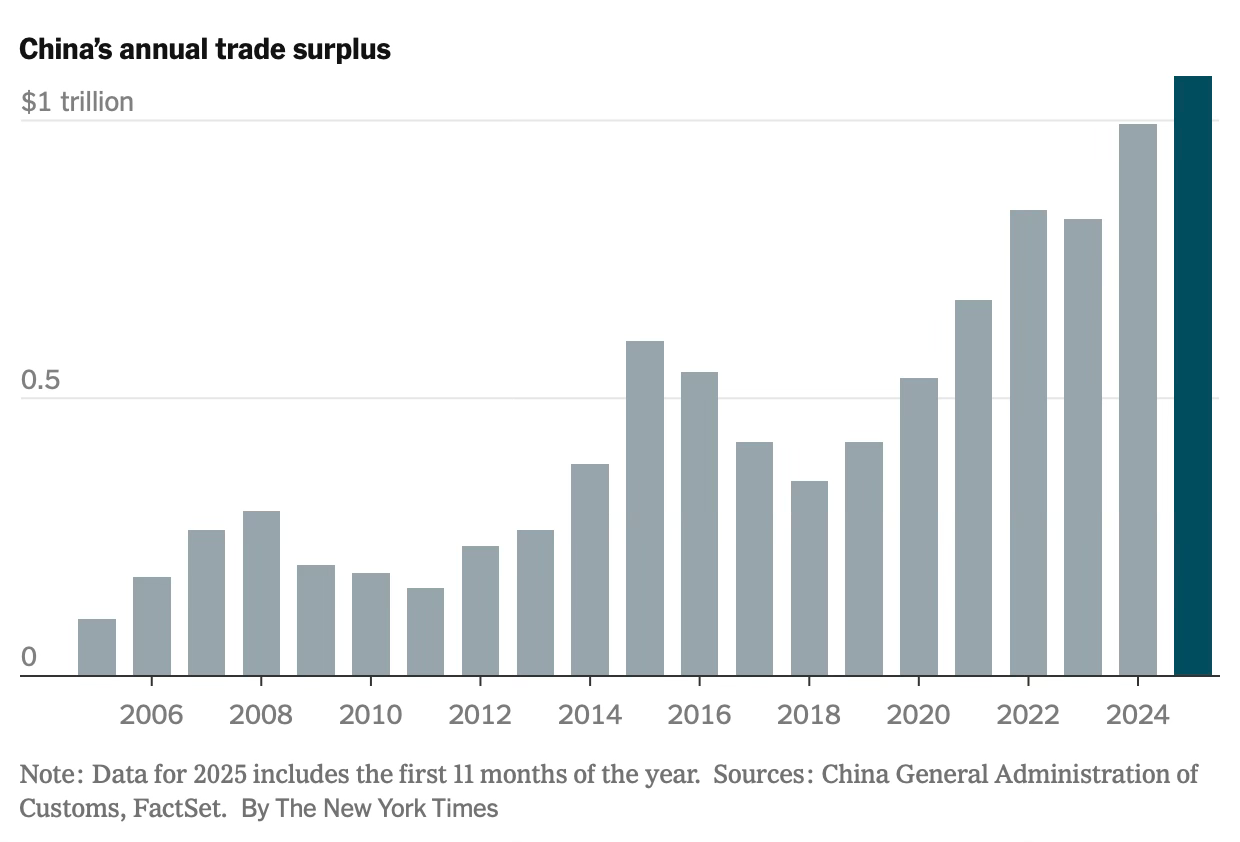

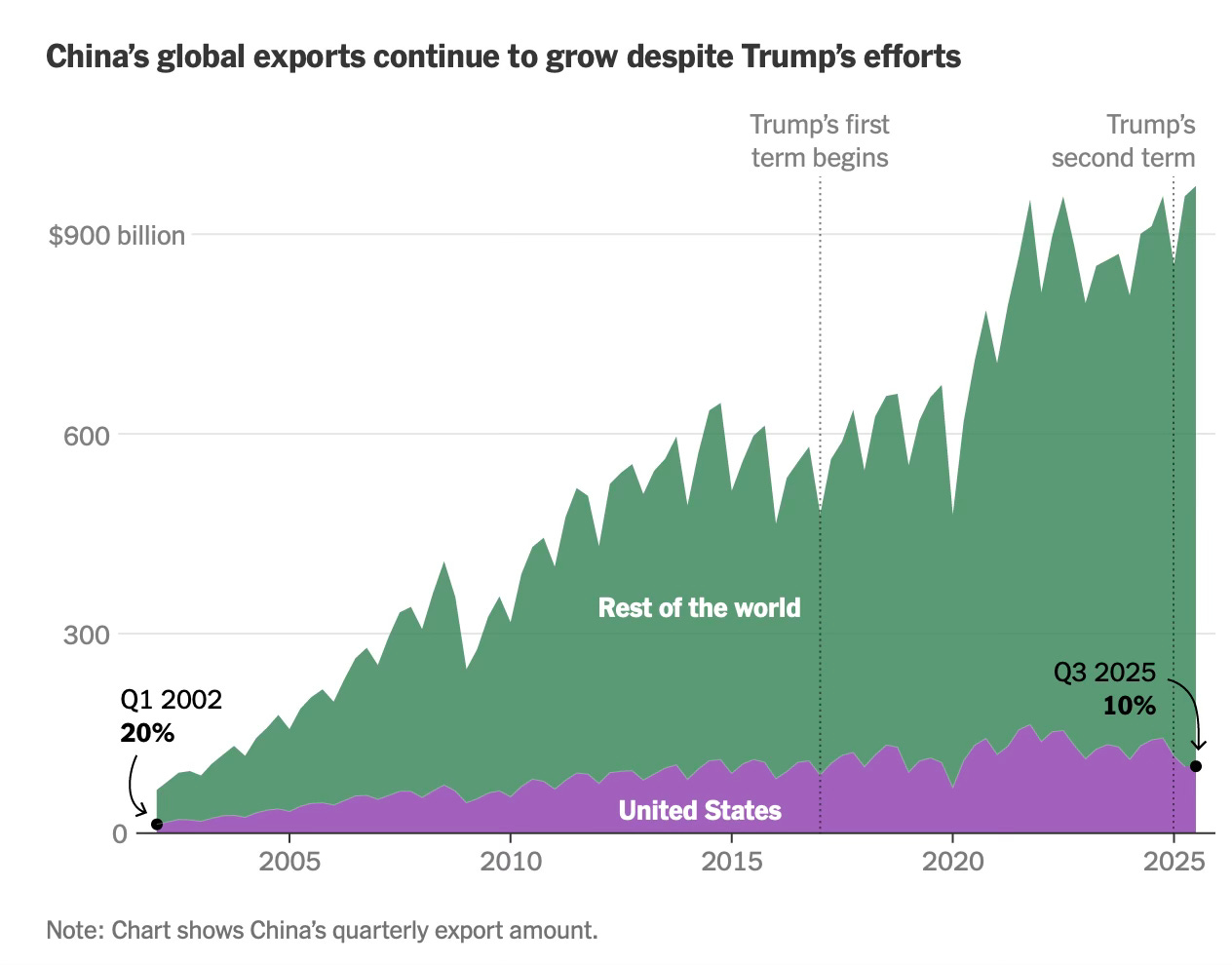

1. Notwithstanding all the trade restrictions, China’s trade surplus continues to surge unabated, topping $ 1 trillion in just 11 months. It reached $1.08 trillion by November, with exports surpassing another record of $3.41 trillion.

