1. Gillian Tett interviews Walter Issacson on the eve of the release of his biography of Elon Musk

Do innovators have to be a psychological mess to have the drive to succeed?... “Musk goes through manic mood swings and deep depressions and risk-seeking highs, and if he didn’t have that risk-seeking maniacal personality he would not be the person who launched EVs and got rockets into orbit. “So my key point and conclusion is that all people have light and dark strands, whether that is Da Vinci or anyone else. We celebrate the light ones while decrying the dark ones. But those strands are entwined and you can’t disentangle them.” To put it bluntly: Isaacson thinks that Elon’s demons are also his inspirational angels. Of course, Isaacson adds, this is not the only key to genius: the other trait that many of the people he has studied also share is a passion for interdisciplinary study. Da Vinci, say, explored the arts, humanities and science in combination, while Jobs used the principles of calligraphy to design computers. Isaacson argues that building interdisciplinary curriculums is one secret of unleashing more innovation.

2. Even by Chinese standards, the country's spectacular surge in automobile sector to emerge as the largest car exporter in the world since early 2021 is unprecedented.

A stark mismatch between production at Chinese factories and local demand has been caused, in part, by industry executives mis-forecasting three key trends: the rapid decline of internal combustion engine car sales, the explosion in popularity of electric vehicles and the declining need for privately owned vehicles as shared mobility booms among an increasingly urbanised Chinese population. The result has been “massive overcapacity” in the number of vehicles produced in factories across the country, said Bill Russo, former head of Chrysler in China and founder of advisory firm Automobility. “We have an overhang of 25mn units not being used,” he said... The overcapacity problem is hitting both local companies such as Chery, SAIC, BYD, Geely and Changan, and an increasing number of foreign groups. Companies including Tesla, Ford, Nissan and Hyundai are among those repositioning their Chinese factories towards export markets... Chinese auto exports have mostly targeted developing markets in Europe and Asia... The export wave is expected to intensify as Chinese EVs, which are significantly less expensive than rivals, gain a foothold, especially in Europe... Tesla already exports electric cars from its Shanghai facility to Europe and about one-fifth of all EVs sold in Europe are manufactured in China. BYD is spearheading China’s EV exports into developed markets.

3. Singapore may have the highest housing rent, but Tokyo has the lowest!

In the past half century, by investing in transit and allowing development, the city has added more housing units than the total number of units in New York City. It has remained affordable by becoming the world’s largest city. It has become the world’s largest city by remaining affordable. Two full-time workers earning Tokyo’s minimum wage can comfortably afford the average rent for a two-bedroom apartment in six of the city’s 23 wards. By contrast, two people working minimum-wage jobs cannot afford the average rent for a two-bedroom apartment in any of the 23 counties in the New York metropolitan area...But the benefits are profound. Those who want to live in Tokyo generally can afford to do so. There is little homelessness here. The city remains economically diverse, preserving broad access to urban amenities and opportunities. And because rent consumes a smaller share of income, people have more money for other things — or they can get by on smaller salaries — which helps to preserve the city’s vibrant fabric of small restaurants, businesses and craft workshops... Tokyo appears as a vast sea of low- and mid-rise buildings laced with archipelagos of high-rises, each island marking the location of a station along one of the city’s railroad lines... As Tokyo grew and demand for housing increased, the railroad has rebuilt the areas around its stations with condominium towers, shopping malls and office buildings...In Tokyo, by contrast, there is little public or subsidized housing. Instead, the government has focused on making it easy for developers to build. A national zoning law, for example, sharply limits the ability of local governments to impede development. Instead of allowing the people who live in a neighborhood to prevent others from living there, Japan has shifted decision-making to the representatives of the entire population, allowing a better balance between the interests of current residents and of everyone who might live in that place. Small apartment buildings can be built almost anywhere, and larger structures are allowed on a vast majority of urban land. Even in areas designated for offices, homes are permitted. After Tokyo’s office market crashed in the 1990s, developers started building apartments on land they had purchased for office buildings... Tokyo makes little effort to preserve old homes. Historic districts subject to preservation laws exist in other Japanese cities, but the nation’s largest city has none... Parks, too, are sometimes treated as unaffordable luxuries. Parks and gardens occupy just 7.5 percent of the city’s land, far below the figures for New York (27 percent) and London (33 percent)... Between 2013 and 2018, new homes accounted for 86 percent of home sales in Japan, according to the most recent government data. In the United States, new homes typically account for about 15 percent of sales, according to data from the National Association of Realtors!

