1. Business Standard reports a series of incentives offered by the Government of Maharashtra to attract Foxconn to establish manufacturing facilities in the state at an investment of $5 bn. They include 100% and unlimited subsidy on fixed capital investment, 20% capital subsidy over and above central government subsidies, 100% exemption on stamp duty during investment period, 100% exemption from local body taxes (property tax, land conversion tax, and entry tax), 100% VAT exemption on local purchases, 100% retention from VAT and CST payable, electricity at Rs 2 per unit, and exemption from payment of energy and water duties for 15 years.

These are staggering commitments made with little public debate and most likely, limited understanding. There has been little discussion of its magnitude, in terms of transfers and revenues foregone, or its costs and benefits. This is sure to rekindle another round of race to the bottom among states in attracting trophy investors. It also raises questions about the central thrust of the 'Make in India' campaign.

In the context of special investment zones like Charter Cities, NYU economist Paul Romer has the following smell test, which carries relevance to this debate,

This smell test is in sync with the 'Make in India' campaign, whose objective is to boost the country's manufacturing sector by competing on improved ease of doing business environment and not by a race to the bottom with irresponsible and unsustainable fiscal transfers.

2. Indian states are not the only ones in the race to the bottom with fiscal incentives. Ireland, which already has one of the lowest corporate tax rates, has opened a new front in the global race to the bottom with taxation rates. It recently announced a new 6.25% rate category, a "knowledge development box", on revenues and royalties derived from patents and other forms of intellectual property. Countries like Britain, Luxembourg, and Netherlands have created similar tax categories for intellectual property, but with far higher rates. It has been argued that the royalties and other payments on IP no not reliably reflect where the inventions were made or where the innovations generate the most revenue.

The move comes on the face of a ruling by the European Union Competition Commissioner Margaret Vesteger last month that the sweet-heart tax deals given by Luxembourg to Fiat and Netherlands to Starbucks were illegal. Both the firms have been asked to pay €30m on the grounds that the payments constitute illegal state aid. Both firms, and many others, are alleged to have received "selective" tax benefits, comfort letters, unavailable to their competitors, which allowed them to transfer large slices of their profits calculated at non-market prices (even as market pricing comparables exist) from one part of the firm (located in the host country) to another (located in another country) and classify them as royalty to avoid payment of taxes. In case of Starbucks, its Dutch subsidiary under-reported its profits and transferred them to a subsidiary in UK, a low IP tax country, for coffee-roasting services.

The OECD, which conservatively estimates global tax avoidance to be about $240 bn or 10% of global corporate tax revenues, too has initiated moves to crack down on tax avoidance strategies by multinationals. America's largest 500 firms hold more than $2 trillion in profits overseas, and this has been growing rapidly.

Unless the "independent entity" principle which underpins corporate taxation policies, whereby subsidiaries are treated as separate legal entities, is changed and the entire corporation is taken as a single firm, transfer pricing strategies can never be satisfactorily resolved.

3. As the graphic below shows, debt raising by frontier markets, a group of 18 EM economies, have surged in the last couple of years, touching a record $23 bn in 2014.

Driven by a world awash with cheap credit from quantitative easing and search for yield by asset managers, many of these debt issuances have been at attractively low rates. But early this year, in a sign that the reversal of the commodity super-cycle and slowdown in China was taking its toll on these economies, Ghana had to pay 10.75 per cent to borrow over 15 years, one of the highest borrowing rates for any country in the past two decades. Underlining the perils of foreign currency borrowing, the FT writes,

Countries rarely borrow for the first time with the intention of repaying their debt at maturity. They borrow under the assumption that they will refinance the debt and keep on borrowing... A little over a year ago, Ivory Coast was able to borrow for 10 years at a rate of 5.63 per cent while Vietnam secured a rate of just 4.8 per cent, illustrating the abrupt shift in sentiment towards frontier debt.

The problem now is that having already borrowed, most of these countries have no choice but to borrow again to refinance their loans as it matures. And that comes at an ever higher cost, thereby pushing them down the slippery slope.

