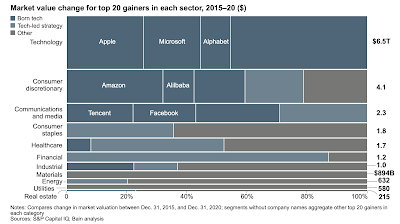

Bain & Company has released its Technology Report 2021. It points to the outsized role of technology companies in creating shareholder value across sectors.

Technology has been fuelling most of the growth across sectors in recent years.

Within technology too, cloud technology and platform business models have created hyperscalers who have cornered most of the value creation.

Naturally, technology companies therefore corner most of the venture capital finance.

A good summary of the landscape of AI/ML venture investments in 2010-21 period, dominated by US and then China.

FDI between US and China has shrunk dramatically, down 96% in technology sectors.Contrary to conventional wisdom about flat-companies and decentralisation, most companies intend to ride the IT wave to centralise decision making.DevOps speeds up the software cycle by developing and deploying continuously, increasing automation, and giving the development team more accountability for operations. That’s why more than 90% of business leaders cite DevOps as a top strategic priority for their business. It’s a powerful tool that helps companies digitalize processes quickly and support critical business operations. DevOps leaders like Amazon and Netflix deploy code thousands of times a day. Spotify uses it to rapidly ship innovations like Spotify Wrapped, its year-end personalized collection based on each user’s history, the framework of which was set up in one day.

Disappointingly, but expectedly given its implicit role as a cheerleader for existing trends, the Report urges caution against regulating Big Tech by focusing on the consumer welfare side of the story.

No comments:

Post a Comment