There is background excitement around the introduction, in January, of an expanded tax-protected investment scheme (structured much like a UK Isa and known as Nisa) and its capacity to draw into the Tokyo stock market some of the $7tn that Japanese households currently hold in cash. The so-called “Mrs Watanabes” — a moniker given to stereotypical keepers of the family purse strings — are generally conservative, but deflation has made them more so... That hoard of cash and deposits represents more than half of the households’ total financial assets, and is a far higher ratio than their peers in the US, UK and Europe, and than the worldwide average of 28.6 per cent. For a country that has accumulated such vast household financial assets — ¥2.1 quadrillion at the end of June 2023 — it is remarkable how little has flowed into the stock market...

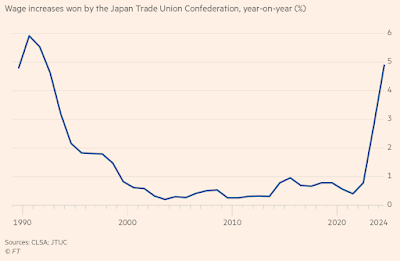

Inflation is back... wage increases in 2024 have been the largest in 33 years and the prospect of them rising even higher are guaranteed by the fact that every single industrial sector in Japan is now short of labour... Japanese investment trusts, pension funds and insurance companies, said Smith, hold respectively 26.9 per cent, 9.1 per cent and 6.1 per cent of their portfolios in equity. That compares with 61 per cent, 28.1 per cent and 11.1 per cent by their US equivalents. Over the past decades, the 12-month forward earnings per share of Topix stocks have (in local currency) outperformed peers in the US, Germany, China and the MSCI Emerging Market index. The profits of corporate Japan, Smith showed, are overwhelmingly correlated with global industrial production and world trade, rather than with US 10-year Treasury yields, the dollar-yen exchange rate or Japanese industrial production, as many imagine.

2. Germany and Canada are the only two triple A rated economies among G-7.

Eurostar launched with just two core routes linking London to Paris and Brussels. It took 15 years to become consistently profitable, and 24 years for direct services between London and Amsterdam to launch. But industry executives believe several factors have combined to make starting new services more viable.

4. FT Alphaville has some stunning factoids about the private equity industry.

Private capital firms have taken more money from investors than they’ve distributed back to them in gains for six straight years, for a total gap of $1.56tn over that period. And this isn’t just about the recent glut of capital raised, lagged returns and private equity exit blockages either. Even if you include the big returns of 2013-2017, private capital funds have now called $821bn more than they’ve returned over the 14 years that Preqin’s data series stretches over.But this has not stopped PE executive compensation from hitting the roof

The fact that private equity alone is sitting on a record backlog of 28,000 companies worth an estimated $3tn at a time when most equity markets are at or near record highs doesn’t fill one with confidence. There’s a reason why PE and VC fund stakes are being sold at often steep discounts. There just seems to be too big a mismatch between what private equity and venture capital have paid for a lot of assets, the returns their investors expect, and what public markets or other potential buyers are willing to pay.

5. UAE is outcompeting China to emerge as the largest foreign investor, atleast in terms of intentions to invest, in Africa.

In 2022 and 2023, the UAE pledged $97bn in new African investments across renewable energy, ports, mining, real estate, communications, agriculture and manufacturing — three times more than China, according to fDi Markets, an FT-owned company tracking cross-border greenfield projects... A UAE official tells the FT that its total investments into Africa amount to $110bn... While many of these investments will not materialise... the Emirates has consistently been a top-four investor on the continent over the past decade. Companies from the UAE have embraced projects in Africa that more risk-averse investors have avoided... This wall of money is allowing the UAE to help shape not only their countries’ economic destinies, but in some cases the political fortunes of some African leaders... African companies are choosing to base themselves in Dubai to trade with the rest of the world... The number of African companies registered in Dubai has increased dramatically in the past decade, reaching 26,420 by 2022, according to the Dubai Chamber of Commerce. “Dubai is New York for Africans now,” says Ricardo Soares de Oliveira, a professor of international politics at Oxford university who has studied Africa-UAE links... UAE’s engagement in places like Sudan is partly motivated by its desire to counter Islamist extremism. But, he says, it has also seized the chance to diversify its economy with investments in food security, critical minerals and renewable energy... some see the UAE’s inroads into Africa as part of a larger vision to wield more power on the world stage... Dubai has become an attractive jurisdiction for Africans to trade, do business and park offshore money.

