One of the defining social, political, and economic challenges of our times is the issue of widening inequality. The crux of the issue is the trends in the apportionment of income between capital and labour. It’s universally observed that an increasing proportion of the share of total income is being cornered by capital at the expense of labour.

This trend revolves around three causal factors - trade, technology, and politics. Globalization and trade liberalization has increased the global supply of labor relative to capital; technological changes have lowered the price of capital and increased the substitutability of capital and labor, especially less skilled labor, thereby lowering the demand for labor; and political ideological shifts have undermined labor bargaining capacity.

This post is about the second factor, the increasing automation of production.

Such automation works both through the hardware (equipment) and the software channels. While much has already been written about the former in the context of automation, there has been less attention to the role of software in increasing returns to capital. It can be argued that capital in the software market enjoys several unique advantages - high margins, low marginal cost of production, increasing returns with network effects, and high entry barriers. Not only are the profits higher, but they also endure for longer. The network effects induced entry barriers are a clear example of market failure that blunts capitalist incentives.

While the skill-biased nature of modern technologies gives a premium or higher share of income to labour, this share of labour is too small to be sufficient to offset the general trend of increasing return to capital.

On the issue of returns to capital and labour, conceptually, the issue is about figuring out the elasticity of substitution between the two factors. There’s a macro Vs micro dissonance here. Econ 101 inform us that labour and capital are complements, with an elasticity of substitution of less than one. But as I blogged here, Lukas Karabarbounis and Brent Neiman have shown that since capital and labour are substitutes (with increasing automation), the more efficient (technology-enabled) production of capital goods reduced the labour’s share of income over time.

