1. Fascinating graphic which shows how the US and UK resemble societies where the poor are poorer than the developed country average, and the rich are richer.

While the top earners rank fifth, the average household ranks 12th and the poorest 5 per cent rank 15th. Far from simply losing touch with their western European peers, last year the lowest-earning bracket of British households had a standard of living that was 20 per cent weaker than their counterparts in Slovenia... In 2007, the average UK household was 8 per cent worse off than its peers in north-western Europe, but the deficit has since ballooned to a record 20 per cent... The rich in the US are exceptionally rich — the top 10 per cent have the highest top-decile disposable incomes in the world, 50 per cent above their British counterparts. But the bottom decile struggle by with a standard of living that is worse than the poorest in 14 European countries including Slovenia.

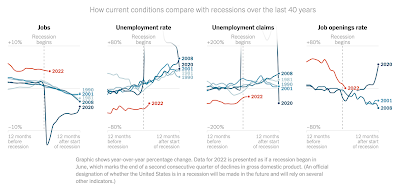

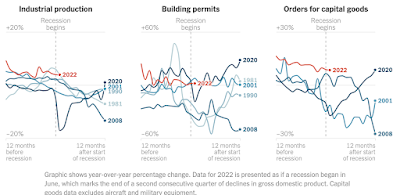

2. I have blogged here about the difficulties presented in evaluating the current episode of economic slowdown. As the graphics show, on most parameters of labour market health, the current situation is far better than in any recession over the last ten years.

The picture is mixed on the consumptionAffluent southern states often have more cinema screens than the Hindi-speaking heartlands. Tamil Nadu, with a population of less than 80mn, has 1,104 screens; Hindi-speaking northern Uttar Pradesh, India’s most populous state with nearly 230mn inhabitants, has just 539.

4. Local government financing vehicles (LGFV) in China have stepped in as buyers of last resort in the property market, thereby allowing cash strapped local governments raise money by selling lands and also backstopping the real estate market from crashing.

According to official data, land acquisitions by LGFVs rose to Rmb400bn ($57bn) in the first half of the year, up more than 70 per cent compared with the same period in 2021. This is despite overall land purchases, which have previously been dominated by private developers, falling by almost a third as Beijing cracks down on real estate speculation. The buying spree is intended to help cash-strapped local authorities, for whom selling land is an important source of income. But the LGFVs, which play a critical role in funding long-term infrastructure development, are being forced to borrow more from state banks and issue bonds to finance the deals... Most LGFVs, which typically have little experience in property development, are leaving their newly purchased plots idle. This, combined with the larger housing market meltdown, means the short-term relief that local authorities get from the financing vehicles’ land purchases ultimately risks bigger problems for China’s already faltering economy...Official data show LGFVs accounted for almost a quarter of land sales in the first half of this year, compared with 9 per cent in the same period a year ago. The ratio exceeded 50 per cent in some less-developed small cities... To make up for the lack of bidders, many cities have raised the minimum price for land auctions. That has often forced LGFVs to pay a premium even as the market is weakening... Most LGFVs face cash flow constraints as they derive the bulk of their income from government-backed infrastructure projects with long-term horizons for returns. In the meantime, state lenders are willing to either issue loans to LGFVs against land as collateral or buy the latter’s bonds in the hope authorities will step in if a crisis occurs.

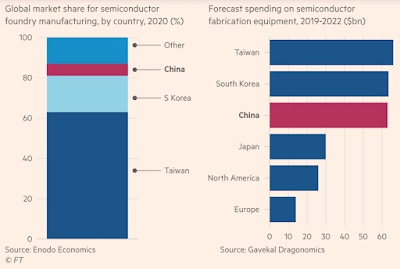

5. The global race to dominate semiconductor manufacturing

At a national meeting held this month in the eastern province of Jiangsu, China named 8,997 enterprises as “little giants”, putting them in line for tax breaks so they can help China compete with the US and other western powers... In the past few years, China has overseen the establishment of more than 1,800 so-called government guidance funds, which have raised more than Rmb6tn ($900bn) to invest largely in tech sectors that Beijing deems “strategic”. The funds’ salient feature is that they are mostly run by provincial and local governments or by state-owned enterprises... Companies had to be vetted by local governments in the first instance, opening up the potential for favouritism and corruption. At the same time, government officials can be poor assessors of a company’s prospects, especially when it involves technology that is hard to understand.

Till the last week (September 16), the government has raised Rs 7.72 trillion without any hiccups. Net of redemptions, the net borrowing has been Rs 4.39 crore... In FY2019, it had borrowed Rs 5.71 trillion gross amount (net Rs 4.23 trillion). The next year, the gross borrowing was Rs 7.10 trillion (Rs 4.74 trillion). In the Covid-hit FY2021, the gross borrowing zoomed to Rs 13.7 trillion (Rs 11.43 trillion). Last year, it dropped to Rs 11.27 trillion (Rs 8,63 trillion) before rising to its historic high of Rs 14.31 trillion this year (Rs 11.61 trillion)... In FY2019, the gross SDL was to the tune of Rs 4.78 trillion (Rs 3.49 trillion); in FY2020, it rose to Rs 6.35 trillion (Rs 4.87 trillion) and further to Rs 7.99 trillion (Rs 6.52 trillion) in the next financial year. Last year, the states raised Rs 7.02 trillion (Rs 4.92 trillion). Till September 16 this year, the states have raised just Rs 2.44 trillion (net Rs 1.29 trillion) from the market, much less than the estimated Rs 4.01 trillion in the first half of the financial year.