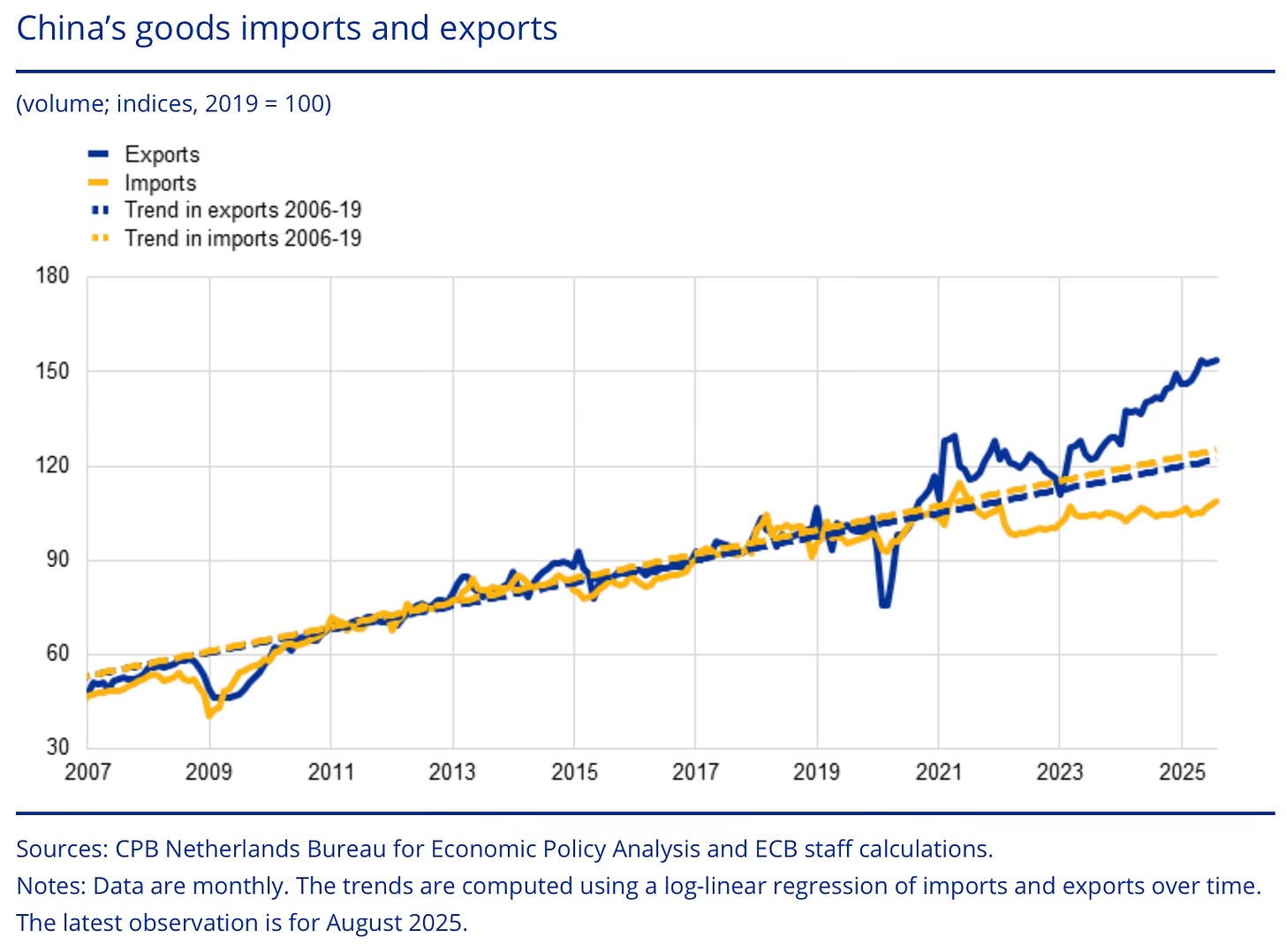

2. This is part of a post-pandemic trend of rising exports and declining imports, which has accelerated since 2023.

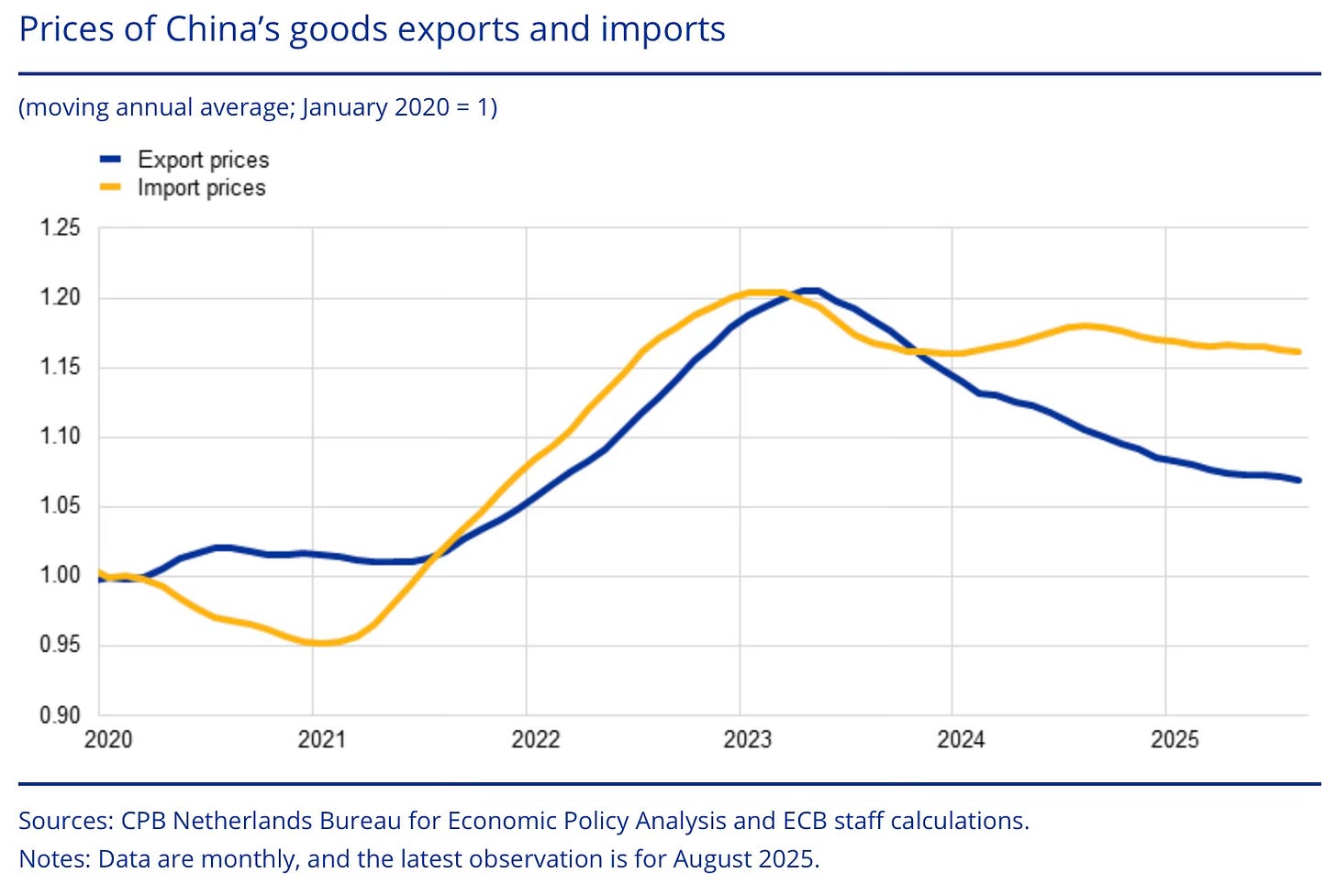

3. The prices of Chinese exports have declined since the beginning of 2023, driven by excess capacity accumulated and price wars, thereby driving export competitiveness and boosting exports. Stagnant domestic demand has further redirected production towards exports while also keeping imports down.

