1. MS Sahoo, Chairperson of the Insolvency and Bankruptcy Board of India (IBBI) has a good assessment of the IBC,

On the face of it, 25 per cent of companies were rescued and 75 per cent proceeded for liquidation. In value terms, however, 75 per cent of the assets were rescued and 25 per cent of assets proceeded for liquidation. Importantly, of the companies sent for liquidation, 75 per cent were either sick or defunct, and of the companies rescued, 25 per cent were either sick or defunct. The companies rescued had assets, on average, valued at 25 per cent of the amount of claims against them, while the companies ordered for liquidation had assets valued at 5 per cent of the amount of claims against them. In terms of these facts, the extent of liquidation under the code does not appear worrisome...About 30,000 applications have been filed for initiation of CIRP. Of them, 10,000 are yet to be disposed of. Of the balance 20,000, the stress underlying 16,000 applications were resolved before admission, and the stress underlying 4,000 applications entered CIRP for resolution. Of these, 1,900 are ongoing, while 800 got resolved, through settlement, review, mediation, or withdrawal. The remaining 1,300 have completed the process. At this stage, the value of the company is substantially eroded, and hence some of them (300) were rescued, and others (1,000) liquidated. That works out to a rescue rate of 25 per cent of CIRP. Another way to work out the number of companies where the stress was resolved (before admission plus midway closure and resolution plans) as a percentage of the number of applications concluded, that is, 17,000/18,000, which gives a rescue rate of 95 per cent. Thus, only 5 per cent of companies seeking resolution through the code end up in liquidation. Of these, 75 per cent are defunct to start with.

2. Neelkanth Mishra has a good summary of the production linked incentives (PLI) scheme of the government. It provides 2-6% of the revenues as time-bound incentive to firms in 10 sectors whose production is above a certain level and have some threshold for additional investments.

The incentive is on value of output, and not value-added, making it attractive for downstream companies, as assembly costs are generally not more than 10 per cent of manufacturing value. For a product where assembly is 10 per cent of value, a 5 per cent incentive would mean a 50 per cent support to the assembler. Thus, assembly, the most labour-intensive part of most supply-chains, can be attracted to India in sectors like electronics and textiles. In food processing, it may help raise India’s share of global exports and thus provide an outlet for rising food surpluses.

The concerns are,

... risks that a more interventionist state can engender: Crony-capitalism (the scheme details can be designed to benefit some firms), resource misallocation due to lack of knowledge (who decides which sectors must get the incentives?), scope creep (as news of the PLI schemes has spread, there appears to be intense lobbying to expand these), requests for relaxation of targets (some firms are already requesting an extension to timelines, given the lockdowns during Covid), and rent-seeking (are targets sufficiently objectively defined to minimise discretion in paying out incentives?).

3. The idea of clubbing a profitable asset with a less profitable one and monetising the combination is logically appealing. But in the real world, investors are unlikely to be enthused by such combinations. The latest example of such bundling is the proposal of Government of India to combine a loss making remote airport with a profit making one.

4. An important explanation for the equity markets bull run is the cost of capital. Michael Mauboussin points to some numbers in this regard,

Aswath Damodaran, a professor and valuation expert, estimates that the equity risk premium dropped from 5.2 to 4.7 per cent over the same period as the rebound in stock prices implied lower future returns. The yields on corporate bonds followed a similar trajectory. These figures imply that the cost of equity declined from 7.1 to 5.6 per cent during the year. When used in valuation calculations, this boosts the current worth of expected future earnings of companies as the future income stream is discounted at a lower rate. Companies therefore received a richer valuation on greater current or prospective earnings. Companies that gained from trends arising from the pandemic, such as those that enabled working from home, particularly benefited.

5. NYT reports that precious metals in catalytic converters of cars is spawning a market for car thieves,

Stricter car emissions rules around the world — particularly in China, which has scrambled in recent years to get its dire air pollution problem under control — have sent demand for the precious metals in catalytic converters surging. That has pushed up the asking price for some of the precious metals used in the device — like palladium and rhodium — to record highs... Required in all gasoline cars and trucks sold in the United States since 1975, the converters have a honeycomb-like interior — coated with precious metals like palladium, rhodium and platinum — that scrubs the worst toxic pollutants from the car’s exhaust... catalytic converters now make up a much larger proportion of a gasoline-powered vehicle’s cost than they did even just a year ago. The metals prices, in turn, are fueling a black market in stolen catalytic converters, which can be sawed off from the belly of a car in minutes, and fetch several hundred dollars at a scrapyard, which then sells it to recyclers who extract the metals.

6. A summary of farm subsidies in India,

More than three-fifths of the 1.3 billion population is stuck on the farm, and kept there with a $11 billion fertilizer subsidy; $9.5 billion in unmetered electric power; about $4 billion annual expenditure on periodic loan waivers; and of late an $80-a-year income supplement, which adds up to $9 billion. For the landless, there’s a rural job guarantee, which cost $15 billion after migrant workers lost their urban jobs to the Covid-19 lockdown and returned to their village homes.

