The Supreme Court of India has delivered two highly consequential judgments in the first two months of the year.

This is in the long list of judgments in the last decade-and-half, some of which have clarified and stabilised the law, and others have introduced deep uncertainties. These judgments have made courts virtually co-designers of policies on critical aspects of the economy, like resource management and taxation, and co-regulators of important sectors.

In the first judgment, on January 15, 2026, the Supreme Court ruled that the US private equity firm Tiger Global must pay tax in India on its 2018 sale of its 17% stake in e-commerce giant Flipkart to Walmart for $1.6 billion. It overturns a 2024 Delhi High Court decision that allowed Tiger Global to claim tax relief under the old India-Mauritius double-taxation avoidance treaty. The High Court had agreed with Tiger Global’s claim that its gains were shielded from Indian tax because the investment was held through entities that had tax residency status in Mauritius. The government had changed the Indo-Mauritius double-taxation treaty in 2016 through the General Anti-Avoidance Rules (GAAR) which made gains from the sale of Indian shares taxable even under treaties if they were “impermissible avoidance arrangements”. However, it exempted investments made before April 1, 2017. Tiger Global’s investments predate the change.

Indian tax authorities rejected the claim and argued that the Mauritian firms served as conduits and were used only to avoid taxes, with no real business purpose. The Supreme Court… ruling that tax certificates alone do not guarantee treaty benefits and that the investment structure lacked real commercial substance. It held that foreign investors cannot rely on complex offshore set-ups when those entities don’t carry out genuine business activities of their own. JB Pardiwala, one of the two judges, wrote: “Taxing an income arising out of its own country is an inherent sovereign right. Any dilution of this is a threat to a nation’s long-term interest.”…

India and Mauritius signed a protocol in 2024 amending their tax treaty to benefit only companies with legetimate businesses and not shell companies set up to avoid tax… India had long tried to attract foreign capital by encouraging investments from companies with structures in countries such as Mauritius, Singapore and the Netherlands, signing treaties to help investors avoid paying taxes twice… Between 2000 and March 2025, Mauritius alone accounted for about $180bn (£133.9bn), nearly a quarter of all foreign direct investment into India, according to official figures.

