This is the latest in the series of China economy updates, covering its structural imbalances, the problems with its fiscal federalism, the reliance on “connector” countries to access increasingly hostile Western markets, how Chinese imports upend economic orthodoxy on trade, and the extent of market concentration involving China in green technologies and critical minerals.

1. Zongyuan Zoe Liu has an excellent essay that reiterates the structural imbalance problem, cited by several others too, as the greatest threat to China’s economic prospects.

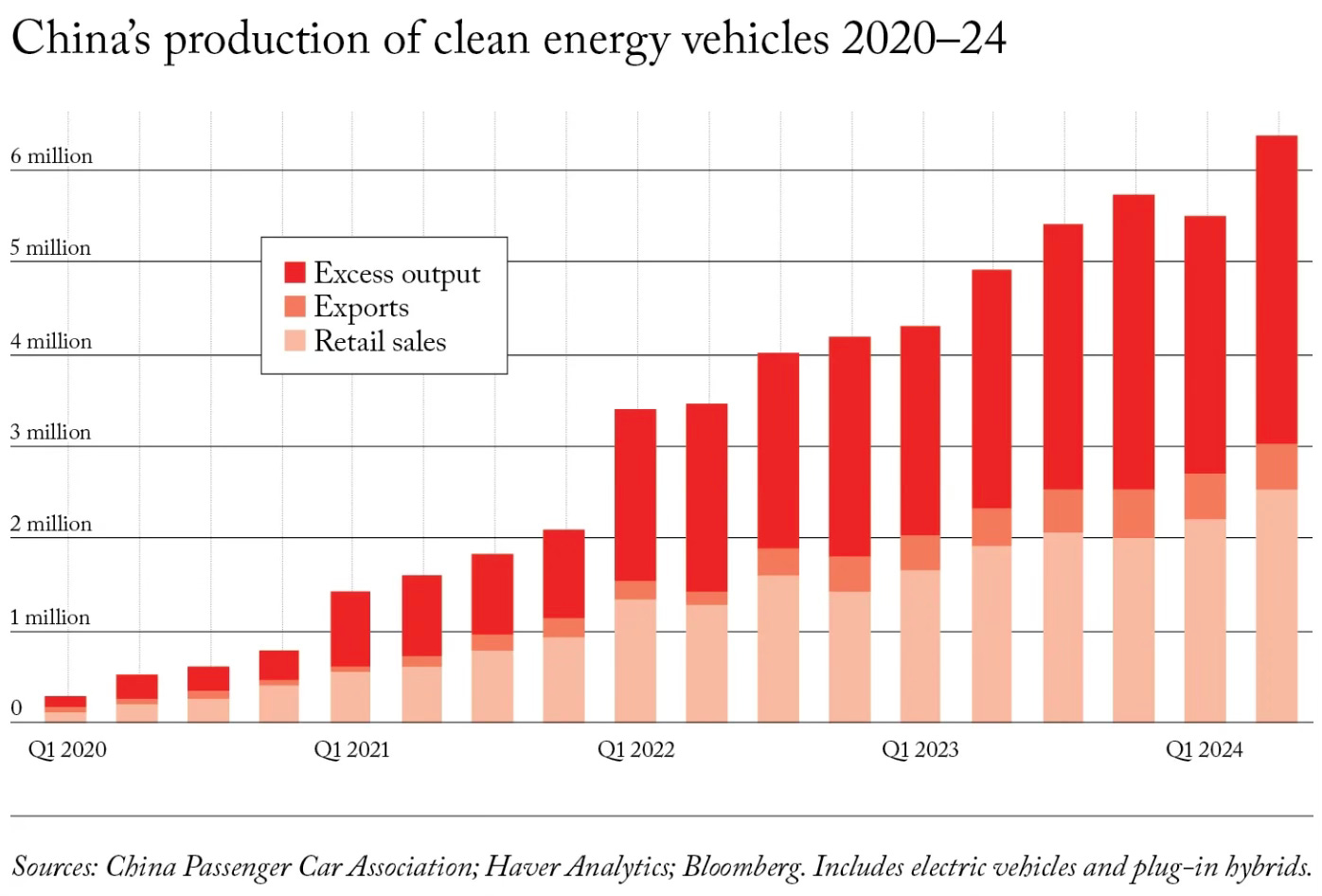

A decades-old economic strategy that privileges industrial production over all else, an approach that, over time, has resulted in enormous structural overcapacity. For years, Beijing’s industrial policies have led to overinvestment in production facilities in sectors from raw materials to emerging technologies such as batteries and robots, often saddling Chinese cities and firms with huge debt burdens in the process. Simply put, in many crucial economic sectors, China is producing far more output than it, or foreign markets, can sustainably absorb. As a result, the Chinese economy runs the risk of getting caught in a doom loop of falling prices, insolvency, factory closures, and, ultimately, job losses. Shrinking profits have forced producers to further increase output and more heavily discount their wares in order to generate cash to service their debts. Moreover, as factories are forced to close and industries consolidate, the firms left standing are not necessarily the most efficient or most profitable. Rather, the survivors tend to be those with the best access to government subsidies and cheap financing…factories in government-designated priority sectors of the economy routinely sell products below cost in order to satisfy local and national political goals. And Beijing has regularly raised production targets for many goods, even when current levels already exceed demand.