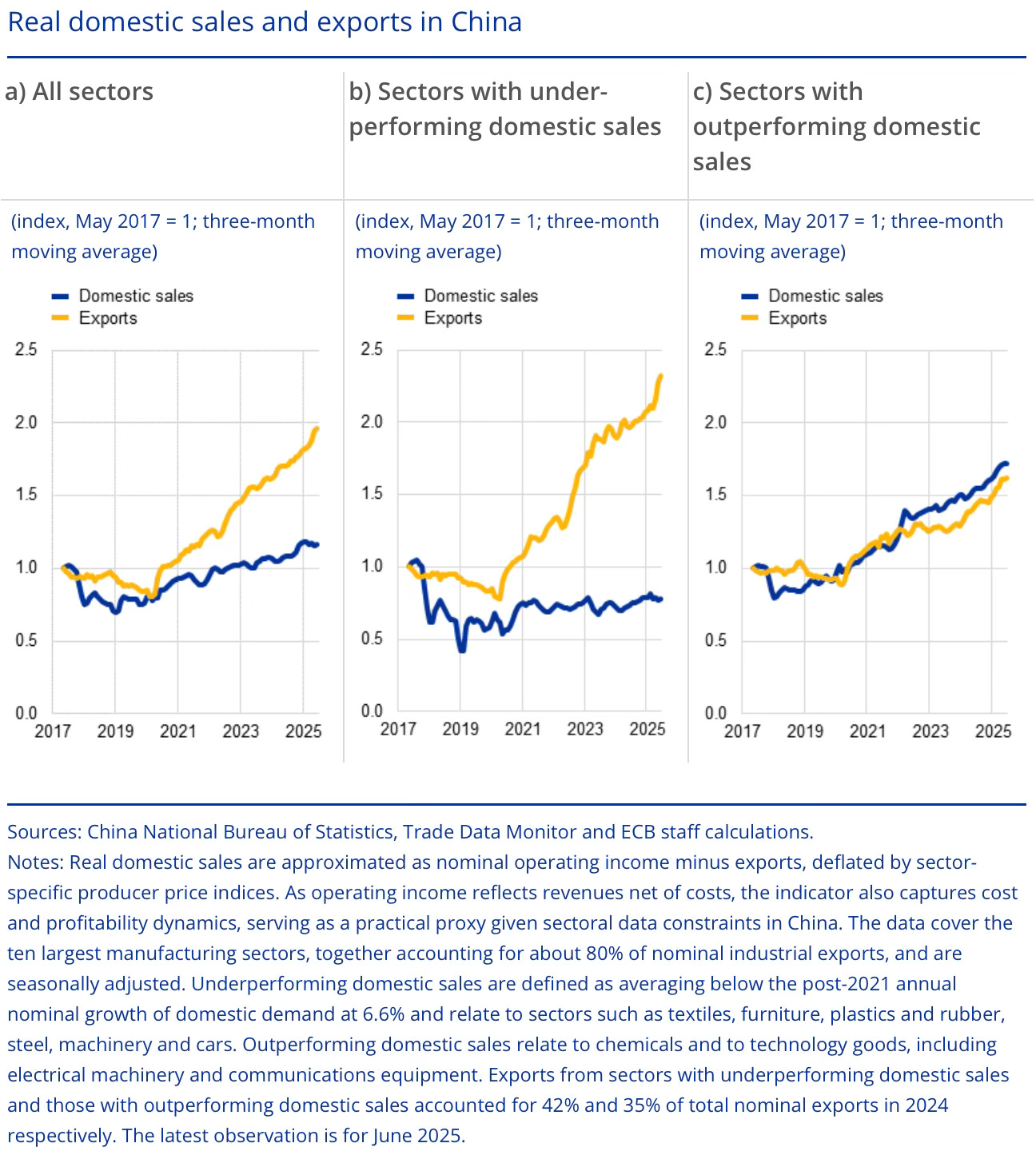

4. Another signature of the export focus comes from the trends in sectors with under-performing domestic sales. In these sectors, exports have surged manifold since the pandemic.

The ECB report from which the above graphics are taken writes,

Excess capacity has led firms into price wars. This has eroded profit margins and discouraged spending in a deflationary environment with significant labour slack – prompting firms to redirect sales toward foreign markets. This shift reflects the “vent-for-surplus” theory of international trade, which posits that a demand-driven decline in domestic sales generates excess capacity that can be redirected abroad… To expand abroad, firms must gain competitiveness in foreign markets. They typically do so by reducing short-run marginal costs and prices, or by accepting narrower profit margins, and in some cases even losses. The “vent-for-surplus” theory helps explain recent trade patterns…

