1. Latest PISA results points to significant learning losses from Covid 19 pandemic across the world.

One interesting finding is the relative decline of Finland's standards

Some of the largest declines in both equity and overall attainment occurred in Finland, once regarded as one of the more successful European education systems. Learning loss since 2018 was almost three times the OECD average in reading and four times higher in science, but educational outcomes in the Nordic country were deteriorating even before the pandemic. Andreas Schleicher, director for education and skills at the OECD, says this was because Finland relaxed its academic expectations for students... There have been significant changes to the Finnish education system in recent years, with traditional subjects scrapped in favour of an approach called “phenomenon-based learning” that requires students to draw on multiple subjects to solve problems. It is also unusual in having no standardised national tests, aside from the matriculation exam at the end of secondary school for students applying to university.

Estonia has emerged as the new model, though its approach may be hard to replicate in larger countries.

Estonia’s education minister, Kristina Kallas, says its community-based system that hands schools considerable autonomy over resources and curriculum is hard to replicate in other European countries. But there are successful practices in Estonia that can be replicated elsewhere. “The common aspects of [successful systems] are teacher competence and autonomy, and the student mindset . . . to aim high and work hard,” she says. Although children start school aged seven, later than in most other developed economies, most benefit from Estonia’s high-quality pre-school system where teachers are required to have a bachelor’s degree. Almost 90 per cent of children are enrolled in pre-school for at least three years, compared with the OECD average of 57 per cent. “[Children] have very affordable and accessible pre-school. It’s still mostly play and developing social skills, but it is a pedagogical approach and we have high quality requirements,” says Kallas.

2. China's consumer price inflation falls by 0.5 percent year on year in November, following 0.2 per cent decline in October. Producer prices have been on the negative territory for the past year.

More than 1.5 million people now work at dozens of electric vehicle companies in China and their suppliers. The largest of them, BYD, has 570,000 workers, compared with 610,000 worldwide for Detroit’s Big Three combined.

4. Argentine President Javier Milei will struggle to implement dollarisation in an economy struggling to survive and with no foreign exchange reserves.

Argentina’s economy is in its most fragile state for two decades, with annual inflation running above 140 per cent. The central bank has exhausted its foreign exchange reserves, leaving businesses unable to buy the dollars to settle some $60bn worth of debt with foreign suppliers, and the government is at risk of going into arrears on its $43bn programme with the IMF, which Milei will need to renegotiate. Interest payments are spiralling on a pile of more than $20bn in short-term liabilities issued by the central bank to local financial institutions to mop up an excess of pesos in circulation.

In the meantime Milei's government has made his first major economic policy announcement to devalue the Peso by half, slash public spending, and reduce energy and transport subsidies.

The new government would move the official exchange rate to 800 to the dollar from levels just below 400 last week. Banks had already anticipated a sharp devaluation, but the new official level for the dollar was still some way below the black market rate of 1,045 on Tuesday. Federal budget transfers to the provinces would be cut to a minimum and all new public works projects halted, the minister said... Caputo also announced a temporary rise in taxes on imports but promised to scrap the existing system of government permits for imports. Export taxes, which are hated by Argentina’s powerful farming lobby, will be removed once the economic emergency is over. To offset the impact of the cuts on the more than 40 per cent of Argentines living in poverty, Caputo said the value of the government-provided food card would rise by 50 per cent and child benefits would double. The budget for one of Argentina’s largest welfare programmes, Potenciar Trabajo, would be frozen at 2023 levels.

5. Staying on in South America, in case you missed it in an extraordinary referendum, Venezeulans have voted overwhelmingly to claim rights over Guyanan territory. More than 10 million people voted with atleast 95% support in the referendum that the oil rich Guyana Esequiba region, which makes up 60% of Guyana, should become a Venezuelan state. And days after the vote, Venezuelan President Nicholas Madura ordered the state-owned companies to grant licenses for oil exploration in Essequibo.

6. Remarkable that profit margins of corporates in the US have spurted during the post-pandemic period. In fact, interesting that net profit margins of US S&P 500 companies have been rising steadily since 2010, even as labor wages have been relatively stagnant.

