Much has been written about the ongoing equity market bubble, which defies all explanations. It is the time under the sun for the likes of David Portnoy. When the history of now is written, this video will figure prominently.

Here are a few graphics, mostly courtesy this excellent compilation from The Gold Standard and other links from Ananth's blog, that capture the strange times in equity markets.

Jesse Felder describes this decoupling of Wall Street and the Main Street as the "craziest" thing he has seen in his stock market career.

From Liz Ann Sonders, the graphic shows that the share of the top five shares in the total market capitalisation of S&P 500 is reaching record highs. It is more than a quarter of the market, the first time in over 50 years.

Even as the markets have boomed, its beneficiaries have mostly been the richest. The Fed estimates show that the top 10% of population by wealth own 87% of all US shares outstanding, with the bottom half's ownership share being negligible.

Interestingly, even as the stock markets have boomed and the stock-owning rich have seen their wealth rise sharply, pension funds appear not to be benefiting. An index which tracks the 100 largest US defined benefit pension plans shows that unfunded liabilities risen unabated even as the markets have boomed, since the bond returns have continued to decline. The funded ratio has declined from 89.8% at the beginning of the year to 81.1% by end-July 2020, and bond rates have fallen nearly a percentage point from 3.2% to 2.26% over the same period.

The share of zombie companies being propped by the overdose of cheap debt has grown explosively in the US,

Interestingly, even as the stock markets have boomed and the stock-owning rich have seen their wealth rise sharply, pension funds appear not to be benefiting. An index which tracks the 100 largest US defined benefit pension plans shows that unfunded liabilities risen unabated even as the markets have boomed, since the bond returns have continued to decline. The funded ratio has declined from 89.8% at the beginning of the year to 81.1% by end-July 2020, and bond rates have fallen nearly a percentage point from 3.2% to 2.26% over the same period.

The share of zombie companies being propped by the overdose of cheap debt has grown explosively in the US,

In the US, the generous stimulus threatens to keep alive "zombie jobs". The story is the same everywhere, and these companies can be a big drag on productivity.

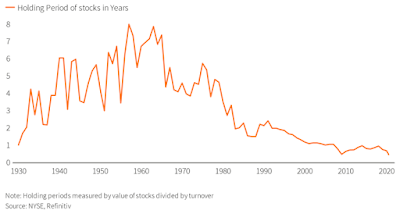

It is to borne in mind that these are not new trends, though the scale and duration of the present episode is perhaps unprecedented. In fact, for many years now, the markets have become an area of increasing speculation than efficient financial intermediation. As a signature, the average holding period of stocks at the NYSE has been declining for a long time.

This parody love letter to the Fed says it all,

It is to borne in mind that these are not new trends, though the scale and duration of the present episode is perhaps unprecedented. In fact, for many years now, the markets have become an area of increasing speculation than efficient financial intermediation. As a signature, the average holding period of stocks at the NYSE has been declining for a long time.

This parody love letter to the Fed says it all,

A rental car company was trying to sell new shares while in bankruptcy court, because its stock price was on a tear? Let me repeat that: Hertz. Sold. Shares. While. In. Bankruptcy. I can’t even!

And also this from The Economist,

The S&P 500, a share-price index of America’s biggest public companies, reached an all-time high on August 18th in the middle of perhaps the sharpest ever economic downturn... Tesla, a carmaker that is undertaking a stock split at the end of August, has quadrupled in value so far this year. It is now worth $354 bn, more than Ford, Toyota and Volkswagen combined. Nikola, an electric-truck firm (that has yet to make any lorries), has tripled in value since May. Even more perplexing was investors’ fondness for Hertz, a car-rental firm. Its share price rose tenfold after it declared bankruptcy (though this bubble has since popped).Final word to Aswath Damodaran (see blog here),

"... the notion that stock markets and economies are closely tied together is deeply held, simply because it appeals to intuition”. However, US data going back to 1960 shows, “there is almost no correlation between stock returns and real GDP growth . . . In short, there is almost nothing of use to investors from poring over current macroeconomic data, which is one reason why markets have started ignoring them.”

This decoupling is also evident elsewhere. Even as public debts soar, bond market yields have been declining.

A nice graphic which captures the surge in US federal Government debt, which at $20.53 trillion at end of June 2020, touched 106% of GDP. This 26 percentage points surge since January, which is not yet over, represents the steepest rise ever.

Yet, this surge has been accompanied by a decline in the US Treasury yields. The 10 year Treasuries have slid down to 0.7%, far below the 2% it was a year ago.

This explanation about expectations is important,

Investors see almost no chance that the United States, which has one of the best track records of any borrower on earth, will stiff them by defaulting. One big reason: As during World War II, much of the money the government has borrowed is coming from an arm of the government itself, the Federal Reserve. The central bank has increased its holdings of Treasury securities by more than $1.8 trillion since March, effectively creating all the new money it needed to buy them. For many years, such arrangements were viewed as something that was done in wobbly emerging market economies. But since the financial crisis of 2008 and the deep recession that followed, central banks in the richest nations in the world — the Fed, as well as the Bank of Japan, the Bank of England and the European Central Bank — have printed large amounts of money to buy government bonds and spur economic growth by lowering long-term interest rates.

Update 1 (28.08.2020)

More fuel to the already frothing market comes from stock splits. While there is no theoretical benefit from stock splits, there are uncertain psychological effects which could attract more retail investors into the shares.

Update 2 (06.09.2020)

Tesla facts of the day,

Tesla is currently valued at about $379bn, one and a quarter times more than Toyota and Volkswagen combined...For comparison, Toyota and Volkswagen jointly produced 21.8m cars and generated $15.6bn of free cash flow in 2019, according to JPMorgan. That same year, Tesla made 366,000 cars and $1.1bn of cash. Looked at another way, the stock market “values” every car Tesla sold last year at over $1m apiece. You can buy a Tesla Model 3 for $35,000.

It has also been discovered that the main cause for the August rally in US tech stocks has been equity derivatives trading worth nearly $4 billion by Softbank. The Japanese investor has been buying up options in tech stocks in huge quantities, fuelling the lattes ever trading volumes in contracts linked to individual companies.

The surge in purchases of call options — derivatives that give the user the right to buy a stock at a pre-agreed price — has been the talk of Wall Street, as the sheer size of the trades appears to have exacerbated a “melt-up” in many big technology stocks over the past few months. In August alone, Tesla’s share price shot up 74 per cent, while Apple gained 21 per cent, Google’s parent Alphabet rose 10 per cent and Amazon 9 per cent.See also this.

Update 3 (05.12.2020)

Tesla's valuation in perspective, from GMO

Update 4 (17.12.2020)

From John Mauldin, a stunning table of how historically overvalued is the S&P 500 on a host of valuation metrics.

No comments:

Post a Comment