Much has been written about the relationship between Donald Trump and Elon Musk, and the serious conflicts of interest it poses for both. In many respects, in both absolute and relative terms, the private benefit for Musk from this relationship, without even any pretensions that characterise such relationships, has the potential to dwarf all other examples of crony capitalism from anywhere in the world.

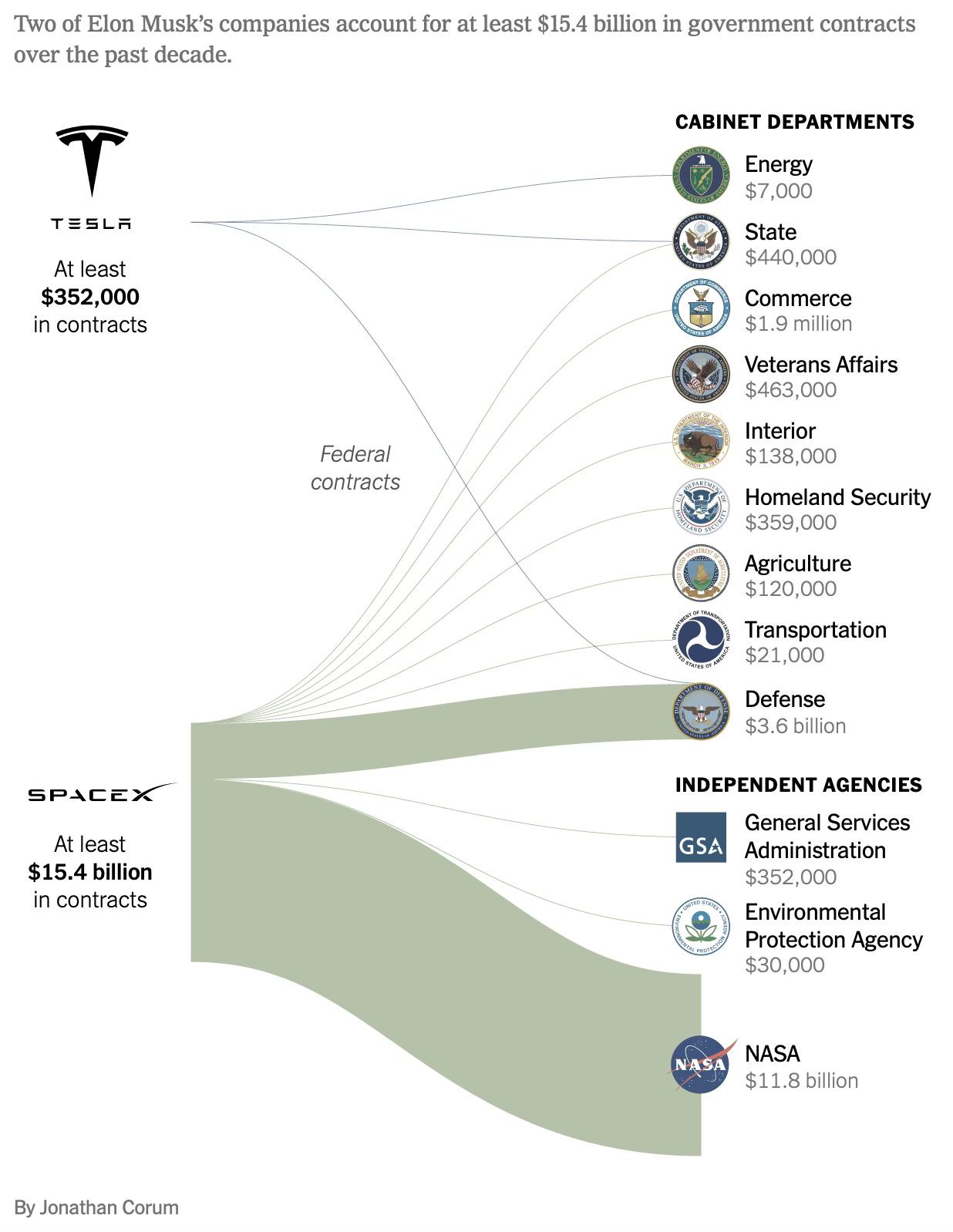

The potential for serious conflicts of interest are massive, as documented nicely by the Times here. See also this. Musk’s companies have benefited enormously from public contracts.

