1. Harish Damodaran writes about the contrasting fortunes of two-wheeler and tractor sales in India. Given that 55-65% of two-wheeler sales are in rural areas, and given non-farm rural sector which has not been doing well compared to agriculture sector and they also form a significant share of the rural economy, is the distress in non-farm rural sector contributing to keeping down two-wheeler sales?

The article has an interesting point about how deferral of implementation of stricter emission standards may have contributed to higher tractor sales,

The government had originally planned to introduce new Bharat Stage TREM IV emission standards for tractors with above 50 horsepower engines from October 1, 2020. That would have entailed replacing mechanical pumps for fuel injection with semiconductor-based common rail direct injection (CRDI) engines. But following representations from tractor makers, the implementation of the revised emission norms was deferred and made effective from January 1, 2023. Companies were also given six months’ additional time to sell their existing stock of tractors based on TREM III A standards.

2. The rise of venture debt

Debt was around 30 per cent of all venture capital raised in European tech in 2022, according to figures from Dealroom, compared with around 16 per cent in the previous six years. Cleantech and fintech companies were among the biggest borrowers...

The Silicon Valley Bank was the pioneer and linchpin of a venture debt market that gave start-ups an alternative source of funding, without the need to sacrifice equity stakes or swallow a much lower valuation. Across the US, SVB was responsible for roughly a tenth of all venture debt issued in the year so far. But on its home turf in California, the bank was behind more than 60 per cent of all deals this year, according to data from Preqin.

3. It turns out that many popular Italian cuisine dishes are not after all Italian. In fact, the migration of South Italians in the late nineteenth and early twentieth centuries into the US led to the emergence of a fusion cuisine which has today come to dominate as Italian cuisine in popular imagination. From an FT article,

Panettone is a case in point. Before the 20th century, panettone was a thin, hard flatbread filled with a handful of raisins. It was only eaten by the poor and had no links to Christmas. Panettone as we know it today is an industrial invention. In the 1920s, Angelo Motta of the Motta food brand introduced a new dough recipe and started the “tradition” of a dome-shaped panettone. Then in the 1970s, faced with growing competition from supermarkets, independent bakeries began making dome-shaped panettone themselves... Tiramisu is another example. Its recent origins are disguised by various fanciful histories. It first appeared in cookbooks in the 1980s. Its star ingredient, mascarpone, was rarely found outside Milan before the 1960s, and the coffee-infused biscuits that divide the layers are Pavesini, a supermarket snack launched in 1948...Parmesan, he says, is remarkably ancient, around a millennium old. But before the 1960s, wheels of parmesan cheese weighed only about 10kg (as opposed to the hefty 40kg wheels we know today) and were encased in a thick black crust. Its texture was fatter and softer than it is nowadays. “Some even say that this cheese, as a sign of quality, had to squeeze out a drop of milk when pressed,” Grandi says. “Its exact modern-day match is Wisconsin parmesan.” He believes that early 20th-century Italian immigrants, probably from the Po’ region north of Parma, started producing it in Wisconsin and, unlike the cheesemakers back in Parma, their recipe never evolved. So while Parmigiano in Italy became over the years a fair-crusted, hard cheese produced in giant wheels, Wisconsin parmesan stayed true to the original.In the story of modern Italian food, many roads lead to America. Mass migration from Italy to the US produced such deeply intertwined gastronomic cultures that trying to discern one from the other is impossible. “Italian cuisine really is more American than it is Italian,” Grandi says squarely. Pizza is a prime example. “Discs of dough topped with ingredients,” as Grandi calls them, were pervasive all over the Mediterranean for centuries: piada, pida, pita, pitta, pizza. But in 1943, when Italian-American soldiers were sent to Sicily and travelled up the Italian peninsula, they wrote home in disbelief: there were no pizzerias. Before the war, Grandi tells me, pizza was only found in a few southern Italian cities, where it was made and eaten in the streets by the lower classes. His research suggests that the first fully fledged restaurant exclusively serving pizza opened not in Italy but in New York in 1911. “For my father in the 1970s, pizza was just as exotic as sushi is for us today,” he adds.Like pizza, mozzarella was fast-tracked to global fame through the funnel of mass migration to America from the Italian south. Comparing her recollections with those of my grandmother, it’s clear that Sicily’s elevated “Sunday” dishes (aubergine parmigiana, cannoli, pasta con le sarde) were the ones that went mainstream, thanks to the south’s contribution to the Little Italys of the US. My grandmother, on the other hand, grew up eating tordelli alla massese (large fresh tortelli with a meat filling, cooked in a ragú sauce) and cappelletti in brodo (fresh tortelli in chicken broth), dishes that are almost entirely unknown outside the region.

