The world of macroeconomics has certain numbers which have, over time, come to become sacrosanct. The 2% inflation target, 3% budget deficit target, and 60% public debt to GDP ratio are the three most important. Each of these have limited substantive basis, but have become entrenched anchors in macroeconomic policy making.

Jeff Sommer writes in NYT on how the 2% inflation target became universal.

The 2 percent inflation target is something of a historical accident. It has roots in New Zealand, which passed a law in 1989 establishing the independence of the country’s central bank, and, in addition, said the bank should target inflation. But what should the target be? Officials started with 0 to 1 percent, which seemed too low, and shifted to 2 percent. There was no particular magic or science to the 2 percent number, but it stuck, and it spread to other Anglophone countries in short order: Britain, Canada and Australia adopted it. So did Sweden.Eventually, the Federal Reserve did, too, but with great reluctance. Mr. Volcker never embraced an inflation target. He wanted inflation to be as low as possible and saw no reason to restrict the Fed’s flexibility by indicating publicly what low meant at any specific time. And Alan Greenspan, who succeeded Mr. Volcker as Fed chair, resisted setting a target for years... Behind closed doors, in a pivotal 1996 Federal Open Market Committee meeting, Mr. Greenspan said the Fed’s goal was “price stability.” A transcript of the meeting shows that he defined that goal this way: “Price stability is that state in which expected changes in the general price level do not effectively alter business or household decisions,” he said... He’s saying it’s OK if prices rise a little. Only when those increases feel out of control — as they have over the last year or two, and as they did in the 1970s and early 1980s — has inflation mattered to me, as a citizen and as a consumer...But economists, by their nature, like to put numbers on things. And in that crucial 1996 meeting, a distinguished economist and Fed official named Janet E. Yellen — now the Treasury secretary, and, before that, a Fed chair herself — pressed Mr. Greenspan to “please put a number on” his estimate of price stability... The transcript shows that he said “zero” was the proper target if “inflation was correctly measured.” But it is difficult to measure inflation accurately, as everyone in the room acknowledged. So Ms. Yellen said, “Improperly measured, I believe that heading toward 2 percent inflation would be a good idea, and that we should do so in a slow fashion, looking at what happens along the way.” That, essentially, was that. Other Fed members agreed, and the 2 percent target became enshrined in Fed policy, though only in a clandestine way.

This about the evolution of Fed communication,

Mr. Greenspan and the Fed favored a style of communication that even he described as opaque. In testimony before Congress in 1987, he was droll but on the mark. “Since I’ve become a central banker, I’ve learned to mumble with great incoherence,” he said. “If I seem unduly clear to you, you must have misunderstood what I said.”It wasn’t until 2000 that the Fed began issuing regular “forward guidance” after its meetings, projecting where it expected that the economy and inflation would be headed. By now, Mr. Powell’s news conferences have become routine. But it’s worth remembering that it wasn’t until 2011, well into Ben S. Bernanke’s tenure as Fed chair, that the central bank broke with the Volcker and Greenspan tradition of extreme circumspection and held its first regularly scheduled news conference. In 2012, it finally embraced the 2 percent target openly and formally, and made it part of the Fed’s practice of “forward guidance.” Come what may, over the long run, the Fed would veer toward its North Star, the 2 percent inflation target.

And its ongoing struggles with breaking away from the firm 2% target,

By August 2020, the Fed had revisited the 2 percent target and widened its range in subtle ways. Because of that adjustment, the Fed doesn’t need to hit 2 percent exactly. It can “average” 2 percent “over time.” The central bank “absolutely needs to move inflation toward 2 percent” but it has some flexibility, Bill Dudley, a former president of the Federal Reserve Bank of New York, told me. The Fed’s long-range policy statement says that it doesn’t need to get there immediately, and it has room for judgment in its timing.

This article flags some important insights for discussion.

For long central banks grappled with monetary policy through a combination of managing money supply level, money supply growth, and interest rates. This was the period when non-academic technocrats presided over central banks. This was also a time when central banks were comfortable with pursuit of monetary policy amidst ambiguity.

This is important since ambiguity is a constant in our lives. But human beings loath ambiguity and hanker for certitude. And in economics, as elsewhere, there's nothing more comforting than the certitude of numbers. And academic economists, whose job requires them to communicate ideas and concepts, naturally find it easier to do so if they are dealing with numbers. There is a misleading illusion of precision associated in communicating with numbers.

I have written earlier on the problems with forward guidance and central bank communications. One of the important contributors to market discipline is the presence of risk. This in turn is determined by information, or more accurately, the lack of it. This ignorance makes market participants hedge for and price risks. Now central banks have stepped in with their forward guidance, which gives a false precision of risk mitigation, which in turn encourages market participants to assume greater risks.

There is another aspect to the idea of forward guidance which contradicts Economics 101. Central bank forward guidance can be compared to a central planner having some superior capabilities to access information that the markets cannot. These capabilities then allow it to provide more credible and accurate assessment of the future than the markets as a collective. In simple terms, the central bank guides the market with some superior information, which can ostensibly de-risk the actions of market participants.

Update 1 (7.4.2023)

Gillian Tett compares the current bank run with that in 2007-08 and 1997-98 in Japan. The big difference was the speed with which the information spread, depositors pulled out $42 billion, and the bank collapsed. And the contagion spread rapidly across others. As a metric, the share of US households using internet or mobile banking rose from 39% to 66% between 2013-21.

The point here is that information flows were so fast and unfiltered that the asymmetric ignorance which often allowed depositors to stay on had disappeared.

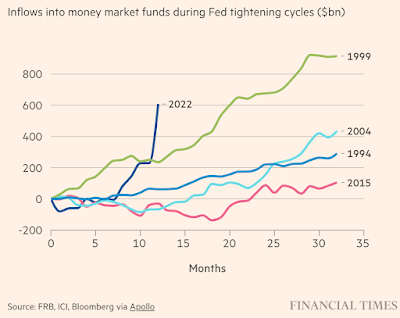

Until now, the models used in finance do not seem to have taken account of the fact that consumer behaviour online might be different from that in the old-fashioned, physical banking world. But one striking feature about American banks, even before the March panic, was that consumers were moving money out of low-paying deposit accounts into better-yielding money market funds at a dramatically faster pace than at similar points before in history.

That might imply that greater information transparency accelerates consumer reaction to news, even outside crises, increasing the risk of “herding”. Either way, we urgently need some behavioural finance analysis, since American banks will stay healthy only if they hang on to deposits — and digital herding could increase the risks of turmoil in other markets, such as Treasury bonds, if shocks emerge there too... The dangerous weakness of fractional banking is that if nobody has a reason to panic, banks are safe; but if everyone runs, a bank can collapse, even if it previously passed tests on issues such as capital adequacy — unless a government steps in. And while the government never used to worry about smaller banks collapsing, now they fear the digital domino effect.

This raises the issue of how fractional reserve banking can survive in the era of rapid and real-time information flows.

No comments:

Post a Comment