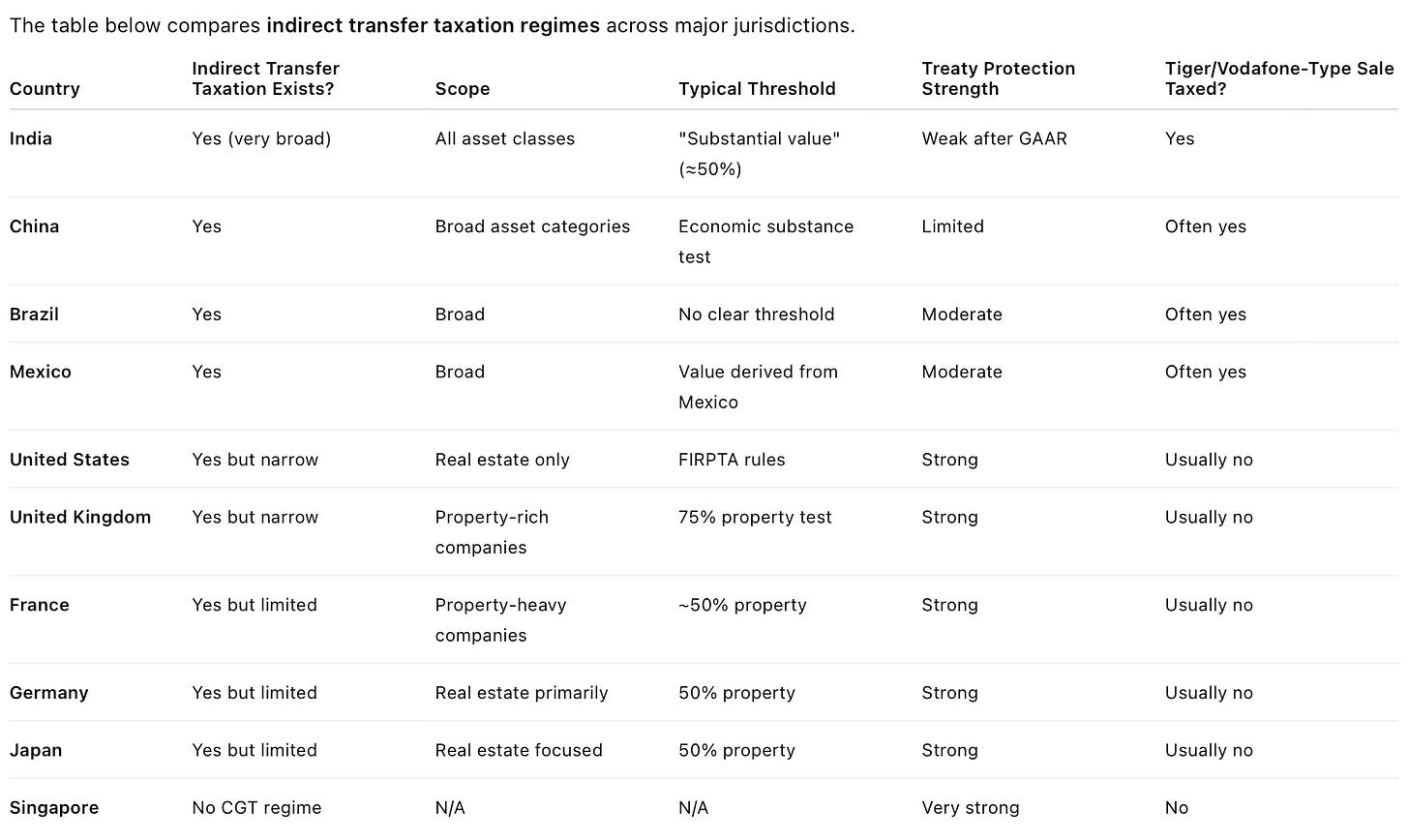

This effectively means that GAAR’s look-through of treaty structures overrides any treaty claims in the cases of transactions lacking any commercial substance or made solely to avoid taxes. In this backdrop, how does India compare with other jurisdictions in the taxation of gains from share sales?

After the Vodafone case, the government had, in 2012, retrospectively legislated for taxation of offshore share transfers in a foreign company where the underlying shares derive “substantial value” from India. While this is the legal foundation underlying the Tiger Global ruling, it overrides the grandfathering provision in the legislation for prior deals. See below the indirect transfer taxation regimes across countries, which show that indirect transfer taxation is confined to real estate in most developed economies.

In conclusion, the ruling, which could reshape how foreign investors exit their Indian investments, sets out a tougher interpretation of tax treaties. It allows authorities to deny treaty benefits if offshore investment structures are deemed sham entities with little commercial substance, even when investors hold valid documentation. The judgement gives India wide powers to scrutinise any offshore corporate deal. It also operationalises the Vodafone legislation.

In the second judgment, on February 13, 2026, in the State Bank of India Vs Union of India, it ruled that telecom spectrum is a natural resource held in public trust and the right to use it does not form part of the insolvency estate of a telecom service provider (TSP). Given that the spectrum (and associated license) is the bedrock for TSP’s business, it forms the basis of TSP’s bankability. MS Sahoo and Raghav Pandey write,

This ruling effectively places the most valuable asset of a TSP beyond the reach of a resolution plan. The likely consequence is the liquidation of stressed TSPs and the fragmentation of the insolvency framework, contrary to legislative design… the ruling rests on a conceptual overextension. The Public Trust Doctrine (PTD) is applied without sufficient regard to the evolution of the modern regulatory state and market economy… The PTD emerged to protect communal access to resources such as air and water, as a check against the privatisation of the commons… In telecommunications, the state has translated the PTD into a detailed statutory and contractual framework of auctions, licences, and contracts. That framework explicitly permits the allocation, trading, and transfer of spectrum-usage rights.

