The Ken has an article on how the health systems in India are adopting AI applications, specifically ambient AI transcription apps (always-on AI systems that use contextual interpretation to transcribe speech without explicit prompts). The article highlights several important insights about not only AI-adoption but also generally startups in India.

The idea is simple: use AI transcription tools as scribes to document patient consultations and integrate them into the patient and hospital management workflows, thereby improving efficiencies and quality of care. Besides, “ambient AI could become the layer on which a full AI stack in diagnostics, predictive health, and ICU optimisation” can be built.

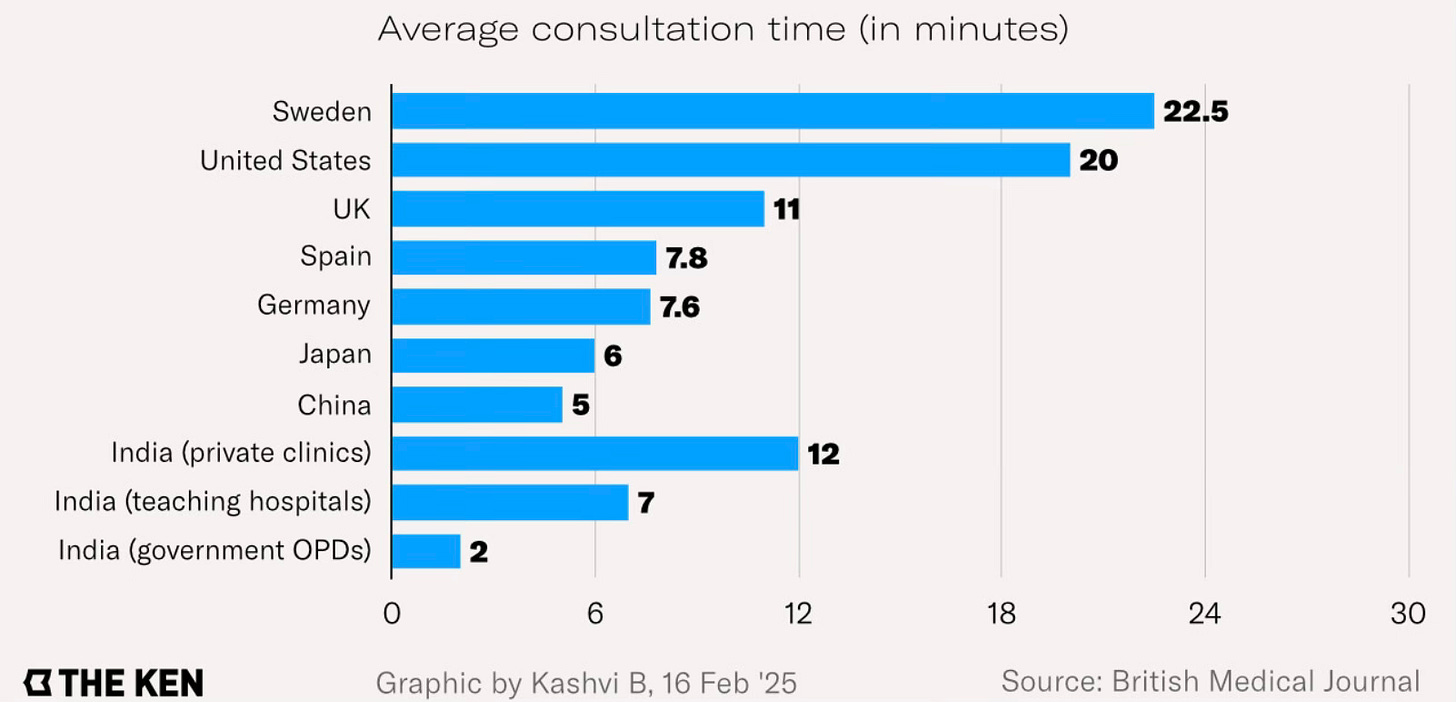

Apart from the inherent productivity-enhancing value of a digital scribe, the felt need in India is the sheer volume of patient load faced by doctors. An Indian doctor sees, on average, 30 patients compared to three for the US doctor.