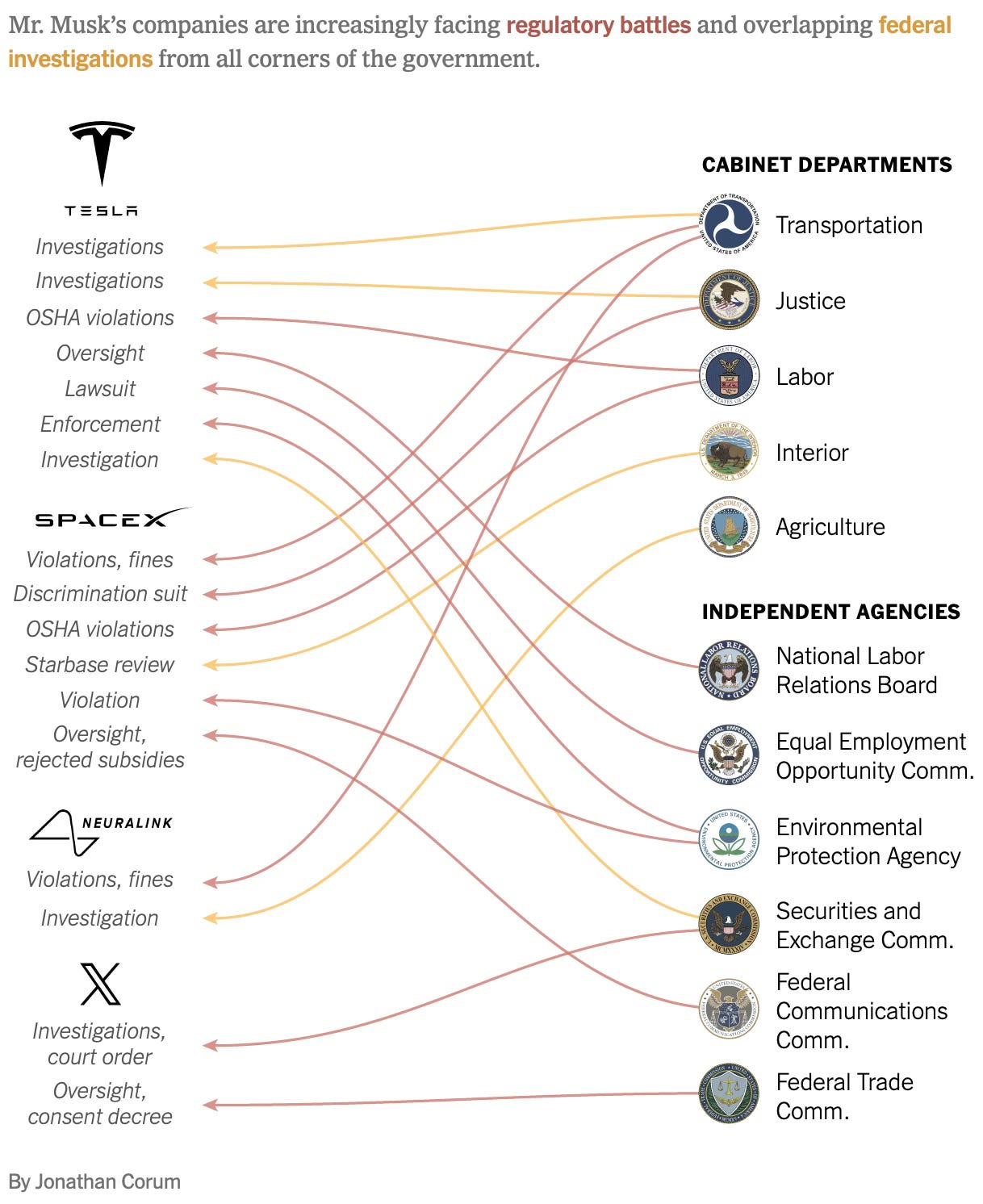

They are also exposed to regulatory oversight and investigations by federal government agencies.