4. More from Byju's cupboard

One of India’s hottest tech companies, Byju’s, allegedly hid $533 million in an obscure three-year-old hedge fund that once said its principal place of business was an IHOP pancake restaurant in Miami, according to lenders trying to recover the cash. Byju’s last year transferred more than half a billion dollars to Camshaft Capital Fund, the investment firm founded by William C. Morton when he was just 23 years old, some Byju’s lenders claim in a lawsuit. Morton’s fund received the money despite an apparent lack of formal training in investing, according to the lenders. What’s more, luxury cars — a 2023 Ferrari Roma, a 2020 Lamborghini Huracán EVO, and a 2014 Rolls-Royce Wraith — have been registered in Morton’s name since the transfer occurred, according to court papers...

In a 2020 Securities and Exchange Commission filing, Camshaft listed its principal business address as 285 NW 42nd Ave. Far from a typical office, that building is currently home to an IHOP. The diner in Miami’s Little Havana district is surrounded by a drive-through car wash and a strip mall that hosts a massage parlor and a sandwich shop... the address had been home to the IHOP for decades... Miles away from that IHOP, an entity linked to Camshaft listed a swanky oceanfront condo at the Porsche Design Tower in Sunny Isles Beach — where the likes of Lionel Messi own homes — as its business address, court papers show.

You can bet this is not going to be the last, and that this might well end up along these lines.

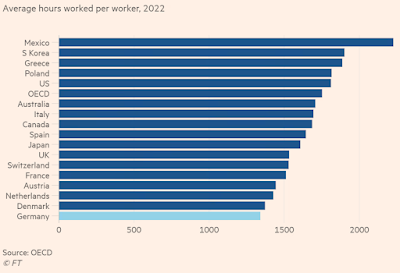

5. Germans work fewer hours than any other OECD countries

The manoeuvres... have cropped up as many older private equity funds run low on cash just as the companies they own struggle with their own debt loads. Buyout firms have turned to so-called net asset value (NAV) loans, which use a fund’s investment assets as collateral. They are deploying the proceeds to help pay down the debts of individual companies held by the fund, according to private equity executives and senior bankers and lenders to the industry. By securing a loan against a larger pool of assets, private equity firms are able to negotiate lower borrowing costs than would be possible if the portfolio company attempted to obtain a loan on its own... The borrowing was spurred by a slowdown in private equity fundraising, takeovers and initial public offerings that has left many private equity firms owning companies for longer than they had expected. They have remained loath to sell at cut-rate valuations, instead hoping the NAV loans will provide enough time to exit their investments more profitably... Private equity executives who spoke to the FT noted that the borrowings effectively used good investments as collateral to prop up one or two struggling businesses in a fund. They warned that the loans put the broader portfolio at risk and the borrowing costs could eventually hamper returns for the entire fund.

7. Surge pricing or dynamic pricing is becoming more common.

Stonegate, Britain’s biggest pub company which runs the Coach House, has announced it will charge pubgoers 20p extra for a pint of beer on busy evenings and weekends. It is part of what it called a new “dynamic pricing” policy in some of its venues... When booking flights and hotel rooms, consumers have become accustomed to the rhythms of the dynamic pricing model: book early or during the shoulder season and get a good deal; book last-minute or during the busy holiday periods and get penalised. However, powered by algorithms and artificial intelligence, it is being introduced at a rapid pace by a growing number of consumer industries. Amazon changes the price of its products on average every 10 minutes, using millions of real-time data points to benchmark against competitors and track demand surges... As high inflation erodes margins and improvements in technology make dynamic pricing cheaper and more practical for businesses to implement, the temptation to deploy the pricing strategy is growing in industries that have so far remained largely untouched by the method. Bars, restaurants and bricks-and-mortar retailers have historically only adopted dynamic pricing for basic discount offers, but that could change.

And this about how the present interest in dynamic pricing is perhaps a return to the norm

For most of the history of human commerce, dynamic pricing was the norm, with customers haggling and bartering with vendors over the price of every item. But in 1876, inspired by notions of equality, Quaker merchant John Wanamaker introduced price tags at the launch of his eponymous department store in Philadelphia. Macy’s, the iconic New York-based department store, also under Quaker ownership at the time, did the same. Beyond high-minded ideas of fairness, fixed prices allowed the stores to save on years of training for shop clerks in price negotiation, which in turn enabled faster expansion. The price tag quickly caught on. Now, however, with advancements in data collection and the transition of commerce online, businesses are reverting to the historical norm and pivoting away from the fixed price.

This is a fascinating graphic of how different categories of consumers react to surge pricing.

Already several leagues are struggling to maintain the levels of unpredictability and jeopardy that fuel fan interest. PSG has won nine of the past 11 French league titles, Bayern Munich has been German champions 11 times in a row, while Manchester City has won five in six Premier League races.

Cost controls and salary caps are a feature of other sports, particularly in the US. Hard spending limits have been a boon for owners and helped boost team valuations in basketball, NFL and more recently in Formula One. A Forbes list of the 50 most valuable sports franchises published last week includes just seven from global football, compared with 30 NFL teams. Other football competitions, such as Spain’s La Liga, are subject to financial controls that force member clubs to submit regular updates on revenue that the league then uses to allocate a set budget for playing staff.

