1. Another consequence of the Ukraine invasion and President Putin's sabre-rattling by putting the Russian nuclear forces on "high alert" may be the return of nuclear weapons to the centre stage of geopolitics. C Rajamohan has a good summary of the moves already afoot,

In an important statement last week, the former prime minister of Japan, Shinzo Abe, called for a national debate on hosting American nuclear weapons on Japanese soil. In South Korea, which is electing its president this week, front-runner Yoon Suk-yeol has talked of strengthening Seoul’s nuclear deterrence against both Pyongyang and Beijing. Taiwan, which is in the cross-hairs of President Xi Jinping’s regional strategy, is reportedly developing a nuclear-powered submarine that could offer some deterrence against a Chinese invading force. Australia, which is working with the UK and the US to build nuclear-powered submarines, is accelerating the project after the Ukraine invasion...On the nuclear front, the debate in Japan and South Korea is about potential nuclear sharing arrangements with the US. In Taiwan and Australia, the emphasis is on developing nuclear-powered submarines. The US too is debating the deployment of new strategic weapon systems in Asia that might encourage China to pause before trying to emulate Russia’s Ukraine adventure. One way or another, Russia’s war in Ukraine is bound to transform the Asian nuclear landscape.

2. Making a mockery of the proceedings before the Supreme Court on the dispute by Amazon of the planned $3.4 bn purchase of Future Group's retail assets, Reliance physically seized by stealth the assets of Future Group,

Reliance's takeover began with utmost stealth on the night of Feb. 25 when its staff began arriving at Future stores. Many in Future's management were in the dark about the plans as store employees from all over the country frantically began to call, according to people with direct knowledge of the matter. "It was tense, everybody was panicking. We didn't know who they were. They wanted access and seniors didn't know about it," a New Delhi Big Bazaar store employee said, describing what happened around 8 p.m. that day. At a Future store in Sonipat town in northern Haryana state, announcements were made asking customers to leave as Reliance seized control, one source said. In Vadodara in western Gujarat, Future employees arriving for work the next morning were asked to go back home with no explanation, said another source. Citing unpaid payments by Future, Reliance has taken control of operations of some 200 Big Bazaar stores and has plans to seize another 250 of Future's retail outlets. Combined, they represent the crown jewels of Future's retail network and around a third of all Future outlets.

By any yardstick, given prevailing conventions in the Courts, this is a clear contempt of the court. It makes a mockery of rule of law in the country. If the government did something similar, the media would go to town excoriating the government. When it's India's largest corporate group, analysts describe it gushingly as a "coup de grace" delivered on Amazon!

More here

Ambani’s Reliance Industries Ltd. in late-February quietly began poaching employees and taking over rental leases of hundreds of stores once run by Future Retail Ltd. and Future Lifestyle Fashions Ltd., even as Amazon furiously tried to block formal acquisitions through lawsuits and arbitration across India and Singapore. Ambani’s bloodless coup forced Amazon to seek settlement on the bitter dispute and alarmed Future’s investors and lenders wary of asset-stripping... Reliance’s tacit takeover of about 200 stores by signing new lease agreements with landlords owning Future’s stores and sending job offers to 30,000 workers from the Future Group.

3. Even as brands continue their exit from Russia, the Big Tech have, in keeping with their reputations, continued to stay on. Sample this from an FT article,

Social media platforms have given wings to international Kremlin news outlets such as RT television and its video channel Ruptly. On YouTube, RT boasted of billions of viewers, significantly more than via TV. Ruptly was the most watched “news agency” on YouTube in 2020.... Leaders of the Baltic states wrote to YouTube, Google, Twitter and Facebook asking the platforms to demonetise state media accounts, and not to allow accounts to glorify crimes against humanity. The fact that a political appeal is needed to push companies to take a stance against glorifying war and alleged war crimes is devastating.

McDonalds has followed Coco-Cola, Pepsico, Starbucks, and Unilever in halting operations in Russia, closing down all its 850 restaurants. About 300 major companies have joined the "business blockade" of Russia.

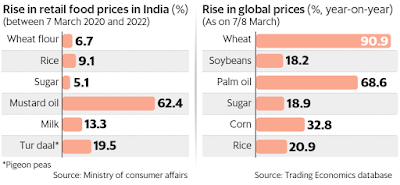

4. The crisis is hitting food prices badly

As the oil embargo by US and UK starts to bite and others join in, oil prices are expected to rise further and also stay elevated for the foreseeable future. Its impact on Indian consumers will be significant, thereby posing a serious problem for the government to absorb some of the increases through excise duty cuts, which in turn would erode its tax revenues.

The cost of the Indian basket of crude, which averaged $69.88, $60.47 and $44.82 per barrel in FY19, FY20 and FY21, respectively, averaged $94.07 in February, according to data from the Petroleum Planning and Analysis Cell (PPAC). The average was at $126.32 a barrel as of 7 March. The Indian basket represents the average of Oman, Dubai and Brent crude... Petrol and diesel have around 2.5% weight in the Consumer Price Index and 13% weight in the wholesale Index. A ₹1 cut in excise duty on petrol costs the exchequer ₹4,000-5,000 crore, while the same for diesel costs ₹14,000-15,000 crore. An ICRA report recently said that India's current account deficit is likely to widen by $14-15 billion, or 0.4% of GDP, for every $10 barrel rise in the average price of the Indian crude basket.

