1.

FT long read on the protests in Israel following the decision by the government to push ahead with judicial reforms that would give government control over appointment of Supreme Court judges and grant Knesset the power to override court rulings that strike down laws.

2. China woos back tech entrepreneurs as it realises the need to continue fostering innovation and foreign investment in its technology sectors if it's to take on the restrictions on technology transfers being imposed by the West. But this has not meant any

respite from the Communist Party's relentless drive to control the economy,

In the broader tech sector, meanwhile, the Communist party is still quietly tightening its grip on the industry. Nearly all of China’s largest tech groups are adding state-appointed directors and shareholders in key operating entities. State groups generally make a token investment for a 1 per cent stake. These “golden shares” carry a slew of special rights. Alibaba, for instance, has handed the government “golden shares” in two units dedicated to streaming video and web browsing. At the start of the year, a state-owned fund tied to the CAC paid just Rmb350,000 ($51,000) for 1 per cent of an Alibaba unit in Guangzhou. Documents seen by the Financial Times show the CAC appointed a mid-level official as a director of the company as part of the deal. The official has a vote on “business and investment plans”, mergers and acquisitions, and veto power over certain other business decisions, the company bylaws show.

As part of the efforts to revive confidence in the private sector and foreign investors, the Chinese Prime Minister Li Qiang, former Shanghai Party leader, courted them during the recent China Development Forum meeting. However, this courting too has been accompanied by several disturbing actions against tech entrepreneurs and foreign companies.

This has always been the way in which the Communist Party has sought to engage with the economy. It first relaxes controls on the private sector and woos investors. Once the momentum sets in and there's a belief that China is turning capitalist, it reins back some of the relaxations to send home the message that the Party is in control. This dialectical approach has been a feature of the Communist Party's approach historically, and continues to remain so. It's therefore facile to assume that the Communist Party has changed its spots.

3. On China, FT long read on how the country formally shifted from Deng Xiaoping's "hide your strength, bide your time" to Xi Jinping's "dare to fight" strategy in its foreign policy. In the recently concluded National People's Congress, Xi summed up his foreign policy as "dare to fight", signalling a shift towards a directly engaged and interventionist foreign policy. This has been accompanied with hectic diplomacy in Middle East, Xi's visit to Russia, a proposal for peace in Ukraine, and a series of visits by European leaders to China.

This shift is also part of the strategy to demonstrate China's foreign policy prowess commensurate with its economic power, and also to outwit the American attempts to "contain" China.

“In the past we would declare some principles, make our position known but not get involved operationally. That is going to change,” said Wu Xinbo, dean of the Institute of International Studies at Fudan University in Shanghai... Beijing hopes the Spanish prime minister’s two-day trip will prepare the ground for China-EU co-operation once Spain assumes the rotating presidency of the bloc in July, said one Chinese expert. France’s Emmanuel Macron and Ursula von der Leyen, the European Commission president, will also visit in the coming weeks... In recent weeks, Xi has promoted what he calls “Chinese-style modernisation” as a concept better suited to developing countries than the west’s “rules-based” order... Xi launched the Global Development Initiative in 2021 — another push to use Chinese economic power to rally developing countries. The following year, he announced the Global Security Initiative and this month he pitched the Global Civilisation Initiative, a still-vague policy that appears aimed at challenging the western concept of universal values. “People need to . . . refrain from imposing their own values or models on others,” China’s State Council said on the latest initiative...

China’s argument that modernisation did not have to equal westernisation would be well received in many developing countries, said Moritz Rudolf, a research scholar at Yale Law School’s Paul Tsai China Center, particularly if it brought them material benefits from closer co-operation with Beijing. “It appears to be a counterargument to [US president] Joe Biden’s autocracy versus democracy narrative,” said Rudolf. “It’s an ideological battle that’s more attractive to developing countries than people in Washington might believe.” In Latin America, for instance, overall sentiment towards Beijing’s diplomatic strategy was positive, said Letícia Simões, assistant professor at La Salle University in Rio de Janeiro.