Big companies that had previously pushed through one standard price increase per year are now raising prices more frequently. Retailers increasingly use digital price displays, which they can change with the touch of a button. Across the economy, executives trying to maximize profits are effectively running tests to see what prices consumers will bear before they stop buying... For big companies in the S&P 500 index, the average profit margin — the percentage of profit relative to revenue — soared in late 2020 and into 2021, as government stimulus and the Federal Reserve’s emergency interventions stoked consumer demand. At the same time, companies raised their prices so much that they more than covered higher costs for energy, transportation, labor and other inputs, which have recently started to come down.

Corporations as varied as Apple and Williams-Sonoma recently reported their highest-ever margins for the third quarter, while Delta Air Lines said its international routes generated record profitability over the summer... Average margins in nearly every sector in the S&P 500 are running near or above 10-year highs, according to Goldman Sachs.

It's also interesting that this accompanies a subtle shift in strategy by companies from chasing growth (which often entailed competing aggressively to lure customers) to focusing on margins.

7. Andy Mukherjee points to the emerging Reliance-Sony duopoly in India's television and streaming market.

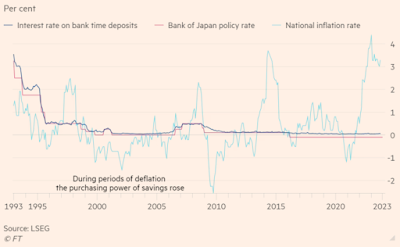

8. Fascinating long read in FT on Japanese savers who have over a three-decade span of near zero interest rates and having been scarred by the stock market crash of the late eighties preferred to save in currency and cash deposits over equities or real estate, but are now facing the prospect of higher interest rates on the back of inflation which has now spend more than 18 months above the BoJ's 2% target rate.

Even after 30 lean, post-bubble years, Japanese households hold ¥2.1 quadrillion ($14.7tn) of financial assets, of which more than half ($7.7tn) is held in cash and deposits. By contrast, households in the US and UK respectively hold 13 and 31 per cent in deposits. In national terms, Japan’s cash savings alone are equivalent to the combined annual gross domestic product of Germany and India. In corporate terms, Mrs Watanabe could buy Apple, Microsoft and Saudi Aramco with what she has sitting (earning almost zero interest) in the bank. When prices in Japan were stagnant or falling, as they were for most of the past 25 years, Mrs Watanabe’s preference for holding the majority of savings in cash was reasonable, especially so after the government guaranteed bank deposits in 1995. The central bank’s long experiment with ultra-low interest rates, which began in the late 1990s, meant she was not making any returns, but nor was her wealth being significantly eroded as long as Japanese companies held back from raising prices. But as more and more Japanese companies have broken ranks and raised prices in the past couple of years, Mrs Watanabe has arrived at a pivotal moment...

After years of failed efforts to coax that exact switch into investment, the Japanese government has created an unprecedented inducement. From January 2024, a dramatically expanded version of the Nippon Investment Savings Account, or Nisa, will offer a remarkable lifetime tax exemption for individuals’ equity investments. They have also raised the limit on both annual contributions from ¥1.2mn to ¥3.6mn and the cumulative limit from ¥6mn to ¥18mn. If the ploy works, it will begin to offset an aversion to stocks that has bedded-in since the collapse of the 1980s stock bubble. Japanese households hold just 24 per cent (17 per cent direct and 7 per cent through their pensions) of their assets in equities — far lower than the 54 per cent in the UK and 75 per cent in the US. That sets up, over the coming weeks and months, one of the biggest questions ever asked of the Tokyo stock market, its constituent companies and of Mrs Watanabe. Are savers about to become serious, price-moving retail investors in a domestic Japanese stock market that they have long shunned like a casino? Even a relatively moderate positive answer and a mere 2 per cent reallocation of assets, say analysts at AllianceBernstein, could produce $150bn of inflows into equities. If that happened, it would be market moving, say brokers. Inflows of less than half of that from foreign investors triggered a rally of more than 25 per cent in the Topix this year...