4. A Coasean bargain appears to be playing itself out in the global asset management industry. FT writes,

Global asset managers are facing a double hit to their fees, as sovereign wealth funds withdraw billions to support their oil-dependent economies — and switch to a cheaper in-house investment approach... Azerbaijan’s oil fund, which oversees $37bn of assets, has said in its annual report that it intends to bring the management of all of its assets in-house... Similarly, the Abu Dhabi Investment Authority — the second-largest sovereign fund globally with $773bn of assets — has also grown its in-house teams. It reduced its allocations to investment managers from 75 per cent to 65 per cent last year — in effect, a $77bn outflow from external fund houses... According to a new report from Moody’s, the rating agency... sovereign wealth funds taking money in-house represents a long-term trend — and, those that still use external managers are “being more aggressive about negotiating prices”.

This was to be expected given the persistently high fees on these services despite the low returns on these investments. It is also following the pattern of large endowments like those of universities which already are primarily managed by in-house teams.

5. Italy is the latest to join the negative interest rate club. It joined Germany, Switzerland, and France in being able to sell €1.75bn of two-year debt at a yield of minus 0.023%. That "investors are paying to lend to a country which has one of the highest debt-to-GDP ratios in the world and has long been a byword for fiscal profligacy" and whose short-dated borrowing rate had it 8.12% at the height of the eurozone debt crisis, turns conventional wisdom on its head.

This follows the recent announcement by the European Central Bank president Mario Draghi that it is not averse expanding on its current €1.1 trillion monetary easing involving monthly purchases of €60 bn worth of mostly government bonds. Andrew Milligan, head of global strategy at Standard Life Investments reflects the underlying sentiments,

This is an Alice in Wonderland situation. Negative rates are highly strange. What is underpinning them is not so much a desire to own a particular country’s debt but the broader issue of slow global growth and what central banks are going to do to address it.

6. The remarkable story of blood-testing start-up Theranos, its rise and disgrace, is emblematic of this age of instant celebrity-dom. The firm says its technology can run a wide range of lab tests from a tiny sample of blood from a finger prick, collected on nanotainers, thereby eliminating the need for intravenous blood draws and making blood-testing more accessible.

As the Times writes, Ms Elizabeth Holmes, who dropped out of Stanford and started Theranos at the age of 19, raised $400 m in venture capital, got prominent people like Henry Kissinger, Larry Ellison, and Cleveland Clinic to embrace the firm, and reached a valuation of $9 bn, fitted in the classic mould of the start-up entrepreneur with a great story,

It all fit together perfectly: the college dropout, the fear of needles, the humanitarian mission. She checked all the boxes. Indeed, Ms. Holmes seems to have perfectly executed the current Silicon Valley playbook: Drop out of a prestigious college to pursue an entrepreneurial vision (like Bill Gates, Steve Jobs, and Mark Zuckerberg); adopt an iconic uniform (black turtlenecks like Steve Jobs); embrace an extreme diet; and champion a humanitarian mission, preferably one that can be summed up in one catchy phrase... Ms. Holmes envisions “a world in which no one ever has to say goodbye too soon,” brought about through improved health care. Theranos also has a slogan: “One tiny drop changes everything.” She stays relentlessly on message, as a review of her numerous conference and TV appearances make clear, while at the same time saying little of scientific substance.

All went well till WSJ ran this investigative story which questioned the company's technology and its processes, showing that it does not even use the technology that it promotes and doubting the intent behind its refusal to subject its technology to peer review.

7. Global steel industry looks set for a long period of turmoil on the back of massive over-capacity and falling demand which has rendered producers in many parts of the world uncompetitive.

As the FT writes, this has left the door open for Chinese producers to aggressively export away their excess capacity,

Since 2000, China's annual production has expanded nearly sevenfold, reaching 858m tonnes in 2014 — around half of the worldwide total... However, while China’s output used to be for domestic consumption, its appetite for steel shrank for the first time last year — resulting in its producers pushing their output into other markets. Exports are expected to surpass 100m tonnes this year, after jumping by more than 50 per cent to 93m tonnes in 2014... By undercutting European costs, Chinese imports are finding buyers around the world...