The article also had an interesting factoid which underlines the problem of low investment appetite among corporates

Till June, the net corporate bond issuance has been negative. This means, redemptions of old bonds have been higher than fresh bond floats. Contrast this with Rs 4.04 trillion net issuance in FY2022 and Rs 3.59 trillion in FY2021.

7. Fascinating set of stats about Roger Federer, Novak Djokovic, and Rafael Nadal.

More on Roger Federer. Barney Ronay in The Guardian

And with Federer greatness was as much about style and form and texture. There was a sense in his talent of something that never quite reached its end point. Even at its most concentrated pitch one never felt one got to the limits of what Federer might do. There is probably still a bit in there, Rog, if you ever feel like giving it another go... His backhand was frankly ridiculous, overblown, hilariously good. This, one thought, watching that thing – the flex of the knee, the flourish of the wrist – is a kind of artefact, a European cultural treasure, like a Bach cantata or a complete acorn-fed Iberian ham, the kind of backhand a power-crazed Bond super villain might try to steal from its laser-guarded case and transport to the moon... It was not the styling, the deep, piercing (woof) eyes, the balletic grace in his movements. The real Federer hit was the way these things were combined with accuracy, power, shot selection, competitive will. Federer was never just getting the ball back or staying in the rally but challenging to live at this pitch, to exist in his sporting world.

8. In an interview with CBS News, President Joe Biden has clearly indicated that the US would defend Taiwan from a Chinese attack by sending US forces to defend Taiwan.

Whether he intended it or not, there is a game being played out here. Hitherto there was a strategic ambiguity about the likely American response in case of a Chinese invasion. This and the three previous statements by President Biden should serve as sufficient enough indication to the Chinese that there may no longer be any ambiguity about US response. To this effect, it has atleast significantly reduced, if not removed, from the Chinese calculations the possibility of US staying out in case of an invasion. One can reason that this, coupled with the outcomes from the ongoing Ukraine crisis, would have significantly reduced, at least for now, any possibility of a Chinese invasion.

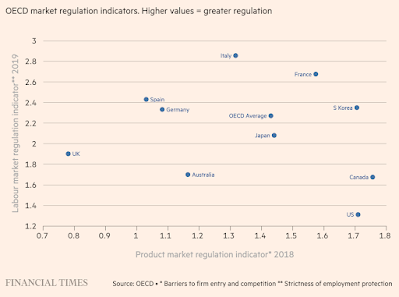

9. From Martin Wolf, in the context of UK economy, the point about limited correlation between tax rates and economic prosperity.

And this about product and labour market regulation among western economies.The Reserve Bank of India (RBI) on Thursday barred non-banking financial services company Mahindra & Mahindra Financial Services(MMFSL) from outsourcing recovery agents, days after a 22-year-old pregnant woman died in Jharkhand’s Hazaribagh while trying to block loan recovery agents from taking away her father’s tractor and was crushed under the vehicle. The loan was taken from M&M Financial. “The RBI has… in exercise of its powers under Section 45L(1)(b) of the Reserve Bank of IndiaAct, 1934, directed MMFSL, Mumbai, to immediately cease carrying out any recovery or repossession activity through outsourcing arrangements, till further orders,” the RBI said... This is probably the first time the regulator has cracked down on lenders on recovery by coercive methods, which is typically a hallmark of outsourced recovery agents.

As the report says, given the widespread use of this practice, it remains to be seen how the RBI will be able to enforce its circular.

It has become an increasingly common practice among banks to outsource its two critical activities - credit-worthiness assessment and recovery operations. In the circumstances, the lender becomes a fund manager who takes deposits, manages it, and transacts through the third parties. If you add securitisation of the loan book, the lender has limited skin in the game.

11. Following concerns raised by Amundi Asset Management's Chief Investment Officer Vincent Mortier a few weeks back, now Mikkel Svenstrup, the CIO at ATP, Denmark's largest pension fund has compared the private equity industry to a pyramid scheme.

Mikkel Svenstrup... said he was concerned because last year more than 80 per cent of the sales of portfolio companies by the private equity funds that ATP has invested in were either to another buyout group or were “continuation fund” deals, where a private equity group passes it between two different funds that it controls. “We’re a big fund investor, we have hundreds of funds and thousands of portfolio companies,” he said. “This is not good business, right? This is the start of, potentially, I’m saying ‘potentially’, a pyramid scheme. Everybody’s selling to each other . . . Banks are lending against it. These are the concerns I’ve been sharing.” ATP is a major investor in private equity funds. It has $119bn under management and has committed money to 147 buyout funds, according to PitchBook data...Mortier said some parts of the private equity industry “look like a pyramid scheme in a way”. Svenstrup said the “exponential growth” of the private equity industry in recent years, as investors have poured cash into its funds, would stop “at some point”, adding that this was “just a question of time”.

