As of 2024, there were about 1,800 offshore corporate offices in India, owned by hundreds of foreign-based multinational companies — most of them American. There are 1.9 million people in India working for foreign companies, with 600,000 to 900,000 more expected to join them by 2030. Together, the offshore business centers in India earned about $65 billion last year, more than the value of American imports to India. By 2030, they are expected to earn $100 billion or more... Across India, these foreign-owned offices are now the primary driver of commercial real estate. An estimated 50 new ones were established over the past year. The expectation is that 100 more will join them during 2025... these offshore subsidiaries are no longer providing only low-value services. They are full-fledged branches of American headquarters, not just outposts, let alone temporary offices that provide outsourcing for information technology services. In fact, that sector announced a reduction of 64,000 jobs in 2024...While salaries have gone up over the years, they are still about a quarter to a third of their dollar-adjusted equivalent in the United States. Managers of these offices, known as global capability centers, acknowledged the savings, but they said multinational companies were just as drawn to the quality and abundance of potential Indian workers. “Where else can you scale up with 2,000 engineers, or marketing professionals, within a year?” exclaimed one executive, who asked not to be named because he was not authorized to speak publicly.

5. Automobile trade with the US

For Japan and South Korea, automobiles are the top export to the United States. Mexico, in addition to cars, produces tens of billions of dollars worth of automobile parts each year that are exported to its northern neighbor. In Canada, auto manufacturing and auto parts are the country’s second-biggest export by value... In recent years, Japanese and South Korean automakers, as well as European brands — which account for 18 percent of U.S. car imports — have become increasingly reliant on the American market. That is in part because of stagnant demand in their home countries, but also because they are facing heightened competition from local competitors in the world’s biggest car market, China... Japanese brands shipped 1.37 million vehicles to the United States last year, while South Korean automakers exported 1.43 million. In addition, 821,000 light vehicles sold in the United States last year were assembled in the European Union, according to JATO, a research firm. Conversely, U.S. automakers have a minimal presence in Japan, South Korea and Germany — a reality that has vexed Mr. Trump since his first term as president.

6. In six years, China's trade surplus has nearly tripled!

7. Grim assessment of the development aid scenario

Not only has the US shut down USAID and the UK slashed development aid, but there have also been cuts to the French, Belgian and Dutch budgets. The latest warnings come from Berlin, where the new coalition has put the development budget on the chopping block. In a worst-case scenario, global aid budgets could be slashed by a staggering $74bn in 2025 alone. That would be 30 per cent or so of total overseas development assistance, or ODA.

8. Gautam Mukunda makes a very good case for freedom on expression in academic campuses.

But why can’t universities innovate while getting rid of that irritating tendency to annoy and even offend... They provide a home for people too contrarian, difficult or just downright odd to function in the rest of society. Colleges welcome people who reject the mainstream consensus. They’ve even created structures like tenure to protect and encourage those people. There’s good reason to do so. The most important discoveries are the ones that tell us that something important that we thought we knew is wrong. Most research is what the great philosopher of science Thomas Kuhn called “normal science.” It works within established paradigms. That’s valuable work. Doing it well is rewarded with the esteem of your peers. Revolutionary research, in contrast, overturns old paradigms. It destroys accepted consensus. That’s hard. People, even scientists, tend to react poorly when someone tells them they’re wrong, and they often reject the ones who do it.

9. The length of tasks AI is doing is doubling every seven months.

It finds that LLMs’ ability to perform a given task is a function not so much of how intellectually challenging the same job would be for you or me, nor of the level of specialist skill required, but of how long it would take a human and how “messy” or unstructured the workflow. So carrying out the duties of an executive assistant, travel agent or bookkeeping clerk — all computer-based jobs requiring entry-level skills — is still beyond the capabilities of even cutting-edge AIs. They struggle to keep track of multiple streams of information, respond to a dynamic environment, work with unclear or changing goals and multitask. These unstructured workflows are a far cry from coding tests and essay questions.

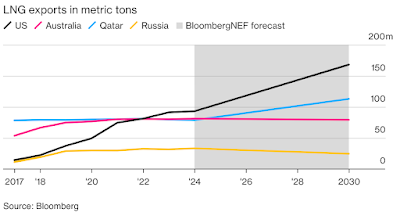

10. Amidst all the credentially and virtue signalling on climate change, America continues its commitment to fossil fuels. In the last few years, it has not only emerged as the largest oil producer, but now has become the largest LNG exporter.

Twenty years ago, the idea that natural gas would play an even more important role than crude oil in US diplomatic calculations would have been preposterous. At the turn of the millennium, the US was short of gas. It generated less than 15% of the country’s power, outflanked by nuclear and coal, and Federal Reserve Chairman Alan Greenspan called for a major expansion of imports to address the shortfall in domestic supply. Horizontal drilling and hydraulic fracturing, or fracking, which picked up in the early aughts, changed all that. The two techniques unlocked previously inaccessible oil and gas reserves from North Dakota to New Mexico. The US more than doubled its natural gas production, to more than 100 billion cubic feet per day, and it now fuels 41% of the country’s electricity... US natural gas prices have averaged $3.55 per million British thermal units over the past five years, about 70% lower than the European average, providing the economy with a major competitive advantage and helping to underpin both Biden and Trump’s policies to bring US manufacturing back from overseas.

