Paul Krugman has differed arguing that the US is facing a liquidity trap - interest rates touching the zero-bound and counter-party risks forcing banks to shut their lending taps - and though the world is awash with a savings glut, appetite for borrowing remains constrained. In the circumstances, government is the only agency capable of borrowing and deploying this excess liquidity.

Over the past two decades, household and financial sector debt has sky-rocketed, while non-financial sector debt and government too have risen

Thanks to the fiscal stimulus and the credit expansion through unconventional monetary policy responses, the budget deficit projections have gone over the roof.

All this, as Arthur Laffer points out, has dramatically expanded the monetary base - comprised of currency in circulation, member bank reserves held at the Fed (which has exploded, as banks have been shored up with equity injections), and vault cash - in an unprecedented manner and money supply has exploded.

Further, long term yields on US Treasury Bonds have been hardening in recent weeks, reflecting fears of inflation lurking round the corner.

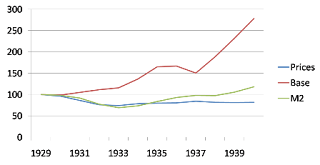

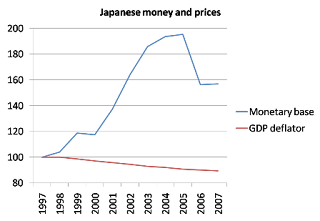

But history shows that during stag-deflations, the expansion in monetary base does not automatically translate into inflation. Figures from the Great Depression...

... and then with Japan in the nineties shows that inflation has remained reined in despite the expansion in monetary base during the recessions.

Even the experience in the US from the last half century, shows that expansion of monetary base does not automatically translate into bank loan growth.

Further, increase in government borrowing, while huge, has not quite offset a huge plunge in private borrowing.

And, the spare capacity of US industry has now reached a 40-year high, with companies churning out just 68.3% of their potential output, the lowest since the data series collection started in 1967. To put this in perspective, the average capacity utilization between 1972 and 2008 was 80.9%. As Christopher Swann blogs, "clearly American industry has huge amounts of slack to deploy when the recovery comes. With unemployment at 9.4 percent, companies will also have a huge pool of workers to draw upon before they start bidding up the price of labor. This will give policy makers plenty of time to withdraw their stimulus before inflation becomes a problem."

And Andy Harless identifies 15 requirements (from output stabilizing to firms raising wages faster than trend productivity growth) before wage pressure reverses and becomes inflationary, and feels that we have some distance to traverse before inflation takes hold.

Update 1

Alan Blinder is the latest to cast doubts on the inflation danger.

Update 2

Greg Mankiw has this nice explanation as to why an increase in monetary base does not automatically translate into higher inflation. As he writes, unlike in normal times, the Fed is now paying interest on excess reserves, and as long as the interest rate on reserves is high enough, banks should be happy to hold onto those excess reserves, which in turn will prevent a surge in the monetary base from being inflationary.

No comments:

Post a Comment