1. Long read in FT on the issue of weight-loss drugs, especially Wegovy the new drug by Novo Nordisk. The self-administered weekly injection is part of the increasing belief that obesity is a disease rather than resulting from unhealthy habits and for the seriously overweight medical treatment may be necessary.

The article points to the long history of failures with weight loss drugs,

Despite the vast need, many major pharmaceutical companies have held back from developing weight-loss drugs, in part because the category is marred by a long history of quackery and safety scares. From the 1930s to the 1960s, the industry poured money into diet pills based on amphetamines. These eventually fell out of favour because they were highly addictive and had harmful side effects. In the 1990s, fen-phen — a combination of fenfluramine and phentermine — became so popular that weight-loss clinics sprung up across the US just to prescribe it, even though some patients on the drug experienced manic episodes. It was later taken off the market after a study showed up to a third of patients could suffer from heart valve defects. As recently as 2020, US regulators forced the withdrawal of weight-loss drug Belviq because of concerns it increased the risk of cancer. For the most desperate, surgery has become popular, though it is expensive and comes with its own risks and restrictions.

2. George Bass, a security guard in a university, has a brilliant essay chronicling life in times of rising inflation.

In my job keeping people and property safe on a university campus, I earn £10.71 per hour. Working 16 12-hour shifts a month bags me an average £1,400, after tax. I’ve always been comfortable earning a modest wage. Since I began working at the age of 15, I’ve picked jobs based on two guiding principles: I don’t want to have to tell lies all day, and I don’t want to get work calls beyond the car park. In my various roles over the past 25 years, working on a gun range, in a lead factory, as a labourer and shifting boxes, those two rules have never been broken. Getting a job in security taught me a third: once the uniform’s on, you need to help people. This year, the drumbeat of news about inflation has made me increasingly anxious.

The essay is a great example of how exceptional talent can remain hidden in all of us. Some, and only some, realise it and become rich and famous (in varying degrees), whereas it remains latent in the lives of most others. And the reason for the talent getting expressed in most cases is either the ovarian lottery of birth circumstances or plain good luck.

3. The tumult in financial markets have hit emerging market bonds very hard. It's estimated than $52 billion has already been pulled out from EM bonds this year, with devastating consequences on EM bond yields.

EM bonds are having their worst year on record.

4. As it pulls ahead in mass manufacturing of 5 nm chips, TSMC's lead in the semiconductor chip business increases.

5. The age of ultra-loose monetary policy is being followed by a period of frenetic tightening,

In the three months to June, 62 policy rate increases of at least 50 basis points were made by the 55 central banks tracked by the Financial Times. Another 17 big increases of 50 basis points or more have been made in July so far, marking the biggest number of large rate moves at any time since the turn of the millennium and eclipsing the most recent global monetary tightening cycle, which was in the run-up to the global financial crisis. “We’ve seen this pivot point in the market where 50 is the new 25,” said Jane Foley, head of foreign exchange strategy at Rabobank.

This demonstrated collective resolve is an important point that can help anchor inflation expectations.

6. Pratik Datta writes about the latest example of judicial activism which threatens the future of the Insolvency and Bankruptcy Code.

The Supreme Court recently passed an important judgment in Vidarbha Industries Power Ltd. v. Axis Bank. It held that the National Company Law Tribunal (NCLT) cannot admit an insolvency application filed by a financial creditor merely because a financial debt exists and the corporate debtor has defaulted in its repayment. Instead, the NCLT must consider any additional grounds that the corporate debtor may raise against such admission... The balance-sheet test is one method for determining insolvency at the point of trigger. This test, however, is vulnerable to the quality of accounting standards. That’s why the Bankruptcy Law Reforms Committee did not favour this test in the Indian context. Instead, it recommended that a filing creditor must only provide a record of the liability (debt), and evidence of default on payments by the corporate debtor. This twin-test was expected to provide a clear and objective trigger for insolvency resolution. The hope was this would minimise litigation at admission stage, enabling quicker resolution of distressed businesses. The Supreme Court’s latest ruling is likely to radically alter these expectations. Even if the NCLT is satisfied that a financial debt exists and that the corporate debtor has defaulted, it may not admit the case for resolution if the corporate debtor resists admission on any other grounds. Corporate debtors are likely to use this precedent to the fullest to resist admission into IBC. The likely outcome would be more litigation and delay at the admission stage, enhancing the risks of value destruction in the underlying distressed business. Unless the NCLT consciously constrains the use of its own discretion at the admission stage, the IBC may well end up like the SICA.