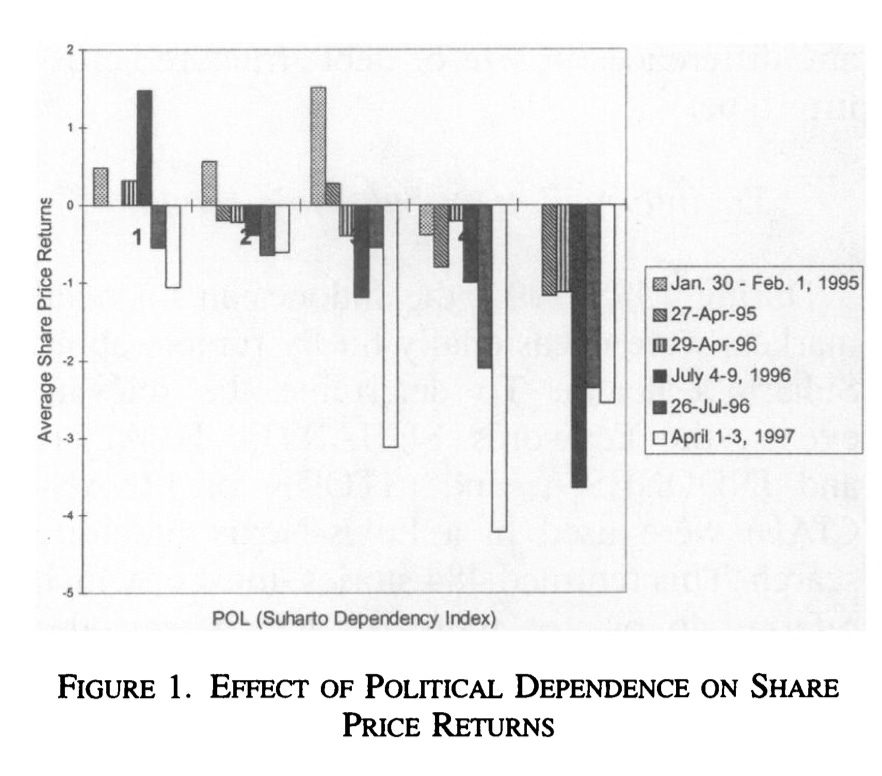

In this context, I’m reminded of a seminal and famous paper from 2001 where the economist Raymond Fismandocumented the importance of political connections to the fortunes of companies by studying crony capitalism in Suharto’s Indonesia. He found

To infer a measure of the value of connections, I take advantage of a string of rumors about former Indonesian President Suharto's health during his final years in office. I identify a number of episodes during which there were adverse rumors about the state of Suharto's health and compare the returns of firms with differing degrees of political exposure. First, I show that in every case the returns of shares of politically dependent firms were considerably lower than the returns of less-dependent firms. Furthermore, the magnitude of this differential effect is highly correlated with the net return on the Jakarta Stock Exchange Composite Index (JCI) over the corresponding episode, a relationship that derives from the fact that the return on the JCI is a measure of the severity of the rumor as perceived by investors. Motivated by these initial observations, I run a pooled regression using all of the events, allowing for an interaction between "political dependency" and "event severity." The coefficient on this interaction term is positive and statistically significant, implying that well-connected firms will suffer more, relative to less-connected firms, in reaction to a more serious rumor. My results suggest that a large percentage of a well-connected firm's value may be derived from political connections.

He compared the effect of six episodes on the share prices of firms with varying levels of connectedness (the Suharto Dependency Number 1 representing fewer connections and 5 the most).

In quantitative terms, he found that in the event of a regime shift a very closely connected firm would suffer a 23 percentage points reduction in share price compared to that for a firm with no political connection.

