1. Nigeria can lay claim to the dubious honour of being the worst-governed big country in the world and the most consistent global economic under-performer. The FT has a long read.

During the eight years Muhammadu Buhari was in office, Nigeria’s GDP shrank, in per capita terms, as he pursued ineffective economic policies with an interventionist theme. Decades before that, Nigeria fell to the so-called resource curse: though oil contributes a relatively small amount to the country’s GDP, it plays an overweening role in state finances, making up 80 per cent of government revenue.

President Bola Tinbu, who's entering his second year, has pursued a shock therapy policy of austerity, Tinbunomics, which involves cutting subsidies (the fuel subsidy of $10bn in a total budget of $34 bn) and two sharp devaluations. The result has been a tripling of oil prices and inflation climbing to a three-decade high of 34%.

Food prices are rising faster, putting even basic staples like rice, milk and maize beyond the reach of many and sending malnutrition levels soaring. The Food and Agriculture Organization estimates that 26.5mn of Nigeria’s 220mn people are food insecure with at least 9mn children at risk of wasting, a medical condition that stunts development.

Desperate groups of hungry people have raided warehouses storing food. There have been deadly stampedes for the bags of emergency rations being handed out by some states, largesse that goes by the name of “palliatives”. Nigeria, which for years took pride in being Africa’s biggest economy, has tumbled to fourth place in dollar terms. Without a strong recovery, the IMF predicts it is likely to slip to fifth by the end of 2024, behind South Africa, Egypt, Algeria and Ethiopia — a huge blow to Nigeria’s self-image as “the giant of Africa”.

The most successful such parties in Europe — Fidesz in Hungary and the conservative nationalist Law and Justice in Poland — are left-leaning on economics while rightwing on social issues, positioning themselves squarely in the quadrant inhabited by most voters. In France, RN has moved in a similar direction, as has Geert Wilders’ PVV party, which now forms part of the Dutch government. Giorgia Meloni’s ruling Brothers of Italy party (FdI) is no crusader for free markets.

The problem with elevators is a microcosm of the challenges of the broader construction industry — from labor to building codes to a sheer lack of political will. These challenges are at the root of a mounting housing crisis that has spread to nearly every part of the country and is damaging our economic productivity and our environment. Elevators in North America have become over-engineered, bespoke, handcrafted and expensive pieces of equipment that are unaffordable in all the places where they are most needed. Special interests here have run wild with an outdated, inefficient, overregulated system. Accessibility rules miss the forest for the trees. Our broken immigration system cannot supply the labor that the construction industry desperately needs. Regulators distrust global best practices and our construction rules are so heavily oriented toward single-family housing that we’ve forgotten the basics of how a city should work.Similar themes explain everything from our stalled high-speed rail development to why it’s so hard to find someone to fix a toilet or shower. It’s become hard to shake the feeling that America has simply lost the capacity to build things in the real world, outside of an app... With around one million of them, the United States is tied for total installed devices with Italy and Spain... In Western Europe, small new apartment buildings of just three stories typically include a small elevator (and sometimes buildings of just two stories as well). These types of buildings have almost never had elevators in America, and developers are planning and building new five- and six-story walk-ups in some cities. When a developer in Philadelphia or Denver comes across a piece of land zoned for a few stories, elevator expenses are often one reason they build townhouses rather than condos — fewer in number and with higher price tags.Behind the dearth of elevators in the country that birthed the skyscraper are eye-watering costs. A basic four-stop elevator costs about $158,000 in New York City, compared with about $36,000 in Switzerland. A six-stop model will set you back more than three times as much in Pennsylvania as in Belgium. Maintenance, repairs and inspections all cost more in America, too. The first thing to notice about our elevators is that, like many things in America, they are huge. New elevators outside the U.S. are typically sized to accommodate a person in a large wheelchair plus somebody standing behind it. American elevators have ballooned to about twice that size, driven by a drip-drip-drip of regulations, each motivated by a slightly different concern — first accessibility, then accommodation for ambulance stretchers, then even bigger stretchers. The United States and Canada have also marooned themselves on a regulatory island for elevator parts and designs. Much of the rest of the world has settled on following European elevator standards, which have been harmonized and refined over generations... Not only do we have our own elevator code, but individual U.S. jurisdictions modify it further.

4. Another example of market failure, in the US home insurance market.

Higher premiums are being charged in states where regulators apply less scrutiny to requests for rate increases, compared with states where officials question the justifications offered by companies and try to keep rates low, the research shows. The effects of those state-by-state regulatory differences are only now becoming clear. In a separate paper, new data makes it possible for the first time to see what households pay for home insurance by county and ZIP code, across the United States. The average premium jumped 33 percent between 2020 and 2023, far more than the rate of inflation, the data show. But in some places, homeowners are paying more than twice as much for insurance, as a share of home value, than people who live elsewhere and face similar exposure to severe weather. As a result, America’s home insurance market is increasingly distorted, said Ishita Sen, a professor of finance at Harvard Business School who studies why insurance rates diverge from risk. In communities where insurance rates exceed the actual risk, homeownership can be unaffordable. And in places where insurance prices are too low, it encourages people to move into homes in areas likely to be hit by wildfires or other disasters that could deliver financial ruin, Dr. Sen said...

