1. NYT has a feature on the flood of venture capital into artisan ice creams in the US. Like elsewhere in the startup world, this too has had its corrosive effects,

... “angel investors” were everywhere, offering large investments to incubate the transition from small store into juicy acquisition target. Few owners could resist. “People are like, ‘I’m going to be the next Ben & Jerry’s because I listened to whatever that podcast is,’” Ms. Freeman said. Going down the acquisition path meant a frantic scramble for exposure as well as access to freezer shelves, an expensive enterprise that, people say, can be more about connections than how good the ice cream is... The industry shifted from multiple distribution channels to a “warehouse-driven model” dominated by packaged food corporations, he said. As a result, he added, “artisanal brands have to go to retailers and pay an enormous amount of slotting” — industry speak for fees to get placement on store shelves, which can run as high as $40,000 per flavor...“Too much money and a lack of business expertise,” Mr. Bucci said when I asked him what had gone wrong. “It’s disheartening,” he added. “The waste blows your mind.” Quoted in an article that dissected the collapse for Medium’s Marker publication this year, an Ample Hills co-founder, Brian Smith, called the business “a runaway train of raising and raising and growth and growth.”... “Investors have urged us to grow,” Ms. Gallivan said. “It’s tempting because they’re dangling all this money and saying, ‘We’re going to get you in supermarkets across the United States.’” She was skeptical. “We’ve seen a lot of people fall in that trap,” she said. “They grow way too quickly, get overextended and ultimately collapse.”

Finance loses its disciplining powers when it becomes plentifully available.

2. Contemporary Amperex Technology Ltd (CATL), the world's largest electric car battery maker, based in the Chinese coastal city of Ningde, has unveiled a new battery which runs on the cheap and abundantly available Sodium instead of Lithium. CATL dominates the global production of lithium iron phosphate batteries which use iron and phosphate instead of the more expensive nickel and cobalt. However, its global dominance is based largely on its presence in China, outside of which CATL is only one of the challengers to the South Korean and Japanese battery makers.

Gold loans have surged nearly 85 per cent over the past year, to Rs 60,464 crore… The outlier growth in gold loans compared to any other segment was also aided by the Reserve Bank of India’s (RBI’s) move to hike the loan-to-value (LTV) ratio for such loans from 75 per cent to 90 per cent… Take a look at the gold auctions. Mannapuram Finance had auctioned Rs 8 crore worth of the yellow metal in the first three quarters of FY21. This shot up to Rs 404 crore in the fourth quarter and further to Rs 1,500 crore in the June quarter.

5. In the context of the perception of stock market dominance by the tech giants, Ruchir Sharma draws attention to the tenuous nature such leadership,

Data going back to 1970 shows companies that finished a decade in the top 10 saw median earnings gains of around 330 per cent over the course of that decade, and their stocks beat the market by more than 230 per cent. The top 10 of the 2010s were not that different from the norm: earnings were up 350 per cent and their stocks outperformed the market by 330 per cent. By the end of the 2010s, the top 10 accounted for 16 per cent of global stock market value, which was similar to the top 10 share at the end of the 1970s and 1990s. Given how popular US tech brands have become, it is widely forgotten that a decade ago Amazon and Facebook were not in the world’s top 100 companies by market value. Yet their meteoric rise is not that unusual, either. On average, companies that reach the top 10 rise by around 75 places over a decade to get there, then fade. Since 1970, companies that finished a decade in the global top 10 have had a less than one in five chance of finishing the next decade there. Oil companies ruled the list in the 1970s, followed by Japanese banks in the 1980s. Tech names reached the top in the 1990s, but the cast keeps changing. Only two European tech companies, Deutsche Telekom and Nokia, have ever cracked the top 10, flashing into that club during the 1990s before quickly falling off. Only one company, Microsoft, has reinvented itself often enough to stay in the top 10 club for three decades…In the decade after companies reach the top 10, they typically see earnings growth fall over the next 10 years from 16 per cent a year to 4 per cent. As earnings growth slips, so does profitability and market appeal. After finishing in the top 10, the giants usually see returns turn negative, and their relative performance shrinks by 70 per cent over the next decade. In effect, they give back all of the gains they made in their run to the top. On average, top 10 companies slip over the next decade by around 60 places in the rankings — an outcome that should not be mourned.