Like the Chinese, the UAE's investments have generally been in the old-economy industries.

Over the past decade, Masdar, Abu Dhabi’s renewable energy investor, has built infrastructure including five wind farms in South Africa, a battery energy storage system in Senegal and solar power facilities in Mauritania. Masdar is leading UAE plans to invest $10bn to increase sub-Saharan Africa’s electricity-generation capacity by 10GW. But UAE companies are also investing in fossil fuels. In May, the Abu Dhabi National Oil Company bought a 10 per cent stake in Mozambique’s Rovuma gas basin, acquiring it from Portuguese energy company Galp for around $650mn. In real estate, Dubai Investments, a listed conglomerate whose biggest shareholder is Dubai’s sovereign wealth fund, this year announced it would start work on a 2,000-hectare property development in Angola. The Abu Dhabi-based telecoms company formerly know as Etisalat... operates in 12 countries across Africa. UAE companies have begun to make a splash in mining too. International Resources Holding, a unit of International Holding Company, the $240bn Abu Dhabi conglomerate chaired by UAE national security adviser Sheikh Tahnoon bin Zayed al-Nahyan, last year paid $1.1bn for a majority stake in Mopani, a Zambian copper mine previously owned by Glencore. IHR has also expressed interest in investing in mines in Angola, Kenya and Tanzania. Last year, Primera, an Abu Dhabi-based gold trader, was granted a 25-year monopoly by the government of the Democratic Republic of Congo for all small-scale “artisanal” gold supplies in the country. Much African gold, both legal and smuggled, passes through Dubai, according to experts and African government officials... DP World is present in nearly a dozen African countries after pouring some $3bn into the continent. It now operates ports from Mozambique on the Indian Ocean in the south to Algeria on the Mediterranean in the north and Angola on the Atlantic, virtually encircling the continent.

The UAE's rising role in these industries is welcomed by Washington which sees it as a diversification away from the excessive role that China has been playing in these strategic industries in Africa for several years. And this is an interesting political economy consequence of the emergence of Dubai

Many of the 26,000-plus African companies registered in Dubai are “letterbox companies”, says Soares de Oliveira. “That allows Africans to keep dollars away from African economies. You pay suppliers in Dubai and the money never comes back.” Wealthy Africans, including politically exposed persons, also find a safe harbour in Dubai where they can buy property and enjoy a world-class lifestyle. Other high-profile residents include Isabel dos Santos, the billionaire daughter of Angola’s former president, who moved to the city in 2020 days after the new Angolan government froze her assets.

6. Fascinating portrait of Elvira Nabuillina, the head of the Russian Central Bank for the last 11 years, and widely respected in the markets and credited with steering the Russian Rouble and war economy during the difficult times. This is interesting.

Nabuillina’s friends say she is one of the few advisers granted leeway to speak candidly to Putin, which he appreciates... Today the bank has a degree of autonomy few other Russian institutions enjoy, with a mandate both to set interest rates and to regulate banks... After taking over the central bank in 2013 Nabiullina set about turning it into a workplace capable of attracting the best economists. She assembled a young, highly qualified team; many – such as her deputy, Ksenia Yudaeva, who helped introduce modern practices for data collection and analysis – were trained in the West. A lot of “smart, talented people” at the bank came to feel strong personal loyalty towards Nabiullina, said Alexandra Prokopenko, a colleague who left the bank shortly after the start of the Ukraine war.

A feature of Nabuillina's tenure has been her willingness to embrace orthodoxy on currency management.