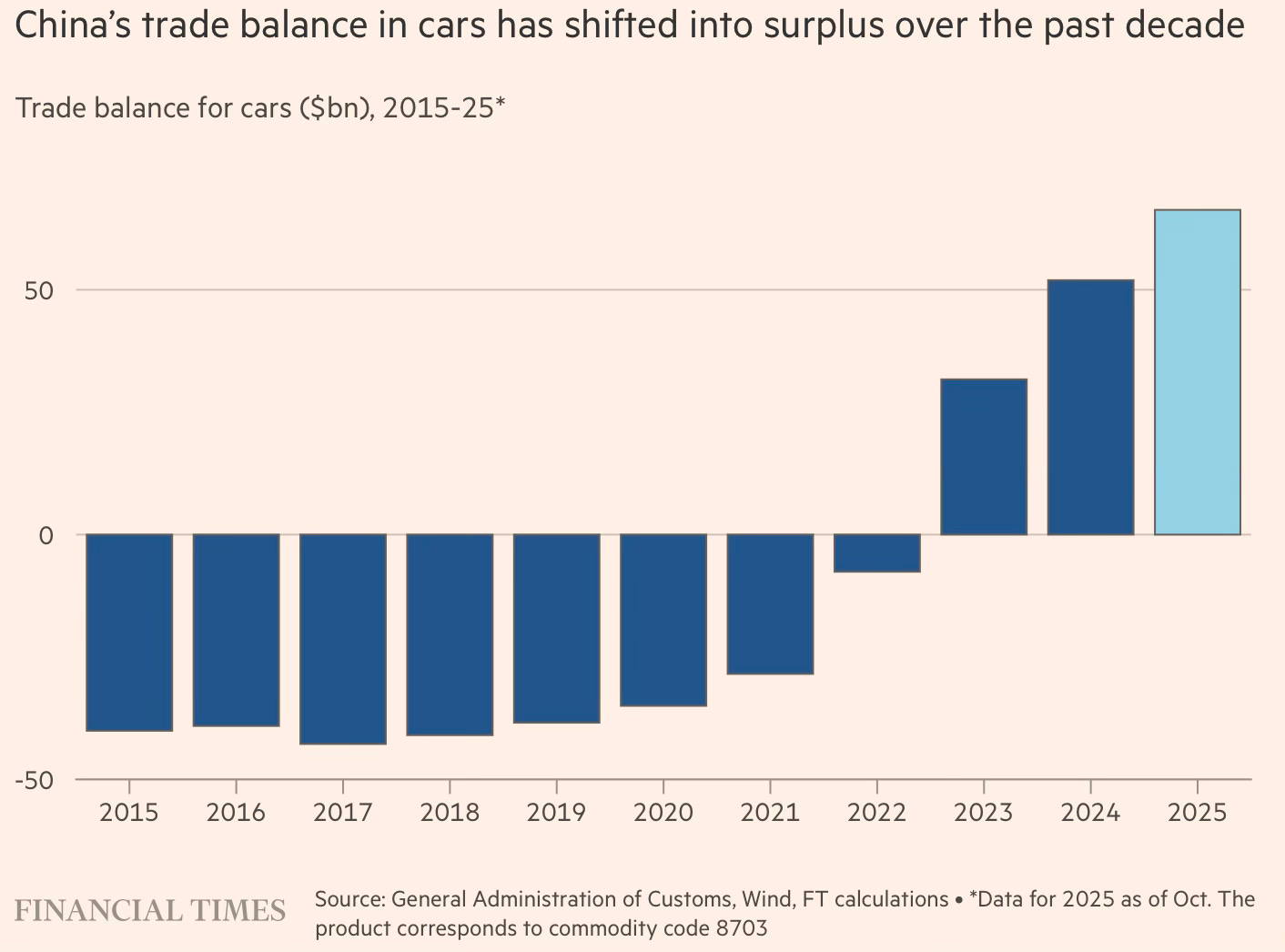

Since 2022 export volumes in sectors such as motor vehicles and steel have risen by about 75%, suggesting that firms have increasingly shifted sales to foreign markets. Domestic absorption of excess capacity through lower prices has been constrained by weak demand, as the housing downturn continues to weigh on consumer confidence. By contrast, in sectors with outperforming domestic sales growth, mainly related to technology goods, export volumes have largely moved in line with domestic sales, rising by about 30% since 2022.

