From 1989 to 2019, the S&P 500 index grew at an impressive real rate of 5.5 percent per year, excluding dividends. The rate of U.S. real GDP growth over the same period was 2.5 percent. What accounts for this enormous discrepancy? And is it sustainable? I argue that it is not. To reach this conclusion, I consider 60 years of data on the earnings and stock price performance of S&P 500 nonfinancial firms, from 1962 to 2022. My central finding is that the 30-year period prior to the pandemic was exceptional. During these years, both interest rates and corporate tax rates declined substantially. This had the mechanical effect of significantly boosting corporate profit growth. Specifically, I find that the reduction in interest and corporate tax rates was responsible for over 40 percent of the growth in real corporate profits from 1989 to 2019. Moreover, the decline in risk-free rates over this period explains the entirety of the expansion in price-to-earnings (P/E) multiples. Together, these two factors therefore account for the majority of this period’s exceptional stock market performance... The overall conclusion, then, is that—with the expected slowdown in corporate profit growth and no offsetting expansion in P/E multiples—real longer-run stock returns in the future are likely to be no higher than about 2 percent, the rate of GDP growth.

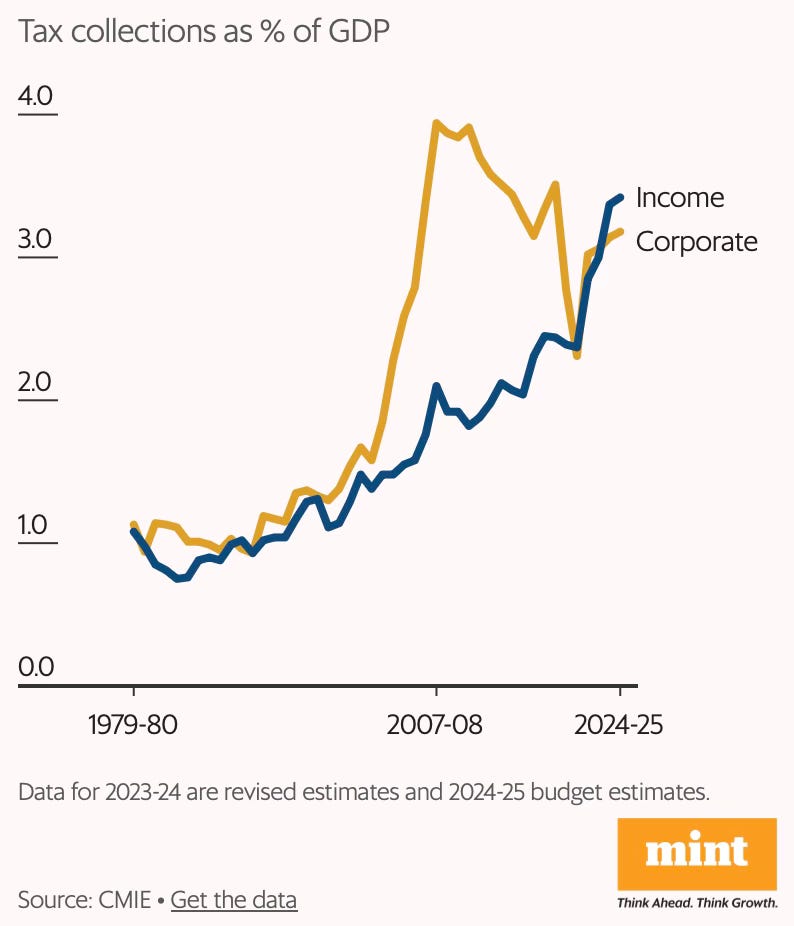

He compares the real EBIT (earnings before interest and tax expenses) growth for the 1962-89 and 1989-2019 periods - 2.2% and 2.4%. He shows that interest and tax expenses as a share of EBIT declined from 54% in 1989 to 27% by 2019, pointing to an ever-declining share of profits being paid out to debt holders and tax authorities.

This blog has been long-time sceptic of the economic orthodoxy and conventional wisdom that low corporate tax rates will spur investment. In The Rise of Finance, we point to evidence that contradicts this.

The latest example is from India, where corporate investments have struggled to materialize despite significant corporate tax cuts and a favourable economic environment. In fact, not only have corporate tax cuts not revived private investments but it has also led to a reduction in corporate tax revenues as a share of GDP.

Soft-ground TBMs evolved from unmechanized tunnel shields, large hollow structures that supported the sides of the tunnel while it was being excavated. The tunnel shield was invented by Marc Brunel (father of Isambard Kingdom Brunel) in 1806 for tunneling under the Neva River in Russia, and was first used to tunnel under the Thames in 1825. Brunel’s shield consisted of a 21-foot-tall grid of iron frames, divided into 12 separate frames, each one consisting of three compartments stacked on top of one another. Within each compartment, the face of the tunnel would be supported by a series of boards called poling boards. A worker would remove a single board, dig away the soil behind it to a depth of around nine inches, and then replace the board and move on to the next one. After all boards had been dug out, the frame would advance forward with large mechanical jacks, and the process would repeat. Behind the shield, brick lining would be installed around the sides of the tunnel to form its structure. With Brunel’s shield, tunneling under the Thames proceeded at about eight feet per week on average...