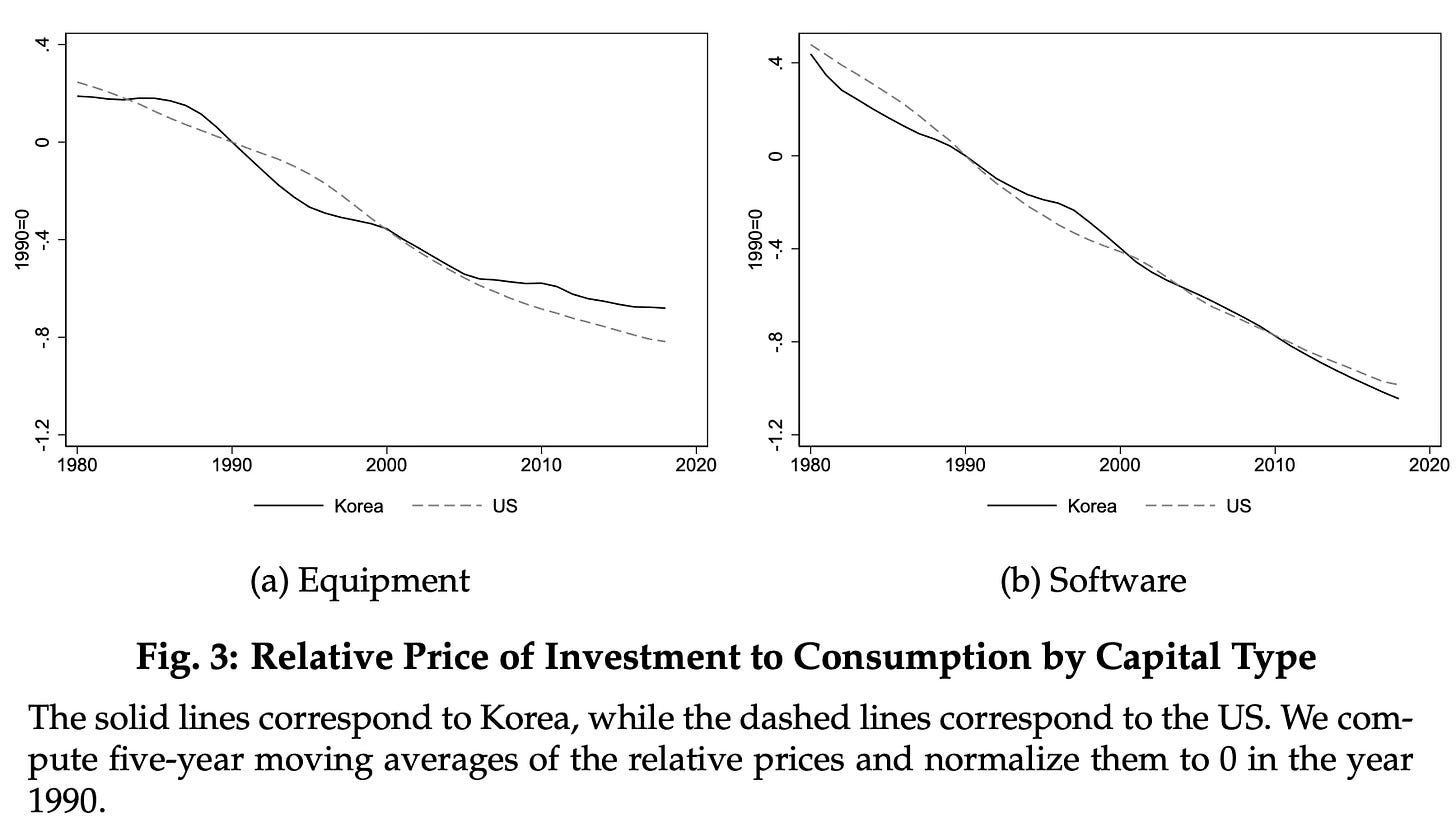

Sangmin Aum and Yongseok Shin have a new paper where they use firm and establishment-level data from South Korea to divide capital into two forms (equipment and software), and examine how they interact with labour. They explore the dynamics of returns to capital arising from labour substitution and price markups (difference between selling price and cost) for each of equipment and software.