Previous governors of the bank of Russia had protected the rouble, keeping its exchange-rate value artificially high: Nabiullina announced plans to let it float. She resisted pressure from the oligarchs to keep cheap credit flowing, instead maintaining high interest rates. She also closed 300 banks in four years, many for “questionable transactions” – in other words, money-laundering. It was an ambitious agenda, guaranteed to upset people along the way, especially in the banking sector. But Putin was happy with the macroeconomic stability she was giving him. “Her enemies know he has her back,” said one observer... In 2014, the year Nabiullina had planned to fully float the rouble, Putin annexed Crimea. Europe and America imposed sanctions that made it harder for Russia’s major banking, energy and defence firms to get credit. On top of that, world oil prices dropped, and the rouble began to weaken; Russians saw their savings losing value fast. It would have been easy for Nabiullina to spend the bank’s reserves to shore up the rouble and impose capital controls to stop Russians from buying hard currency. But that would have shaken confidence in the kind of economy she was trying to develop. She stuck to her plan and allowed the rouble to float. Predictably, it sank. Establishment economists called her foolhardy. Right-wing nationalists denounced the bank’s “us State Department” staff. But her calculated gamble paid off, and by the autumn of 2016 the rouble had regained value. Inflation, meanwhile, was falling towards her target of 4%.

And break from orthodoxy when required.

In the days following the invasion, the eu froze Russian central bank assets worth over €200bn ($217bn) and Western nations slapped wide-reaching sanctions on Moscow’s banking, energy and defence sectors. On the morning of Monday February 28th, Russians queued to withdraw savings as the rouble lost nearly 30% against the dollar. Nabiullina had to impose extraordinary measures to calm the situation, far from her slick 2014 playbook. First she raised interest rates to 20% – such a bold move that one employee recalls her personal security detail being increased afterwards. Then she and Putin set capital controls, one of her personal red lines, obliging big energy firms to buy roubles with their dollars and banning most transfers out of Russia. She even froze Russian deposit-holders’ access to their funds for a while... Most of these measures were eventually reversed, and a kind of stability was achieved.

7. Exiting a stock market position is hard.

Last year Mr Imas and colleagues published a paper on the buying and selling choices of 783 institutional portfolios with an average value of $573m. Their managers were good at buying: the average purchase, a year later, had beaten the broader market by 1.2 percentage points. But they would have been better off throwing darts at the wall to select which positions to exit. After a year, sales led to an average of 0.8 percentage points of forgone profit compared with a counterfactual in which the fund selected a random asset to sell instead.

8. The Economist has a good survey on cross-border capital flows. This about the trends in FDI flows and their realignments in recent years.

All types fell after the financial crisis of 2007-09, and have not recovered since. But the drop in FDI became more pronounced after the onset of America’s trade war with China during Donald Trump’s presidency. A study by economists at the IMF published in April 2023 found that, as a share of global GDP, gross global FDI had fallen from an average of 3.3% in the 2000s to just 1.3% between 2018 and 2022... To assess whether FDI has also been redirected over time, the IMF researchers analysed data on 300,000 new (or “greenfield”) cross-border investments carried out between 2003 and 2022. They found a rapid drop in flows to China after trade tensions ratcheted up in 2018. Between then and the end of 2022, China-bound FDI in sectors which policymakers deemed “strategic” fell by more than 50%. Strategic FDI flows to Europe and the rest of Asia fell, too, but by much less; those to America stayed relatively stable. FDI for China’s chip sector plunged by a factor of four, even as FDI for chip firms rose sharply in the rest of Asia and America.

The IMF researchers then compared investments in different regions completed between 2015 and 2020 with those completed between 2020 and 2022. From one time period to the next, average FDI flows declined by 20%. But the decline was extremely uneven across different regions. America and countries in Europe, especially its emerging economies, came out as relative winners. FDI to China and the rest of Asia fell by much more than the aggregate decline. The roster of relative winners—rich America and its closest allies—suggests that geopolitical alignment has played a part in diverting capital flows. Sure enough, it has become more important than ever. Measuring such alignment through UN voting patterns, the IMF researchers calculated the share of FDI flowing between pairs of countries that are geopolitically close. They found that this share has risen significantly over the past decade, and that geopolitical proximity is more important than the geographical sort. The same correlation with geopolitical alignment is present for cross-border bank lending and portfolio flows, though to a lesser extent.

