margins. “Apple has been spoiled in China,” a senior manager at an Apple supplier, who was recently deployed from China to India, told Rest of World. “Here, except labor, everything else is expensive.”...

Indian Foxconn workers told Rest of World that eight hours under intense pressure is already hard to bear... For the expatriate workers, the slower pace of the factory floors in India is its own shock to the system. A Taiwanese manager at a different iPhone supplier in the Chennai area told Rest of World that India’s 8-hour shifts and industry-standard tea breaks were a drag on production... In China, Foxconn relies on lax enforcement of the country’s labor law — which limits workdays to eight hours and caps overtime — as well as lucrative bonuses to get employees to work 11 hours a day during production peaks... Foxconn used bonuses and promotional opportunities to encourage engineers and managers in India, too.But five Chinese and Taiwanese workers said they were surprised to discover that their Indian colleagues refused to work overtime. Some attributed it to a weak sense of responsibility; others to what they perceived as Indian people’s low material desire... the foreign staff are still frustrated by local workers’ performance. “They know how to do it, but they are slow,” the employee said. “They even walk slowly.” A foreign manager complained that Indian workers requested leave too frequently — to care for sick family members, for instance — or for reasons they considered insufficient, such as a “blood moon” lunar eclipse, deemed particularly inauspicious for women. They and another foreign manager said Indian workers were also frequently late to meetings... At Foxconn’s factories in China, people strive to exceed their targets, sacrifice leave days, and stay late to impress the bosses.

Interesting gender dynamic in Foxconn factories,

When electronics manufacturing took off in China in the 1980s, rural women who had just begun moving to the cities made up the majority of the factory workforce... Over the past 30 years, that’s changed. Today, most of China’s iPhone workers are men; women have moved into less arduous service sector jobs. But in India, Foxconn and other electronics manufacturers are once again recruiting from a female workforce beginning to migrate for better jobs. Hiring a young, female workforce in India comes with its own requirements — which include reassuring doting parents about the safety of their daughters. The company offers workers free food, lodging, and buses to ensure a safe commute at all hours of the day. On days off, women who live in Foxconn hostels have a 6 p.m. curfew; permission is required to spend the night elsewhere.

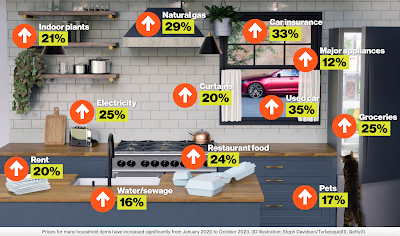

5. Inflation in the US in the last three years, January 2020 to October 2023 - nice illustration!

American oil fields are gushing again, helping to drive down fuel prices but also threatening to undercut efforts to reduce greenhouse gas emissions. Only three years after U.S. oil production collapsed during the pandemic, energy companies are cranking out a record 13.2 million barrels a day, more than Russia or Saudi Arabia. The flow of oil has grown by roughly 800,000 barrels a day since early 2022, and analysts expect the industry to add another 500,000 barrels a day next year. The main driver of the production surge is a delayed response to the Russian invasion of Ukraine in February 2022, which sent the price of oil to well over $100 a barrel for the first time in nearly a decade. The wells that were drilled last year are now in full swing...The United States now exports roughly four million barrels a day, more than any member of the Organization of the Petroleum Exporting Countries except Saudi Arabia. On balance, the United States still imports more than it exports because domestic demand exceeds supply and many American refineries can more easily refine the heavier oil produced in Canada and Latin America than the lighter crude that oozes out of the shale fields of New Mexico, North Dakota and Texas... Most of the new U.S. oil production is coming from the Permian Basin, which straddles Texas and New Mexico. There are also some new projects and expansions in Alaska and offshore in the Gulf of Mexico.

