The hottest manufacturing topic of our times is semiconductor chips. Given their central role in emerging technology trends like AI and quantum computing and the bubbling new Cold War with China, their control has become an issue of strategic importance.

Chad Bown and Dan Wang have a good paper that examines the semiconductor chip manufacturing landscape. This is a short summary of the evolution of the chip industry.

Chip firms mostly did everything in-house in the 1980s. The contemporary set-up features a long and highly-fragmented supply chain, with companies specializing in tasks, buying from some and selling to others, focusing on what they do best. Today’s supply chains are global; thus, where firms locate geographically has also changed.

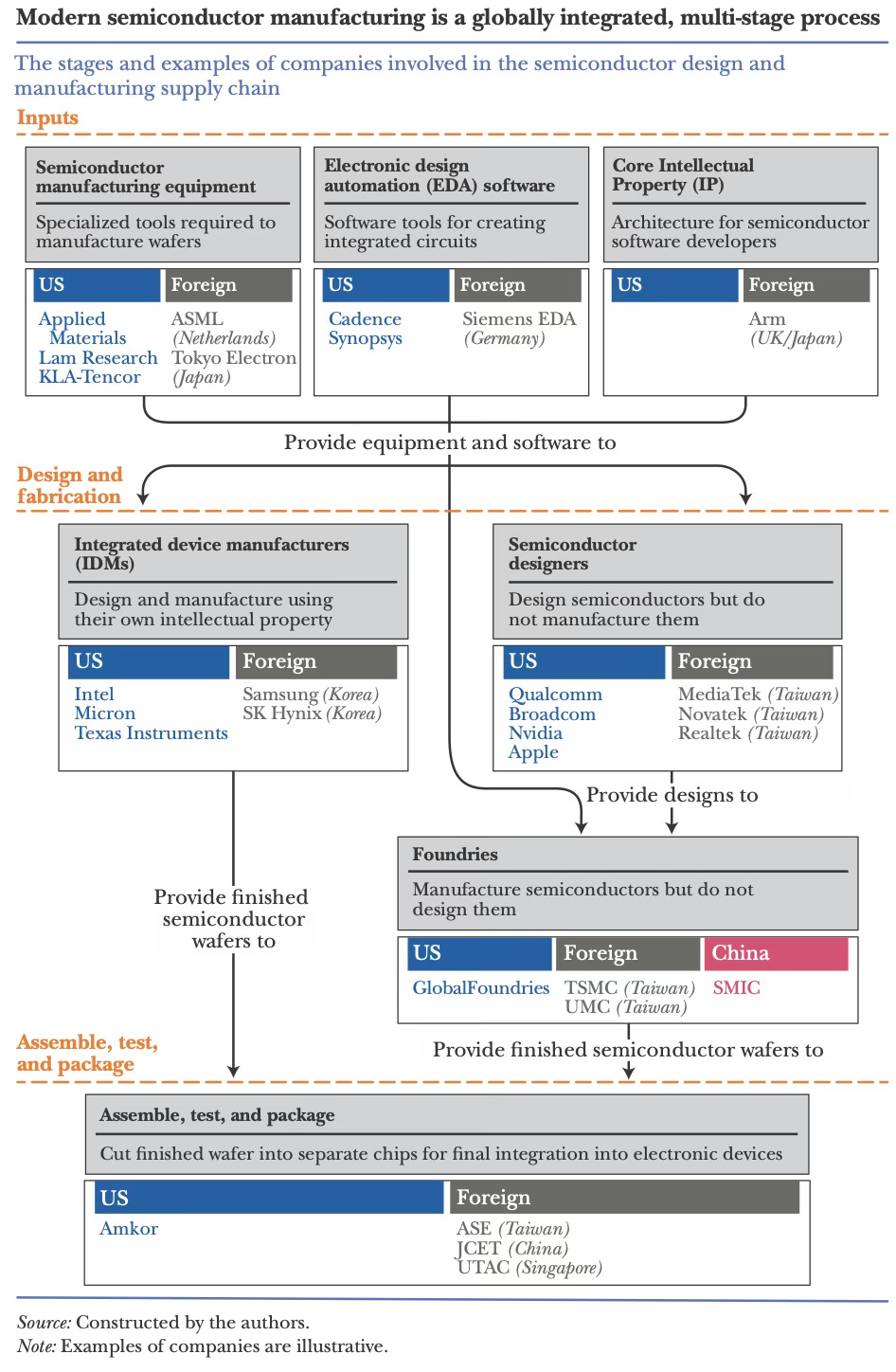