This production focus is deeply entrenched in the Communist Party’s world view

As the party sees it, consumption is an individualistic distraction that threatens to divert resources away from China’s core economic strength: its industrial base. According to party orthodoxy, China’s economic advantage derives from its low consumption and high savings rates, which generate capital that the state-controlled banking system can funnel into industrial enterprises. This system also reinforces political stability by embedding the party hierarchy into every economic sector. Because China’s bloated industrial base is dependent on cheap financing to survive—financing that the Chinese leadership can restrict at any time—the business elite is tightly bound, and even subservient, to the interests of the party. In the West, money influences politics, but in China it is the opposite: politics influences money. The Chinese economy clearly needs to strike a new balance between investment and consumption, but Beijing is unlikely to make this shift because it depends on the political control it gets from production-intensive economic policy…

China’s sixth five-year plan (1981–85) was the first to be instituted after Chinese leader Deng Xiaoping opened up the Chinese economy. Although the document ran to more than 100 pages, nearly all of it was devoted to developing China’s industrial sector, expanding international trade, and advancing technology; only a single page was given to the topic of increasing income and consumption. Despite vast technological changes and an almost unrecognizably different global market, the party’s emphasis on China’s industrial base remains remarkably similar today. The 14th five-year plan (2021–25) offers detailed targets for economic growth, R & D investment, patent achievement, and food and energy production—but apart from a few other sparse references, household consumption is relegated to a single paragraph.

The success of this industrial strategy is increasingly reliant on exports and the world economy.

In prioritizing industrial output, China’s economic planners assume that Chinese producers will always be able to offload excess supply in the global market and reap cash from foreign sales. In practice, however, they have created vast overinvestment in production across sectors in which the domestic market is already saturated and foreign governments are wary of Chinese supply chain dominance. In the early years of the twenty-first century, it was Chinese steel, with the country’s surplus capacity eventually exceeding the entire steel output of Germany, Japan, and the United States combined. More recently, China has ended up with similar excesses in coal, aluminum, glass, cement, robotic equipment, electric-vehicle batteries, and other materials. Chinese factories are now able to produce every year twice as many solar panels as the world can put to use.

But the global backlash against these policies puts a natural limit to its pursuit.

Since the mid-2010s, the problem has become a destabilizing force in international trade, as well. By creating a glut of supply in the global market for many goods, Chinese firms are pushing prices below the break-even point for producers in other countries. In December 2023, European Commission President Ursula von der Leyen warned that excess Chinese production was causing “unsustainable” trade imbalances and accused Beijing of engaging in unfair trade practices by offloading ever-greater quantities of Chinese products onto the European market at cutthroat prices. In April, U.S. Treasury Secretary Janet Yellen warned that China’s overinvestment in steel, electric vehicles, and many other goods was threatening to cause “economic dislocation” around the globe. “China is now simply too large for the rest of the world to absorb this enormous capacity,” Yellen said…

In a speech in May, Lael Brainard, the director of the Biden administration’s Council of Economic Advisers, warned that China’s “policy-driven industrial overcapacity”—a euphemism for antimarket practices—was hurting the global economy. By enforcing policies that “unfairly depress capital, labor, and energy costs” and allow Chinese firms to sell “at or below cost,” she said, China now accounts for a huge percentage of global capacity in electric vehicles, batteries, semiconductors, and other sectors… At their meeting in Capri, Italy, in April, members of the G-7 warned, in a joint statement, that “China’s non-market policies and practices” have led to “harmful overcapacity. ” The massive inflow of cheap Chinese-manufactured products has already raised trade tensions. Since 2023, several governments, including those of Vietnam and Brazil, have launched antidumping or antisubsidy investigations against China, and Brazil, Mexico, Turkey, the United States, and the European Union have imposed tariffs on various imports from China, including but not limited to electric vehicles.

This strategy has engendered several problems. For a start, its impact on the domestic economy has been brutal.

In China’s domestic market, overcapacity issues have provoked a brutal price war in some industries that is hampering profits and devouring capital. According to government statistics, 27 percent of Chinese automobile manufacturers were unprofitable in May; at one point last year, the figure reached 32 percent. Overproduction throughout the economy has also depressed prices generally, causing inflation to hover near zero and the debt service ratio for the private nonfinancial sector—the ratio of total debt payments to disposable income—to climb to an all-time high. These trends have eroded consumer confidence, leading to further declines in domestic consumption and increasing the risk of China sliding into a deflationary trap.

Besides, it has entrapped local governments in a debt-fuelled investment race whose consequences are now becoming evident.

