Back to blogging by catching up on news.

1. So, finally it happened. Henkel and Sanofi became the first two non-government companies to sell corporate bonds at negative rates. John Mauldin has a nice reminder about the damage being inflicted by NIRP.

There is a first order dissonance. The assumption that extended period of low rates will help buy time to repair balance sheets, boost consumption, and thereby stoke an investment cycle may be way off the mark. In its absence, low rates are merely pushing at a string, engendering distortionary resource misallocations everywhere. This has no pleasant end-game. Strong words from Ananth.

2. Martin Wolf, in a disappointing column, has this graph from the work of Lukas Rachel and Thomas Smith of Bank of England on the different contributors to the near five percentage points decline in global neutral interest rates since 1980.

This graphic, as Wolf likes to point out, shows that there is a secular decline in real interest rates. But an analysis of the contributing factors should also highlight the futility of trying to stoke demand and investment by keeping rates low.

3. Wise words from Larry Summers,

There is a case for experimenting with mobilising private capital for use on infrastructure that has been a public-sector preserve, such as airports and roads. But, the reality that government borrowing costs are much lower than the returns demanded by private-sector infrastructure investors should lead to caution. It would be unfortunate if, in an effort to avoid deficits, large subsidies were given to private financial operators. Only when private-sector performance in building and operating infrastructure is likely to be better than what the public sector can do is there a compelling argument for privatisation.

Though made in a different context, the underlying message that cautions against the indiscriminate advocacy of public private partnerships and private investments in infrastructure. As we wrote sometime back, PPPs make sense only when there are real efficiency gains to be had. Unfortunately, governments have come to rely on PPPs as a means to overcome their fiscal constraints.

4. Interesting twist to the Milanovic "elephant graph" that had become the focus of debates on widening inequality and the role of globalisation. A new study by the Resolution Foundation appears to show that the hump is largely the result of China's spectacular rise and the trough is due to the declining or stagnant incomes in post-Cold War Eastern Europe and Japan. Stripped of these, incomes appear not to have done as bad.

This revision does not upend the globalisation-has-produced-winners-and-losers story. There are too many smaller stories within countries, which are likely to convey a more accurate story.

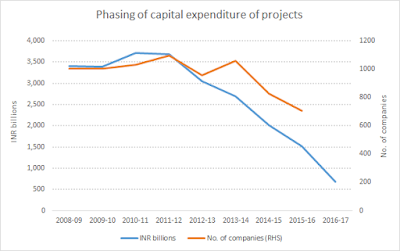

5. Amidst all the talk of the "fastest growing large economy", the underlying reality for India may not be very healthy. Ananth points to this dismal trend on corporate investment from the latest RBI bulletin.

Private investment is unlikely to rebound anytime soon given the twin balance sheet problem that has ravaged banks and corporates. While the non performing asset problem of banks is well-known, what is less known is the country's corporate sector woes. The FT writes,

According to Ashish Gupta, Credit Suisse’s Mumbai-based financial analyst, almost one-third of Indian companies are “chronically stressed” — defined as lacking the cash to cover interest payments in four of the past eight quarters. Most of these are infrastructure companies that over-borrowed on the erroneous assumption that India’s economy would grow quickly, sustaining demand for the roads and power they sought to provide. They did not envisage unhelpful government policies and payment delays. Today, their plight, and that of their lenders, is preventing the flow of credit needed to fuel further economic growth. As a result, the entire country has become caught in a lending gridlock, since few banks have the capital to absorb a huge writedown of their bad loans.

The article points to HSBC having NPAs cross ten percentage points, levels already breached by many public sector banks some quarters back. Scratch the surface more vigorously, and do not be surprised if some of the largest private sector banks join the group.

6. Nice weekend article in FT which captures the age of Rodrigo Duterte. Boris Johnson, the British Foreign Secretary, has interesting things to say about the two US Presidential candidates. On Donald Trump,

“The only reason I wouldn’t visit some parts of New York is the real risk of meeting Donald Trump.”

And on his rival, Hillary Clinton,

“a sadistic nurse in a mental hospital”.

7. Finally, Tim Harford points to a new term for the 'economics of rottenness', kakonomics. It is a state where economics get caught in a low level equilibrium of mediocrity, a kakocracy! Could extend this term to all social science.

No comments:

Post a Comment