The case for industrial policy rests on its cutting-edge and dynamic science, massive upfront investment requirements (nearly $20 bn required for a fab or foundry), and its learning-by-doing manufacturing process. It’s also a ripe sector for agglomeration effects - skilled workers, upstream toolmakers, design and prototyping firms, chip makers, and downstream users like digital and telecom companies. They point to three main traits of the industry - the separation of chip design and manufacturing (fabless foundry model); fragmentation of the semiconductor supply chain; and the global shifts in demand for supply of chips.

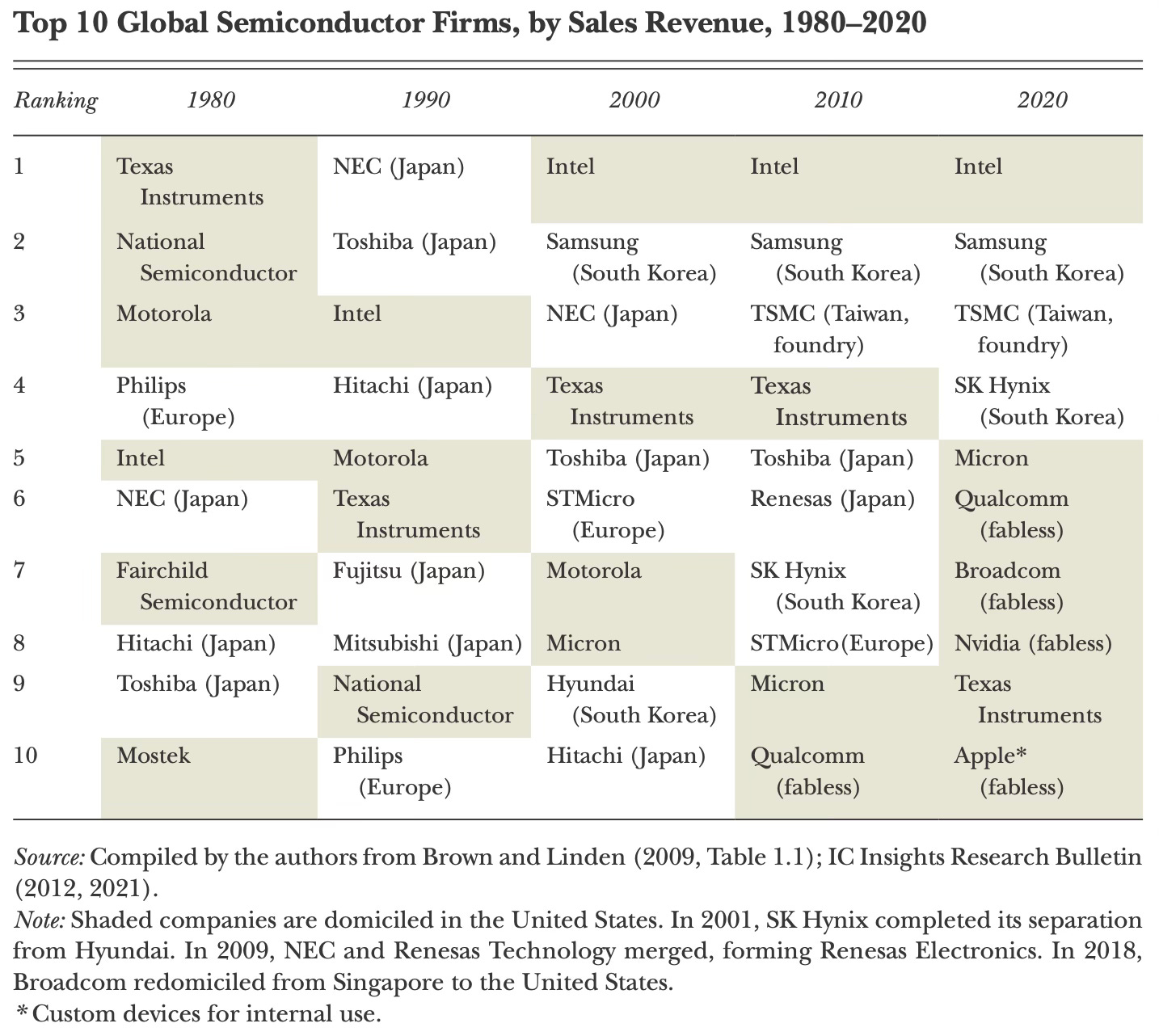

While the demand for chips started with the space and defence sectors in the US, the real breakthrough came with the rise in private demand in the seventies starting with calculators, telecom equipment, consumer electronics, and computers. The graphic below captures the shifts in industry dominance over the decades.

