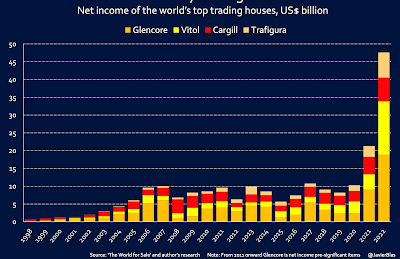

1. Commodity traders had a spectacular year in 2022 with eye-popping profits.

Talk about ESG investing and the phase out of mining stocks!

2. An example of restrictive land conversion laws in the US

There is an aging office building on Water Street in Lower Manhattan where it would make all the sense in the world to create apartments. The 31-story building, once the headquarters of A.I.G., has windows all around and a shape suited to extra corner units. In a city with too little housing, it could hold 800 to 900 apartments... But 175 Water Street has a hitch: Offices in the financial district are spared some zoning rules that make conversion hard — so long as they were built before 1977. And this one was built six years too late, in 1983.“There’s nothing about that building — its construction, its mechanicals, its structural engineering — that prevents it from being converted,” said Richard Coles, the managing partner of Vanbarton Group, which has developed both conversions across the street. Vanbarton owned and thought hard about converting 175 Water, too... A mere stroke of a pen would do it, Mr. Coles said. But that idea died in the State Legislature this spring, along with the rest of the governor’s housing agenda. When Vanbarton concluded no change was coming, it sold the property.

This is the summary

We ask far more of buildings today than decades ago, including that they be accessible, sustainable, hurricane- and earthquake-proof, that they deter flying birds and provide public spaces. Each new goal, while worthy, widens the disconnect between buildings constructed decades ago and what regulation requires today. And we’ve developed over time more rigid ideas about the built environment: that housing should gain value indefinitely, that politicians should ensure that’s so, that property owners have a right to veto change around them. The cumulative effect today, if you want to turn an office into an apartment, or even turn your back porch into an enclosed home office? The building code says no. Or the zoning does. Or the neighbors do. Or a phrase in a decades-old state law does. Or the politicians asked to change that phrase decline to...

Zoning rules in many cities say precisely how many parking spots are needed per hundred square feet of pawnshop (different from the parking needed per hundred square feet of furniture store). They spell out the architectural flourishes builders must apply, the minimum acreage a home can occupy, or the size of individual units in an apartment building... These rules impede conversions in particular. In New York, a hotel requires a 20-foot rear yard. But a residential building requires a 30-foot one. Does that mean developers should lop off the back of hotels to make housing? Why do we draw such fine lines anyway between buildings where people sleep short-term and those where people sleep permanently?

This statistic is stunning

“It’s pretty clear when you look at zoning codes — over the last century that zoning codes have existed — that they have only gotten longer and more complex,” said Sara Bronin, an architect and legal scholar who helped rewrite the zoning in Hartford, Conn. New York’s original 1916 code was about 14 pages. Today, it is nearly 3,500 pages. Cities have accumulated more prohibitions, more prescriptions, more appendix tables.

It's important that countries like India shed its legacy of copying US planning regulations and avoid adopting their regulations in the name of misguided catch-up and modernisation.

This is a good multimedia article on the challenges associated with usage conversion in the US cities.

3. US imports from China as a share of the country's imports has been declining since it peaked in 2018.

Whoever said that President Trump's actions on China were blunt! While today it has become the norm to pursue policies that sanitise China's access to sensitive technologies, it can be argued that the reversal could not have happened without Trump.

4. Ruchir Sharma points to the remarkable resilience of emerging economies

Normally inflation runs much hotter in emerging economies but, excluding outliers, the median rate is now running at 5 to 6 per cent — no higher than in developed economies. That has not happened in four decades. Some central banks in the developing world have started to cut rates and many others are likely to follow soon. Emerging economies are on track to grow faster than 4 per cent on average over the coming year, or four times faster than developed ones.