When the state auctions spectrum, it does not abandon the public trust; it operationalises the use through market mechanisms. A sovereign resource is converted into a regulated, tradeable economic entitlement, juridically embodied in the licence. For the Insolvency and Bankruptcy Code (IBC), 2016, it is this statutory-contractual construct that matters, not the doctrine in abstraction. The judgment does not fully distinguish between sovereign ownership of spectrum and the contractual licence conferring the right to use it. These operate at distinct juridical levels. Spectrum remains vested in the state at all times, while the licence is a statutorily recognised intangible right, acquired for valuable consideration… In accounting and economic terms, the money paid to acquire the licence exits the balance sheet and is replaced by an intangible asset of corresponding value… Banks and financial institutions lend money to TSPs secured against these licences; that security ought not to be diluted by invoking the PTD.

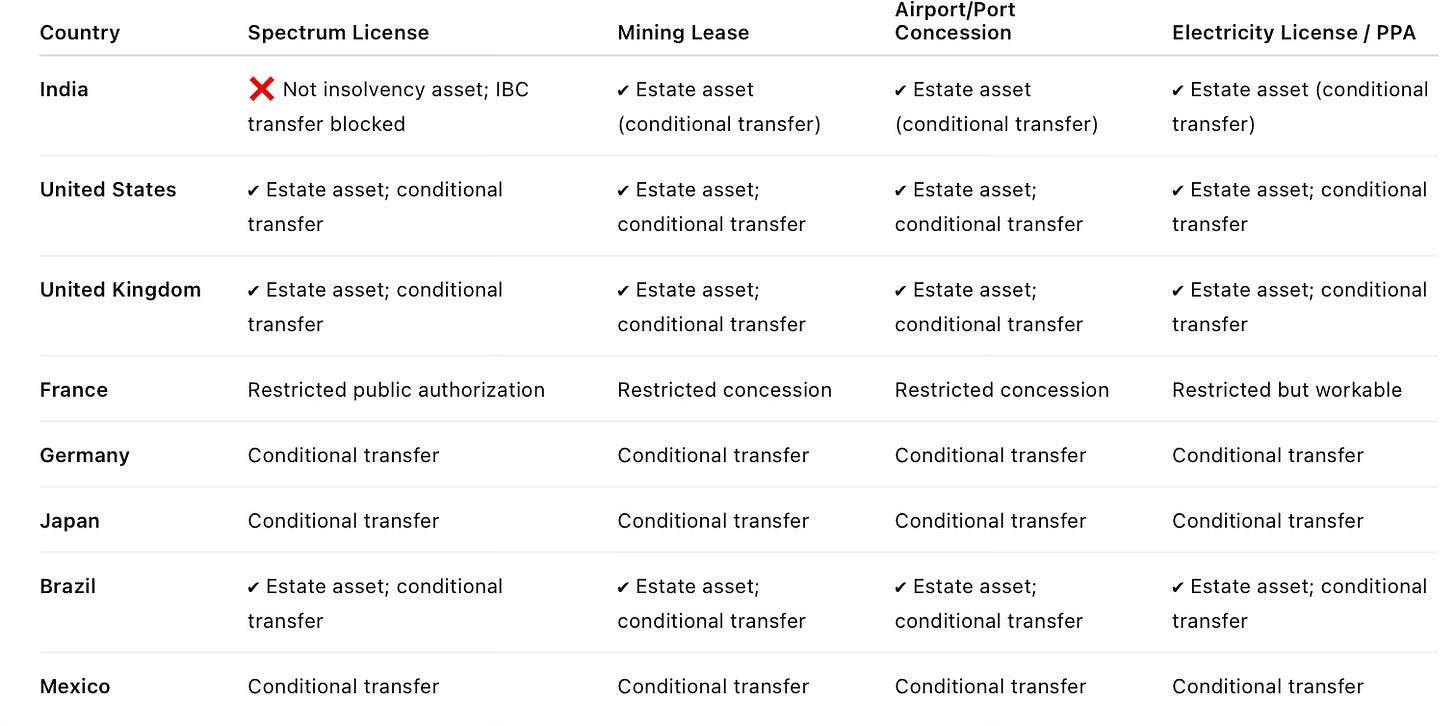

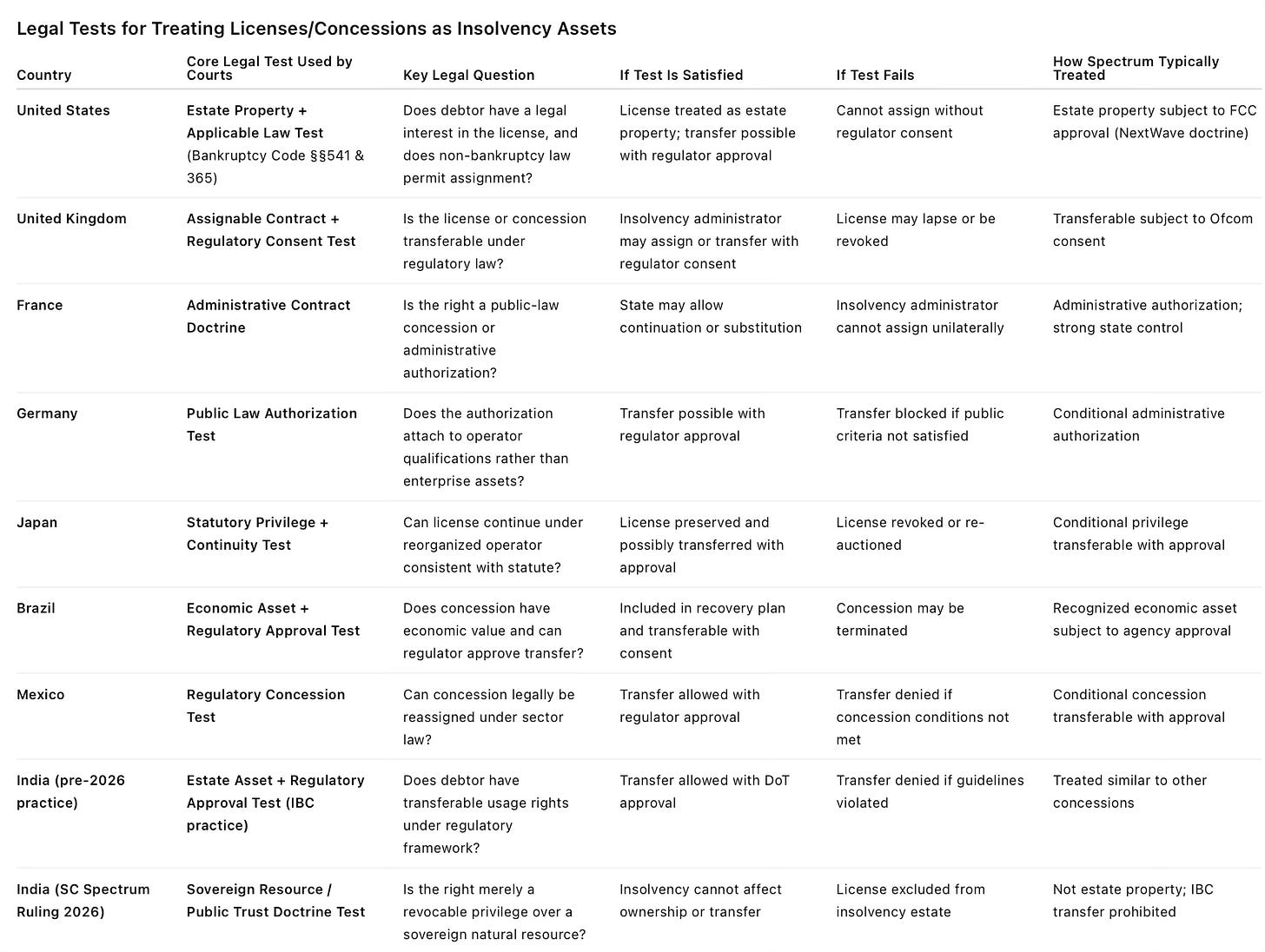

This decision makes India an outlier in the treatment of spectrum in insolvency proceedings. The US, UK, EU, Japan, Brazil, and Mexico treat telecom like other sectors in bankruptcy proceedings.