These calls may be the canary in the coal mine with respect to the PE industry.

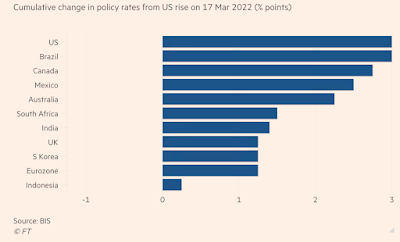

12. In The Rise of Finance, we discussed the adverse effects of US monetary policy spillovers on developing countries. The ongoing rate hikes and consequent strengthening of dollar, and associated sudden stops and capital flows reversals and imported inflation into developing countries is only the latest instance.

The Fed, which on Wednesday made its third 75 basis point increase in a row, is playing catch-up. While that may be the best course of action for the US economy, its aggression is triggering what Maurice Obstfeld, of the Peterson Institute for International Economics, labels “beggar-thy-neighbour” policies. The consequences of the Fed‘s mistakes are effectively exported from the US, burdening America‘s trade partners. Higher US rates have bolstered the dollar, exacerbating inflation elsewhere by raising the cost of commodities which are, more often than not, priced in the greenback. A “reverse currency war” is in full flow, with monetary authorities across the world now ditching their standard quarter-point increases in favour of 50, 75 and — in the case of Sweden and Canada — 100 basis point moves in order to stem dollar declines. Rate rises, while necessary to quell inflation, have become so aggressive the World Bankwarned last week they risk sending the global economy into a devastating recession that would leave the world’s poorest countries at risk of collapse... Since the 2008 global financial crisis the Fed and other major market central banks have deployed wave after wave of stimulus. That left global interest rates at ultra-low levels for years on end. The result of that — plus the pandemic — is international debt levels are close to all-time highs. As financing costs rise, more and more of the world’s poorest countries are seeking support from the IMF and the World Bank.

Business and first class account for about one-third of all airline seats but generate up to 70 per cent of revenue. The promise of a better meal is part of what motivates passengers to buy a premium ticket... At 35,000ft, the human tongue goes partially numb, causing you to lose about one-third of your taste buds. The microclimate of an aeroplane is drier than most deserts, which has an effect on the nose roughly equivalent to stuffing one nostril with toilet paper. Even the sound of the engine changes the way food tastes. Exposure to the background noise of an aeroplane, which can reach 80-85dB, dulls your sensitivity to salty and sugary flavours, while enhancing your perception of the proteinous fifth taste, umami. This explains the enduring love affair between air passengers and tomato juice, which is ordered as much as beer in flight. If you drink it in the sky, it will taste richer, more savoury, and less acidic.

14. Finally, Andy Mukherjee calls for greater scrutiny of the drivers of wealth creation of Gautam Adani.

Adani’s commodities, energy and transportation empire the $255 billion stock-market juggernaut it is today, even when the combined annual net income of its seven publicly traded firms is less than $2 billion... Elara India Opportunities Fund, which has amassed $4.2 billion — practically all of its assets under management — from three stocks: Adani Transmission Ltd., Adani Enterprises Ltd., and Adani Total Gas Ltd. APMS Investment Fund Ltd., whose $3.6 billion portfolio also includes Adani Power Ltd., has done it with four. There are three more of these Mauritius-based entities among major shareholders: Cresta Fund Ltd., LTS Investment Fund and Vespera Fund Ltd. A sixth, Albula Investment Fund Ltd., has exited Adani firms, with its portfolio shrinking to about $240 million from $1.6 billion in December, according to Bloomberg data. Between them, these publicity-shy investors own a combined $12 billion of Adani stock.

And the staggering reach of the conglomerate

The coal he mines, moves through his ports, and burns at his power stations provides electricity to Indians. Adani supplies families with piped gas when they’re sitting down to dinner, in which the cooking oil is also his, and the wheat probably stored at his warehouses. The new structures that will adorn the landscape of an underbuilt India over the next couple of decades will take construction materials from Adani, who just acquired 70 million tons of cement capacity and now wants to double it in five years. The businessman will collect toll on roads in the states of Gujarat and Andhra Pradesh, and host Indians’ data when they’re browsing the internet, waiting for a flight to take off from one of his airports. He’ll also help book the airplane tickets. And before you complain about the impact of coal, cement, palm oil and data centers on the environment, Adani says he’ll invest $70 billion into “cooling the planet down” with green hydrogen, wind turbines and solar panels. Throw in forays into media and money-lending to small businesses, and Adani may soon command a bigger share of an average Indian’s life than Amazon will ever garner from a typical American’s wallet.

No comments:

Post a Comment