5. Andrew Haldane cautions against tightening monetary policy prematurely and excessively, what he describes as monetary austerity,

Despite the headline inflation rise, inflation expectations remain anchored... A year from now, a reasonable view would see inflation at 3-4 per cent without any further tightening. At those levels, it is highly questionable whether those last inflationary drops need to be squeezed out at greater speed. At 3-4 per cent, inflation no longer enters the public consciousness. That is why there is essentially no evidence it would impose costs that are any greater than at 2 per cent. But the costs of lowering inflation those extra few percentage points, measured in lost incomes and jobs, are larger at these levels of inflation...Imagine a doctor, uncertain about the nature and severity of a disease, who has administered a large medicinal dose which has yet to take effect. Prudence would cause them to pause to see how the patient responded before doubling the dosage. That principle is one central banks should heed now to avoid overdosing the economy. Over a decade ago, in pursuit of lower debt, the UK enacted fiscal austerity. This ruptured growth and was self-defeating for debt. Today, in pursuit of lower inflation, monetary austerity risks the same fate. It is time to steer the stampeding herd away from the cliff edge, for the sake of the financial security of millions of people and the credibility of our policy institutions.

6. Some snippets on Canary Wharf redevelopment

There are about 3,500 residents and 120,000 office workers in Canary Wharf, a 128-acre estate in London’s eastern Docklands area that is jointly owned by Canadian asset manager Brookfield and the Qatar Investment Authority. The district, which sprung out of London’s 1980s financial services boom to house big banks’ expanding trading floors, is now under pressure to reinvent itself as companies downsize their office space to adapt to hybrid working. Home to 30 office buildings, the area has been hit by high-profile exits in recent years, including law firm Clifford Chance and now HSBC, which this week said it would move its global headquarters out of the Canary Wharf tower that bears its logo to smaller premises in the City of London...Canary Wharf’s history as a financial district dates back to the early 1980s when Michael von Clemm, chair of Roux Restaurants but also investment bank Credit Suisse First Boston, was scouting out the area of decrepit 18th-century warehouses as a potential site for a frozen food processing plant. Von Clemm realised the district would work better as a hub for back-office financial services jobs, with the dockside offering an attractive location for shops and restaurants. It also reminded him of his native Boston, whose own 18th-century warehouses had been through a similar rejuvenation. By the time work began on the development, a host of international banks including Morgan Stanley had signed up — and Canary Wharf would no longer be a base for administrative back-office jobs but a beacon of financial power containing the European head offices and trading desks of the world’s biggest banks...The district is home to more than 300 retailers as well as eight supermarkets — including the country’s largest Waitrose — more than 70 restaurants and bars, and a cinema. The Elizabeth line, which opened last year, has contributed to a 40 per cent year-on-year increase in footfall in the retail area, where occupancy stands at 97 per cent, according to the estate. However, analysts warn such amenities are a byproduct of the concentration of offices and could vanish with them. “Canary Wharf is first and foremost a place for work and production as opposed to a place for consumption,” said Quinio of Centre for Cities. “Commercial space dedicated to consumption is only there to serve the needs of people who work there.”

7. On Vietnam's success in school student learning outcomes compared to India

Vietnam’s children spend less time in lessons than Indian ones, even when you count homework and other cramming. They also put up with larger classes. The difference is that Vietnam’s teachers are better prepared, more experienced and more likely to be held accountable if their pupils flunk.

More on Vietnam

The latest data from the World Bank show that, on aggregate learning scores, Vietnamese students outperform not only their counterparts in Malaysia and Thailand but also those in Britain and Canada, countries more than six times richer. Even in Vietnam itself, student scores do not exhibit the scale of inequality so common elsewhere between the genders and different regions... Vietnam’s stellar performance. Its distinctive secret lies in the classroom: its children learn more at school, especially in the early years...In a study in 2020, Abhijeet Singh of the Stockholm School of Economics gauged the greater productivity of Vietnam’s schools by examining data from identical tests taken by students in Ethiopia, India, Peru and Vietnam. He showed that between the ages of five and eight Vietnamese children race ahead. One more year of education in Vietnam increases the probability that a child can solve a simple multiplication problem by 21 percentage points; in India the uplift is six points...The biggest reason is the calibre of its teachers. Not that they are necessarily better qualified; they are simply more effective at teaching. One study comparing Indian with Vietnamese students attributes much of the difference in scores in mathematical tests to a gulf in teaching quality. Vietnam’s teachers do their job well because they are well-managed. They receive frequent training and are given the freedom to make classes more engaging. To tackle regional inequality, those posted to remote areas are paid more. Most important, teacher assessment is based on the performance of their students. Those whose pupils do well are rewarded through presitigious “teacher excellence” titles. Besides such carrots, a big stick is the threat of running foul of the ruling Communist Party. The party apparatus is obsessed with education. This percolates down to school level, where many head teachers are party members.