China already has the world's largest diplomatic network

4. Fascinating set of infographics on the problems of higher youth mortality rates and lower life expectancy in the US compared to UK and elsewhere.

And this about youth mortality

One in 25 American five-year-olds today will not make it to their 40th birthday. No parent should ever have to bury their child, but in the US one set of parents from every kindergarten class most likely will... These young deaths are caused overwhelmingly by external causes — overdoses, gun violence, dangerous driving and such — which are deeply embedded social problems involving groups with opposing interests.

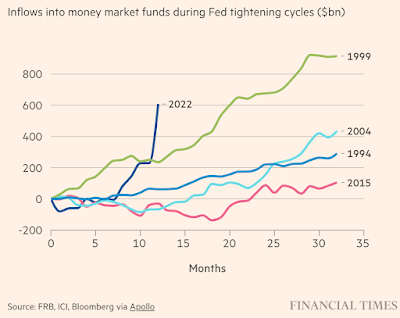

5. A good FT primer on the stresses facing US banks.

Some banks, notably in Europe, are stuck with big loan books at interest rates fixed far below current levels. Others with a higher share of their book at variable rates can immediately charge more for outstanding loans but risk a wave of defaults from borrowers who can no longer afford to service their debt. Then there is the issue of government bonds, where banks have been holding ever more of their liquidity after post-financial crisis regulations curbed their risk-taking. Bonds bought a year ago have fallen in value because they offer lower interest rates than those sold today, which is fine unless banks are forced to sell them to meet depositors’ demands. Another concern is the unpredictable behaviour of depositors as they look for more lucrative places to park their cash, including money market funds and crypto, if banks are slow to raise rates for savings.

The article informs that the US Fed estimated $620.4 bn in unrealised losses with banks on their securities portfolios at the end of 2022.

Other areas of concern include high exposures to commercial real estate (over 40% of CRE held by banks in the US) and leveraged loans to private equity (which have aggressive repayment and weak covenants), both of which can engender defaults with rising interest rates. There's also the rising cost of capital.

6. Excellent long read on the challenges of perfectionism in life and work,

Fundamentally different from having high standards, perfectionism, the theory goes, holds people back instead of propelling them forward. Research suggests that perfectionists are intensely self-critical and unwilling to take risks for fear of failure or criticism, which can be devastating to their fragile self-image. Increasingly viewed as unhealthy and debilitating, perfectionism is correlated with a vulnerability to anxiety, depression, eating disorders and burnout. Perfectionists don’t simply want to be perfect (if only it were that simple). Rather, they want to be deemed worthy. While typically associated with academic, sporting or professional achievement, perfectionism can apply in any sphere of life, including personal relationships. Perfectionists don’t realise, or have lost sight of, what every parent knows: that love is not earned. Curran’s research shows that perfectionism is rising among young people in the UK, US and Canada at what he calls an “alarming” rate. By far the largest increase is seen in a specific variety called “socially prescribed perfectionism”, or the perceived need to be perfect in order for others to value you. Compared with other varieties (“self-oriented” and “other-oriented” perfectionism), this type also has the most significant correlation with serious mental illness. Perhaps it shouldn’t have been surprising to hear an educator talk about dismantling it...

The realities of adult life for younger generations must seem to confirm the perfectionist’s innermost suspicion: that whatever you do, it’s never enough. When I was at school, knowing how hard my classmates were studying felt like pressure. But I wasn’t being bombarded by images of them doing their homework in effortlessly stylish outfits at aesthetically pleasing desks, while also carrying on fulfilling social and romantic lives. The headmistress probably doesn’t care whether it’s called perfectionism or maladaptive perfectionism. Her aspiration is to free children from fear-driven paralysis, to ensure they never question their essential enough-ness.