By the eighties, the Japanese keiretsu’s emerged as strong competitors to the US firms. They benefited from the industrial policy support that came with the closed network support and industrial policy that characterised the Japanese industrial landscape.

Two policies that helped globalise semiconductor supply chains.

First, these major economies implemented international agreements featuring a general reduction of import tariffs for semiconductors and critical inputs, such as semiconductor manufacturing equipment. This included the 1997 Information Technology Agreement, a deal to cut tariffs to zero on a wide range of high-tech products, as well as China and Taiwan joining the World Trade Organization (WTO), which locked in their low tariffs, in 2001 and 2002, respectively. The second policy innovation involved the TRIPs (Trade Related Aspects of Intellectual Property Rights) Agreement, implemented as part of the establishment of the WTO in 1995. Improved protection of patents and other trade secrets would help facilitate the fabless-foundry model— one firm licensing its technology to another firm for manufacturing purposes, without fear that the first firm would lose its intellectual property to another of the manufacturer’s clients.

An important shift was the emergence of fabless foundries

Some companies (especially in Silicon Valley) have decided to focus solely on the design of logic chips, while contracting with specialized foundries (mostly in Asia) to manufacture them. The most prominent foundry company is Taiwan’s TSMC, the industry pioneer, which emerged as a top ten firm by revenue by the 2000s. Other examples of such “pure-play” foundries include UMC (Taiwan), GlobalFoundries (United States), and SMIC (China). A large share of their expenditures involves the physical plants and capital equipment needed to run state-of-the-art facilities. Again, by the 2020s, the cost of building and equipping a leading-edge fab was above $20 billion…

The complements to foundries are “fabless” chip companies. They focus only on design. For example, Broadcom developed chips for modems, routers, and telecommunications networks, while Qualcomm designed semiconductors for smartphones and other devices. Apple has become a major semiconductor player in its own right by replacing chips from Intel, Qualcomm, and others in its computers and mobile phones. Nvidia has become prominent for its GPU chips that are in demand with the growth of artificial intelligence applications. These design companies devote the bulk of their costs to research and development, while letting the foundries worry about capital-intensive manufacturing. By 2020, four of the top ten semiconductor firms by revenue were fabless.

Apart from the design and foundry, the chip ecosystem consists of several other players

The last step involves taking a finished “wafer” and putting it through a process known as “assembly, test, and package” by cutting the wafer into separate chips for final integration into electronic devices. This phase is relatively worker-intensive and thus is not only often outsourced to a different company, but is also often offshored to a labor-abundant country where wage costs are lower… The upstream direction of the supply chain includes key input providers. One input is the software from electronic design automation firms, currently dominated by two US-based companies, Cadence and Synopsys, as well as the German firm Siemens EDA. Many semiconductor companies are also reliant on the intellectual property input—or “Core IP”—of Arm, a firm headquartered in the United Kingdom and owned by a Japanese financial institution (Softbank). For physical inputs, five companies—three in the United States (Applied Materials, Lam Research, KLA-Tencor), one in the Netherlands (ASML), and one in Japan (Tokyo Electron) dominate the provision of capital equipment used in these $20 billion fabs… the physical manufacturing at foundries and the tasks of assembly, test, and package have gravitated both toward each other and toward the location of downstream demand for many of those chips. SIA estimates that 70 percent of end users of chips are companies making consumer electronics, computers, and telecommunications equipment. Assembly of such products became increasingly concentrated in China over the 2000s.