According to ASML, the Dutch lithography machine manufacturer, it takes 34 lithography steps to achieve 7 nm on DUV machinery, compared to just nine steps with EUV. The additional production steps result in higher production costs and lower yields. With each additional step, more chips would be thrown away, and equipment costs go up... More components and materials are also consumed... The advanced lithography machine is subject to the Wassenaar Arrangement, a multilateral export control agreement formed by more than 40 nations to restrict the sale of products that could have a dual military purpose.

The Chinese government has heavily subsidised SMIC, Huawei and other semiconductor chips related firms in its efforts to overcome the handicap from the 2019 US sanctions on Huawei and to help the country catch up with the US.

Starting with the establishment of the China Integrated Circuit Industry Investment Fund in 2014, Beijing has nurtured its microchip industry with state funding. The investment fund has amassed a whopping $47bn over the past decade and is projected to raise an additional $41bn, further bolstering China’s quest for technological self-sufficiency. A report by research firm JW Insights, which analysed governmental investment by 25 provinces and regions, revealed that the government had poured $290.8bn into semiconductor-related sectors in 2021 and 2022, with one-third going to semiconductor equipment and materials.

The Shenzhen Major Industry Investment Group Co. was created in 2019 with state capital and given direct orders to support China’s chip efforts and Huawei specifically, according to people familiar with the matter. It has invested in about a dozen companies in the supply chain, including three Huawei-linked chip fabrication facilities, according to data from Tianyancha, an online platform that provides company registration information. But perhaps its most significant operation is a chipmaking tool company called SiCarrier Technology Ltd., founded in 2021. SiCarrier has formed a close, symbiotic relationship with Huawei, where it mainly interfaces with the electronic giant’s internal research arm, known as the 2012 Lab...The exchange of talent goes both ways. SiCarrier is vigorously hiring elite engineers to work directly on Huawei’s projects in Shenzhen and Dongguan, according to a person familiar with the matter. (The recruits are told not to reveal who they actually work for.) Huawei has also transferred about a dozen patents to SiCarrier, including sound-proof technologies for electronic machines and data center designs, according to patent transfer information published by the China National Intellectual Property Administration...Its importance to Huawei is as far more than just a manufacturer, said people familiar with the relationship: SiCarrier is also a nexus between Huawei and the rest of the supply chain. For example, it’s the largest shareholder in optical machine maker Zetop Technologies Co., according to Tianyancha. Such technology is central to the production of microchips, which are built of layer upon layer of transistors bound to a silicon wafer. The key to this is a process known as lithography where light is projected through a blueprint of the pattern that will be printed.

Unlike critical minerals, renewables generation, and EVs, in the case of semiconductor chips manufacturing, the US and its allies maintain dominance across the supply chain.

9. The Ken has an excellent article that examines the labour market for nurses. The market for nurses is characterised by both shortages and constraints against expansion in supply. There's a shortage of atleast 1.37 million nursing professionals to meet the WHO norms. There are perhaps two big constraints to the expansion of the supply of good quality nursing professionals. While establishing nursing colleges is easier and there has been significant progress, the challenge has been that of recruiting qualified and good quality faculty to work in newly established nursing colleges.

Nursing colleges offering a B.Sc. degree in the country grew from 30 in 2000 to over 2,200 in 2022. Still, the nursing sector—boasting the biggest workforce in the healthcare industry—continues to struggle. The problem is even more pronounced for those working in private hospitals, which cater to ~74% of healthcare needs in India... the Union cabinet approved the plan to set up 157 new nursing colleges on 26 April. The colleges will be established alongside the existing 5,000 medical colleges to increase the availability of qualified nurses... Even as new colleges are being planned for, the existing ones are scrambling to find teachers... Sometimes colleges are forced to hire faculty on a part-time basis or to call clinical practitioners as tutors because of the lack of full-time faculty...