8. Edward Luce on the hypocrisy and non-relevance of the Ivy League admissions debate in the US following the US Supreme Court direction barring any affirmative action in higher education admissions.

Of the 31mn Americans aged between 18 and 24, just 68,000 are Ivy League schools undergraduates — about a fifth of a per cent. Of these, a varying ratio are non-white beneficiaries of affirmative action. Many of those are from privileged black or Hispanic backgrounds, as opposed to Chicago’s South Side or the wastelands of Detroit. That is the basis on which the Ivy League lays claim to being a deliverer of social change. It is an optical illusion. In that respect the Supreme Court has done America a favour. Any disruption to this status quo is a plus. But it is unlikely to trigger the soul-searching America needs. The US debate remains stubbornly monopolised by the ethnic breakdown of the tiny number of students who win the Ivy League lottery. The 19mn or so of those 31mn young Americans who do not progress beyond high school, and the roughly 12mn who go to less elite colleges, barely feature. Whatever tweaks the Ivy League has to make to keep its diversity ratios after last week’s ruling are thus largely irrelevant to the 99.8 per cent that will never get there.

Instead of expressing outrage, he suggests that the Ivy League do some of this,

The genuinely radical Ivy League option — spending their vast endowments to sharply increase student numbers — is unlikely to be entertained. The key to the Ivy League is exclusivity; a big expansion in intake would dilute that premium. We are thus likely to continue with a situation in which universities such as Harvard, with a $53bn endowment, or Princeton with $36bn, continue to get richer. Each of these fortunes could revolutionise financial aid at dozens of public universities. The second most radical option would be for the Ivy League to abolish what is called “ALDC” — athletics, legacy, dean’s list and children of faculty and staff. Forty-three per cent of Harvard’s intake come from one of these groups. The first, athletics, includes sports that can only be learned by the privileged, such as lacrosse, sailing and rowing. The generous athletics intake by universities is why so many recent admission corruption scandals, such as the FBI’s Varsity Blues sting operation, involved athletics directors. Contrary to popular opinion, most athletics scholars are not black basketball players. Sixty-five per cent are white. The second, legacy students, are the close relatives of alumni — the very definition of elite reproduction. Again, these are mostly white. The third, dean’s List, is a euphemism for the children of people who have donated a lot of money. An example of this is Jared Kushner, Donald Trump’s son-in-law, whose father, Charles, gave $2.5mn to Harvard. Finally, there are the children of faculty members and staff. Taken together, the Ivy League could as easily be construed as an affirmative action plan for wealthy white people, which is very far from the progressive brand it has cultivated.

9. Times has an article that highlights how exports to China is an important factor in the German economy and any shocks will invariably generate social and political tensions. Many mittlestand companies, located in small towns and contributing a disproportionately large share of the local labour force and central to the local economy, are deeply vulnerable to any trade tensions and resultant loss of Chinese market. Take the example of Hate Hydraulics,

In Kaufbeuren, a brightly painted Bavarian town nestled below the Alps, Hawe is a top employer. In the tiny village of Sachsenkam, 60 miles to the west, Hawe provides 250 jobs — the next largest employer is the local brewery, with a staff of 17... The archetypal Mittelstand company is based in a rural German town, making a piece of equipment few have heard of, but that is crucial for goods worldwide — like a screw needed for every airplane or passenger car. These companies... employ 60 percent of its workers, and make up 99 percent of its private sector — a higher percentage than in any industrialized nation in the world... Because that worked so well for years, they had no need to adapt to changes. But now, they need to adjust to the new economic reality. Even as the tech revolution and climate change added strain in recent decades, Germany’s model plodded profitably along. But the pillars it relied on to do that — cheap Russian natural gas and the Chinese market — are collapsing...Like its population, Germany’s business owners and entrepreneurs are aging — the average Mittelstand association member is 55. Some are resistant to adapting to new technologies and cling to a loyalty-based system that created lifetime employees — and customers. (Hawe’s very first client in 1949, a forklift producer, still buys from it today.)

