Business Standard has a sobering news item about India's IT majors choosing to return their profits rather than invest in innovation and R&D. Sample this.

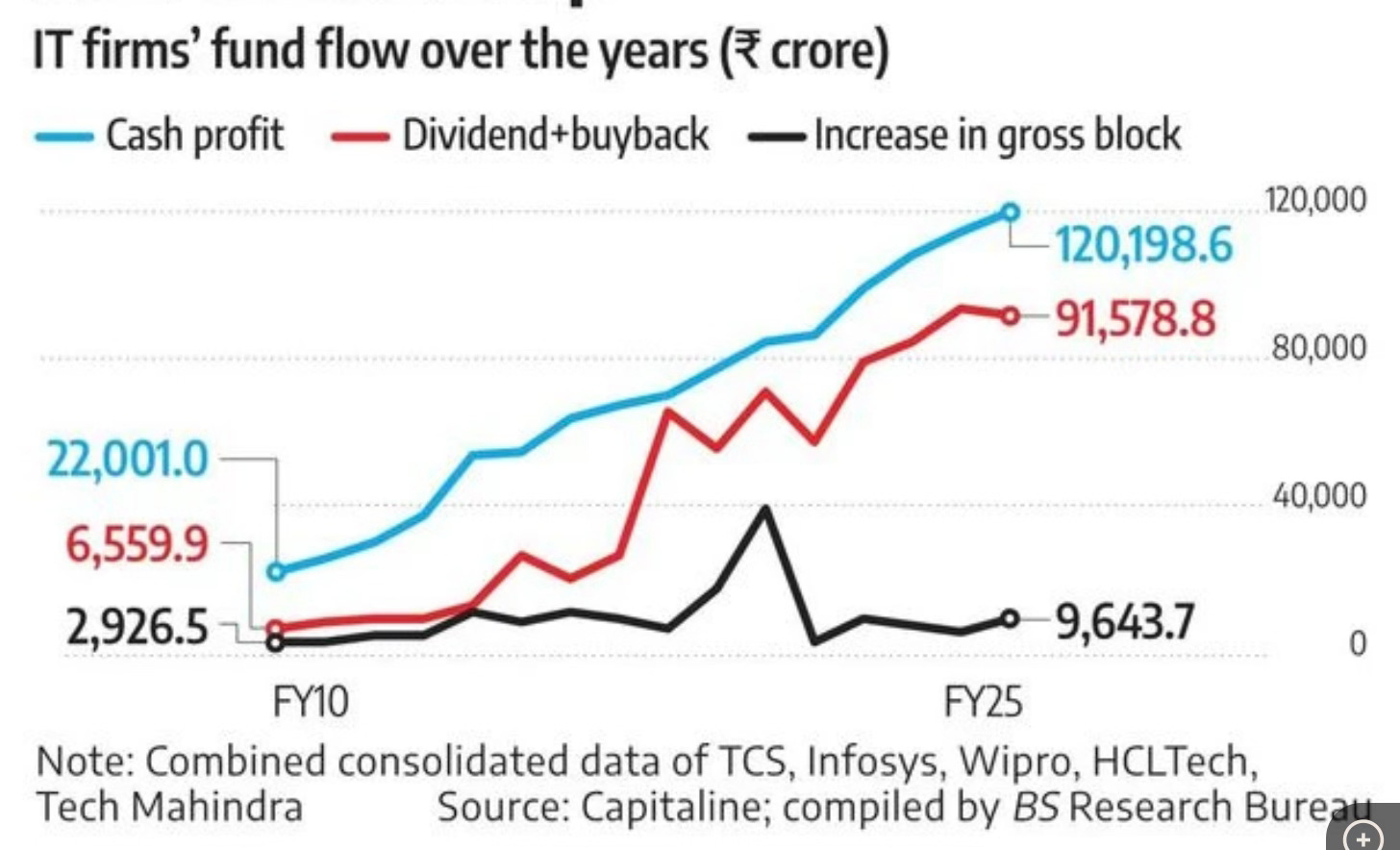

India’s top information- technology (IT) services companies, all cash-rich, have been tightfisted about ploughing back their earnings in new projects or acquisitions and the bulk of the profits have been distributed to shareholders through dividend and share buybacks. In the past 10 years (that is, excluding the current one), the firms have reinvested in growth and expansion only around 13.5 per cent of the cash flow generated from their operations. But, on average, nearly 73 per cent of cash profits have been returned to shareholders by way of dividend and share buybacks. Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies, and Tech Mahindra have cumulatively generated cash profits worth around ₹8.9 trillion since 2015-16 (FY16) but they put only around ₹1.2 trillion in gross block investment in the period... shareholders cumulatively earned around ₹6.46 trillion from these top five companies. In other words, the industry paid ₹5 to their shareholders for every ₹1 reinvested in their businesses...

The numbers suggest the industry accelerated the payout to shareholders in the post-pandemic period while reinvestment and spending on acquisitions slowed. The ratio of investment in gross block to cash profit declined to an average of 6.7 per cent during the period FY21 to FY25 from 22 per cent in the period FY16 to FY20. The ratio of dividend payout (including share buyback) to cash profit jumped, on average, to 76.7 per cent during FY21 to FY25 from 64.1 per cent in the preceding five years (FY16 to FY20). The industry’s apparent lack of investment in new and emerging technologies such as artificial intelligence (AI), either organically or through overseas acquisition, has come under the scanner as individual companies are now struggling to grow.

At a time when FOMO is driving Big Tech in the US and technology firms generally everywhere to pour money into capex, R&D, and acquisitions, in areas like AI and automation, it’s striking that India’s cash-rich software behemoths continue business as usual to avoid R&D and return cash to investors. Even in terms of human resources, the major share of R&D expenses in these industries, none of the Indian IT majors have a research team that can compare with those of even second-rung Western firms in the same industry.

This is all the more surprising since it’s already becoming clear that AI will seriously disrupt the manpower services-based business model that Indian firms have pursued for over four decades.

