1. Bill Gross, the original bond king from PIMCO, writes that the real bond kings have been those sitting on the Chairs of the US Federal Reserve.

2. Rana Faroohar points to a new paper by McKinsey which examines trends in the economy over the past quarter century. This is a fascinating graphic,

Different types of companies have very different impacts on households and economies. The MGI paper divides corporations into eight archetypes: discoverers (for example, biotech firms, which push scientific frontiers); technologists, including the platforms that build the digital economy; experts (professional services, hospitals and universities); deliverers, which distribute and sell products; makers (manufacturers); builders; fuellers; and financiers. For most of the 20th century, makers and builders were pre-eminent. Over the past 25 years, they lost ground to the other archetypes. While makers represented 56 per cent of large companies in the data set in 1995, they accounted for only 41 per cent by 2016-2018. But as they decline, so does good employment. Makers contribute 20 per cent more than average to labour income, employ the most people and have the widest geographic distribution of value thanks to their supply chains and need for physical space and investment into tangible goods.

3. FT looks at the decline in inflation globally over last few decades, but asks whether it's now making a comeback.

This month, Bangladesh’s Cabinet Secretary told reporters that GDP per capita had grown by 9% over the past year, rising to $2,227. Pakistan’s per capita income, meanwhile, is $1,543. In 1971, Pakistan was 70% richer than Bangladesh; today, Bangladesh is 45% richer than Pakistan... India’s per capita income in 2020-21 was a mere $1,947.

5. China children's studying surveillance idea of the day,

“Smart homework lamps” have skyrocketed in popularity since ByteDance Inc., the creator of short video app TikTok, first introduced the $120 lamps in October. Chinese parents snapped up 10,000 units within the first month... The lamps come equipped with two built-in cameras—one facing the child and another offering a bird’s-eye view from above—letting parents remotely monitor their children when they study. There is a smartphone-sized screen attached to each lamp, which applies artificial intelligence to offer guidance on math problems and difficult words. And parents can hire a human proctor to digitally monitor their children as they study. In addition to the basic version of the lamp, a $170 upgraded model sends alerts and photos to parents when their children slouch. That version of the lamp sold out on China’s largest e-commerce platforms earlier this month.

6. Stanley Druckenmiller puts the Fed's persistence with quantitative easing despite the recovered and even overheating economy in perspective. (HT: Ananth)

7. The PLI scheme now covers 13 sectors and has an outlay of Rs 1.97 trillion over five years.

8. China (non) decoupling fact of the day,

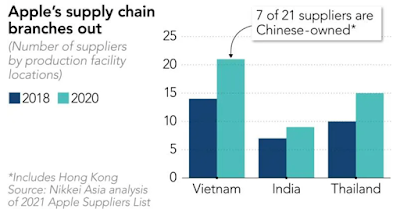

Of Apple's top 200 suppliers in 2020, 51 were based in China, including Hong Kong, according to a Nikkei Asia analysis of the Apple Supplier List released last week, up from 42 in 2018 and knocking Taiwan out of the top spot for the first time. Apple did not release data for 2019... The rise of Apple's Chinese suppliers has come at the expense of its other suppliers. The number of Japanese suppliers has fallen to 34 from 43 in 2017 and 38 in 2018. Japan Display and Sharp, which remain on the list, face competition from Chinese display makers BOE Technology Group and Tianma Microelectronics, while Sharp and Kantatsu are up against Luxshare and Cowell in camera modules. Taiwan -- which held the top spot on the list for more than a decade -- is also losing ground. Its 48 Apple suppliers in 2020 made the island the second-largest group after China and Hong Kong, but that represents a drop from 52 suppliers in 2017. The number was 47 in 2018.

But Apple's supply chain has also been diversifying, helped ironically by China-based suppliers,

China-based suppliers are also rapidly helping Apple increase production outside the country. The number of Apple suppliers in Vietnam grew to 21 last year from 14 in 2018, when the trade war began. Seven of those 21 are owned by Chinese- or Hong Kong-based companies. These include AirPods assemblers Luxshare Precision Industry and GoerTek, which both have been producing the wireless earbuds in Vietnam since early 2020. Most Apple-certified factories in Vietnam are in the north of the country, a growing cluster for consumer electronics gadgets.