10. Times article on how (automobile, in particular electric vehicles) repairs have become prohibitively expensive,

The average cost of making damaged cars good as new has soared 36 percent since 2018, and may top $5,000 by the end of this year, according to Mitchell, a company that provides data and software to insurance companies and auto repair businesses. That big increase is the main reason that insurance premiums have been soaring — up 17 percent in the 12 months through May. New sport utility vehicles and pickup trucks, including a rapidly growing number of electric models, have become so complex and luxurious that seemingly simple repairs can cost a small fortune, auto experts said. Insurers are often on the hook for much of those costs, leading them to raise their rates.Materials designed to crumple or deform in a crash to protect pedestrians or passengers, for example, can be hard or impossible to repair. Many bumpers must be replaced after low-speed dings because the safety sensors embedded in them may no longer work properly after repairs. Other systems, even some that do not appear to be damaged, must be inspected or recalibrated.

This is part of the trend of businesses trying to maximise value capture. It's a sale plus O&M approach, where businesses seek to maximise their returns over the entire life cycle of their products.

11. Critical minerals required for the energy transition are acutely deficient,

Achieving the energy transition will demand far more lithium and other minerals by 2030 than the world is on track to produce. Responsibly boosting global production is paramount. Avoiding critical minerals shortages will require some 330 new mines over the next decade, according to Benchmark Minerals, even assuming maximum progress on recycling. This includes 59 new lithium mines; the world currently has a couple of dozen.

Meanwhile automobile makers are striking deals either buying up Lithium mines or entering into long-term purchase agreements with mining operators. This is a throwback to the early stage of automobiles when Ford set up rubber plantations in Brazil to manufacture tyres. But the challenges are daunting,

Many countries with big reserves, like Bolivia, Chile and Argentina, have nationalized natural resources or have stringent currency exchange controls that can limit the ability of foreign investors to withdraw money from the country. Even in Canada and the United States, it can take years to establish mines.

12. On the rise of private credit

Private credit alternative lending has grown nearly six times across public and private markets over the past 15 years. Notably, the private credit market has expanded to become an asset class worth about $1.5tn, rivalling the syndicated loan market in size... The supply of credit from commercial banks has declined by more than 50 per cent in the wake of the global financial crisis, the Covid-19 pandemic and the 2023 turmoil in banking... As a result, in the past 18 months more than 90 per cent of leveraged buyouts globally were financed by private credit.

13. Eurostar's passenger traffic projections were wildly over-optimistic

... since the first trains ran from London Waterloo to Paris and Brussels in November 1994. During construction of the Channel Tunnel between 1988 and 1994, forecasts had projected that the operation within two years would be handling 13mn passengers annually — a level that the cross-Channel operations have still never achieved. They projected it would be carrying 20mn passengers annually by 2004. The service carried only 3mn passengers in 1995, its first full year, and only 6mn in 1997.

The numbers never even got close to 20 million

Eurostar merged last year with Thalys, which operates high-speed services from Paris to Brussels, Amsterdam and Cologne, to launch what former SNCF president Guillaume Pepy predicted would be a “new era” in high speed rail in Europe. The group is now aiming to double traffic from the 14.8mn people it carried in 2022 to 30mn people annually by 2030, according to Cazenave. The operation carried 8.3mn passengers on Eurostar trains and 6.5mn on Thalys in 2022.

Despite its problems, Eurostar has an 80% share of the London-Paris and Paris-Amsterdam rail and air markets.

No comments:

Post a Comment