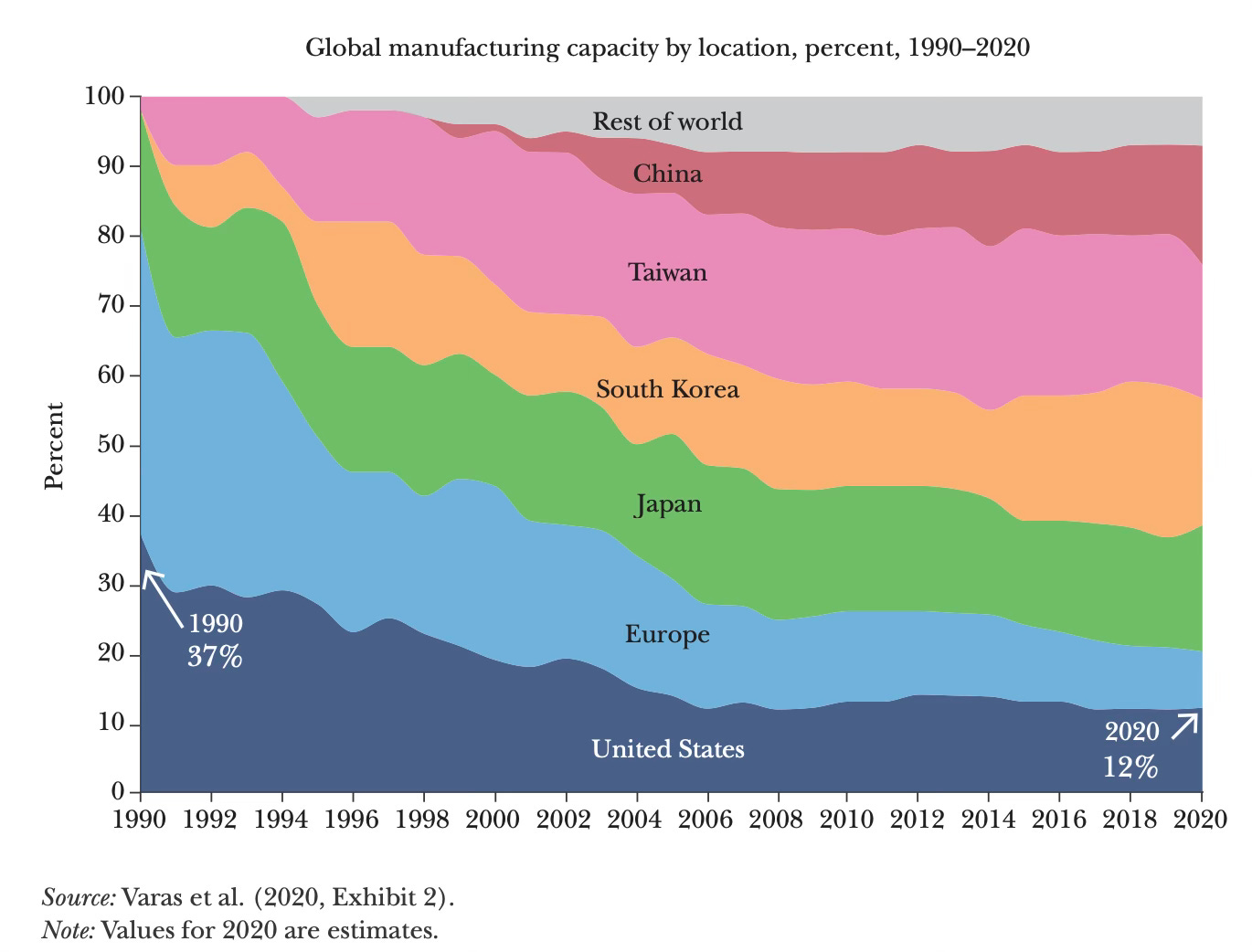

On the demand side of chips, by 2020, 62% of end-users were in Asia, with 34% from China alone. Even for the US-headquartered integrated device makers and fabless designers, China was a major destination, making up nearly 30% of sales of Intel, Broadcom, and Nvidia, and over half of Qualcomm and TI. Manufacturing capacity too mirrored the demand-shift. This graphic captures the geographical shifts in the manufacturing of chips.

Industrial policy has played an important role in the geographical shift of manufacturing.

The Semiconductor Industry Association… argued in 2020 that it was 30 percent more costly to operate a fab in the United States relative to Taiwan or South Korea and up to 50 percent more costly than in China. The SIA also estimated that 40–70 percent of that cost differential was due to relatively higher foreign government subsidies.

This is a good description of the types of chips and their markets.