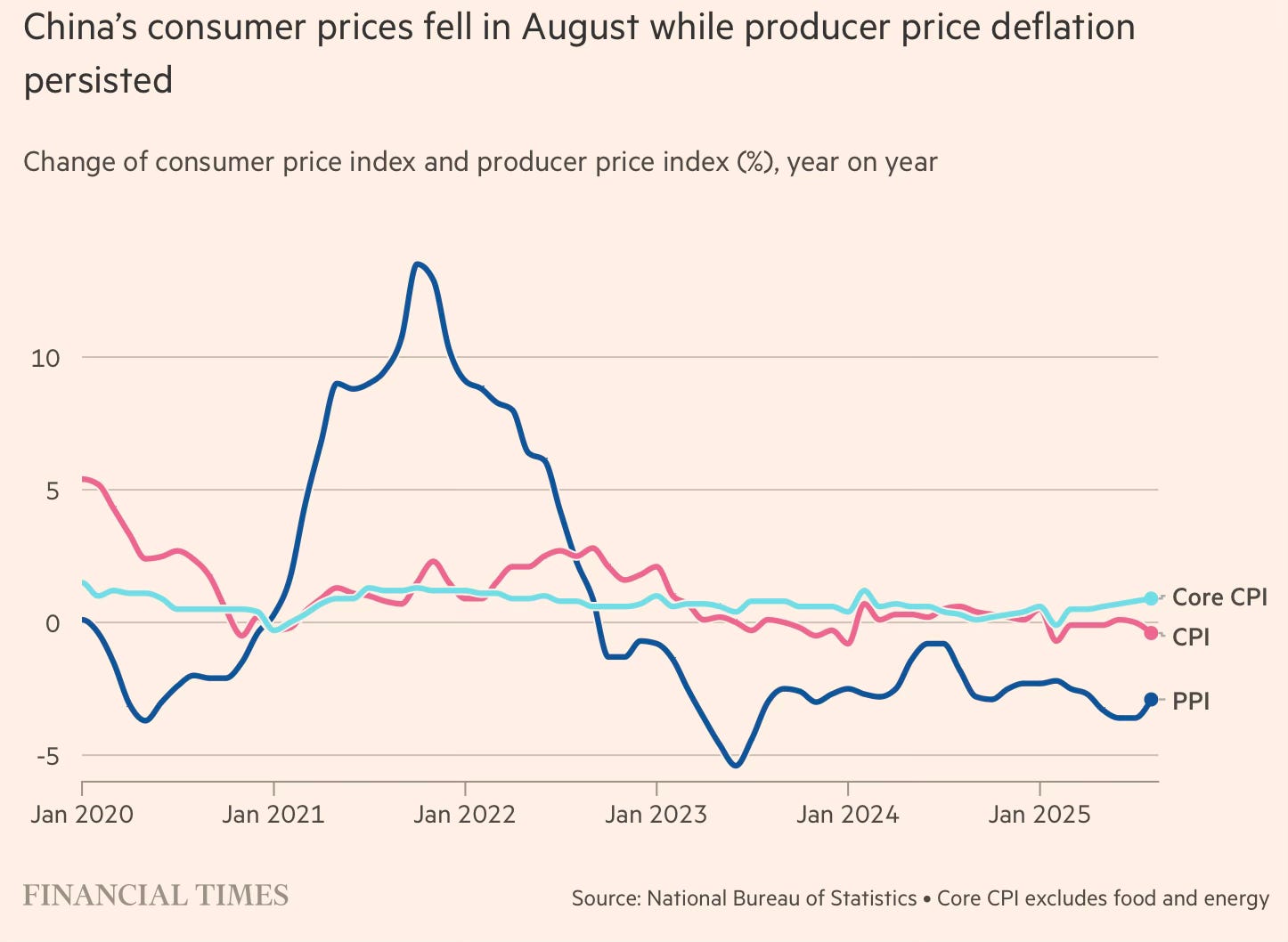

5. In general, the Chinese economy has been in a deflationary environment, with producer prices falling for 38 months now.