And its impact on inflation in India,

It is estimated that a 10% rise in pump prices or retail fuel prices could lead to a direct impact of 20-25 basis points (bps) on inflation measured by the Consumer Price Index (CPI).

The oil embargo will seriously impact Russia only if European countries follow the US and UK in banning Russian oil imports.

About 60 per cent of Russia’s oil exports go to Europe, including around 2 per cent to the UK, while 8 per cent go to the US. China accounts for about 20 per cent.

The crisis has also forced the Europeans to shift away from its dependence on Russia for natural gas

The EU unveiled a plan on Tuesday to cut Russian gas imports by two-thirds within a year. Moscow supplies 40 per cent of the bloc’s gas and a quarter of its crude oil. Brussels aims to import more liquefied natural gas, increase the amount of wind and solar energy, produce biogas and reduce demand by insulating homes and asking people to turn down their central heating.

Oil prices are inching their way to record high.

First, a second successive year of extraordinary demand growth is putting massive pressure on infrastructure and global logistics. Shifting crude from well-head to pump is proving problematic. Second, oil has joined in the general commodity rally of the last 18 months and has had an important interplay with gas along the way. Super-high gas prices in Europe and Asia have encouraged arbitrage and some gas-to-oil switching, albeit much lower volumes than many feared. Both factors helped pull up oil prices. Third, there have been multiple threats to global liquids supply in the last few months: civil unrest in Kazakhstan, which briefly reduced production; political disputes and pipeline outages in Libya; ongoing militant attacks in Nigeria; drone attacks on the UAE; and now the mounting tension in the Russia-Ukraine crisis. Together, these have heightened fears of a supply shortage.

Xiang had bet that the price of nickel would fall, but when the market moved sharply the other way, he would have been required to either post more cash to cover his losses or buy back the position. The move on Tuesday followed a jump of more than 70 per cent in the previous session as rumours about the size of Xiang’s position swirled around London’s tight-knit metals market. The size of Xiang’s short position is unclear but it is at least 100,000 tonnes of nickel, according to people with familiar with the matter, who said the LME had been forced to act when it became clear that some of its small members were also facing large demands for extra cash to cover trades put on for clients. Several market participants said Xiang faced potential losses stretching into billions of dollars given the size of the trade, but that the figure could change depending on where nickel prices reopen...

The decision to suspend dealings and cancel all trades made on Tuesday is the biggest crisis at the 145-year-old exchange since a rogue trader at Japan’s Sumitomo Corporation racked up huge losses in the 1990s trying to corner the copper market. Unlike most futures exchanges, the LME’s contracts can be settled physically from metal that sits in its network of approved warehouses, which stretch from Rotterdam to Malaysia. This link makes the exchange the leading price setter for industrial metals. Its customers include physical producers and big industrial consumers of metal seeking to hedge their exposure to price moves. Colin Hamilton, analyst at BMO Capital Markets, said it was surprising the LME had let “someone build a short position” in excess of available inventory. “To have such a large short position when there isn’t enough inventory to deliver against it is exchange 101,” he said. “That shouldn’t happen.”

Nickel trading at LME has been suspended since Tuesday morning. The obvious beneficiary is the short position holder, whose margin calls get postponed and allow the markets to get back to normalcy.

However, the reason for the suspension is certain to become a matter of controversy in the days ahead. It emerges that LME's owner is Hong Kong Exchange, which in turn is owned by Chinese investors, who in turn may have been directed by the authorities in Beijing to shut down the exchange to bail out Xiang Guangda and prevent Tsingshan going bankrupt. The company is the world's leading nickel miner and stainless steel maker. It's now open to the counterparts/brokers who were sitting on the massive gains from Tsingshan's short positions to litigate against being deprived off those gains. It's been remarked that "global markets are being shut down to avoid one Chinese company going bankrupt".

7. It has been conventional wisdom that Free Trade Agreements are an important requirement for national economic growth. Livemint has a good graphical summary of the effect of FTAs.

For three of the four FTA regions, imports have growth faster than exports after the FTA was signed. Interestingly, the only region with which exports have grown faster is in the South Asia region, where India is the largest and most advanced economy and therefore well placed to benefit from free trade.

In fact, post-FTA, India's trade gap with ASEAN has diverged, even as exports have stayed flat.

India’s imports from Asean countries have nearly doubled between 2011-12 and 2018-19. Therefore, India’s ‘terms of trade’ with Asean, calculated as the value of exports relative to imports, have worsened over the past decade, when the FTA has been in place. Amid exports that moved in a narrow band, India’s trade deficit with Asean has widened from $5 billion in 2010-11 to $23.8 billion in 2019-20.

8. Striking graphic about India's very low female labour force participation ratio.

9. A good feature in NYT on where the $5 trillion US pandemic money was spent.Ukraine’s place in this doctrine was accurately summed up by former US national security adviser Zbigniew Brzezinski: “Without Ukraine, Russia ceases to be a Eurasian empire.” The Russian establishment entirely agrees. They have also agreed, for the past 15 years at least, that America’s intention is to reduce Russia to a subservient third-rate power. More recently, they have concluded that France and Germany will never oppose the US.

No comments:

Post a Comment