At the center of Beijing’s overcapacity problem is the burden placed on local authorities to develop China’s industrial base. Top-down industrial plans are designed to reward the cities and regions that can deliver the most GDP growth, by providing incentives to local officials to allocate capital and subsidies to prioritized sectors….These planning directives and campaigns put enormous pressure on local party chiefs to achieve rapid results, which they may see as crucial for promotion within the party. Consequently, these officials have strong incentives to make highly leveraged investments in priority sectors, irrespective of whether these moves are likely to be profitable. This phenomenon has fueled risky financing practices by local governments across China. In order to encourage local initiative, Beijing often does not provide financing: instead, it gives local officials broad discretion to arrange off-balance-sheet investment vehicles with the help of regional banks to fund projects in priority sectors, with the national government limiting itself to specifying which types of local financing options are prohibited. About 30 percent of China’s infrastructure spending comes from these investment vehicles; without them, local officials simply cannot do the projects that will win them praise within the party. Inevitably, this approach has led to not only huge industrial overcapacity but also enormous levels of local government debt. According to an investigation by The Wall Street Journal, in July, the total amount of off-the-book debts held by local governments across China now stands at between $7 trillion and $11 trillion, with as much as $800 billion at risk of default…

Ever since China’s 1994 fiscal reform, which allowed local governments to retain a share of the tax revenue they collected but reduced the fiscal transfers they received from Beijing, local governments have been under chronic financial strain. They have struggled to meet their dual mandate of promoting local GDP growth and providing public services with limited resources. By centralizing financial power at the national level and offloading infrastructure and social service expenditures to regions and municipalities, Beijing’s policies have driven local governments into debt. What’s more, by stressing rapid growth performance, Beijing has pushed local officials to favor quickly executed capital projects in industries of national priority. As a further incentive, Beijing sometimes offers limited fiscal support for projects in priority sectors and helps facilitate approvals for local governments to secure financing. Ultimately, the local government bears the financial risk, and the success or failure of the project rests on the shoulders of the party’s local chief, which leads to distorted results.

A larger problem with China’s reliance on local government to implement industrial policy is that it causes cities and regions across the country to compete in the same sectors rather than complement each other or play to their own strengths. Thus, for more than two decades, Chinese provinces—from Xinjiang in the west to Shanghai in the east, from Heilongjiang in the north to Hainan in the south—have, with very little coordination between them, established factories in the same government-designated priority industries, driven by provincial and local officials’ efforts to outperform their peers. Inevitably, this domestic competition has led to overcapacity and high levels of debt, even in industries in which China has gained global market dominance… Whenever the Chinese government prioritizes a new sector, duplicative investments by local governments inevitably fuel intense domestic competition. Firms and factories race to produce the same products and barely make any profit—a phenomenon known in China as nei juan, or involution. Rather than try to differentiate their products, firms will attempt to simply outproduce their rivals by expanding production as fast as possible and engaging in fierce price wars; there is little incentive to gain a competitive edge by improving corporate management or investing in R & D.

2. There are three big distortions that drag down the Chinese economy - the continuing focus on investments as the driver of economic growth, the corollary of a disproportionately low share of consumption, and the skew between central and state government revenues and expenditures.

Robin Harding has a good article about how the problems due to fiscal federalism in China are impacting economic activity. While central government debt is just 24% of GDP, that of local governments at 93% is an underestimate.

This is a good description of China’s fiscal federalism

A basic fact about China’s fiscal system is that local governments do almost all of the spending, but rely on the centre for revenue to an extent that is rare elsewhere in the world. Localities bear most of the responsibility for education, health, social security and housing, in addition to obvious local duties such as roads, parks and rubbish collection, and spend about 85 per cent of the government total. They directly collect only around 55 per cent of government revenues. The system is balanced by transfers from the centre to the regions.

This is about the problems created by the mismatch between the revenues and expenditures of local governments.

For example, the lower down the pyramid of governance, the more the system gets starved of resources, because each tier — province, prefecture, county — tends to hold back what it needs before passing cash onwards down the chain. The implementation of central government spending plans is haphazard. Meanwhile, local government officials, who must deliver growth to climb the bureaucratic ranks, do whatever they can to find money. China’s property boom was partly driven by the reliance of local governments on land sales for revenue. Off-the-books borrowing by so-called local government financing vehicles was a way to get around the revenue constraint and fund infrastructure. As land sales slump due to the housing slowdown, and the central government cracks down on local borrowing, there are many reports of municipalities resorting to fines and penalties, launching retrospective tax investigations or simply not paying staff on time as they struggle to balance their books. None of this is good for the struggling private sector.

The central government has been reluctant to undertake reforms that give local governments more revenue generation powers.

What the central government has not been willing to do, as is typical for Xi, is surrender control. It often specifies the services that local governments must provide, yet declines to hand over the revenue sources that fund them. It is reluctant to take big new spending responsibilities onto the central books. It has cracked down on local government debt, and yet… it is unwilling to let central government debt rise instead. The result has been a de facto fiscal tightening during the past few years even as the economy has struggled to recover after Covid. At the recent “third plenum”, an important meeting for economic policy held once every five years, Beijing promised to… give local governments more control over taxes and increase fiscal transfers from the centre. It will consider rolling various local surcharges into a single local tax. It will move the liability for consumption tax from manufacturers to retailers and let local governments collect it, which would be an important reform. Where the central government has more fiscal power, it will “raise the proportion of central government expenditure accordingly”… lengthy debates about whether to introduce property taxes, a natural way for local governments to fund local spending. If Beijing is actually going to implement these plans, it will have to surrender some control, and if it is to do so while reviving the stagnant economy, it will also have to accept a rise in the central government’s debt.