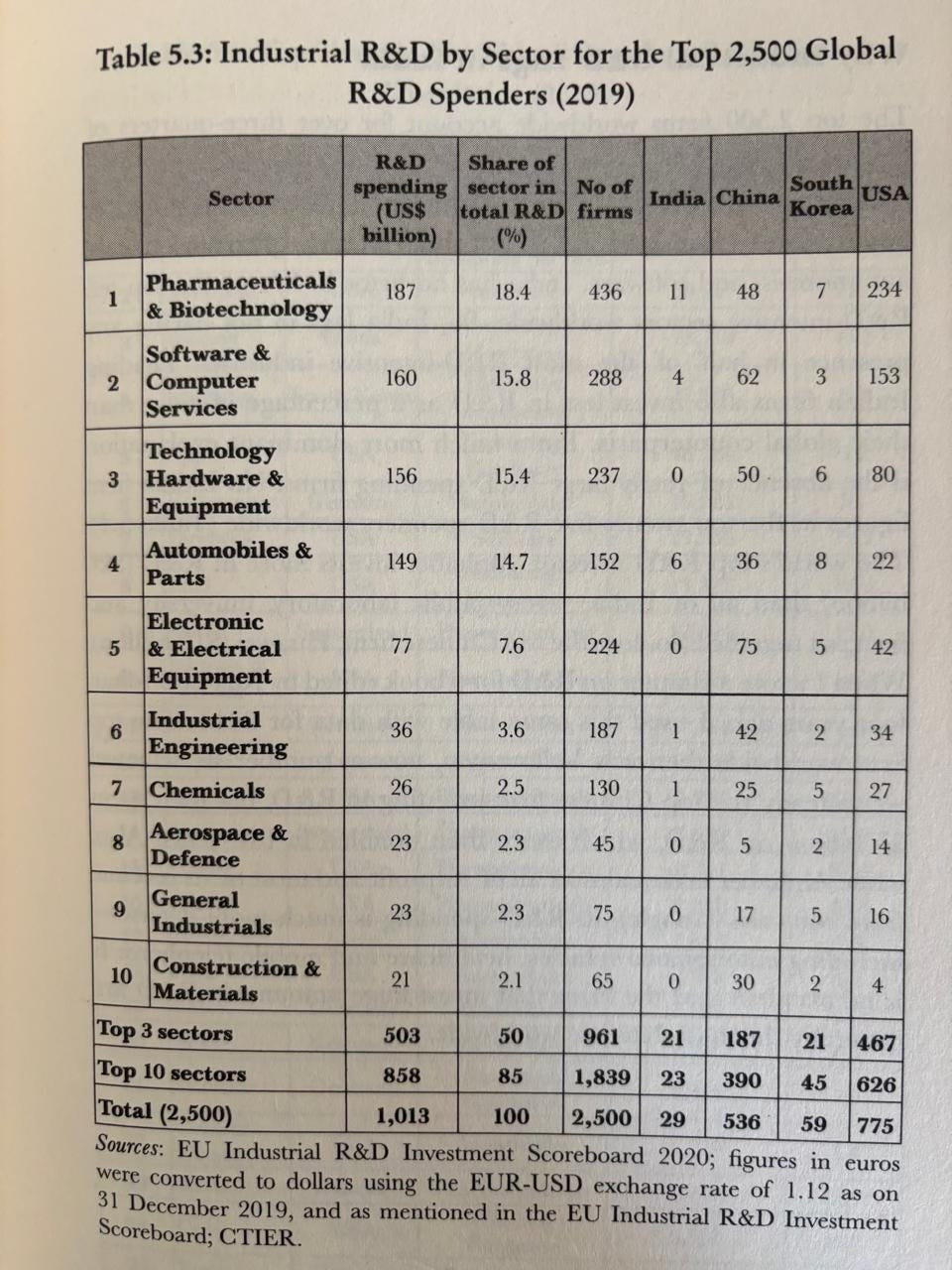

As Naushad Forbes has documented in his excellent book, Struggle and Promise, India’s software industry has long skimped on innovation and R&D. This comparison with the Chinese software industry, a much late entrant, is illuminating.

Compare the software industry in China and India. The top ten companies in China invest over 8% of turnover in R&D; in India, the top ten companies invest 1% in R&D. An obvious explanation is that India’s software companies are software service firms, not product firms. But most Indian software companies are worried about how long the existing model of labour arbitrage, combined with excellence in project execution, can continue to drive growth. No one would consider TCS, Infosys, or Wipro to be either small or unprofitable. They just invest little in R&D.