7. A few weeks back I pointed to an FT article which highlighted the corrosive impact of smart phones and social media on children's mental health. Another article has described teen mental health as a "reckoning for Big Tech".

Suicide among those aged between 10 and 19 years old in the US surged by 45.5 per cent between 2010 and 2020, according to the Centers for Disease Control and Prevention. A survey last month from the same government agency found nearly one in three teenage girls had seriously considered taking their own life, up from one in five in 2011... some academics point to a growing body of research that they say is hard to ignore: that the proliferation of smartphones, high-speed internet and social media apps are rewiring children’s brains and driving an increase in eating disorders, depression and anxiety. “Multiple juries are in. They’re all reaching the same conclusion,” says Jonathan Haidt, a social psychologist and professor at New York University Stern School of Business. “When social media or high-speed internet came in, [studies] all find the same story, which is mental health plummets, especially for girls.”

... In January, a report by experts in psychology and neuroscience at the University of North Carolina said teenagers who habitually checked their social media accounts experienced changes in how their brains — which do not fully develop until around 25 years old — responded to the world, including becoming hypersensitive to feedback from their peers. A review of 68 studies related to the risk of social media use in young people published in August 2022 by the International Journal of Environmental Research and Public Health examined 19 papers dealing with depression, 15 with diet and 15 with psychological problems. The more time adolescents spend online, the higher the levels of depression and other adverse consequences, the report notes, especially in the most vulnerable.

8. Even as France grapples with its pension reform challenges, the Spanish Parliament passed a pension reform which mandates higher contributions by younger workers. The fundamental problem with pensions is the same,

Spain’s efforts exemplify the impossible dilemmas faced by many European countries: how to balance decent pensions for existing retireepensios, intergenerational fairness for young people, and financial sustainability. Achieving two of these goals tends to be manageable. Securing all three is hard.

This latest reform comes after the failure to implement the 2013 pension reforms

In order to limit costs, they had introduced mechanisms that would cap monthly pension payments when the system was in deficit and reduce benefits as the average lifespan increased. These reforms had been due to come into force in 2019 but never did. As soon as it came to cutting the actual pensions of 10mn people who vote, the reforms became unacceptable to the Socialist-led government. Parliament voted to scrap them in 2021, although the PP opposed the decision. That left Spain’s pensions linked simply to inflation. As a result, they rose 8.5 per cent in January.

9. Interesting that English speaking countries have fared worse than others at increasing housing supply. Three reasons appear to be at work.

There appears to be a deep-seated aversion to urban density in anglophone culture that sets these countries apart from the rest. Three distinct factors are at work here. The first is a shared culture that values the privacy of one’s own home — most easily achieved in low-rise, single-family housing. The phrase “an Englishman’s home is his castle” dates back several centuries. From this came the American dream of a detached property surrounded by a white picket fence, while Australians and New Zealanders aspired to a “quarter acre”. A new YouGov survey bears this out: when asked if they would like to live in an apartment in a 3-4-floor block — picture the elegant streets of Paris, Barcelona or Rome — Britons and Americans say “no” by roughly 40 per cent and 30 per cent respectively, whereas continental Europeans are strongly in favour... Across the OECD as a whole, 40 per cent of people live in apartments, and the EU average is 42. But that plummets to 9 per cent in Ireland, 14 per cent in Australia, 15 per cent in New Zealand and 20 per cent in the UK.

... the second shared problem: planning systems. No matter that the UK has a discretionary approach while the others use zoning — the planning regimes in all six anglophone countries are united in facilitating objections to individual applications, rather than proactive public engagement at the policy-setting stage. This preserves the low-density status quo. Finally, we have what I call the nature paradox: Anglophone planning frameworks give huge weight to environmental conservation, yet the preference for low-density developments fuels car-dependent sprawl and eats up more of that cherished green and pleasant land.

10. Reflecting the importance of food prices, the average Indian spends a very high share of income on food.