6. Gideon Rachman writes about the geopolitical consequences from the uncertainty and instability caused by Taliban's takeover of Afghanistan. The quick surrender of the US-trained Afghan army without any fight has been remarkable. This should count as a rare bloodless rebel victories in history.

The billions spent by the US arming and training the Afghan army appears to have been wasted, and the ultimate beneficiary appears to be the Taliban who've now captured the weapons and equipment from the fleeing Afghan army. The amount of money spent by the US in Afghanistan is massive,

Of the approximately $145 billion the U.S. government spent trying to rebuild Afghanistan, about $83 billion went to developing and sustaining its army and police forces, according to the Office of the Special Inspector General for Afghanistan Reconstruction, a congressionally created watchdog that has tracked the war since 2008. The $145 billion is in addition to $837 billion the United States spent fighting the war, which began with an invasion in October 2001. The $83 billion invested in Afghan forces over 20 years is nearly double last year's budget for the entire U.S. Marine Corps and is slightly more than what Washington budgeted last year for food stamp assistance for about 40 million Americans.

When the Taliban previously ruled Afghanistan from 1996 to 2001 it enforced a literalist interpretation of Islamic law, carrying out public executions, stoning women accused of adultery and cutting off the hands of accused thieves. It was subsequently driven from power by a US-led invasion following the terror attacks of September 11 2001.

C Rajamohan examines Afghanistan's history in recent decades and examines its geopolitical implications. He urges India to wait and watch, and engage opportunistically.

Profile of Mullah Abdul Ghani Baradar, the Taliban leader who's expected to takeover as President.

7. John Taylor argues that technology businesses are fleeing California for places like Texas, due to the state's high personal and corporate tax rates, high property prices, restrictive land-use regulations, progressive labour regulations, stricter occupational licensing etc. He writes,

According to the Pacific Research Institute, California has the second-highest regulatory burden on employment of all 50 states. The ranking is based on a composite score of seven labour regulatory categories: Worker compensation, occupational licensing, the minimum wage, lack of right-to-work laws, mandatory medical benefits, unemployment insurance, and short-term disability regulations. Each regulation — even hidden ones like occupational licensing — creates compliance costs, the burden of which is relatively greater for small start-ups.

In simple terms, Taylor appears to be arguing against progressive labour regulations. Or is it a case of such regulations having gone too far?

8. The Government of India has unveiled a jobs subsidy scheme which offered to cover the full 24% mandatory employee and employer contributions to EPFO for new hires with salary upto Rs 15000 per month. The scheme is from 1 October 2020 to 31 March 2022. Its uptake till date

9. TT Rammohan writes about the findings of the Parliamentary Standing Committee that examined the working of the India Bankruptcy Code (IBC).

In India, creditors decide the future of an insolvent firm with the help of an administrator called the Resolution Professional (RP). The National Company Law Tribunal (NCLT) is the adjudicating authority. The idea is that with banks having messed up in a big way, it is better to carry out resolution under the auspices of independent authorities. Alas, it turns out that the RP is a weak link in the chain. The Parliamentary Committee has scathing observations to make about RPs. Many are graduates. The regulatory authorities have pursued disciplinary actions against 123 RPs in a total of 203 inspections carried out so far. The Committee wants a self-regulatory body to oversee professional standards for RPs akin to the Institute of Chartered Accountants of India. As for the NCLT, its processes are plagued by delays. There are delays of over 180 days in 71 per cent of cases. The NCLT takes a long time to admit cases in the first place —the Committee wants cases to be admitted within 30 days. One reason for that is, as in the judiciary, several positions on the NCLT bench remain unfilled. The NCLT is 34 members short of the sanctioned strength of 62 members.

On the critical issue of haircuts, he argues for some reforms,

It is more important to get the estimate of liquidation value right and to get as many parties to bid as possible. Let there be an independent evaluation of a sample of liquidation values and auction processes. Were the estimated liquidation values appropriate? Was every effort made to open up the auction to a large number of bidders? The answers will shed light on the effectiveness of the IBC process and help address infirmities. It may be useful to create an Office of Independent Evaluation at the Insolvency and Bankruptcy Board of India (IBBI) similar to the one that obtains at the International Monetary Fund.

10. FT points to a study which analysed 104 companies from N America, W Europe, and Australia that started with a market capitalisation between $150 m and $10 bn, and generated a total shareholder return of at least 350 per cent in 2015-20 period. It excluded all companies in energy, materials and financials sectors, and required companies to have positive revenue growth and EBITDA for previous 12 months.