11. Affordable housing crisis in Spain.

Since 2015, nearly one-tenth of the country’s housing stock has been plucked by investors or converted to tourist rentals. The scarcity has helped drive up prices much faster than wages, making affordable homes out of reach for many... The problem is complex, perhaps no more so than in Barcelona, which has become ground zero for Spain’s housing dilemma — and a crucible for the challenges of trying to fix it... Barcelona’s woes mirror the pain lashing European cities: Residential real estate has increasingly been turned into financial assets by investors. A surge in global tourism and workers crossing borders has landlords favoring short-term rentals over protected long-term tenants...The affordability problem has become one of the biggest drivers of inequality in Europe. Rents in the European Union rose 20 percent in 10 years, and house prices have surged by half, according to Eurostat. In 2023, one in 10 Europeans spent 40 percent or more of his or her income on housing... But rental prices have increased 57 percent in the country since 2015 and home prices 47 percent, while household income has grown just 33 percent, according to PwC. In Barcelona alone, rents surged 68 percent in a decade... Barcelona will become the first European city to end licenses for Airbnb homes, requiring owners by 2028 to offer them as long-term lodging at capped rents or put them up for sale.

India’s exports of merchandise and services from $465.9 billion in 2013-14... to be around $780 billion and their share in global exports around 2.8 per cent. In 11 years, that is a compounded aggregate growth rate of 4.79 per cent... The merchandise exports in 2019-20 were lower at $313.361 billion compared to $314.405 billion in 2013-14... This financial year merchandise exports are likely to be around $435 billion, which means a CAGR of 3.1 per cent in 11 years. Our share in global merchandise exports remains around 1.8 per cent... The services exports grew from $167 billion in 2013-14 to only around $206 billion in 2020-21, a CAGR of 3.04 per cent. Thereafter... the services exports have grown smartly and in FY25, it is expected to be around $380 billion, a CAGR of about 7.76 per cent over 11 years. Our share in global exports of services has also gone up to about 4.3 per cent. In 2013-14, our goods imports were about $450 billion. This financial year, total imports are likely to be around $855 billion, a CAGR of about 6.01 per cent over 11 years. Since 2014, our average industrial tariffs have gone up from about 13 per cent to about 18 per cent.

13. Long read on Tamil Nadu's success with attracting non-leather footwear contract manufacturers to invest in the state. Today all the major global contract manufacturers - Feng Tay, Pou Chan, Hong Fu, Shoe Town, and Dean Shoes (all Taiwanese) - have established factories in the state.

Feng Tay Enterprises, one of the largest contract manufacturers for Nike, which had entered Tamil Nadu in 2006 with a factory at Cheyyar (northern Tamil Nadu), has recently expanded its operations by setting up factories at Bargur in Krishnagiri district and at Tindivanam (northern Tamil Nadu). Feng Tay employs over 37,000 workers and is estimated to produce about 25 million pairs of footwear annually.

14. The supply-driven solar contracting by SECI is engendering perverse incentives.

India issued a record 73 GW of renewable energy (RE) tenders in 2024, far exceeding its annual target of 50 GW. But, 8.5 GW of capacity was under-subscribed, five times higher than the previous year, said a report from the Institute of Energy Economics and Financial Analysis (IEEFA), released earlier this month. Worryingly, the cumulative unsigned power sale agreement (PSA) capacity now exceeds 40 GW. This means while companies are willing to set up renewable energy (RE) projects, there aren’t enough buyers. Another report by the Delhi-based Centre for Science and Environment (CSE), released in January, underlined the sluggish pace of commissioning of RE projects. For 34.5 GW of solar, wind, and hybrid projects, power purchase agreements (PPA) have been signed but projects are yet to be commissioned. PPA’s are signed between project developers, or companies which produce solar power, and agencies which issue tenders like the Solar Energy Corporation of India (SECI). This implies a lack of interest from state-owned discoms to purchase renewable power.

As I have written earlier, it may be time to wind down SECI, or at the least restrict it from solar and focus on green hydrogen and the likes.

15. DMart is the most efficient grocery retailer in the world!

India’s textile and apparel (T&A) exports have grown steadily from $11.5 billion in FY2001 to $34.8 billion in FY24, accounting for only a 4 per cent share in global exports of $774.4 billion... The apparel segment (HSN codes 61 and 62) within overall T&A exports comprises about 42 per cent. It rose from $5.5 billion in FY2001 to $14.5 billion in FY24. Its share in global apparel exports has remained stubbornly around 3 per cent over this entire period. Meanwhile, competitors like Bangladesh and Vietnam have surged ahead. Bangladesh’s global share has grown from 2.2 per cent to 9.6 per cent, while Vietnam’s share jumped from 1 per cent to 5.8 per cent between 2000 and 2023 (see infographics). A significant portion of this shift occurred post-2010 when China’s global market share slipped from 34.8 per cent to 29.8 per cent, partly due to its trade war with the US.

Here are some striking facts about its declining cotton production and how India became a net cotton importer.

Between 2002-03 and 2013-14, India’s cotton production almost trebled from 13.6 million to 39.8 million bales (mb; 1 bale=170 kg). During the three marketing years (October-September) ended 2002-03, its average imports of 2.2 mb exceeded exports of not even 0.1 mb. That completely changed in the three years ended 2013-14, with imports halving to 1.1 mb and exports surging well over hundredfold to 11.6 mb. Cut to 2024-25, when India’s output is projected at 29.5 mb, the lowest since the 29 mb of 2008-09. Also, imports at 3 mb would surpass exports of 1.7 mb. In short, we are back to being a net importer of the natural fibre. A country that had turned the world’s no 1 producer in 2015-16 and a close second biggest exporter to the US by 2011-12 has today been “inundated” by American, Australian, Egyptian and Brazilian cottons... India’s cotton production has been on a downward slope from the peaks scaled in 2013-14, falling to an average of 33.8 mb during the last five years and below 30 mb in 2024-25. National lint yields, too, have plunged to sub-450 kg per hectare.

The reason is the reluctance of successive governments to adopt genetically modified cotton.

No comments:

Post a Comment