4. Martin Wolf has some suggestions on how to avoid the next banking crisis. This is an important and under-appreciated aspect,

The best protection against occasional huge banking crises is frequent smaller ones. Fear works. We have seen, for example, some unwise deregulation. That of smaller banks in the US in 2019, which contributed to the recent crisis, is a powerful example. Pressure for deregulation has also been growing in the UK. A shock like this should make mindless deregulation less appealing to politicians and mindless risk-taking less appealing to bankers. Both lessons might have been learnt in the US and elsewhere, for a while.

5. Charles Goodhart argues that bank managers must face personal financial liability

The main cause of moral hazard is limited liability, especially when this applies to bank managers’ large shareholdings, mostly from bonuses. We cannot go back to the pre-Victorian approach of unlimited liability for all, because it would mean that banks could never get equity capital from outsiders. But there is no reason why we could not require senior bank management to face multiple liability, and in the case of chief executives possibly to have unlimited liability. If senior management faced a really serious loss when their bank failed, there would be far less need for shed loads of restrictive regulations.

6. Rana Faroohar points to a potential fault line from the impact of higher rates on real estate holdings of private equity,

Consider, for example, the trouble brewing in commercial property loans, and private equity real estate funds. This is where the shadow bank and small bank stories meet. Small banks hold 70 per cent of all commercial real estate loans, the growth of which has more than tripled since 2021. Following the easing of Dodd-Frank rules for community banks, smaller financial institutions have also invested more in riskier assets owned by private equity and hedge funds (as have other institutions looking for better returns, including pension funds). Small bank funding to commercial real estate is now tightening. This, along with interest rate rises, is putting downward pressure on commercial property values, which are now below pre-pandemic levels. That will curtail capital flows, derail investments and put pressure in turn on private equity funds with loans that are maturing, or which need equity injections... This means asset managers may be forced to go to investors for more capital (which will be a tough negotiation at the moment) or sell property out of their portfolio to cover loans. This has the feel of a doom loop to me. Big real estate indices had already turned negative in 2022... Consider, for example, how rich non-bank asset managers such as Blackstone, Apollo, Carlyle and others became on both residential and commercial real estate in the wake of 2008. This was partly because they were able to make deals that more regulated banks couldn’t. Private equity players have also made new investments in utilities, farmland, transportation and energy.

7. Apple and Microsoft make up 7.1% and 6.2% of S&P 500, making them disproportionately influential drivers of the index. Tech sector itself has more than doubled to 29% of the index by 2021 since 2001.

8. India's interesting services exports growth storyMost of the world’s electric car batteries are now made in China. Accounting for more than 70 per cent of market share by shipments... But Tesla’s new batteries are set to upend the hierarchy of the industry for good. Panasonic and LG Energy Solution have long been the leading suppliers. But in recent years, Chinese makers such as CATL and BYD have steadily won market share away from Korean and Japanese rivals and have grown to dominate the world’s supply.Electric car batteries have undergone rapid technological change in recent years. Until now, the priority has been on improving energy density — for longer driving range — by changing the composition of battery materials. The shape of the battery cells has been less of a focus. Currently, most electric car batteries are designed and moulded in the shape and form that ensures the most efficient use of space. That has meant batteries that are shaped like flat pouches or stackable rectangular boxes have been the leading standards for electric cars until now. Cylindrical battery cells, the third type on the market, have long been considered the less attractive option because empty gaps between the round cells when stacked together was seen as wasted space. These made up just a fifth of the global market last year. Yet Tesla is betting big that these will become the future industry standard. Its cylindrical 4680 battery cells, named after their size, with a diameter of 46mm and length of 80mm, have been developed to have energy density of up to five times that of the batteries currently used in most Tesla cars. For both electric car buyers and for Tesla, the cost advantage is clear. The new cells are cheaper to produce than previous versions. They use new material which includes aluminium, a relatively abundant and lower cost metal, and less raw materials overall. Upgraded technology means the batteries are made using fewer parts — also meaning less weight. They are easier to mass produce as they do not have to be customised to fit different car shapes and designs.