In the 1970s, Japanese individuals owned 40 per cent of the Japanese stock market. After stocks peaked and then crashed in the late 1980s and early 1990s, that ratio began to sink towards its current level of just 17.6 per cent.

It's interesting that many companies are bundling "shareholder benefit schemes" - offers of food products, cash equivalent prepaid cards and other perks - along with share ownership. Supermarket chain Aeon, who shares are very popular, distributes benefit cards with store discounts, and Oriental Land offers a one-day passport to Tokyo Disneyland!

9. Bloomberg article on Salesforce's marketing and sales focus

Salesforce built an army of cheerful young people who spent a lot of their time checking in and hanging out with customers such as Amazon, PayPal, Spotify and Uber. The company’s “customer success” teams functioned as in-house consultants for clients, helping them set up applications and use new features—a service that consulting companies could have charged many thousands of dollars more for. “We recognized the more successful the customers are with your technology, the higher likelihood they’re going to spend more money with you going forward,” says Brian Millham, who joined Salesforce more than two decades ago as one of its first salespeople and now serves as chief operating officer.The bet worked. Salesforce was bringing in $1 billion a year in revenue by 2009 and $26 billion by 2022. Some of that came from increased demand for its CRM software, but most of it came from selling leases for new tools, often ones Salesforce acquired. The 2013 purchase of ExactTarget gave the company a marketing product so Salesforce clients could email everybody who might have browsed, say, a pair of shoes on their site; Demandware, purchased in 2016, brought a tool for building those e-commerce sites. Salesforce has bought nearly 70 companies since its founding in 1999. One of its largest acquisitions, MuleSoft, gave Salesforce the means to stitch all these different software platforms together.

10. Two nice long reads in The Economist on UAE and London. Both have, in different ways and over differing time periods, proved how countries and cities can adapt to changes. UAE, with just 1 million citizens out of a total population of 10 million, has sought to diversify its economy away from oil and has done so successfully. It competes with Hong Kong and Singapore in attracting businesses and high networth individuals.

Dubai, which has little oil of its own, led the way, creating lightly regulated, low-tax economic zones designed to attract multinationals... its basic economic formula, of turning itself into a trading entrepot, transport hub and financial centre, remains successful. At the same time, the UAE has invested its oil wealth in strategically important industries and strategically important parts of the world... Start with the Emirates’ role as an entrepot. The fact that it is within easy flying and shipping distance of most of Africa, Europe and Asia makes it a natural hub. DPWorld, a firm owned by the government of Dubai, runs Jebel Ali, one of the world’s biggest container ports. Dubai airport is the busiest in the world for international travel. Logistics have grown to account for nearly 8% of the country’s GDP.But the business climate is as important as geography. In an index of economic freedom compiled by the Heritage Foundation, an American think-tank, the uae ranks 24th out of 176 countries—one notch above America. Foreigners laud the ease with which offices can be set up, flats rented, visas approved... In recent years, businesses have set up in Dubai at a frenetic pace: the number of new businesses joining the city’s chamber of commerce rose by more than 40% in the first half of the year, compared with 2022. A fifth went to Indian firms; the numbers of companies from China and elsewhere in the Middle East also grew rapidly... For Chinese ones, it has become an offshore trading hub. One example is Dragon Mart, a wholesale and retail complex in Dubai that bills itself as the biggest trading hub for Chinese goods outside China. Last year DP World helped set up Yiwu Market, which hopes to eclipse it. For Indian firms, the uae offers what Hong Kong and Singapore do for China and South-East Asia: an easier place to do business internationally, with more efficient courts, better infrastructure and access to capital and talent. It is also becoming a second home of sorts... Indifference towards Western sanctions has made the UAE a haven for businesses from shunned places. Iranian oil is often exchanged at sea off the emirate of Fujairah, blended with other crude and sold on. After traders in Geneva began shunning Russian crude, Dubai became the place to finance and trade shipments... Hong Kong’s seemingly never-ending lockdowns during the pandemic, meanwhile, sent some of its professionals fleeing to Dubai, where covid restrictions lasted only three months. Last year more millionaires moved to the UAE than anywhere else in the world, in net terms...Its various sovereign-wealth funds have assets of more than $1.5trn in all manner of businesses. The varied holdings of Mubadala, one of them, include stakes in Chime, an American fintech firm, XPeng, a Chinese electric-vehicle maker, and Jio, Mr Ambani’s telecom network, among other things. Many of the investments are in logistics. DP World runs ports everywhere from London to Sydney. All told, no less than a tenth of the world’s container-shipping passes through the firm’s hands... In 2006 the UAE made a prescient bet, setting up a firm called Masdar to diversify its energy supply and build on its energy expertise by investing in renewables. Masdar is now one of the world’s biggest developers of wind farms and solar power.

