I blogged here with a set of proposals to address India’s recurrent power sector bailouts. But the post did not directly explain the causes for the recurrence of the problem. This post will seek to offer an explanation.

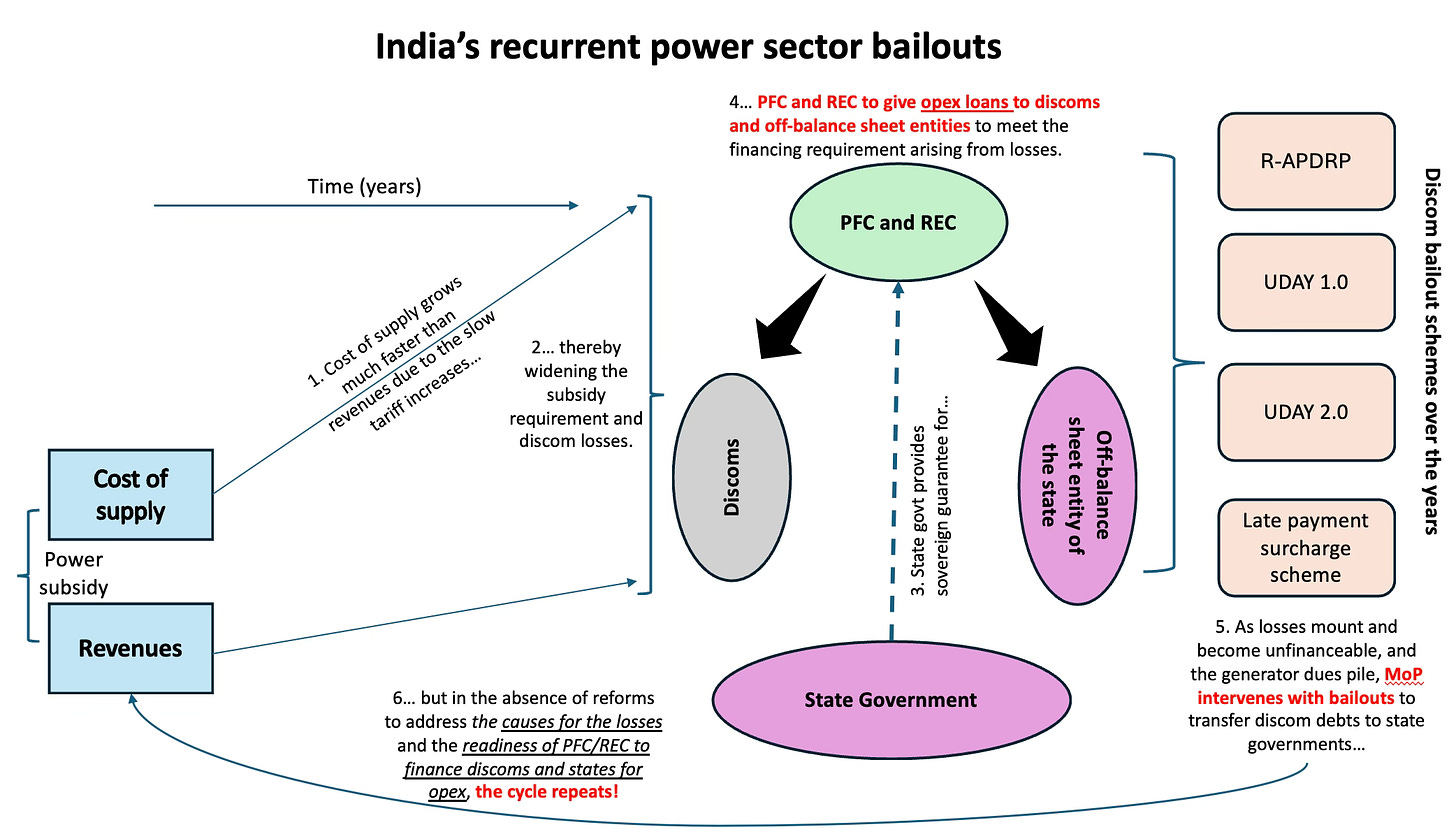

The graphic below captures the life-cycle of debt accumulation by the electricity distribution companies (discoms) that lead to central government bailouts and their mechanism.

There are two fundamental problems that contributes to its recurrence:

1. Even after the slate is wiped clean with a bailout, the tariff increases continue to lag behind the rising cost of supply. This is because the AT&C and other unprovisioned losses (as explained in the earlier post) accumulate again on the discoms’ balance sheet.

2. The two power sector development finance institutions, Power Finance Corporation (PFC) and Rural Electrification Corporation (REC), provide opex loans to the discoms and state government off-balance sheet entities to finance the rising losses.

While the first is a state-level political economy problem, the second is a central-level political economy problem. Just as state governments cannot constantly raise tariffs to keep up with the cost of supply, the central government cannot avoid the pressures from (private) generators to offer these bailouts.

How can this gridlock be broken?

If the banking regulator, RBI, can tighten the oversight of PFC/REC and prohibit opex loans, then addressing the second problem might be a slightly less difficult challenge than addressing the first. This would force the state governments to support the discom losses directly from the budget. And given the scale of opex funding that keeps alive the discoms and states (till the next bailout), this strain on the budget will get quickly exposed and likely force the kind of hard decisions that are required.

However, complicating matters, PFC and REC's exposure to these same captive government borrowers is such that it's not possible to suddenly shut credit taps without very badly damaging themselves. Therefore, there’s a need to calibrate any such phase down.

In any case, given the complex nature of the political economy surrounding power tariffs and free farm power, this might perhaps be the only policy response to address the problem of recurrent power sector bailouts in India.

No comments:

Post a Comment