This is also because India has a doctor for every 811 people, rising to nearly 11,000 in rural areas, compared to one for 300 people in the US.

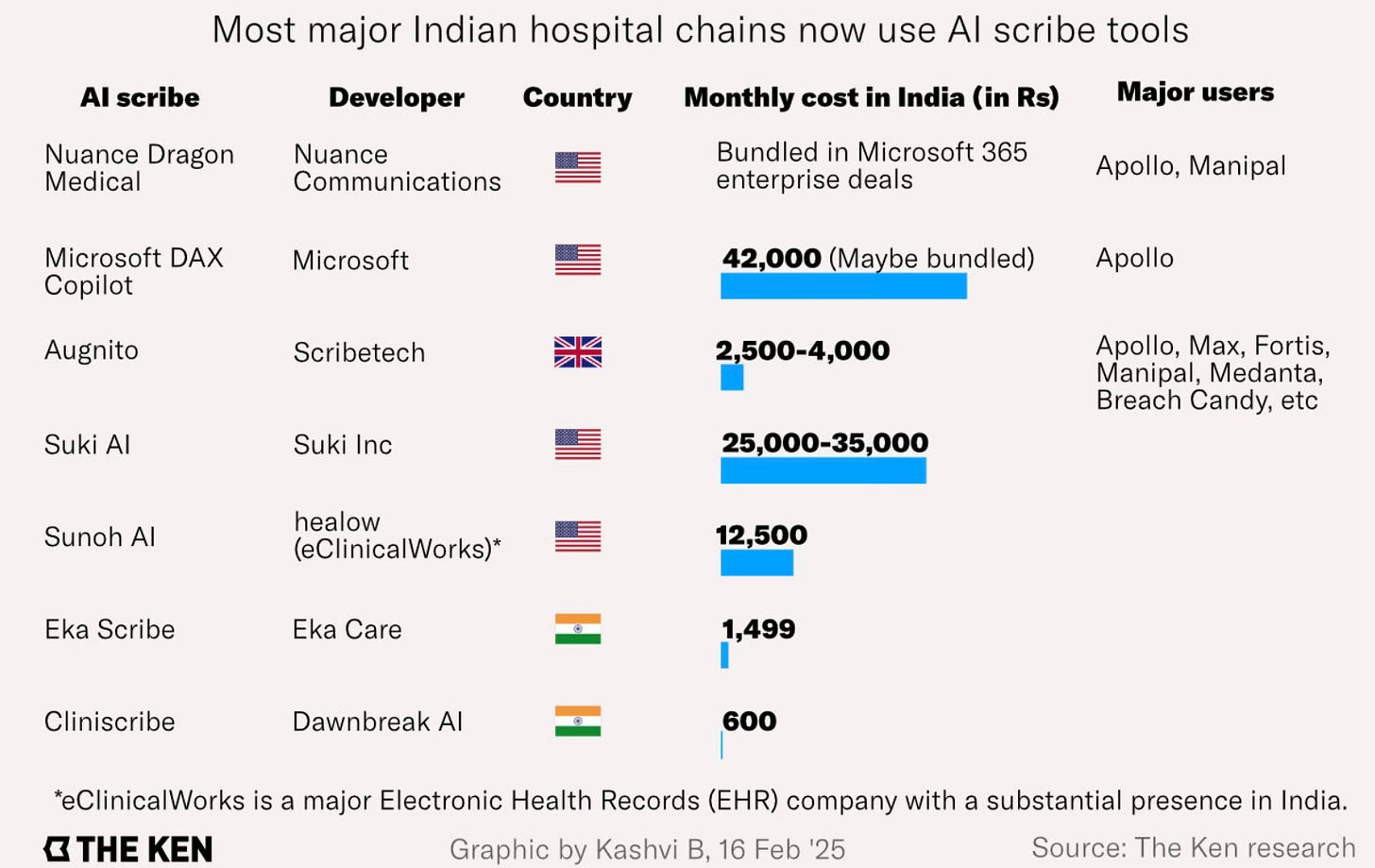

This patient load has naturally led to the search for methods to optimise consultations, especially by adopting ambient AI scribes. The well-heeled hospital chains have preferred to use the mature foreign solutions instead of relying on Indian startups.