3. Faced with these structural problems, China has been focusing outward to maintain high economic growth rates.

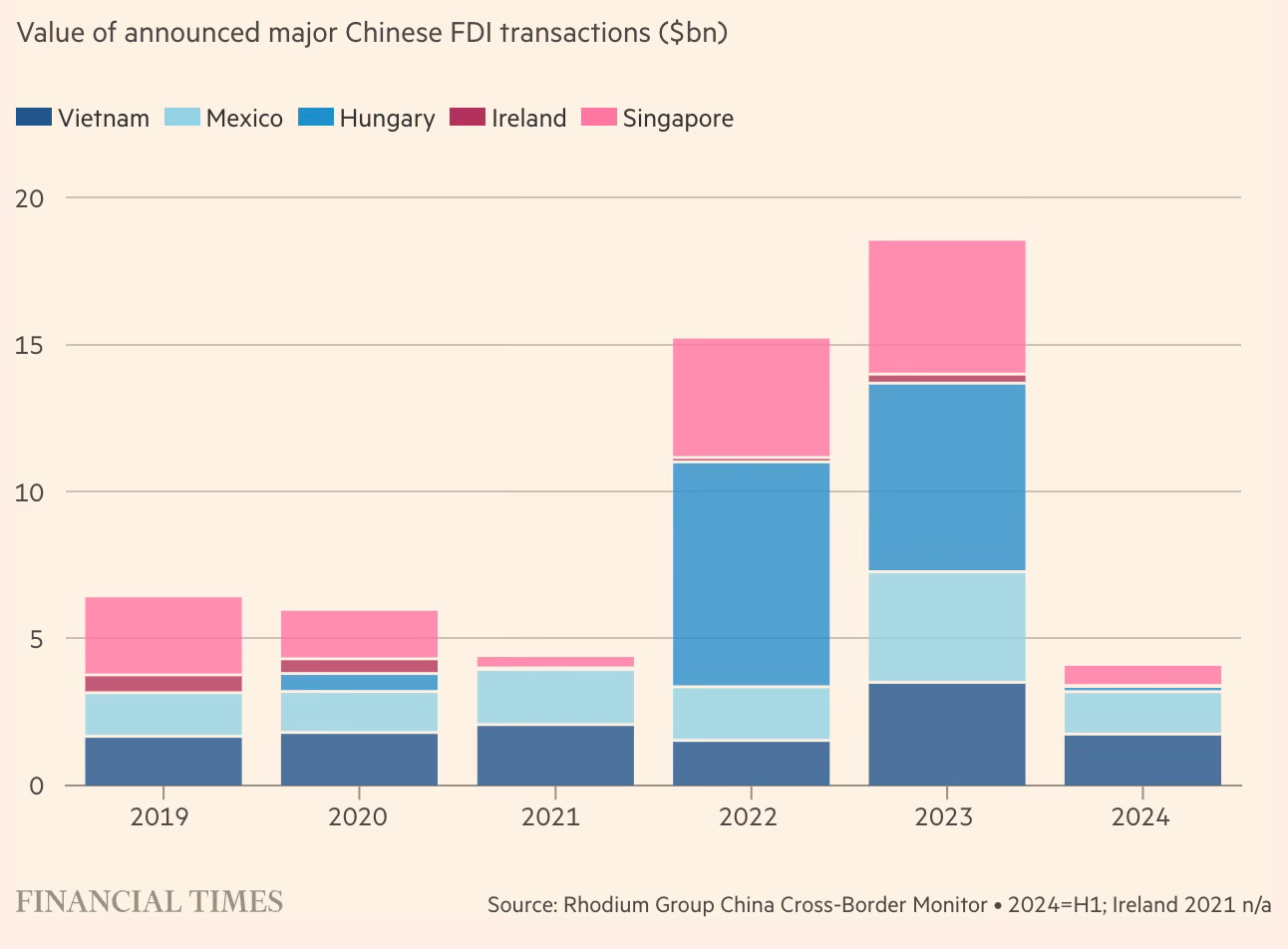

The FT has a good long read that throws some interesting insights on China’s foreign direct investments (FDI). Specifically, the article points to the emergence of a group of “connector” countries that are being courted with Chinese FDI to help the country skirt around the restrictions imposed by Western economies.