9. Interesting news that Adar Poonawala, the talkative CEO of vaccine maker SII, has made investments worth Rs 3456 Cr to take a controlling stake in a financial services company Magma Corporation. This comes on top of the company's recent announcement that it's investing £ 240 million in vaccine manufacturing in India. There are murmurs of other investments.

It appears the case that even as SII has been complaining about inadequate resources to invest in manufacturing capacity expansion, it has actually been taking money out to make purely financial investments. Clearly, this is not a company short cash surplus arising out of its vaccine manufacturing business.

Another interesting point is about SII's profit margins despite being just a contract manufacturer of vaccines - underlining its predominantly manufacturing role, despite profits of Rs 17,146 Cr over the 2010-19 period, the company spent just Rs 900 Cr on R&D. However, its margins appear more closer to those of a Pharma company - among the 418 Indian companies with revenues of more than Rs 5000 Cr in 2019-20, SII had the largest net margin of 41.3%.

All this raises questions.

Did it use the at-risk commitments made by the likes of BMGF, GAVI, and Covax Alliance to merely manufacture more or invest in capacity expansion? If the latter, by how much and at what cost? More generally, as distinct from advance manufacturing, how much has been actually invested to expand capacity? What does it actually cost SII to make a vaccine? How much margin is SII actually getting on its sales to Government of India at Rs 150? Given that the original investments made were on the back of at-risk commitments by NGOs and western governments, did SII assume any risk at all?

Being a privately held company, SII is not required to answer any of these questions. Further, in purely commercial terms and in Econ 101-speak, a private company cannot be faulted of leaving nothing on the table and charging the highest price possible, a la Apple on the iPhone. But what triggers repugnance is when commerce meets moral posturing (see also this), and worse still when commerce verges on the margins of price gouging in the domestic market in times of a pandemic.

In the meantime, Indian Express reports that half the vaccines sold privately have been purchased by nine hospital groups,

These nine corporate hospital groups cumulatively bought 60.57 lakh doses of the total 1.20 crore doses of vaccines procured by private hospitals in the first full month since the Central government revised its vaccine policy and opened it to the market. The balance 50 per cent of the vaccine stock was procured by 300-odd hospitals, located mostly in the country’s urban centres, with hardly any of them serving regions beyond the Tier-2 cities... The purchases by private hospitals in May added up to 1.20 crore doses or 15.6 per cent of the total procurement of 7.94 crore doses. Of this, they administered only 22 lakh doses or 18 per cent of the doses received during the month. States procured 33.5 per cent (or 2.66 crore) and the Centre 50.9 per cent (or 4.03 crore) of the vaccine doses. The top nine private entities are Apollo Hospitals (nine hospitals of the group procured 16.1 lakh doses); Max Healthcare (six hospitals, 12.97 lakh doses); Reliance Foundation-run HN Hospital Trust (9.89 lakh doses); Medica Hospitals (6.26 lakh doses); Fortis Healthcare (eight hospitals bought 4.48 lakh doses); Godrej (3.35 lakh doses); Manipal Health (3.24 lakh doses); Narayana Hrudalaya (2.02 lakh doses) and Techno India Dama (2 lakh doses).

10. Global food prices rise by 40%, the biggest margin in a decade, spurred on by demand from China and drought in Brazil.

11. Taiwan is clearly the hottest geo-political spot in the world today, as China shows enough signals that it may be willing to annexe the Island nation using force.

As tensions with the United States have heated up, China has accelerated its military operations in the vicinity of Taiwan, conducting 380 incursions into the island’s air defense identification zone in 2020 alone. In April of this year, China sent its largest-ever fleet, 25 fighters and bombers, into Taiwan’s air defense identification zone. Clearly, Xi is no longer trying to avoid escalation at all costs now that his military is capable of contesting the U.S. military presence in the region. Long gone are the days of the 1996 crisis over Taiwan, when the United States dispatched two aircraft carrier battle groups to sail near the strait and China backed off. Beijing did not like being deterred back then, and it spent the next 25 years modernizing its military so that it would not be so next time...

