As the Union Budget 2023-24 approaches, talking heads in television channels get busy with their wish lists of new types of tax concessions and spending proposals. All these ideas are invariably focused on the expenditure side. Some of them are doubtless good, but difficult to implement without the required resources.

However, apart from the usual proposals on privatisation and selling of government lands (both of which face under-appreciated implementation challenges), ideas for revenues augmentation are scarce. In fact, among the long list of spending ideas, one struggles to come across even a handful of meaningful revenues mobilisation proposals.

One can understand businesses and citizen groups talking only about tax cuts and public spending, but academicians and public commentators? Take academic research. There have been countless research papers which propose new programs and projects. But I cannot remember any which propose a new public revenue stream or increase in a tariff or user fees.

It's as though everyone wants to become a populist by spending money and avoid raising taxes and fees.

It's perhaps not incorrect to say that there are at least a hundred times more expenditure ideas on the table than there are resources to spend. In the circumstances, I would imagine that any social optimisation of ideas generation and academic research should prioritise revenues generation over expenditure.

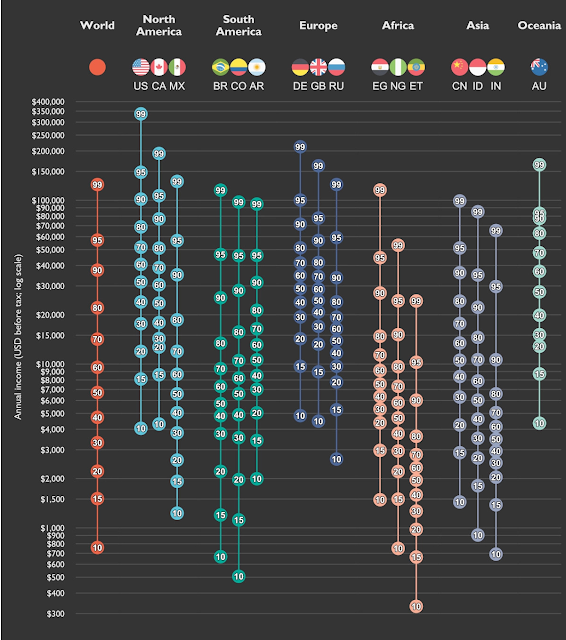

Consider the following. India has one of the lowest property tax, utility tariffs, and municipal user fees in the world. I struggle to find even one paper which examines the magnitude of this problem, much less aggressively advocate reforms to raise rates and fees.

Land registration in India suffer from several channels of leakages. Why doesn't anyone want to do a study to assess the extent of revenue leakages from land registration process? What are ideas and innovations to plug the different channels of leakages?

Where are the ideas to expand the shockingly low income, corporate, and GST bases? In particular, GST itself is a fertile ground for large-scale evasions - how can they be detected? How can practices like cross-border transfer pricing distortions, under-invoicing of imports and over-invoicing of exports etc be avoided? How can IT be used to meaningfully (not the questionable ideas like GIS mapping of properties) plug revenue leakages? See this.

Even with selling of government lands or privatisation, the standard prescriptions on the revenue mobilisation side, there are hardly any insights on the small details of their execution.

Actually, this reluctance of commentators and influencers to engage on the less popular issues goes beyond revenues mobilisation. For example, we're now witnessing the trend among state governments to revert to the defined benefit Old Pension Scheme (OPS) for public employees. Most people would agree that it's one of the most damaging public policy decisions of the last several decades. I'm surprised at the lack of engagement on the issue by the normally strongly opinionated public commentators and academicians (especially those based in the west).

Or consider the issues of fiscal sustainability and incentive distortions in developing countries like India of good-to-have tertiary education scholarships and tertiary care health insurance programs. I have not come across a single oped urging caution on the ever-expanding scope of such first-world welfare state. Nor have I seen serious research and sustained commentaries on the chronic problem of burgeoning manpower costs of state governments in India.

Or rigorous scholarship on the real value of industrial incentives in business investment decisions. I have not seen a study on the marginal value of fiscal and input incentives in the determination of business investment decisions, especially in cases of large businesses, compared to say, business environment or ease of doing business reforms.

What explains this vacuum of ideas on revenues mobilisation?

I can think of at least two simple explanations to this skewed preferences. One, we see so many problems around the world and thinking up ideas to spend more to address them is easy enough. Two, just as governments are easy targets to criticise for not spending (and thereby not solving the problem), it's as much or more difficult to criticise businesses, consumers, and taxpayers for not contributing their fair share.

Taken together, given the pervasiveness of problems facing the world and high psychological cost of proposing pain, everyone piles on the spending bandwagon. Everyone becomes a populist to score brownie points.