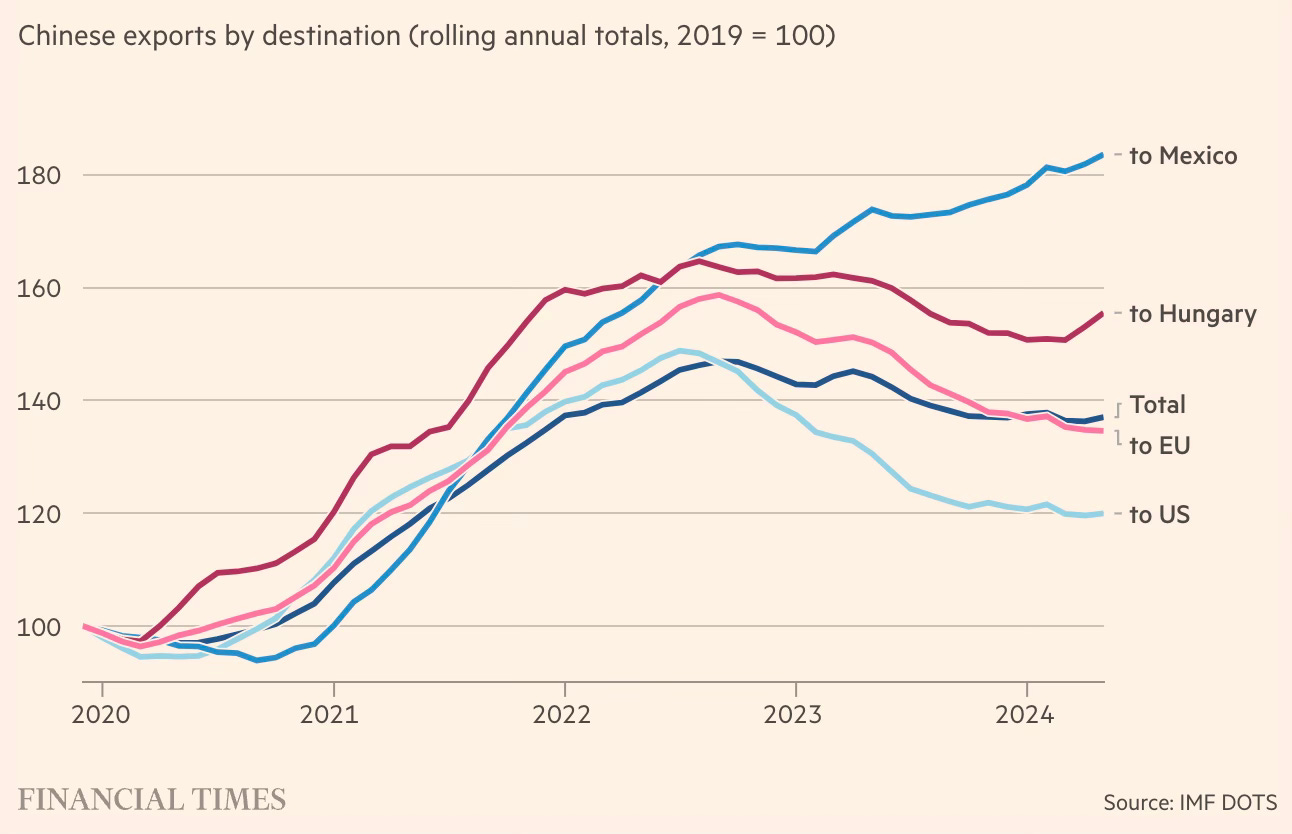

Unsurprisingly, these countries are now also seeing growing exports from China.

The so-called connector countries are seeking to insert themselves between the two and are “rapidly gaining importance and serving as a bridge”, according to the IMF. Flows of trade with and investment in such countries have increased dramatically since the US, Europe and others began erecting trade barriers with China. For Chinese companies, investing in such countries brings several advantages. One is access to large free trade areas with minimal tariffs and regulatory friction. Another is that domiciling in a new geography can allow Chinese companies to dilute or repurpose their identity, thus remaining below the trade flak flying between China and the US-led west, analysts say. So marked is this behaviour in Singapore that it has earned a distinct name. “Singapore-washing” describes a process through which Chinese companies set up a subsidiary or reincorporate in the city-state to mitigate the geopolitical risks and scrutiny often directed at China-based entities…

Perhaps the best-known example is Shein, the fast-fashion group currently seeking a public listing in either London or New York. It originated in 2008 in the eastern city of Nanjing and its supply chains, warehouses and inventory remain in China. But in 2021 its enigmatic founder Sky Xu, who also goes by the names Xu Yangtian and Chris Xu, relocated himself and the company’s headquarters to Singapore. Shein, valued at $66bn in its last private funding round, now defines itself as a “Singapore-headquartered global online fashion and lifestyle retailer”, according to its website… Singaporean identities are also sometimes used to access the market in India, skirting New Delhi’s clear antipathy towards Chinese investment.