7. The rising dependence on imported medical devices, in particular from China.

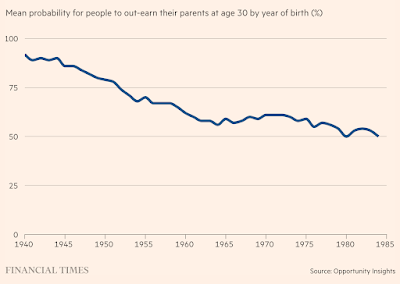

8. FT has a long read on the enduring high risk appetite among young investors in the US. It has a graphic which points out that only half Americans born in 1984 were likely to out-earn their parents at 30.

Gary Stevenson, a 35-year-old former trader and financial education campaigner from east London, is one: “My dad never went to university. He worked at the post office for 35 years and could raise three kids and pay off [a mortgage] . . . he has a comfortable retirement,” he says. “That is off the table for most young people now. It’s created a bit of a panic.” “If you can’t do what your dad or grandad did . . . you have to come up with a better plan,” he adds. At some point, risky bets starts to look like the rational choice: “One way, you see a zero per cent chance of success. But if you take on insane risk . . . at least you have a chance.”... “If you said, ‘My dad spends all day gambling,’ [I’d] say, ‘Oh man I’m so sorry for your family’,” he says. But “if someone says, ‘My dad spends all day FX trading’, you think he’s the Wolf of Wall Street . . . It’s not gambling, it’s investing — and investing is how you get rich.”

9. Esther Bintliff has a long read in FT assessing the value of feedback in improving performance. She examines the research and literature on the topic and leaves you wondering whether there is any scientific basis to the claim that negative feedback when given appropriately can lead people to change habits and behaviours and improve their performance.

The article points to a 1996 meta-study of feedback literature by two academic researchers Avraham Kluger and Angelo De Nisi,

The two reviewed hundreds of feedback experiments going back to 1905. What they found was explosive. In 38 per cent of cases, feedback not only did not improve performance, it actively made it worse. Even positive feedback could backfire... Kluger came to believe that as a performance management tool, it is so flawed, so risky and so unpredictable, that it is only worth using in limited circumstances, such as when safety rules must be enforced. If a construction worker keeps walking around a site without a helmet, negative feedback is vital, Kluger acknowledges. The most effective way to give it is with great clarity about potential consequences. The worker should be told that the next time they go without a helmet, he or she will be fired. But in many other types of work, the formula for good feedback includes too many variables: the personality of the recipient, their motivations, whether they believe they are capable of implementing change, the abilities of the manager...

Instead of managers giving top-down feedback, he argues they should spend more time listening to their direct reports. In the process of talking in depth about their work, the subordinate will often recognise issues and decide to correct them on their own. Based on this theory, Kluger developed something he calls the “feed-forward interview” as an alternative, or prologue, to a performance review. He offers to give me a demo... Much of how we respond to feedback is driven by the nature of our relationship with the person giving it. This is why Kluger believes it’s useless to focus on the recipient of feedback alone. The outcome will always depend on the “dyad” — the sociological term for two people in a particular relationship — and what transpires between them.

The time, effort, and skill required to do a good feed-forward interview is too rare as to make the likelihood of a feedback being effective very rare.

10. Even as the Sri Lankan crisis occupies attention, the situation in Pakistan deserves greater attention as things worsened this week,

The Pakistani rupee’s 7.6 per cent tumble to Rs228 to the dollar marked the latest setback for the currency, which has fallen sharply this year. It marked the rupee’s sharpest weekly drop since October 1998. The latest slide reflected mounting concerns that a $1.2bn loan disbursement from the IMF agreed last week might not be enough to avert a balance of payments crisis. Pakistan’s bonds have been among the worst performers in emerging markets this year... Fitch Ratings this week downgraded its country outlook to negative from stable, noting what it called a “significant deterioration in Pakistan’s external liquidity position and financing conditions” this year. The rating agency said the central bank’s forex reserves had declined to about $10bn by June 2022, down from $16bn a year previously and equivalent to just over one month’s worth of current external payments. Pakistan’s central bank raised its main policy interest rate 125 basis points to 15 per cent on July 7 in an effort to stem demand for foreign currencies and reduce inflation.

No comments:

Post a Comment