7. A NBER working by Fancesco Decarolis et al find that women are less prone to corruption in public bureaucracies,

We examine the correlation between gender and bureaucratic corruption using two distinct datasets, one from Italy and a second from China. In each case, we find that women are far less likely to be investigated for corruption than men. In our Italian data, female procurement officials are 34 percent less likely than men to be investigated for corruption by enforcement authorities; in China, female prefectural leaders are as much as 75 percent less likely to be arrested for corruption than men.

As the authors point out, the results may be complicated by women having greater risk aversion or being less targeted by anti-corruption agencies.

7. Anusha Chari et al find that the RBI's forbearance measures that lowered capital provisioning rates for loans under temporary liquidity stress in the aftermath of the global financial crisis, led to banks spieling firms facing serious solvency issues.

Perversely, in industries and bank portfolios with high proportions of failing firms, credit to healthy firms declined and was reallocated to the weakest firms. By incentivizing banks to hide true asset quality, the forbearance policy provided a license for regulatory arbitrage... Our findings imply that regulatory forbearance can function as an implicit subsidy from the government that postpones costly bank recapitalization. Asset quality forbearance in particular can allow banks to effectively “extend and pretend” distressed loans masking the underlying bank capital erosion. Loan-loss recognition would undoubtedly weaken bank balance sheets and warrant recapitalization.

The million dollar question is whether there is an ongoing redux of this in the aftermath of the Covid 19 pandemic.

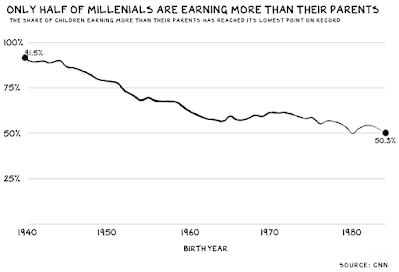

8. It is one of the enduring narratives of development and progress that each generation is better off compared to their predecessors. But, at least in terms of wealth, evidence points to a secular decline.

The blog post itself by Scott Galloway is, as always, excellent. He highlights four factors in the algebra of wealth - focus, stoicism, time, and diversification.

Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

This is a much overlooked fact,

One study found that over a 12-year period, only 5 percent of active retail traders made any profit at all. This time around, apps including Robinhood, with its dopamine-triggering confetti, and 24-hour-a-day, volatile crypto trading are the drugs of choice.

9. The brilliant Morgan Housel on the power of stories,

Tesla is worth seven times more than GM and Ford combined, not because it built a good business but because Elon Musk is good at getting people’s attention. Customers. Investors. Twitter followers – he’s told them all a good story, and the best story wins.

He quotes Rory Sutherland,

Making a train journey 20 per cent faster might cost hundreds of millions, but making it 20 per cent more enjoyable may cost almost nothing... It seems likely that the biggest progress in the next 50 years may come not from improvements in technology but in psychology and design thinking. Put simply, it’s easy to achieve massive improvements in perception at a fraction of the cost of equivalent improvements in reality.

10. Loren Brandt and Thomas Rawski have a good paper on China

Long before the recent boom, Qing-era Chinese society harbored elements favorable to economic growth. Wide dispersion of entrepreneurship, commercial acumen and sophistication, universal regard for education, informal contract enforcement mechanisms and competent local administration all contributed to the initial reform response and its subsequent extension... John Fairbank described China’s political culture and governing institutions as resting on “ancient structures of social order and political values that are too deep for rapid change.”189 These foundations, which shape both the strengths and the limitations of China’s recent economic boom, have survived the transition from empire to People’s Republic. Spanning Qing, the Republic and the PRC, these arrangements weave authoritarian hierarchy and personalist networking into a fabric that binds citizens to the state, motivates vigorous support for official policies and priorities, and enhances security for both rulers and citizens. This system provides essential protection for individuals and private business investment, but its economic costs embed permanent tension between the demands of political stability and economic development... In both the pre-1949 treaty ports and in the aftermath of the Cultural Revolution, the retreat of central control enabled episodes of economic openness and dynamism built upon ‘bottom up’ initiative and decentralized innovation.

11. A sobering reality check on India's private sector, a recurrent theme of several posts in this blog. This on startups is very relevant,

Attracting large PE investments for building businesses built on purveying, say, education services or payments online is more a testimony to the operational capabilities of these entrepreneurs — no small achievement in India’s chaotic business environment — than their innovative capacities.

12. Celebrity tweets, the herd runs. This is the new world of equity market investing. Sample this from Jason Zweig,

At 10:32 a.m. Eastern time on Jan. 26, Mr. Palihapitiya tweeted that he had bought call options on GameStop, adding: “Let’s gooooooo!!!!!!!!” By the end of the next minute, GameStop’s price had jumped 9.6% as trading volume quadrupled, with nearly 10,200 lots of 100 or fewer shares changing hands, according to a Wall Street Journal analysis of market data from DTN.At 4:08 p.m. Eastern time the same day, Mr. Musk tweeted, “Gamestonk!!” More than a quarter-million shares traded immediately and, by the time 10 more minutes had elapsed, GameStop had shot up 31%. The shares, at roughly $144 before Mr. Musk’s tweet, surged to nearly $348 the next day, then fell to about $50 by this week.On Feb. 3, Mr. Cuban tweeted, “If I had to choose between buying a lottery ticket and #Dogecoin .....I would buy #Dogecoin.” Over the next 12 hours, the digital currency shot up roughly 50%.

No comments:

Post a Comment