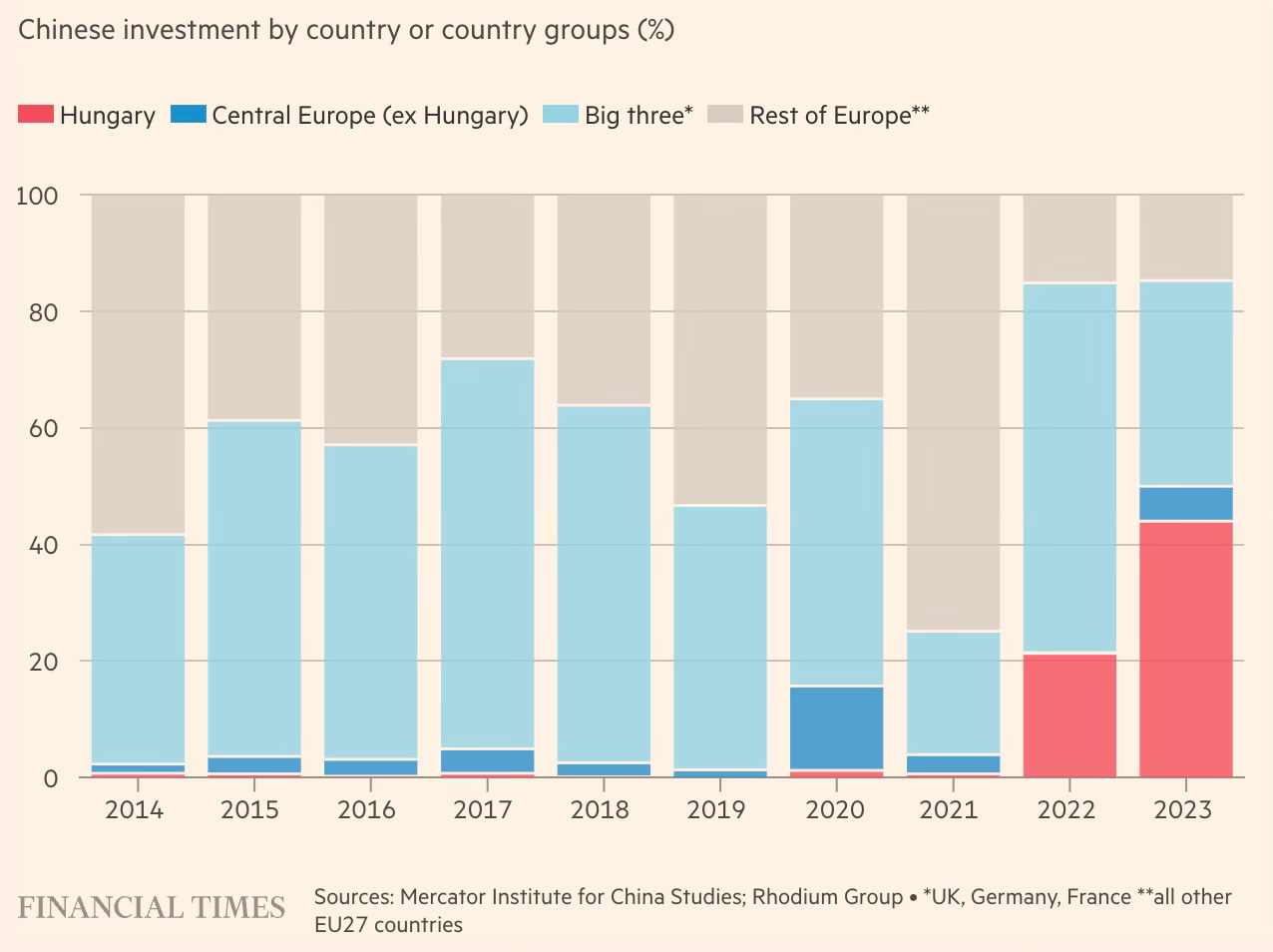

While Singapore and Vietnam are connectors in South East Asia, their counterparts in Europe appear to be Ireland and Hungary, both EU members.

Bilateral trade (of Ireland) with China has tripled in the past five years and there is a clear desire on both sides to increase investment, said Ireland’s then-prime minister Leo Varadkar as he welcomed his Chinese counterpart Li Qiang on a visit early this year. Big-ticket Chinese investments in Ireland include those from ByteDance, parent of the short form video app TikTok, WuXi Biologics, a drug company, Huawei, the Chinese telecoms equipment giant, and the Bank of China, a big Chinese state-owned bank. In total around 40 Chinese companies employing 5,100 people are clients of Ireland’s investment promotion agency IDA… Hungary received 44 per cent of all Chinese foreign direct investment in Europe in 2023, overtaking the ‘big three’ economies of Germany, France and the UK, according to a study by Berlin-based think-tank Merics.

In the Americas, Mexico is the connector.

Mexico is a member of the US-Mexico-Canada Agreement (USMCA), the successor to Nafta, which embraces 510mn people and accounts for another 30 per cent of the global economy. Chinese companies have quietly gained a considerable foothold as investors in Mexico over recent decades. North America’s USMCA free trade agreement means Chinese businesses making everything from fridges and televisions to textiles in Mexico gain privileged US market access. América Móvil, the telecoms group controlled by the billionaire Carlos Slim, relies heavily on Huawei technology. Mexican appliance and refrigerator manufacturer Mabe is 48 per cent owned by the acquisitive Chinese group Haier. One in five cars purchased in Mexico last year was made in China, with half of those coming from Chinese manufacturers. Electric-vehicle makers such as BYD and Chery are now scouting Mexico for factory sites so they can export to the US and avoid tariffs on vehicles imported to the US from China, which rose to 100 per cent at the start of August.

4. Countries like India have been extremely cautious about allowing foreign retail and e-commerce giants due to fears that their competition could hurt the tens of millions of mom-and-pop shops. Even when allowed, there have been stringent domestic sourcing requirements to prevent cheap imports, especially from China.

The spectacular rise of online-only low-price household goods, apparel, and toys retailer Temu in the US and its disruptive impact on local retailers appears to vindicate this concern. Consider this.