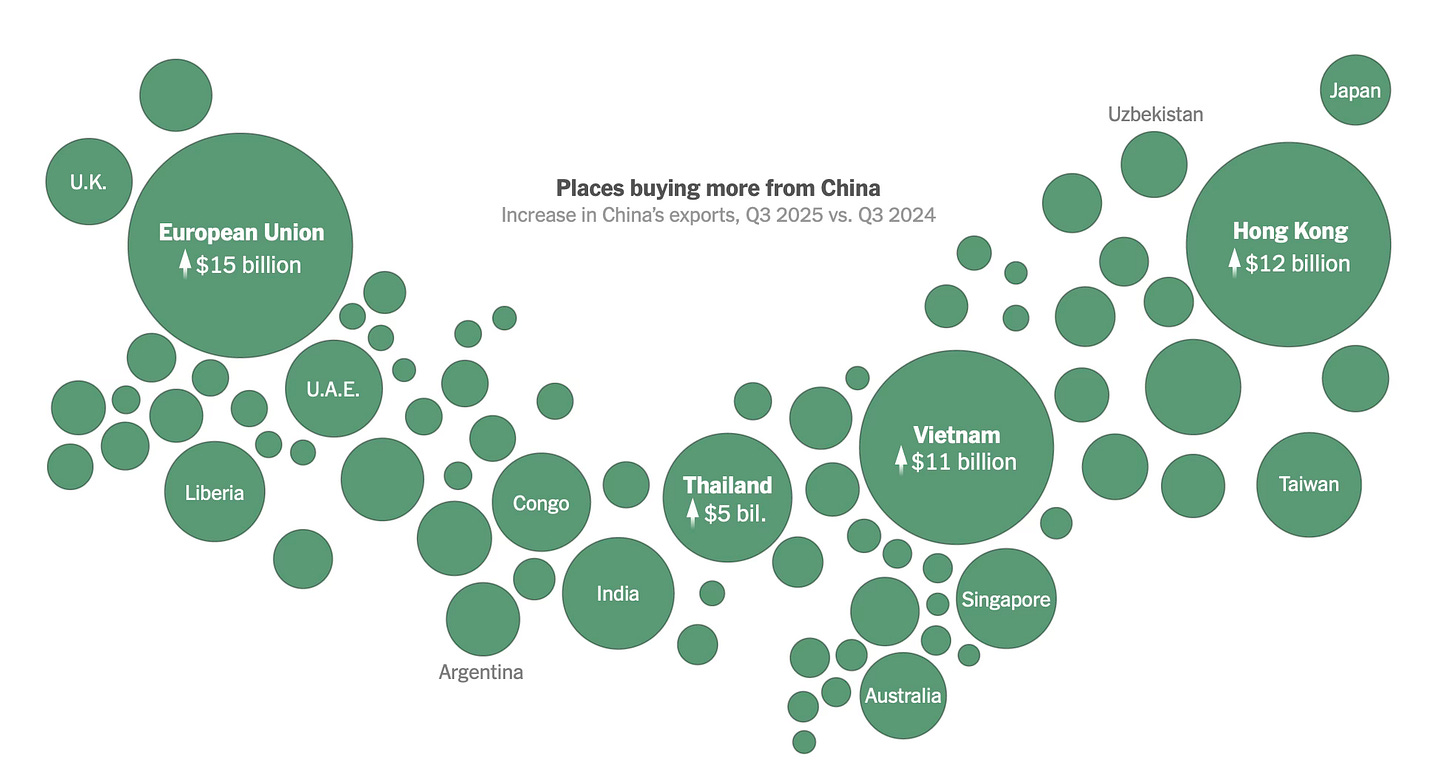

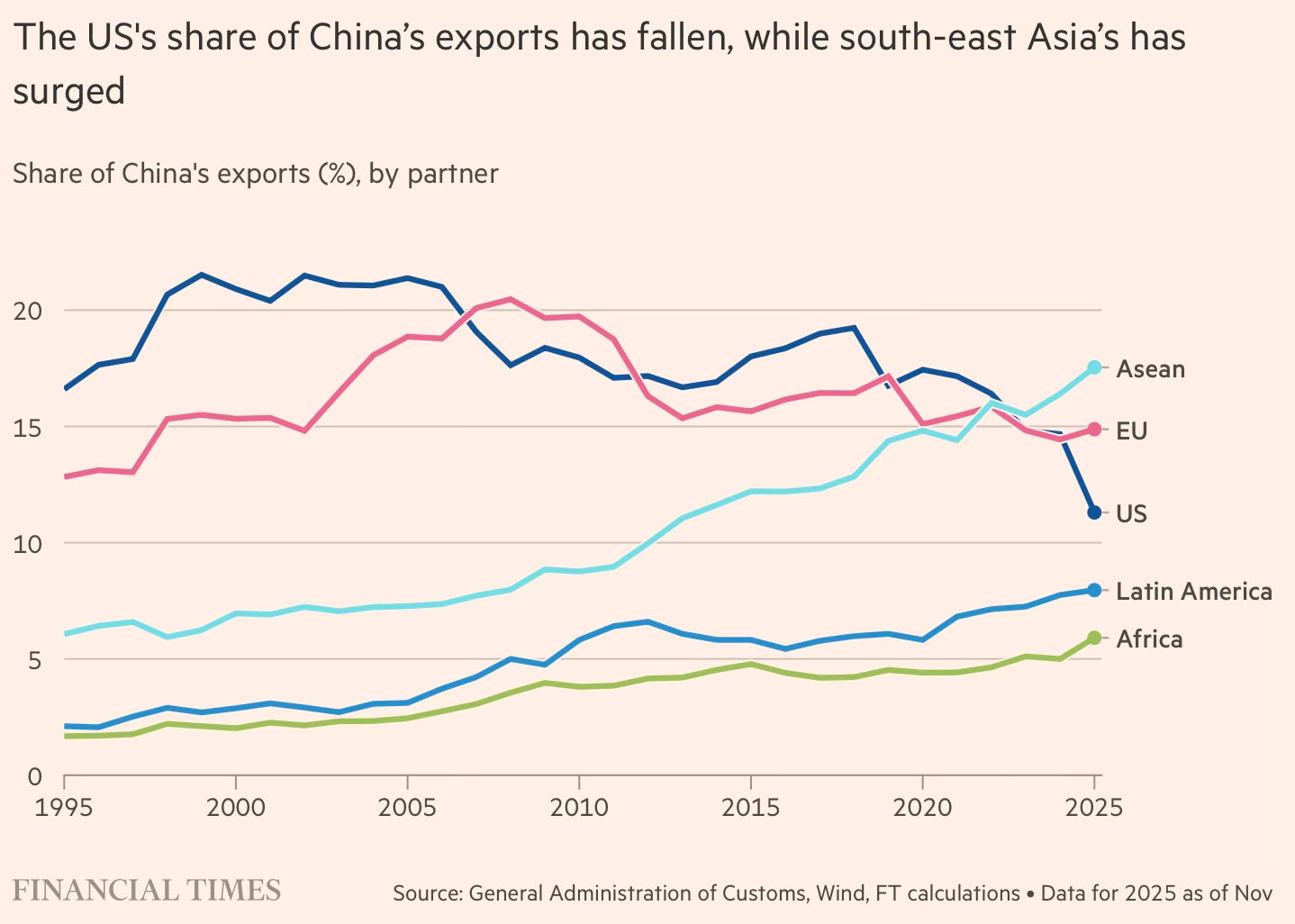

6. While exports to the US have been declining, those to the rest of the world (RoW) have been rising.

7. The Trump 2.0 restrictions appear to be especially effective across the board.

8. The decline in exports to the US has been more than offset by the rise in exports to RoW.

It is most likely that there’s some re-routing of exports to the US through third countries, as evidenced by, for example, the surge in exports to Vietnam and Hong Kong. The extent of such rerouting remains to be seen. Further, in September, Thailand’s exports to the United States rose by 33 percent, Taiwan’s grew by 51 percent, and Singapore’s by 13 percent.