9. Stock markets are irrational. One more example of the irrationality comes from the way markets treat TSMC and Apple. Both are exposed to heavy geopolitical risks. And TSMC's market price reflects these risks. But in case of Apple, with arguably an even greater risk arising from its China-centric manufacturing supply chain (besides the Chinese smartphone market), the markets appear completely unconcerned.

However, this month Apple has lost almost $200 bn in market capitalisation after news emerged of bans on Apple products by Chinese government agencies. A sub-plot is the unexpected rise of Huawei.

Cook, chief executive since 2011, has been praised as the “architect” of Apple’s production shift to China after originally being hired by Steve Jobs in 1998 to run worldwide operations. Under Cook’s leadership, years of investment, marketing and careful corporate diplomacy allowed Apple to orchestrate a manufacturing powerhouse while generating more China-based profit than any other company, western or Chinese. Paul Triolo, an associate partner at advisory group Albright Stonebridge, said the company “invested a lot in its relationships with both the central . . . and municipal governments, particularly in Zhengzhou”, where it has partnered with Foxconn and created hundreds of thousands of jobs. He added that Apple had been “very careful” to abide by local regulations, taking down politically sensitive apps.

Along with concerns over possible curbs on Apple products, a fresh competitive threat has emerged with the unexpected launch of a new Huawei smartphone in China at the end of August. The Mate 60 Pro sold out immediately on a patriotic wave of enthusiasm, as teardown experts revealed it was running advanced Chinese chips inside. US sanctions against Huawei had previously crippled the capabilities of its handsets and enabled Apple to dominate sales of high-end smartphones in China... Beijing would be keen to support homegrown alternatives to Apple such as Huawei — which was briefly the biggest-selling phonemaker in the world before US sanctions banned it from accessing certain foreign components, forcing it to discontinue sales of its 5G smartphones. The Shenzhen-based company’s China sales are now supported by its perceived status as a “national champion” by consumers.

10. US Politics is a gerontocracy

The US is an outlier even in a world where the majority of lawmakers are much older than the broader populace. Compared to peer countries, the US is especially dominated by older elected officials; one in five congresspeople is over the age of 70, making it one of the nation’s most elderly professions.Even among its peers, the US has the oldest legislators.

The chip industry is divided on what this means. On the one hand, SMIC has succeeded only in replicating a manufacturing process — called 7 nanometre — that Taiwan’s TSMC, the world’s leading chipmaker, was already producing at high volume in 2018. SMIC generally lags half a decade behind TSMC in rolling out new manufacturing processes, so by that metric, the Chinese company’s 7nm process has arrived right on schedule. Moreover, to produce Huawei’s chips, SMIC has used DUV lithography machines rather than more advanced EUV tools, which it is barred from buying. Foreign chipmakers such as TSMC and Intel learnt how to produce 7nm chips with DUV machines years ago, before turning to more efficient EUV tools. SMIC’s manufacturing costs are thus probably only competitive because the Chinese state is footing the bill. The company’s 7nm chip is, then, far from an unprecedented breakthrough.

He also argues that Huawei is able to produce such chips only because it's being heavily subsidised by the government.

12. A deflation in China may not set of deflationary pressures across developed markets because producers prices may be a small part of the consumer prices.

Critically, China is at the end of many production chains, but not at the end of supply chains. Supply chains end in the aisles and on the websites of the retailers of Europe and the US. There is a great deal that happens between factory gate and the end consumer. The consumer is not just paying for the goods, but also has to hand over money (or, in the case of US consumers, a credit card) to cover the trade taxes, warehousing costs, transport costs, wholesale costs, retail costs, advertising budgets, financing costs and sales taxes — and, of course, profit margins for each link of the lengthening supply chain. Each of those supply chain links are local components to the price the consumer pays, and they will move independently of the exporters’ or domestic producers’ prices...In the US the gross value added of warehousing, transport, wholesale and retail trade is more than 15 per cent of the economy. The value added by US manufacturing is about 11 per cent of the economy. This is only a hint of the relative importance of different sectors of the supply chain, but it hints very strongly at the muted role of producers. Some sectors of the economy allow a more detailed examination... Clothing and footwear, and household furniture, combined account for just over 10 per cent of US imports from China. In these sectors domestic and foreign producers get about 30-40 per cent of the price paid by the US consumer. This does not mean that the exporters receive so low a share of the consumer price for all items. For autos, the foreign and domestic manufacturers get about two-thirds of the consumer price. But generally an exporter selling in the US can expect to receive less than half the price the consumer pays. This means that China’s export price deflation is likely to be a modest disinflation force for the rest of the world.

No comments:

Post a Comment