Not only does this ruling make India an outlier in telecom spectrum treatment in insolvency proceedings, but it also makes telecom an outlier among other sectors, even in India.

While mining leases, airport, port, and road concessions, and electricity PPAs can be transferred with regulatory approval, the same is now prohibited for telecom spectrum. This is despite telecom having similar features - time-bound lease, competitive allocation, revenue sharing, and regulated transfer - as the others.

While all countries recognise public ownership of resources, with this ruling, India now diverges from others in the legal test to decide whether a government-granted license or concession is part of the insolvency estate and therefore transferable or usable in resolution.

The ruling effectively reduces regulated asset values, raises the cost of telecom finance, weakens restructuring scope, and makes telecom concessions riskier than other infrastructure concessions, all this due to an avoidable regulatory interpretation.

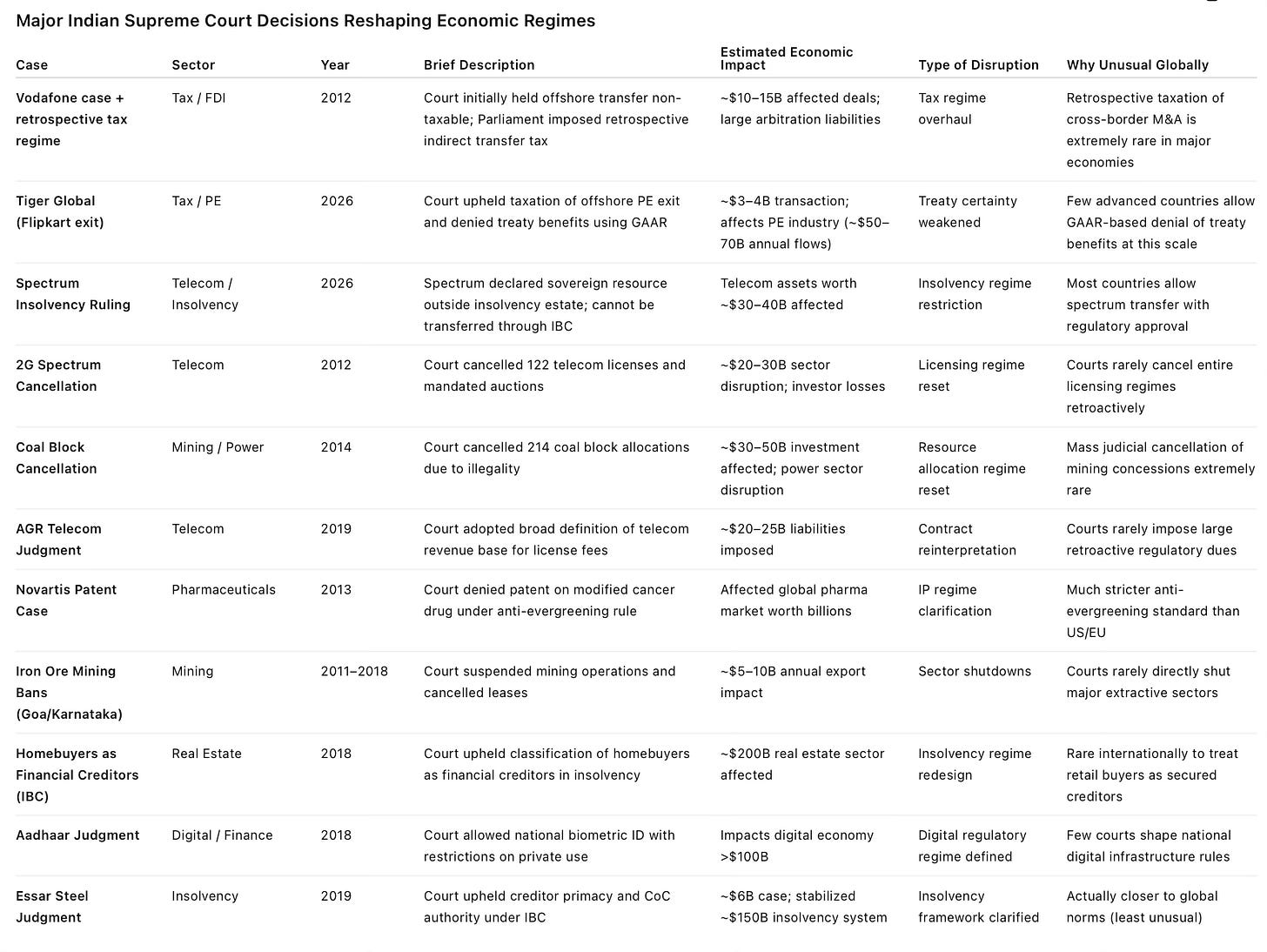

ChatGPT has this compilation of the Court decisions in India that have reshaped economic regimes in their respective sectors. The estimates are unverified and can be significantly off.