The article describes the challenges faced by ambient AI scribe startups in India.

Most hospitals in the country do not have electronic health records, known as EHR, that can integrate such tools… Where EHR systems do exist—mostly in private hospital chains—they aren’t standardised, making the integration of AI-scribe tools into easy-to-use digital infrastructure a custom engineering project for each hospital… An AI scribe can… allow a doctor to see two to three more patients an hour, a tangible capacity gain for high-burden Indian hospitals... After adopting Augnito, a voice-to-text tool from the British firm Scribetech, 35% of Apollo’s doctors saw more patients in 2024… Apollo has deployed Augnito across 37 of its facilities since 2022–23, giving nearly 4,000 doctors access to it…

The tools would need to be highly precise, though, and customised for the Indian context. Transcription errors can impact drug dosage, change patient outcomes, affect insurance claims, and even invite malpractice lawsuits… A medical journal estimated in 2024 that there had been a 400% increase in medical-negligence cases in the previous few years… At a price point of Rs 600–1,500 per doctor per month, AI scribes need wide adoption to break even. Building AI tools is expensive, as model training and GPU costs are high…

Beyond the big players, however, it will take much more to convince doctors to adopt these tools than just a promise of less clerical work... such tools are hardly affordable for a non-chain clinic… Selling to big chains is hard for a new company, however. “Apollo’s actual deal at a corporate level is with Microsoft,” a hospital industry expert says, requesting not to be named. “They have also bundled in another voice solution, Nuance Dragon, to improve documentation.”… So startups like Dawnbreak and Eka Care started with selling their tools to hospitals that didn’t have any EHR at all… Instead of integrating their tools into existing systems, ambient AI firms are looking to provide lightweight tools that hospitals can use piecemeal…

India’s hospital-information-system landscape is fragmented… there are some 2,000 EHR systems compliant with the Ayushman Bharat Digital Mission… Unlike in the US, where Epic and competitor Cerner command 70% of the market, each EHR system in India is different. For makers of AI scribes like Dawnbreak and Eka Scribe, this means building custom-integration solutions for each client rather than a mass product. Dawnbreak, in one year of its existence, has managed to build compatibility with four EHRs out of nearly 2,000… Indian EHR companies like Healthplix and Docpulse safeguard their databases. If they open their APIs up, they lose their competitive edge. Their clients are locked in long-term contracts, leaving them unable to change their systems or integrate any AI tools.

This is a good case study on the problems with scaling startup innovation in India.

1. AI has undoubted potential for significant productivity improvements, including in public systems. Like scribing, triaging of outpatient (OP) cases coming to a primary health centre (PHC), community health centre (CHC), district hospitals, and medical colleges is an area where AI can play a significant productivity enhancing role. In all these places, OP cases come to doctors with limited or no triaging. Further, as we have seen, the daily OP load in these hospitals (at least the better ones among them) is multiples of what a doctor can manage, leaving them overburdened and stressed. The result is inefficient use of the doctor’s time, inadequate diagnosis time, incorrect diagnosis, wrong OP referrals, and so on.

An AI-based triaging application where the symptoms are entered at the OP-registration, nurse and doctor-level, can dramatically improve work conditions, increase hospital productivity, and enhance the quality of treatment. Triaging is already one of the early emerging successes of AI, with examples like Bank of America’s digital assistant “Erica”, which handles billions of client interactions and has reduced call centre volumes by 40 per cent.

2. However, the promise of AI is most likely to be constrained in sectors like healthcare and others where health and public safety are critical factors. In these regulated areas, vertical use cases of AI adoption (agentic solutions that can be outsourced specific tasks) is likely to be slower. The regulatory struggles of autonomous driving systems is an illustration.