The Indian Nursing Council (INC)—the regulatory body for nurses and nursing education—mandates having a teacher-to-student ratio of 1:10. But private nursing schools often only recruit four or five nursing faculty and bring more people in to match the INC-prescribed ratio during inspections... numerous private nursing colleges have ghost faculty that appear only during inspections. This, in turn, leads to extreme anomalies, where one person becomes the principal of nine colleges at a time, or 33 teachers work across 80 colleges. The supply shortage is forcing universities to hire freshers as faculty... This is against the INC’s mandate. Every nursing college needs to have experienced faculty with 3–10 years of experience. Even the clinical instructors who educate nursing students on the responsibilities and practical knowledge should have a minimum of one-year experience. Even then, the colleges are not able to attract talent.

This challenge is amplified by the greater preference among nursing professionals for clinical practice as against teaching.

What the profession really suffers from—lack of faculty, standardised nursing courses, rewarding career progression, individual welfare, and income parity—is yet to be cured... After 31 years, Mani earns only Rs 31,000 (US$ 379.09)per month as a senior staff nurse in a private nursing home. And as an assistant nursing professor with a Bachelor of Science (B.Sc.) in Nursing, she would make only Rs 15,000–20,000 (US$183.43–244.58) with her experience.

The demand for freshers is rising not just for teaching within the country but also for nursing abroad... Earlier, if foreign countries hired experienced nurses with 2–3 years’ experience in clinical practice, they are now hiring nurses right after they graduate... “From our college, 75% of nursing graduates migrate immediately to Canada, UK, US, New Zealand, Australia, and gulf countries; they don’t stay back to work in our own hospitals,” said Dr Judith Noronha, dean at the department of obstetrical and gynaecological nursing, Manipal College of Nursing... With readily available, exciting opportunities abroad, freshers find no incentive in pursuing specialised courses such as M.Sc., further aggravating faculty scarcity... the salary of a fresh graduate nurse at private hospitals such as Fortis and Manipal is about Rs 20,000–25,000 (US$244–306). In contrast, the US, the UK, Canada, and the Gulf countries offer 4–5X of that in starting salary.

When it looked like their big-ticket borrowers, especially real-estate projects, were going to default, some financiers took recourse to new funds tailormade for them by Wall Street firms. Investors who pooled money were issued senior securities, earning them interest. The finance company also contributed, but in a smaller junior tranche that ranks lower down in the repayment pecking order and is the first to absorb any losses. The private funds then lent money to the same stressed borrowers who, in turn, repaid their original loans and avoided bankruptcy proceedings. Finance companies were happy, too, since any mark-to-market losses on the securities they now held would be far lower than the provisioning burden they would have had to bear in case of soured credit.

This is how at least some shadow lenders in India have “evergreened” their loan books to avoid being on the radar of the Reserve Bank of India, their regulator. But the Securities and Exchange Board of India, the stock-market watchdog, has cottoned on to the sleight of hand. According to a Reuters report in October, the SEBI has detected at least a dozen cases involving $1.8 billion to $2.4 billion where alternative investment funds have been misused to sidestep other financial regulators including the RBI. The amounts involved may be small, but the problem with such shady practices is that they invariably lead to stiff regulation. And that could slow down the blistering growth of alternative funds, a broad category that includes venture capital, private equity, real estate funds, and private credit. A prominent Mumbai-based PE investor pointed out to me that it’s mostly the Wall Street firms that sponsored the cute structures. The same marquee buyout specialists will be the first to complain when, as a direct consequence, regulation in India takes a sterner turn. The lawyers who advised on these deals would wash their hands off...

The alternative-asset industry in India has venture capital and hedge funds as its two bookends. The main body, however, consists of private equity and private credit. Whereas just a decade ago these two asset classes were a $200 million sideshow, now they command $83 billion, or more than four-fifths of the $100 billion committed by investors to private funds.

It's good that the boring Indian financial market regulators are stepping in to regulate these practices at a time when the US SEC appears to be struggling to do the same.

No comments:

Post a Comment