This is on the cross-border capital flows and its impact on the economies.

Yet in spite of the vast scale of financial globalisation over the past three decades, with gross cross-border positions rising from 115% of world GDP in 1990 to 374% in 2022, gains have proved elusive to measure. That does not mean there have been no gains. But at the same time there is clear evidence that sudden inflows of foreign capital can cause financial crises. A paper published in 2016 by Atish Ghosh, Jonathan Ostry and Mahvash Qureshi, then all of the IMF, identified 152 “surge” episodes of unusually large capital inflows across 53 emerging-market countries between 1980 and 2014. Around 20% ended in banking crises within two years of the surge ending, including 6% that resulted in twin banking-currency crises (far higher than baseline). Crashes tended to be synchronised, clustered around global financial convulsions. But the link between sudden floods of foreign capital and subsequent credit growth, currency overvaluation and economic overheating is hard to dismiss.

This is a good summary of the latest restrictions on capital flows of all kinds that have come into being following the rise of US-China tensions. While the article unsurprisingly bemoans these restrictions, I'm inclined to feel that they might be just about the right corrective to a trend on easing cross-border capital flows that might have gone too far.

9. On China's renewables industrial policy

In 2022, Beijing accounted for 85 percent of all clean-energy manufacturing investment in the world, according to the International Energy Agency. Now the United States, Europe and other wealthy nations are trying frantically to catch up... Last year, the energy agency said, China’s share of new clean-energy factory investment fell to 75 percent. The problem for the West, though, is that China’s industrial dominance is underpinned by decades of experience using the power of a one-party state to pull all the levers of government and banking, while encouraging frenetic competition among private companies.China’s unrivaled production of solar panels and electric vehicles is built on an earlier cultivation of the chemical, steel, battery and electronics industries, as well as large investments in rail lines, ports and highways. From 2017 to 2019, it spent an extraordinary 1.7 percent of its gross domestic product on industrial support, more than twice the percentage of any other country, according to an analysis from the Center for Strategic and International Studies. That spending included low-cost loans from state-controlled banks and cheap land from provincial governments, with little expectation that the companies they were aiding would turn immediate profits... It all combined to help put China in the position today to flood rival countries with low-cost electric cars, solar cells and lithium batteries, as consumers across the wealthy world are increasingly turning to green tech. China now controls over 80 percent of worldwide production of every step of solar panel manufacturing, for example.

The difference between the industrial policies of China and the US is that the former was focused on sending low-cost (now clean tech) exports to global markets and preventing foreign firms from dominating China's domestic markets, whereas the latter is now intent on keeping out Chinese imports and denying it access to critical advanced technologies in strategically important sectors.

10. From a Sanford Bernstein report (via Ken), the graphic below shows the sprawling empire of Reliance Industries' retail presence.

Of the over 18,000 stores Reliance Retail operated as of March 2022, roughly 8,500 were stores selling Jio SIM cards, handsets, and accessories. But there were 5,500 lifestyle outlets and 3,500 grocery stores too. That’s the kind of scale no one will have in the near future. In grocery, the only other player of note is Dmart, and its footprint is one-tenth of Reliance’s. Reliance is the largest in fashion and electronics too. The Tata Group is a worthy competitor in both (Westside and Zudio in fashion and Croma in electronics) but not one that Reliance would lose sleep over.

11. Facts about widening inequality even among the top echelons of the US society.

Not only have the biggest American companies grown spectacularly relative to the rest, they are also growing more entrenched, as are their owners. Wealth is rising fastest not for the 1 per cent but for the top tycoons, all of whom are — not coincidentally — in Big Tech... By last year, political economist Blair Fix has shown, the wealth of the richest American was 50 times the median for the top 400 billionaires, up from 10 times in 1983. And even among billionaires, inequality begets immobility: top-50 billionaires are now roughly 40 per cent more likely to hold their place on the Forbes list from one year to the next than they were in the 1980s.

No comments:

Post a Comment