After big losses in those tightly regulated states, such as California, national insurers tend to raise rates in more loosely regulated states. In other words, homeowners in states with weaker rules may be overpaying for insurance, effectively subsidizing homeowners in states with tougher rules, she said. If California makes it especially hard for insurers to increase premiums, Oklahoma makes it much easier... the home insurance market is far less competitive than it might seem. After choosing an insurer, people often stick with that same company, even if their premiums go up, she said. Three insurers — State Farm, Farmers, and Allstate — collectively wrote more than half of all home insurance in Oklahoma last year.

5. Manufacturing for exports has replaced real estate as the primary destination for credit flows in China.

Net new bank loans to industrial borrowers reached $614 billion in the 12 months through March. That was six times the annual lending to those borrowers before the pandemic, as lending to industries has almost exactly replaced the loans that previously went to the real estate sector.

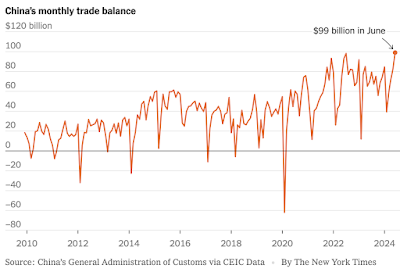

This shift to manufacturing is showing up in the trade surpluses.

China’s already formidable exports surged in June, China’s customs administration reported on Friday. But imports shrank, with Chinese companies and households becoming more cautious about spending money. The result was a record monthly trade surplus of just over $99 billion... China’s trade surplus last month broke a record set in July 2022, when the country’s factories and ports were racing to catch up with global demand after a stringent Covid-19 lockdown in Shanghai had crippled output throughout much of central China... Factories in China already make almost a third of the world’s manufactured goods.

A lot of what will determine Trump administration and interest policy is who ultimately takes the reins and the senior roles in the Trump administration, because they're going to be the ones who are executing on this stuff… So when I think about how to solve how to put those instincts into policy, a lot of it's going to be getting the right people in some of these roles and making sure we don't get rid of some of the good people from the previous administration who are doing the right thing. So I think that's the question, how do we get proper personnel rights so that we can get policy right the next Trump administration?

Education has proved a popular sector for investment in the private markets.A consortium led by the Canadian investment group Brookfield agreed a deal last month to invest in the Dubai-based education company GEMS. Meanwhile, the French investor Wendel earlier this month took a 50 per cent stake in the European primary and secondary school group Globeducate for €625mn, acquiring part of current shareholder Providence Equity Partners’ interest.

7. Nguyen Phu Trong, Vietnam's most powerful leader since Ho Chi Minh and who oversaw the country's emergence as a manufacturing powerhouse, passed away at the age of 80.

Trong consolidated power into his hands during his tenure and weakened the other parts of Vietnam’s four-pillar leadership system — which includes not only his post as Communist party chief, but also the president, the prime minister and the chair of the National Assembly... As party chief from 2011 and the country’s president between 2018 and 2021, he played a central role in Vietnam’s economic rise. Vietnam has attracted billions of dollars in foreign investment from companies across the world, becoming an important link in the supply chain for companies such as Apple and Samsung. Trong deftly balanced Hanoi’s relationship with the global superpowers, maintaining close ties with the US, China and Russia. He forged ties with Vietnam’s former foe, the US, by upgrading the relationship between the two countries to a “comprehensive strategic partnership” — the highest level of diplomatic ties afforded by Hanoi. He also drew criticism because during his leadership the Vietnamese government tightened control over news media, social media and civil society. In 2021, he was elected party chief for an unprecedented third term after the party decided to exempt him from the two-term rule. His defining policy was an anti-corruption drive called “blazing furnace”, in which thousands of government officials were disciplined and many prosecuted. Two presidents and two deputy prime ministers quit after being accused of violations, triggering political instability that has paralysed government activity and affected economic growth.

8. A sample of big state interventionism likely in the UK under Keir Starmer

Sir Keir Starmer’s government looks set to be the most interventionist since the 1970s. He plans to force through housebuilding, nationalise the railways, create an industrial council and a state-backed energy company, roll back curbs on trade unions and usher in new employment rights. Renters will get more rights and there will be new state agencies — including a football regulator — added to the alphabet soup of acronyms.

9. China housing prices graphic of the day

Three years on from a crackdown on excess leverage in the industry, the official measure of new home prices is falling at its fastest pace in almost a decade while the number of foreclosed houses listed for auction in the first quarter increased 35 per cent from a year ago, according to the China Index Research Institute. Official figures show about 10mn of China’s 300mn migrant workers left the construction industry in 2022 and 2023.

No comments:

Post a Comment