Its findings of the study run against significant amounts of received wisdom about the dire lack of fast-growing companies in Europe compared to the US. Of the 104 companies to make the final cut, those in western Europe made up 55.7 per cent of the total compared to 32.7 per cent in North America, with Australia accounting for the rest.

The study finds,

The S&P 500 returned 55.45% from June 2015 to June 2020 while the average return of the set was 922% and the highest performer returned 9,199%.

11. Container shipping industry's windfall year,

AP Moller-Maersk A/S, the world’s biggest container shipping line, was expected to make around $4.5 billion in operating profit in 2021, according to estimates at the start of the year by the financial analysts who follow the company. Their estimates have turned out to be totally wrong. Due to surging freight rates stemming from global supply chain snarl-ups, the Danish shipping giant is now predicted to make around $14.5 billion this year. Maersk’s extraordinary financial results are being repeated across the industry. If freight rates keep rising, the container lines could collectively make $100 billion in operating income in 2021, according to Drewry Maritime Research. For context, that’s more than 15 times the profits they generated in 2019 and nearly as much as Apple Inc. makes in a typical year... Germany’s Hapag-Lloyd AG has earned more in the last six months than in the previous ten years combined.

12. Vivek Kaul has an excellent article on the perils of concluding with partial information and survivorship bias. He points to deficiencies in an analysis of HDFC Bank that uses its housing loan data to conclude that housing affordability in India has increased over the years. Instead, the data only highlights that HDFC is becoming ever better are self-selecting itself to attract only the better-off and most credit worthy housing mortgage applicants.

13. FT has a long read on the disruption happening in the $548 bn (2019) global remittance transfers business due to fintech startups.

The conventional model was to transfer money cross-border using the correspondent banking approach, whereby a remittance sent by a customer of a domestic bank went through three other banks, each of which took a fee and a foreign exchange mark-up. Into this entered startups like Wise with their "netting" approach,

Kristo Kaarmann, an Estonian, was working in London for Deloitte. Taavet Hinrikus, a UK-based friend, was toiling in Estonia as a financial consultant. “I was sending money to Estonia and he was sending money to the UK. We were both losing thousands in hidden foreign exchange mark-ups,” Kaarmann says. “So we set out to do transfers without banks. Every month we looked up the exchange rate. I topped up Taavet’s UK bank account and he topped up my Estonian account by the equivalent amount.” The beauty of the arrangement was that no money needed to cross borders... Wise claims its money transfers are up to eight times cheaper than UK high-street banks. A transfer of £1,000 costs just £3.75. Wise also aims to be faster, with four out of five payments arriving in a day or less. Remittances via the correspondent banking network can take two to five days, with each link in the chain settling on consecutive days... Kaarmann and Hinrikus originally hoped their “netting” — reciprocal payments in matched countries — would be the bedrock of their business. In practice, it constituted only around 15 per cent of $74bn in transfers via Wise last year, because flows between two countries are typically lopsided. Chief technology officer Harsh Sinha says the efficiencies that make Wise price competitive come largely from bulk dealing in currencies and connecting domestic payments systems in each country where it operates.

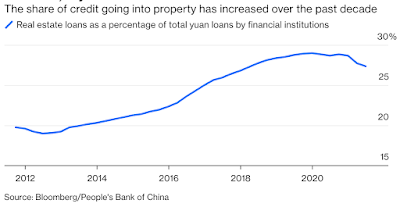

Despite Xi’s admonishment that “housing is for living in and not for speculation,” and the government’s regular entreaties to banks to scale back property lending and increase the flow of credit to small business, the share of funds directed to the industry has risen. Real estate loans have increased to more than 27% of total yuan advances, from less than 20% a decade ago, according to People’s Bank of China data. Moreover, this is certainly an understatement — at least according to the country’s head banking regulator, who ought to know. Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, wrote last year that the real share of property-related loans is more like 39%, or 70 trillion yuan ($10.8 trillion)... With yields so low and no ongoing taxes to pay, many investors choose to keep their apartments vacant. China had more than 60 million empty dwellings as of 2017, with the biggest cities (tiers 1 to 3) having vacancy rates of 17% or more, according to a 2020 paper by Harvard University’s Kenneth Rogoff and Yuanchen Yang of Tsinghua University.

1 comment:

The artisan ice cream point made me think of this: https://www.youtube.com/watch?v=z0vDYs7OEew :)

Post a Comment