Begin with memory chips that store data, which continued to make up roughly 23 percent of global industry sales in 2022. The most noticeable feature of the memory chip segment is its continued consolidation— Samsung, SK Hynix, and Micron, for example, currently make up nearly all of the lucrative DRAM market. Furthermore, memory chips are the most commoditized of semiconductor technologies: products from Samsung or Micron are largely interchangeable, and some memory chips are even sold on a spot market. Still, they are likely the most complex of any products that are commoditized.

Aside from memory, the rest of the semiconductor market includes logic, analog, and a variety of other kinds of chips that perform different functions. These types of semiconductors are also sometimes characterized by their vintage. At one extreme might be the latest graphics processing unit (GPU) chip that is needed to run today’s most powerful large language model for artificial intelligence. At the other extreme are “legacy” or “mature” semiconductors that have been around for a while. Though firms may not require the latest technology to manufacture these older types of chips, the products remain complex. A semiconductor that goes into an automobile that powers a window, for example, may be little different from one of ten years ago. Yet, it has other critical characteristics—such as reliability and durability—allowing it to survive extreme temperature changes over long periods of time without replacement.

China has been the most aggressive user of industrial policy in the industry. But its outcomes have left a lot to be desired.

In no segment of the semiconductor supply chain can Chinese firms claim leadership, although there are a few where they are not many years behind… Chinese firms are competitive in assembly, test, and package, for example, though this is a low value-added part of the supply chain. They also play some role in the design of logic chips and the production of memory chips. Yet, in the manufacturing of logic chips, China’s SMIC remains several years behind TSMC. Chinese firms are also weak in the production of semiconductor equipment and the software companies creating electronic design automation tools. The main area where they are a global player is in the volume of production for the less-complex legacy chips… China… is a latecomer. China’s chip industry began in earnest only in the late 1990s, which is decades behind the leading firms from the United States, Europe, Japan, South Korea, and even Taiwan. The semiconductor industry has tended to favor incumbents, as the pace of innovation in the industry is rapid and unforgiving. Chinese semiconductor firms have struggled, in part due to their smaller commercial scale and lack of experienced personnel. Finally, the United States and other governments have, since 2015, more aggressively wielded export controls in ways that may hobble China’s chip progress.

While the US government placed restrictions on exports to China over several rounds, the most important restrictions covered manufacturing facilities outside the US on October 7, 2022.

Given the United States’s dominance of semiconductor production equipment and electronic design automation software, that would prove devastating to foreign fabs. Legally, the US government deployed the “foreign direct product rule,” which gave foreign fabs a choice—if they wanted to continue to access US-made inputs (like equipment from Applied Materials, Lam Research, and KLA-Tencor), then they would have to give up selling chips to Huawei and other worrisome Chinese companies… for controls on semiconductor manufacturing equipment, governments of the Netherland and Japan eventually adopted policies similar to the US controls of October 7, 2022—restricting exports of ASML and Tokyo Electron in 2023.

US trade policy threats on China draws from the playbook employed by it against Japan in the eighties. For semiconductors, the US adopted a very highly interventionist policy to manage and regulate foreign trade.

Under the threat of US import tariffs, Japan “voluntarily” agreed in the US-Japan Semiconductor Trade Agreement of 1986 to limit exports to both the US and third country markets. The Japanese government also “voluntarily” agreed to expand Japan’s imports of chips—specifically, US firms were to supply 20 percent of the Japanese market by 1992. When goals were not met, the US government retaliated with import tariffs, including on Japanese computers and televisions that used semiconductors as inputs. Such aggressive use of trade policy against an ally was unusual and partly made possible because of Japan’s reliance on the United States for military protection.

Expanding the scope further, Washington is now exploring “component tariffs”

… taxing imports based not on the location of final assembly but on the components inside. Today, a device assembled in Vietnam containing Chinese chips pays the tariff rate for Vietnam, not China. A component-based tariff regime would target Chinese chips, regardless of where final assembly occurs. Such a policy would fit Trump’s desire to tackle Chinese subsidies with more limited cost to companies and consumers than broad-based tariffs.

Both the industrial policy for chips and choking the Chinese chip industry by tightening restrictions enjoy bipartisan support in the US. Further, the Western allies too appear happy to piggyback on the US and limit access to China. And we are in the early stages of this battle to control the semiconductor chips manufacturing industry.

No comments:

Post a Comment