For steelmakers, the level of capacity being utilised becomes important, as high fixed costs mean that if they are running at less than 80 per cent capacity, plants use raw materials less efficiently and producers lose pricing power.High quality global journalism requires investment. This requires the permanent shutdown of excess global capacity, which is expected to widen to around 645m tonnes above demand this year and was identified by the OECD as one of the main challenges facing the sector.

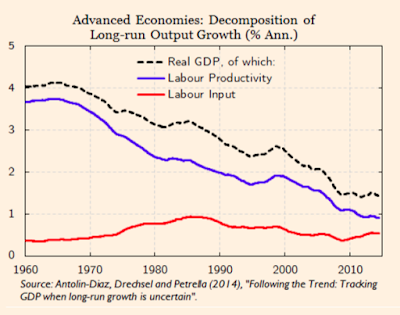

8. Gavyn Davies points to this stunning productivity trend graphic of advanced economies since 1960.

The persistence of the secular downward trend echoes the 'average is over' hypothesis that economists like Tyler Cowen have been making.

9. Times points to the latest in customized political campaigning, neuropolitics. It involves capturing facial coding, biofeedback, and brain imaging, which reveal the true nature of voter's feelings and preferences,

The persistence of the secular downward trend echoes the 'average is over' hypothesis that economists like Tyler Cowen have been making.

9. Times points to the latest in customized political campaigning, neuropolitics. It involves capturing facial coding, biofeedback, and brain imaging, which reveal the true nature of voter's feelings and preferences,

In the lobby of a Mexico City office building, people scurrying to and fro gazed briefly at the digital billboard backing a candidate for Congress in June. They probably did not know that the sign was reading them, too. Inside the ad, a camera captured their facial expressions and fed them through an algorithm, reading emotional reactions like happiness, surprise, anger, disgust, fear and sadness. With all the unwitting feedback, the campaign could then tweak the message — the images, sounds or words — to come up with a version that voters might like better.10. Times has an excellent investigation, here and here, of more than 25000 arbitrations in the 2010-14 period across the US,

From birth to death, the use of arbitration has crept into nearly every corner of Americans’ lives, encompassing moments like having a baby, going to school, getting a job, buying a car, building a house and placing a parent in a nursing home... But arbitration often bears little resemblance to court. Over the last 10 years, thousands of businesses across the country — from big corporations to storefront shops — have used arbitration to create an alternate system of justice. There, rules tend to favor businesses, and judges and juries have been replaced by arbitrators who commonly consider the companies their clients... This amounts to the whole-scale privatization of the justice system... All it took was adding simple arbitration clauses to contracts that most employees and consumers do not even read. Yet at stake are claims of medical malpractice, sexual harassment, hate crimes, discrimination, theft, fraud, elder abuse and wrongful death, records and interviews show....

Little is known about arbitration because the proceedings are confidential and the federal government does not require cases to be reported. The secretive nature of the process makes it difficult to ascertain how fairly the proceedings are conducted... And unlike the outcomes in civil court, arbitrators’ rulings are nearly impossible to appeal. When plaintiffs have asked the courts to intervene, court records show, they have almost always lost... Unfettered by strict judicial rules against conflicts of interest, companies can steer cases to friendly arbitrators. In turn, interviews and records show, some arbitrators cultivate close ties with companies to get business...

Arbitration records obtained by The Times showed that 41 arbitrators each handled 10 or more cases for one company between 2010 and 2014. Anthony Kline, a California appeals court judge, said, "Private judging is an oxymoron. This is a business and arbitrators have an economic reason to decide in favor of the repeat players"... Victoria Pynchon, an arbitrator in Los Angeles, said plaintiffs had an inherent disadvantage. “Why would an arbitrator cater to a person they will never again see again?”.This should be seen as the latest example of how private delivery of essential public services can end up seriously distorting the markets and failing to deliver on its objectives. It also, at a very broad level, reflects the concerns about widening inequality and how it enables political capture that leads to the disenfranchisement of citizens and the evolution of political and public institutions.

No comments:

Post a Comment