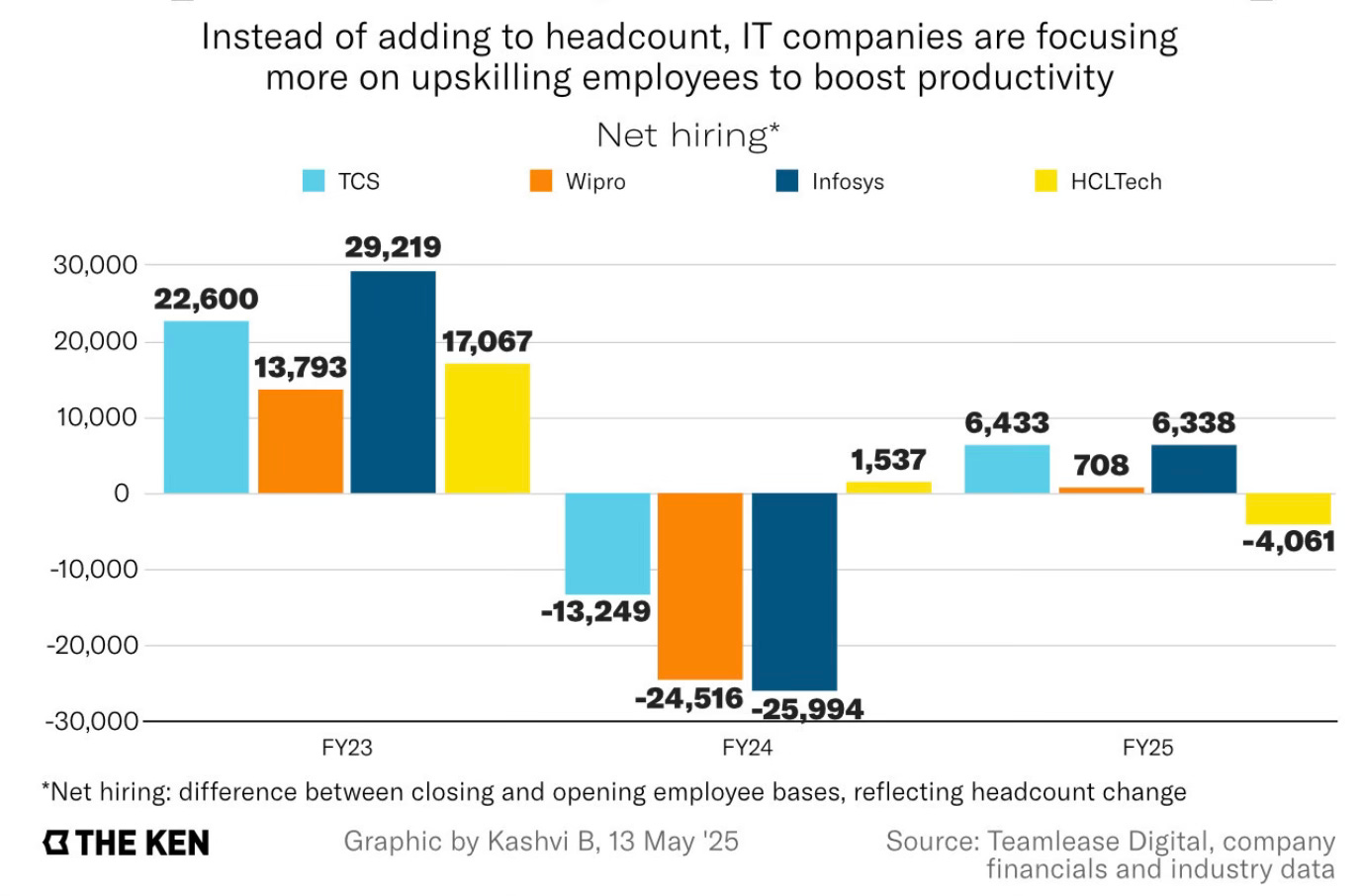

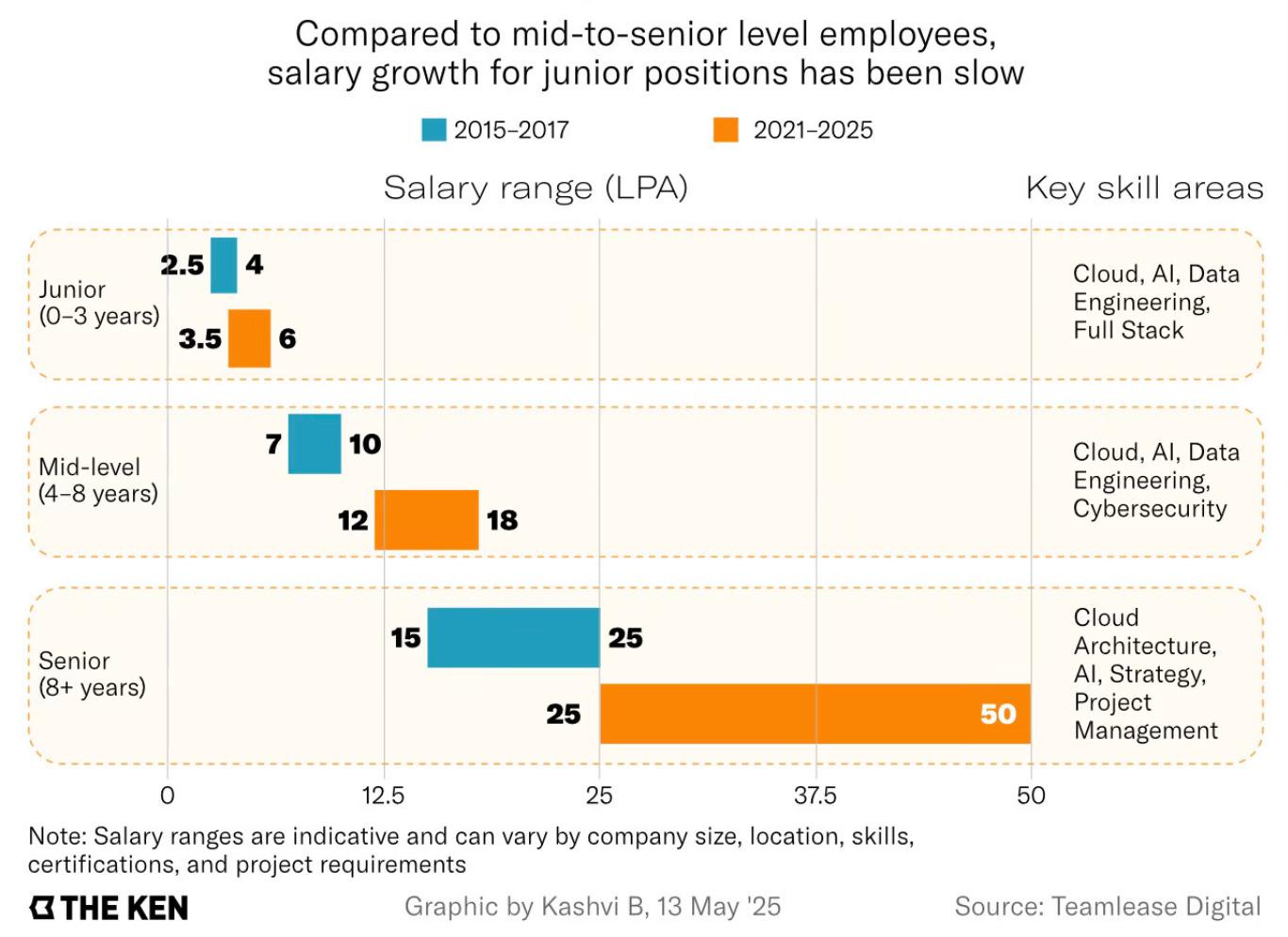

Instead of investing in capex and R&D and gradually shifting towards products and platforms in higher value-added and cutting-edge areas, Indian IT majors appear to be intent on squeezing more out of the existing workforce by laying off, reducing recruitments, and upskilling those remaining.

Between 2021 and 2025, average bench size (workers on payroll but not assigned to any billable projects) has shrunk from 15–20% to less than 10%, according to data from Teamlease. Meanwhile time on the bench has reduced from 45–60 days to 35–45. Companies are also moving from bulk hiring to an on-tap model—which means they’re hiring only the bare minimum required for current projects.

In addition, they have been squeezing salaries at the bottom to remain competitive.

It’s hard not to feel that the Indian IT majors will come to regret their reluctance to innovate and acquire firms to engage at the cutting edge of the industry. It does say something about the preferences and values of an industry that has missed so many opportunities in succession - products, platforms, cloud computing, IoT, data analytics, fintech, robotics, automation, and now AI.

It may not be too inaccurate to suggest that, in terms of the gap between promise and realisation, India’s software industry must count among its biggest economic disappointments. For investors, there’s the real risk that they may not enjoy their dividends and buyback boosts for too long.