Even a clear and credible demonstration that AI is more accurate than the current human-intermediated approach will not be sufficient. Notwithstanding all its flaws, the human psychology and political economy is such that society will demand a very high, near 100%, accuracy from any electronic/digital system that seeks to replace a human-intermediated system.

3. There are some important market insights here. Econ 101 would have it that since health care has inelastic demand, and also given the sustained high economic growth rates, one would have imagined a large supply side of hospitals in India who deploy such solutions. Similarly, one would have imagined that Indian startups would have grabbed the opportunity presented by developing AI solutions on patient triaging, consultation scribing, diagnostics, EHR, etc.

I’m not sure about whether the Indian market can support the demand for such apps and services at the price points required to sustain domestic innovation. Sample this on the limited consumption potential of the Indian economy, and the challenge of making money in the country.

While India’s population of 1.4bn offers enviable scale, its market has proven difficult to monetise. According to Sensor Tower, Indian internet users downloaded 24.3bn apps in 2024 and spent 1.13tn hours on them, but total spending was just $1bn.

The advantage domestic startups have is their lower price point. But any scaling pathway for startup innovation that relies on price point may be no scaling pathway at all. A business model that relies on a low price point does not generate the cash surpluses required to finance the significant R&D investments required to refine such products. The net result is that genuinely innovative companies remain elusive.

I blogged here about the demand-side constraint arising from the deeply price-sensitive nature of consumers and the small size of the consumption class with disposable incomes. It also does not help that Indian firms, including startups, do not have a culture of investing in R&D beyond that required to grow their ongoing businesses.

4. The dominant narrative on startups, shaped by the Silicon Valley giants, is that of scaling by growing exponentially. But contrary to this, apart from killer apps and the few platforms, the main scaling pathway for ambient scribing startups like Eka Care or Dawnbreak may well be through large IT companies already serving the same or similar market segments. The vast majority of these solutions, and not just in health, are limited in their scope as stand alone applications. But this changes dramatically once they are integrated with a larger ecosystem platform to leverage network effects.

These startups will struggle to get the big users, large hospital chains like Apollo and Max, to replace their bespoke legacy solutions or those supplied by established foreign vendors. This is a daunting market access challenge that even the startups with great solutions will face in markets like India.

It raises the important point about a model of the digital economy where startups develop innovations which in turns scales through large firms. This not only makes the large firms even larger, but also maximises value capture by them.

It also raises the question of whether the startups should pursue getting the big hospital chains to become their investors. This will also align the incentives of the hospitals to integrate these solutions with their EHR and legacy systems.

5. It is here that the failure of India’s software behemoths to build on their first-mover and other competitive advantages assumes significance. Both TCS and Infosys have long experience in global hospital systems management, including multi-year, multi-billion-dollar contracts. Hospital tasks management applications should have been a natural area of business development for these IT majors. But Indian software firms have struggled to break out from their services-led business model and embrace products and solutions which require high R&D investments.

IT services still dominate with exports set to reach $210bn this financial year, India Ratings and Research forecasts. It has been a powerhouse industry for India but as IT services presented so much low lying fruit, the sector sucked up tech talent and capital from elsewhere. India’s SaaS sector in particular punched below its potential as a result. Software majors treated their services businesses as cash cows, deploying a small share to intellectual property assets. The 10 largest IT services companies had consolidated profits of $114bn in the past decade; 75 per cent of this was paid out via dividends and buybacks.

While the top five Indian IT firms had free cash flows of nearly $13bn in the 2023-24, their R&D investment was a pitiful 0.88 per cent of sales.

6. Finally, what can public policy do to solve some of the scaling challenges? An India Stack for digital payments is unlikely to work for the far more complex area of EHR. Public policy cannot solve market coordination problems (like sharing APIs to allow integration and inter-operability), except in some contexts by defining standards. Public sector driven demand-side channels like Ayushman Bharat can gently force some standards.

The approach of supporting scaling by procuring for use in public systems runs into the problems of punishing public systems with second quality or inferior products and creating perverse incentives among the startups. Providing a small sample of public hospitals does not address the market scaling challenge arising from network effects, besides also creating procurement problems even if the solution is found effective.