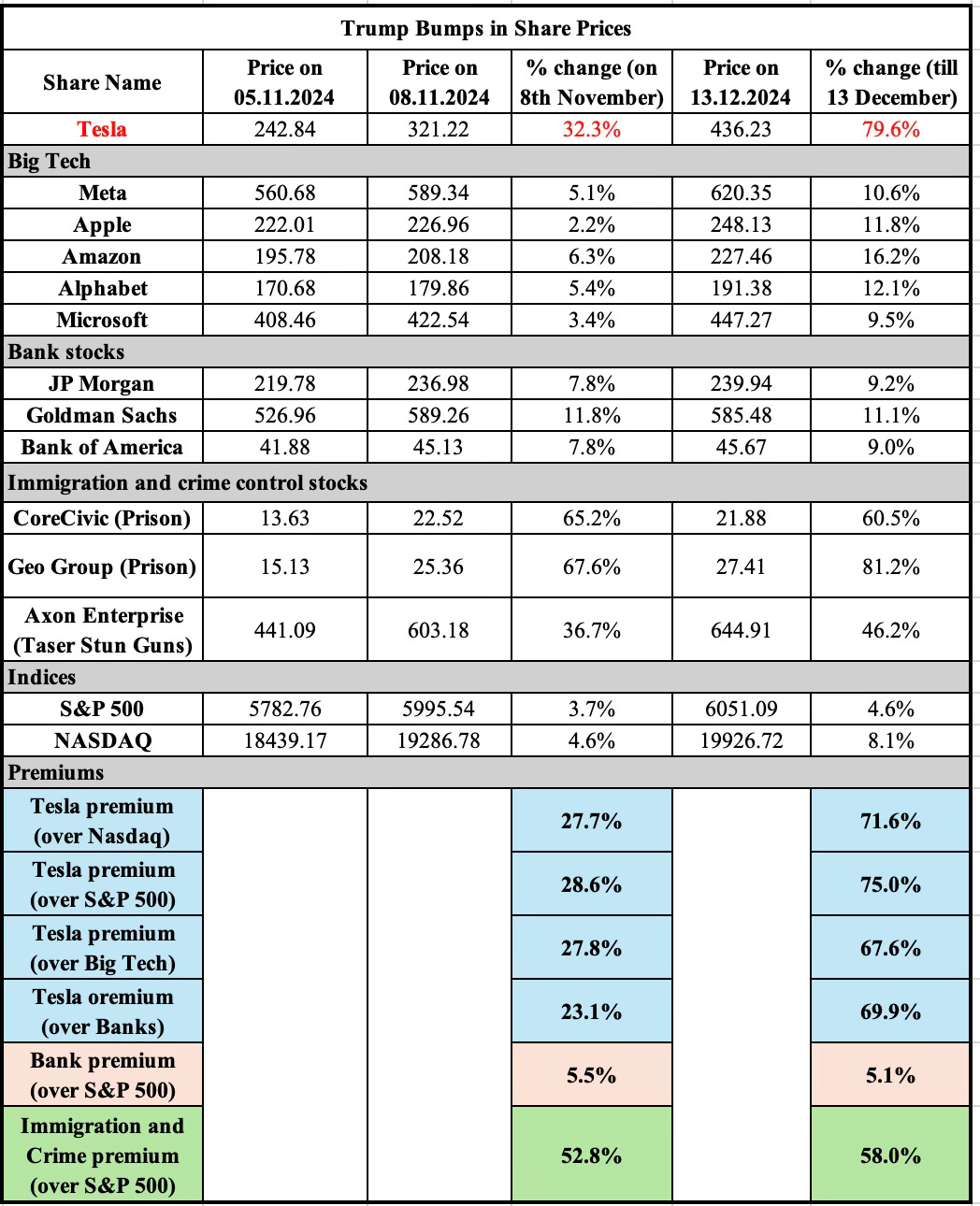

Now that Elon Musk is more closely connected with the incoming President in the US than any politician has ever been in any major country, it may be appropriate to look at the Trump Dependency Number for Elon Musk (5) compared with that for the BigTech firms, Banks, companies serving immigration and crime control, and Nasdaq and S&P 500.

Clearly, the share price of Musk’s only publicly listed company, Tesla, has had a massive Trump bump. Stocks of companies in specific sectors likely to benefit from the policies likely to be followed by the Trump administration, like banks and those involved in immigration and crime control, too have enjoyed the Trump bump. But while their gains were mostly in the first week after the election results were announced, Tesla has continued to gain all through.

Now that the shoe is on the other foot, and the potential for egregious corruption is being normalised in the US as it has been in developing countries, it may be appropriate for American academics to do event studies like this (paper here) and quantify the extent of rents that Musk is likely to extract in the coming months from his proximity to the US President.

Equally importantly, it might also be useful to document the declines in case when news emerges of their differences or any eventual falling out.

No comments:

Post a Comment