Since launching in the US in September 2022, the online retailer — powered by big ad spending — has shot to the top of the app stores. While parent company PDD Holdings does not break out Temu’s financial performance, Temu’s global gross merchandise value — the total of all goods sold — reached $17bn last year and could grow to $40bn this year, according to Bernstein Research. Within this, Temu has made the most inroads among low-income shoppers. In the space of two short years, its share of US discount spending has gone from zero to 17 per cent, according to consumer data analytics firm Earnest Analytics. Over the same period, Dollar General’s market share fell from 63 per cent to 52 per cent. Dollar Tree, which also owns Family Dollar, saw its share shrink 6 percentage points to 19.5 per cent. Temu can undercut US rivals by delivering cheap goods straight from factories and warehouses in China… Temu and its rock-bottom prices means inflation-wary shoppers can skip the trip to the dollar store altogether.

The regulators in Europe and the US have started their efforts to contain damage by changing the “de minimis” rule that allows Temu and others to import in small scale cheap goods tariff-free. Temu and Shein have exploited this rule to make rapid inroads into the US and European markets.

All Econ 101 theories on free trade and comparative advantage breaks down when faced with the onslaught from cheap Chinese imports.

5. This is a good summary of how globalisation helped China more than any other country.

China’s emergence as an economic superpower over the past four decades has been propelled to a large degree by globalisation. Open markets and free trade underpinned China’s long export boom and helped facilitate huge transfers of capital, knowledge and technology from the west to Chinese companies. Many have gone on to become world leaders in their sectors: examples include BYD and CATL in electric vehicles and batteries, Huawei in telecoms and ByteDance in social media. Faced with imported goods that are a match for their domestic incumbents in quality terms, and growing more concerned about national security issues, western powers have cooled on globalisation.

Now that the shoe is on the other feet, developed countries are feeling exactly what the developing countries used to feel all for long when they placed import restrictions to prevent their domestic industry from being destroyed by more competitive imports from developed economies. Economists who used to berate and scorn on developing countries for pursuing autarkic policies are themselves now advocating the same policies to protect domestic industry in the west.

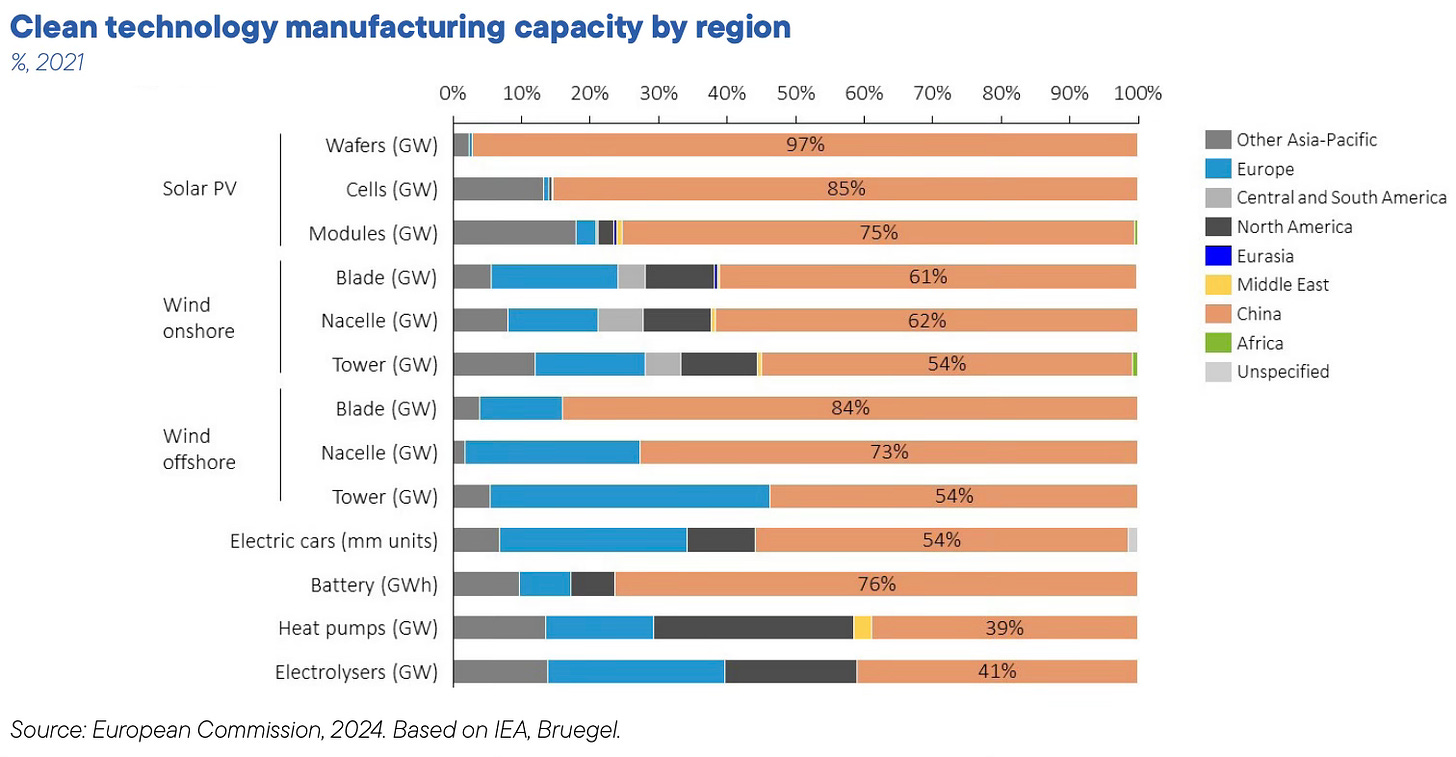

6. Finally, three graphs from the just released EU report by Mario Draghi on measures to improve the region’s economic competitiveness. The first highlights the stranglehold China exercises on the manufacturing of green technologies.