As Naushad Forbes has written, in this area, India’s software industry is merely following the footsteps of corporate India in general.

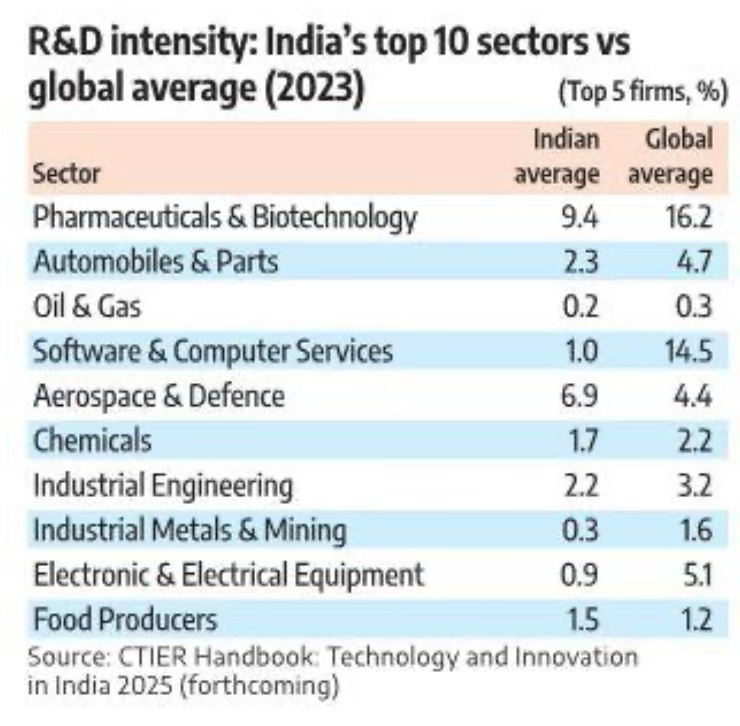

The top 2,500 firms worldwide account for over three-quarters of global industrial R&D spending… of 29 Indian firms (to 536 Chinese firms and 59 South Korean firms), 21 are in just three sectors – pharmaceuticals, automobiles, and software. India has no firms in five of the top ten R&D-intensive sectors worldwide… Leading Indian firms also invest less in R&D as a percentage of sales than their global counterparts… No Indian firm figures in the top 25 R&D spenders worldwide. The world’s top R&D investor, Alphabet invests more in R&D ($26 billion) than all of India – every public laboratory, university, and firm put together. So does the top Chinese firm, Huawei ($19 billion)… And China is constantly widening the gap – from 301 firms in the top 2,5000 R&D investors worldwide in 2014 to 536 firms by 2019. India, meanwhile, increased the number of its firms from 26 to 29… It is no accident that the firms that invest huge amounts in R&D are generally the most dynamic worldwide… China’s manufacturing sector is today ten times that of India’s ($3.9 trillion to India’s $400 billion). But Chinese firms today invest over 25 times what Indian firms do ($225 billion in R&D to Indian firms’ $7 billion)… in our two most R&D-intensive sectors of pharmaceuticals and auto, where our firms invest roughly half as much as a percentage of sales as the global leaders.

In a recent oped, he pointed to the low R&D intensity of even the top Indian firms.

We invest 0.3 per cent of gross domestic product (GDP) in in-house R&D to a world average of 1.5 per cent. Our 10 most successful non-financial firms (highly profitable firms in refining, information technology services and consumer goods) invest 2 per cent of profit in R&D; whereas their 10 most successful peers in the United States, China, Japan and Germany invest between 29 and 55 per cent. And Indian firms are completely missing in five of the 10 most technology-intensive industrial sectors worldwide… our top five firms in six sectors — pharmaceuticals, chemicals, autos, defence, industrial engineering and food — on average have an R&D intensity that is above half of global levels.

I have blogged here and here about the problem of weak R&D and innovation culture in corporate India.

No comments:

Post a Comment