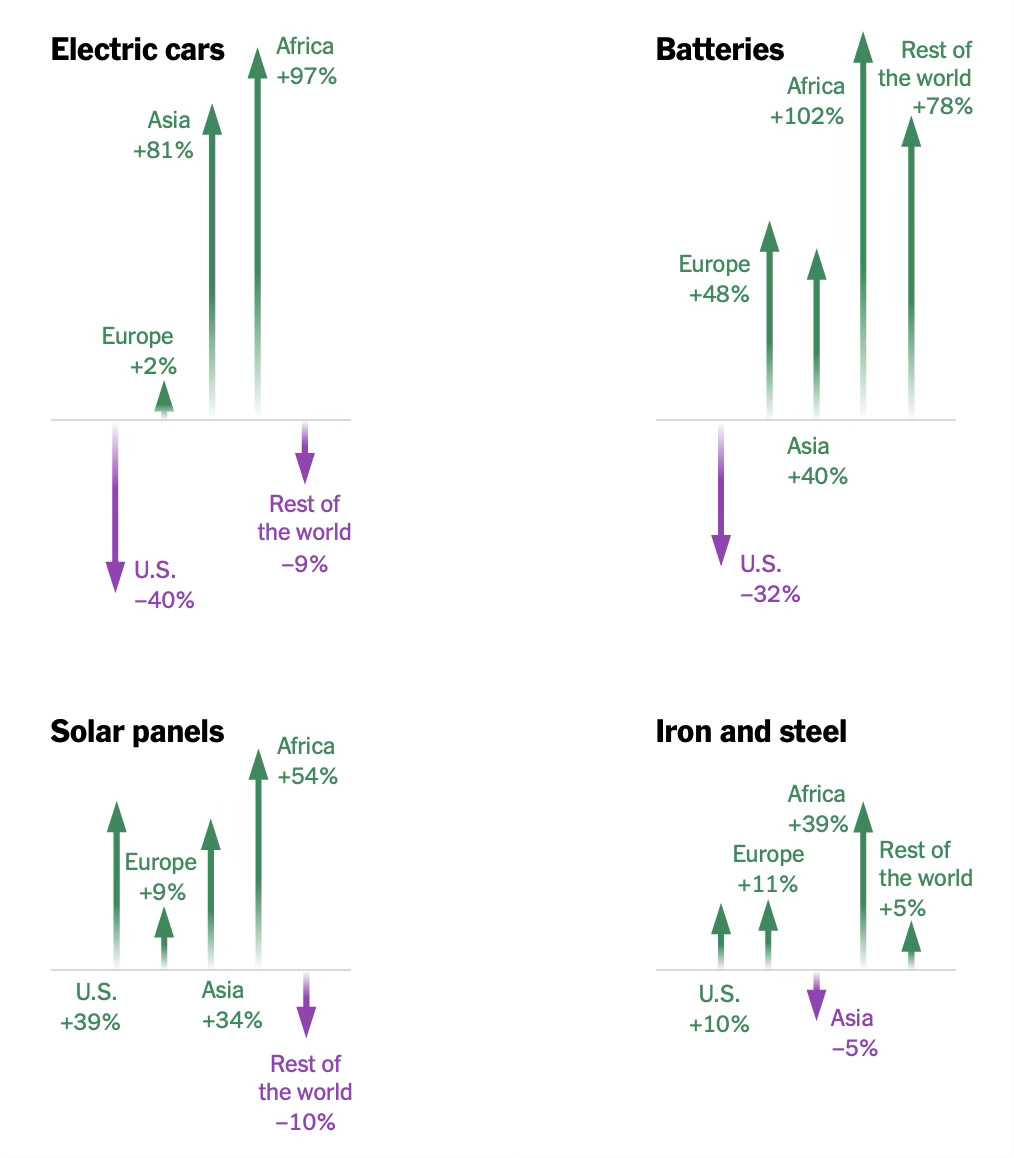

9. EVs, batteries, and solar panels are the major items where there has been a surge in Chinese exports between July and September this year compared with the same period last year, as reported in the China Customs data.

10. The Chinese dominance is not limited to these frontier industries. It covers lower-value-added sectors, where other countries might be considered to have a comparative advantage.

This surge in Chinese exports in these industries is likely to erode the fledgling manufacturing bases in these countries. It would also deprive them of any potential manufacturing opportunities arising from China's move up the value chain and vacating lower-value-added industries.

11. More evidence of the rerouting of exports to the US comes from trends in exports to Southeast Asia. The surplus with the region rose from $191 bn in all of 2024 to $245 bn in the first 11 months of 2025, pointing to likely trans-shipment. Similarly, China’s 11-month surplus with Africa is up $27bn over the full-year 2024 figures.

12. Nothing symbolises the surge in Chinese exports in recent years more than cars, where China’s dominance of EV manufacturing has driven a $64 bn trade surplus in the first 10 months.

The summary. Thanks to generous economy-wide subsidies, aggressive industrial policy, and intense competition between local governments, China has built up excessive domestic manufacturing capacities across sectors, which, coupled with weak domestic demand and the absence of meaningful domestic demand stimulation, leaves firms with no outlet other than exports. And the intense competition among firms has led to price wars and dumping in external markets. The result is a rise in geopolitical tensions and intensification of trade wars, and destruction of manufacturing bases in developing countries.

No comments:

Post a Comment