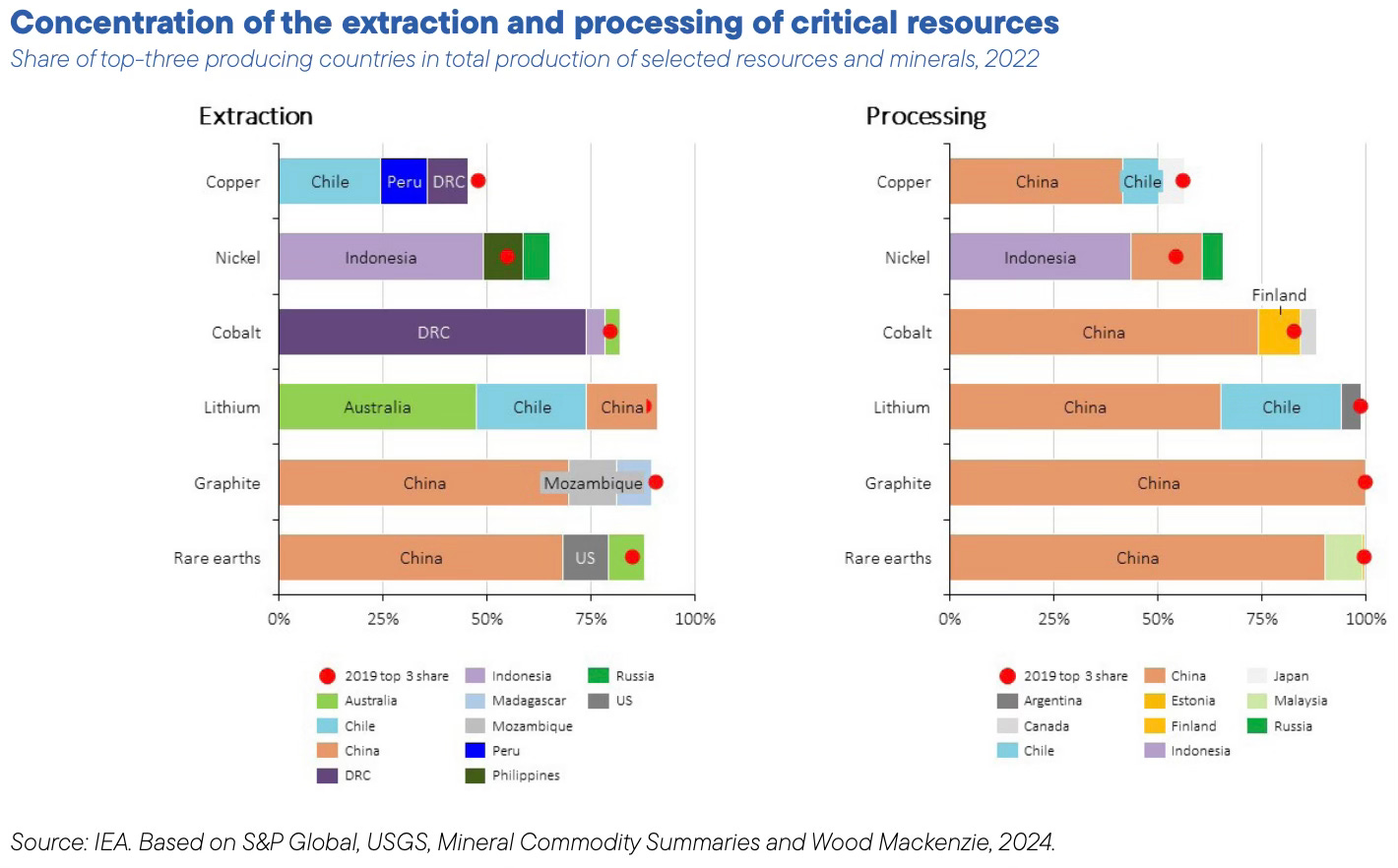

The second highlights the concentration in the extraction and processing of critical minerals and how China dominates the supply chain in most of them.

It’s in the processing that China dominates. Indonesia must be strongly commended and supported for the policies it’s pursuing on indigenising value capture in Nickel. It’s surprising how Australia has allowed the Chinese to import and capture value from its Lithium mines. Chile has done well in Lithium, but not so much in Copper in terms of processing.

In contrast to the clean technologies and critical minerals where China dominates, its presence in the semiconductor industry is modest, even marginal.

No comments:

Post a Comment