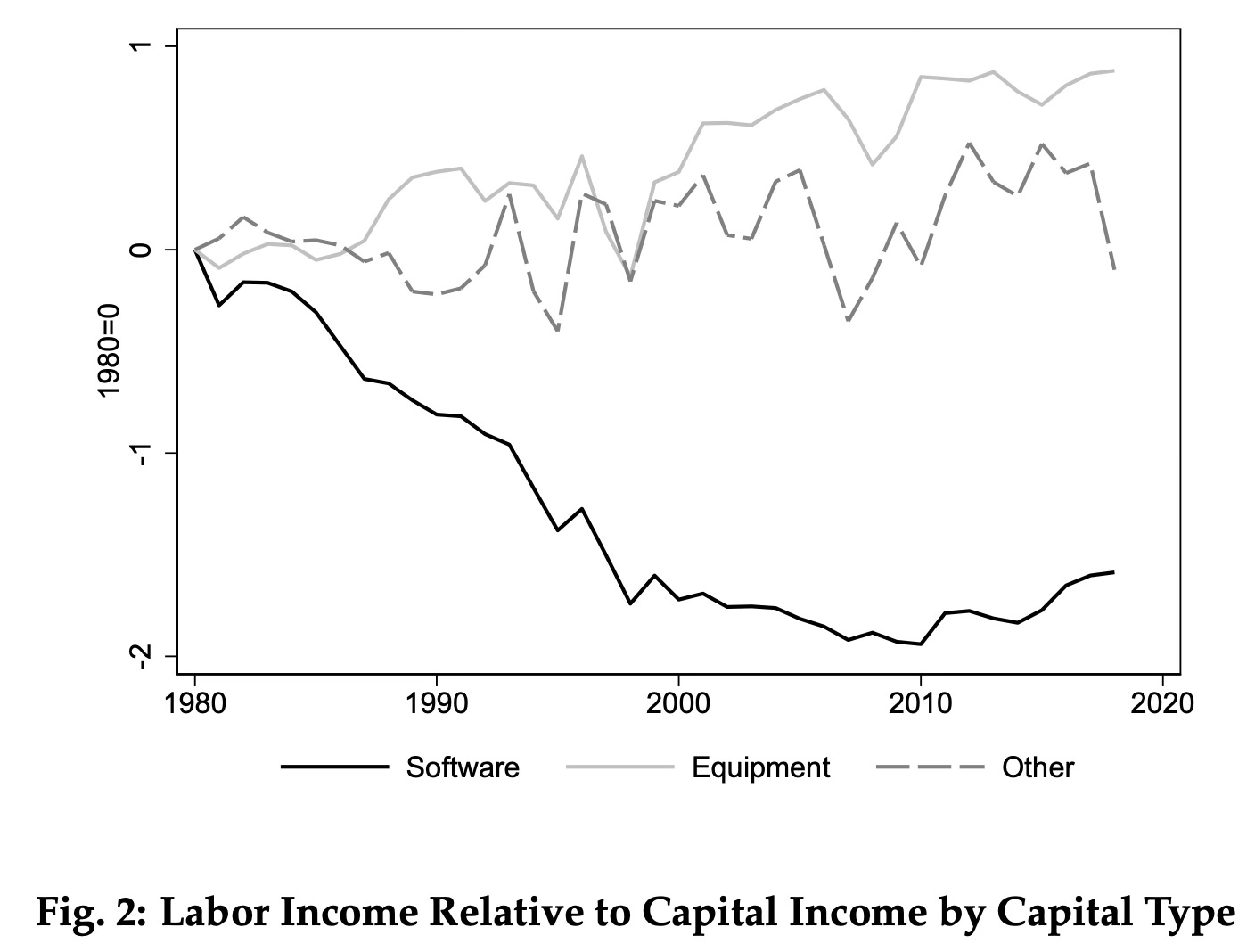

We first estimate the micro elasticity of substitution between labor and either type of capital by instrumenting for wage variations across regions or industries. Our estimation shows that equipment and labor are complements (elasticity 0.6), consistent with other micro-level estimates, but software and labor are substitutes (1.6), a novel finding that helps reconcile the macro vs. micro-literature elasticity discord. As the quality of software improves, labor shares fall within firms because of factor substitution and endogenously rising markups… Because software and labor are substitutes at the micro level, a fall in software price reduces the labor share within a firm. The effect is amplified by the variable markups, as firms charge higher markups in response, further reducing labor shares within firms…

In addition, production reallocates toward firms that use software more intensively, as they become effectively more productive. Because in the data these firms have higher markups and lower labor shares, the reallocation further raises the aggregate markup and reduces the aggregate labor share… Also in the data, high software share firms tend to have high markups… The rise of software accounts for two-thirds of the labor share decline in Korea between 1990 and 2018 (2.9 out of 4.4 percentage points). Slightly more than half of the effect comes through the markup channel (52 percent), and the rest (48 percent) through the factor substitution channel… One immediate implication is that the rise of the software or intangibles income share in the accounting sense… will underestimate the role of software in the decline of the labor income share by more than half, as it misses the impact through the rise in markups. The effect through the markup channel can be attributed almost equally to within-firm markup growth and the between-firm reallocation. By contrast, nearly all the effect through the factor substitution channel is due to within-firm factor substitution…

On the other hand, the falling equipment price plays a minor role, because the factor substitution and the markup channels offset each other… The factor substitution channel pushes up the labor share because equipment and labor are complements within firms, even after factoring in the between-firm reallocation…

In summary, it is software, not equipment, that substitutes for labor and reduces the labor income share. The resulting within-firm markup growth and the reallocation toward high markup firms are quantitatively important channels through which the fall in software prices reduces the aggregate labor share. Our result helps reconcile the macro-literature vs. micro-literature elasticity discord surrounding the labor share decline: Substitution did play a role, even though equipment and labor are indeed complements. Our result also shows that the rise of software is driving the well- documented reallocation toward large firms with high markups and low labor shares.

The price of software has fallen more than that of equipment.

The historical experience has been that increased use of equipment is associated with the rise of complementary roles for people. The increased use of software in the operations of equipment themselves also means that the complementary role of people may be far lower than earlier. In other words, while labour and equipment may have been largely complements till now, software has the potential to significantly reduce the complementarity by automating the labour component. This likelihood increases with the increasing sophistication of the equipment.

No comments:

Post a Comment