This vertical integration would be a shift for Tesla from its practice of relying on an ecosystem of suppliers. But it has its set of advantages. Further, Tesla is also expanding its Nevada plant to make 2 million 4680 cells a year, up from 1000 cells a week in December. And, this indigenisation will also help the company benefit from the incentives under the Inflation Reduction Act.

10. To the list of Martin Skhereli of Turing Pharmaceuticals, Elizabeth Holmes of Theranos, and Trevor Milton of Nikola, comes Charlie Javice, 31, a Wharton alumni, who falsified the number of subscribers of her student finance website, Frank, and sold it to JP Morgan to pocket $45 million in profits.

Javice represented to JP Morgan that Frank had 4.25 m customers when in fact it had only 300,000. This is a standard practice in the startup world where the headline number on users are a signal of growth potential. Founders are not forced to disclose whether these are mere free downloads or registrations, or one-off subscribers, or active subscribers, and several other categories in between. This can be described as subscriber-washing.

11. Martin Wolf has two graphics about global trade. The first points to the progressive downward recalibration of the trajectory of global trade.

The second points to the increasing rise in global trade restrictions.

12. Gillian Tett compares the current bank run with that in 2007-08 and 1997-98 in Japan. The big difference was the speed with which the information spread, depositors pulled out $42 billion, and the bank collapsed. And the contagion spread rapidly across others. As a metric, the share of US households using internet or mobile banking rose from 39% to 66% between 2013-21.

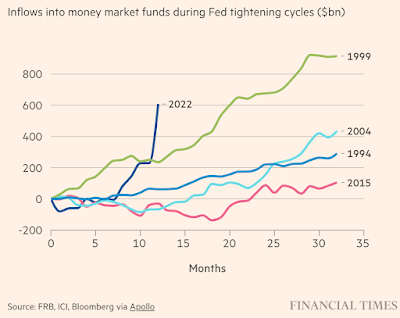

Until now, the models used in finance do not seem to have taken account of the fact that consumer behaviour online might be different from that in the old-fashioned, physical banking world. But one striking feature about American banks, even before the March panic, was that consumers were moving money out of low-paying deposit accounts into better-yielding money market funds at a dramatically faster pace than at similar points before in history.

That might imply that greater information transparency accelerates consumer reaction to news, even outside crises, increasing the risk of “herding”. Either way, we urgently need some behavioural finance analysis, since American banks will stay healthy only if they hang on to deposits — and digital herding could increase the risks of turmoil in other markets, such as Treasury bonds, if shocks emerge there too... The dangerous weakness of fractional banking is that if nobody has a reason to panic, banks are safe; but if everyone runs, a bank can collapse, even if it previously passed tests on issues such as capital adequacy — unless a government steps in. And while the government never used to worry about smaller banks collapsing, now they fear the digital domino effect.

This raises the issue of how fractional reserve banking can survive in the era of rapid and real-time information flows.

In the context of SVB, Morgan Housel writes,

Controlling your behavior amid uncertainty can be hard enough. Controlling your reactions to other people’s behavior is way harder. Fear is more contagious than any virus, and can instantly push people to react in ways that would have seemed unthinkable a moment prior... Bank runs have been happening for centuries. SVB was unique because it had the social web of a tiny town but the balance sheet of a big, disparate, bank. When one person yelled fire, every other deposit holder instantly heard it, and $50 billion rushed out the door.

No comments:

Post a Comment