And this about London

London is thriving—a hardiness that holds lessons for cities everywhere. Its globalised economy has weathered Britain’s exit from the European Union far better than doomsayers had predicted. For all the political bluster on immigration, it remains a magnet for ambitious newcomers. And it is better-placed than many cities to absorb the disruptions of covid-19. Traverse London from south to north and west to east, and you find that its biggest challenges are the results of its dynamism rather than decline... London has produced more tech unicorns than its three nearest European rivals—Berlin, Paris and Stockholm—combined...

London, after all, has absorbed all manner of shocks in its 2,000-year history. Its most precarious period, considers Tony Travers of the LSE, came after the Romans left in the fifth century AD. The Black Death killed much of its population in the 1340s; the Great Fire of 1666 razed swathes of it. A port city that adapted to the decline of its port, it was also an imperial capital that acclimatised to the loss of empire. It defied the Blitz of 1940-41—when, rather than sheltering in the Tube as urban myth has it, most Londoners simply slept at home...

At the last count, disposable household income per person was 43% higher in London than in the country as a whole. Londoners are younger, more left-wing and far more diverse: ethnic minorities account for 46% of residents, over double the proportion in England and Wales. Two-fifths of Londoners were born abroad. Contrary to its reputation in the shires as a latter-day Gomorrah, on average London is slightly more socially conservative and less boozy than other regions. For that, thank its immigrants, many of whom are devout. They have also helped raise standards in London’s schools, which this century have been transformed from the worst-performing of any English region to the best.

London has managed to avoid the race to the bottom with subsidies to promote manufacturing by focusing on services.

London’s emphasis on services rather than manufacturing helped it to sidestep the worst fall-out from Brexit. Between 2016 and 2021 London’s exports of services grew by 47%. London’s status as a global financial centre remains intact even as its dominance within Europe has been eroded; it is a vibrant centre for tech startups. Politicians in America, Europe and Britain itself are shovelling subsidies towards manufacturing, but London is a reminder that high-value services—from law to coding, consulting to higher education—can be a better source of growth, jobs and innovation... Between 2016 and 2021 London’s exports of services grew by 47%, notes Emily Fry of the Resolution Foundation, another think-tank; for the rest of Britain the rise was just 4%. Places that import parts and export goods have suffered more Brexit-related costs and bureaucracy.

A remarkable feature of London has been the dispersed nature of its migrant populations.

Nigerians, South Asians and Latin Americans have taken the place of eu immigrants. Two-fifths of Londoners were born abroad. Most great Asian metropolises are far less heterogeneous: under 5% of Tokyoites are foreign-born, for example. London and New York are roughly as diverse but the British capital is not as ethnically segregated, in part because of the dispersal of social housing across every borough. Immigrants have helped raise standards in London’s schools, which have gone from the worst-performing of any English region to the best.

The long read on London has this interesting irony about Suella Braverman

Suella Braverman, twice forced out as home secretary in Conservative governments, recently claimed multiculturalism has “failed”. She is walking proof of the opposite: a Buddhist brought up in London by parents from Mauritius and Kenya, she found a Jewish husband and rose to one of the highest offices in the land. The London dream, you might call it.

No comments:

Post a Comment