Several retired military officers have argued publicly that the longer China waits, the harder it will be to take control of Taiwan. Articles in state-run news outlets and on popular websites have likewise urged China to act swiftly. And if public opinion polls are to be believed, the Chinese people agree that the time has come to resolve the Taiwan issue once and for all. According to a survey by the state-run Global Times, 70 percent of mainlanders strongly support using force to unify Taiwan with the mainland, and 37 percent think it would be best if the war occurred in three to five years.

12. An area of Covid response where things could have been much better is in demand management of oxygen use in hospitals. While governments were impressive enough to quickly ramp up supply after being initially caught on the wrong foot, the demand management has been poor. Apart from states like Kerala and a few exceptions like this hospital in Bikaner, it's now very evident that hospitals across the country wasted oxygen without following adequate controls.

This is understandable given that demand management requires strong state capacity, especially in terms of ability to transmit granular information to the frontline and be able to enforce compliance. It did not help that governments across were more focused on augmenting supply side even at a prohibitive cost when the same could have been achieved at no cost through demand management.

13. Interesting observations that even as the dues from state discoms to power generators (confined to the 47% from IPPs and 25% CGS) have declined by end-March 2021, the amount of dues under dispute have risen and the dues to IPPs have risen.

The amount of money that remained outstanding after 45-to-60 days of grace period given to the distribution companies fell to about Rs 67,300 crore, over 20 per cent lower than what it was a month ago... In March 2020, the total amount of disputed dues was Rs 10,194 core, which was about 15 per cent of the total overdues (excluding the disputed amount). A year later, in March 2021, the share of disputed dues (Rs 22,565 crore) in total overdues rose to over 33 per cent... The overdues of CPSEs have declined from about Rs 30,000 crore at the end of March 2020 to Rs 20,800 crore at the end of March 2021 — a decline of over 30 per cent... In sharp contrast, the overdues of IPPs... rose from Rs 30,960 crore at the end of March 2020 to... Rs 35,250 crore (end-March 2021)... The total amount of disputed dues for IPPs rose from Rs 9,000 crore at the end of March 2020 to Rs 21,100 crore at the end of March 2021. But the disputed dues for CPSEs saw no such sharp spike as they rose marginally from Rs 1,300 crore to Rs 1,500 crore in the same period.

As indicated in the oped, it may be that the Atmanirbhar package loans were used to pay down the CGS/CPSE dues than the IPP dues.

14. Privatisation by malign neglect has seen the share of public sector banks decline alongside the share of private sector banks rising,

As of March 2021... the state-run banks lent ₹62.29 trillion or 56.5% of the overall lending carried out by all banks... the share of private banks in overall lending jumped to an all-time high of 35.5% as of March 2021. In March 2010, it had stood at 17.4%... The outstanding loans of state-run banks during the year went up by ₹2.16 trillion. Meanwhile, the outstanding loans of private banks went up by ₹3.11 trillion or close to 44% more. This has happened in each of the last six fiscals, starting from April 2015 to March 2016. Even when it comes to deposits, the share of state-run banks in outstanding deposits fell to an all-time low of 61.3% of outstanding deposits of all commercial banks as of March 2021. The share of state-run banks peaked at 74.8% in March 2012. The share of private banks in deposits is at an all-time high of 30% as of March 2021. It was at 17.9% in March 2012.

15. There is an unending debate on the merits of quantitative easing by central banks. Sample the latest from India,

Between May 2016 and April 2021, the weighted average lending rate on fresh rupee loans of banks, fell from 10.61% to 8.1%. During the same period, outstanding bank lending to industry has barely moved up from ₹26.63 trillion to ₹28.96 trillion, at the rate of 1.7% per year.

The article's point is that investment barely rose despite the extraordinary monetary expansion. I am inclined to believe that while investment growth may have been the initial primary motivation for QE, it may no longer be so. Instead, while it's not formally acknowledged, the primary motivation may be to keep borrowing costs low, especially for governments with ballooning debts and high deficits. This alone is a dangerous territory, since governments then have the incentive to keep it going for as long as possible.

No comments:

Post a Comment