I have a co-authored oped in Indian Express today with Noorul Quamer which explains the need for pension reform, why the reversion to the old pension scheme is fiscally ruinous and unsustainable, and presents an alternative that makes the current contributory pension more fair and attractive.

This is our proposal,

The government could then guarantee a certain percentage of the last drawn salary as a fixed annuity pension. The pensioner would purchase the annuity at retirement, and the government could bridge the gap, if any, between the guaranteed pension and the purchased annuity. The gap could be met by direct budget transfers to the pension. The guaranteed annuity would reduce in proportion to any lump sum withdrawal from the corpus... the guaranteed pension could be topped with additional benefits, currently unavailable to NPS pensioners. They include extending pension to the spouse, albeit with a lower annuity, health and life insurance benefits, and a minimum pension to cover for those with lower service tenures.

Given that a reversion to OPS is fiscally just not sustainable and the contributory NPS puts all risks on the pensioner, the only alternative may be to guarantee an amount that is sustainable. And it's here that the debate on pension reform should focus.

Some graphs that are useful in reading the oped.

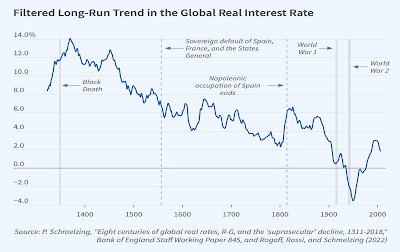

1. The decline in interest rates is a secular trend in the long arc of history. And as I blogged here, demographics makes it even more likely.

2. The pension fund returns in different countries trend in the 3-5% range.3. The demographic challenge in a graph - the post-retirement life span may be as long as the average service career!

4. Finally, the extent of escalation associated with the current OPS over a 25-year post-retirement life is in the graph above. Given the family pension too, we are looking at around 30-40 years of pension payout.

No comments:

Post a Comment