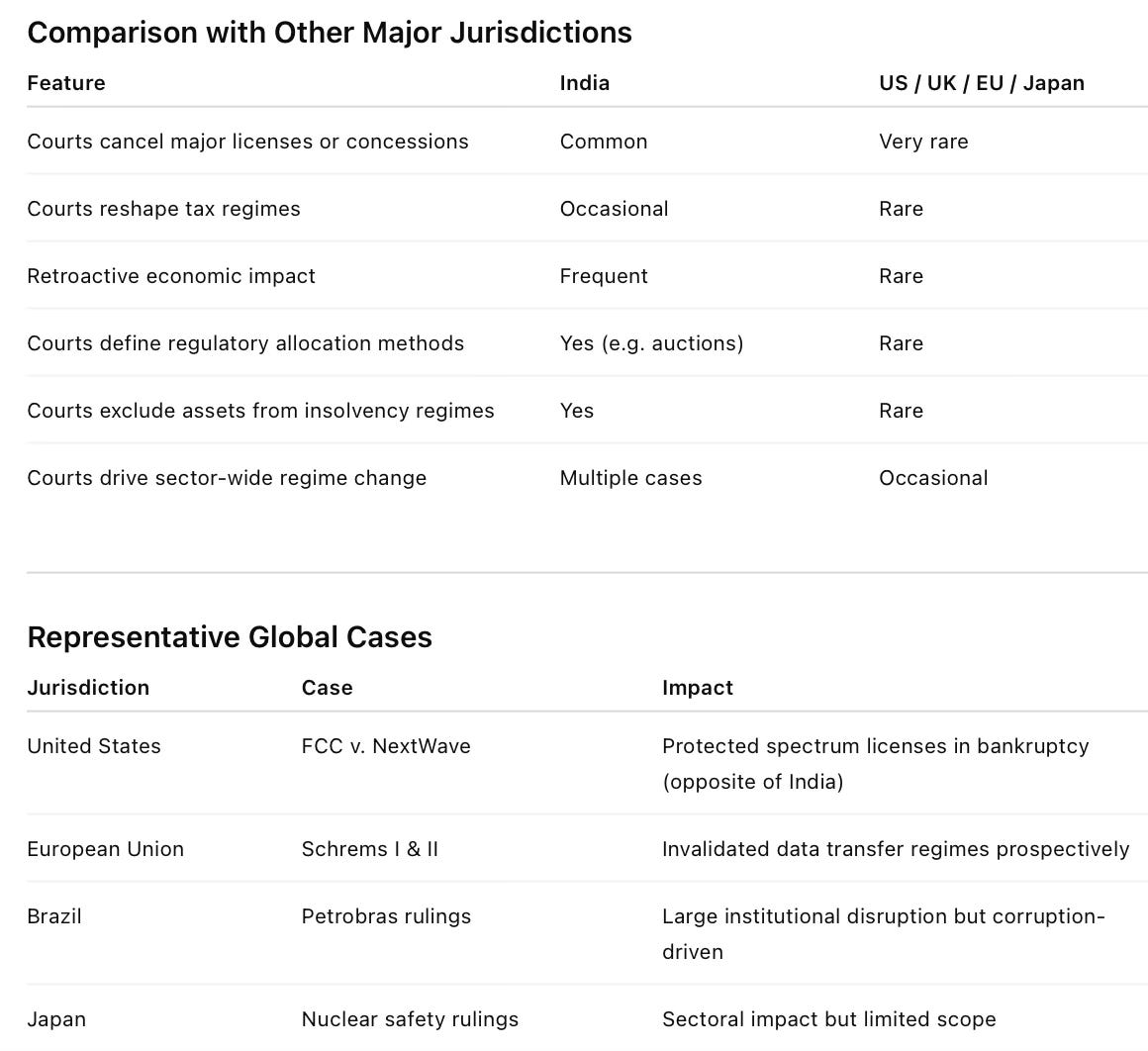

Of these, the cancellations of the coal blocks and 2G licenses, and the spectrum insolvency are major deviations from global norms. Also, on a global comparison, India has a relatively large number of Supreme Court decisions that rewrote regulatory frameworks, applied law retrospectively, and changed business models.

In countries like the US, UK and EU, courts rarely cancel licenses or concessions, retrospective orders are uncommon, and regulatory regimes are usually shaped by legislatures and agencies. Courts in these countries leave policy design and regulation largely to administrators, legislatures, and independent regulators, and prefer to only interpret statutory frameworks.

In contrast, Indian courts have taken an absolute view on public trust doctrine (without regard for its economic dimensions), favoured substance-over-form in taxation, and assumed the powers of broad and unconstrained scope in the judicial review of allocation processes. India remains distinctive in the scale and frequency of judicially driven economic restructuring, with courts almost acting as co-designers of policies on public resource management and taxation.

The concern here is not so much with the nature of the decisions per se. After all, some of these decisions are clearly progressive - substance-over-form in taxation, stricter ever-greening standards on patents, homebuyers as financial creditors - and should be adopted more widely globally.

Instead, there are two important concerns. One, at a fundamental level, should courts be making such definitive policy decisions? The argument that courts have stepped in where governments have abdicated cannot be taken as an answer. This is a slippery slope that risks destabilising the constitutional checks and balances.

The second concern is about the economic uncertainty induced by rulings that upend economic regimes (or rules of the game) based on which business decisions were taken. If investment decisions were taken based on a prevailing interpretation of the regime and the same was widely accepted (governments gave permissions, financial institutions gave loans, rating agencies did not consider them risks, auditors audited statements, tax authorities generally overlooked them, etc.), then a subsequent substantive (logical, ethical, etc.) interpretation should not form the basis for reversing it with retrospective effect. The only exception to this should be if it is established that there was a malafide intent in the decision made by the government entity.

The economic damages are exacerbated by the consequential decisions forced upon government entities. For example, the cancellation of one license immediately leads to the cancellation of all similarly placed ones. The rejection of a tax avoidance claim immediately triggers tax officials across the country to scout for similarly placed cases and issue notices to them.

I’m not sure whether the legislative or executive can do anything to address these concerns. Its answer lies in the judicial realm itself, in the form of restraint while courts take such decisions. The Supreme Court could use the opportunity presented by something like a Public Interest Litigation (PIL) or a case to lay down certain judicial principles that should guide judicial rulings on cases with sectoral policy impacts.