The tunnel shield prevented the sides of the tunnel from collapsing while it was bored, but they still required some method to prevent the face of the tunnel from collapsing, and to prevent water from intruding when tunneling below the water table. By the late nineteenth century, the standard method was to use compressed air. By pressurizing the tunnel to several times atmospheric pressure, water would be kept out. Compressed air remained in use well into the twentieth century, and is still sometimes used today, but it has been largely supplanted by slurry machines and earth pressure balance machines, which respectively use a bentonite slurry and the excavated material itself to support the face of the tunnel. Today, earth pressure balance machines are the most common type of TBM for tunneling through soil.

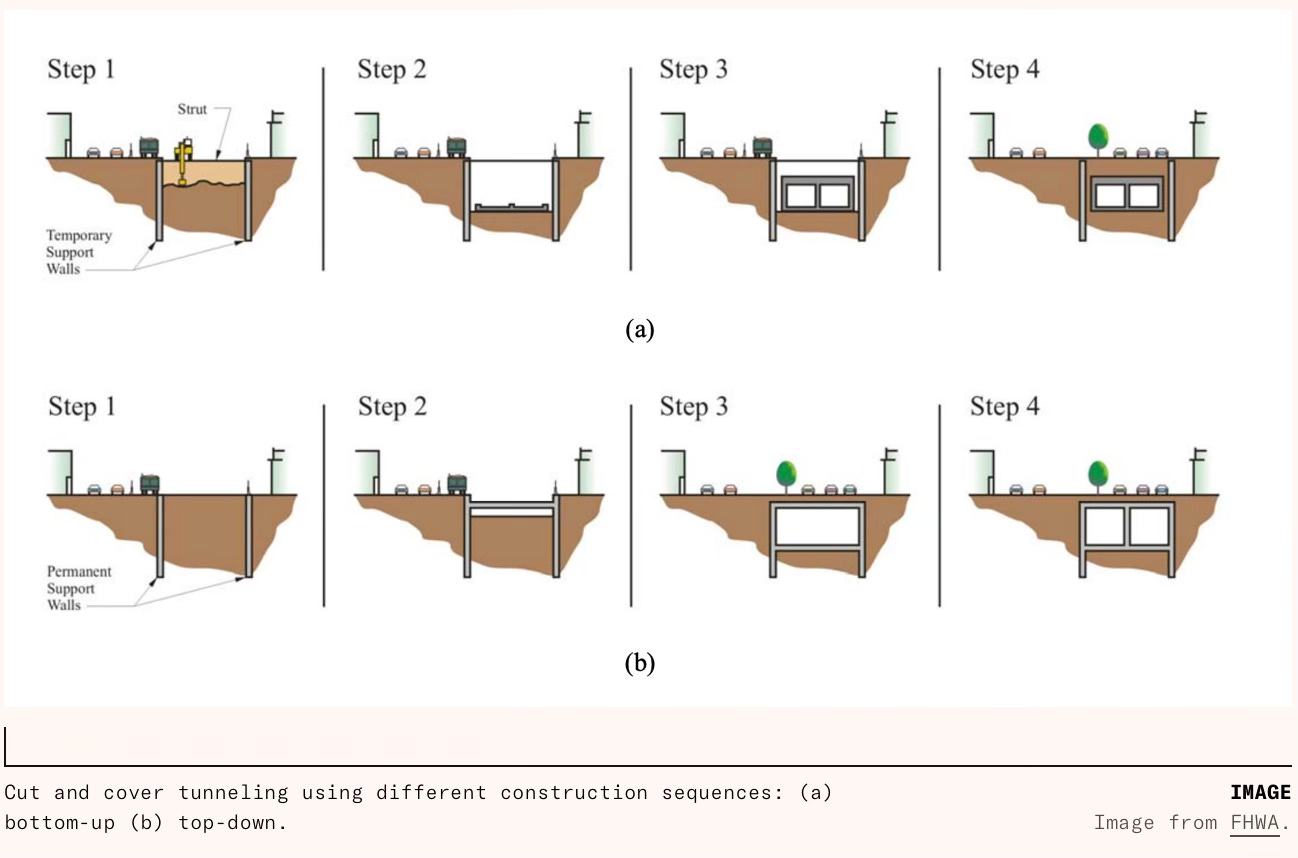

Then there’s the top-down and bottom-up approaches in the cut-and-cover method

Cut and cover also uses different methods for building the tunnel structure itself. In the conventional method, known as bottom-up, the trench is fully excavated and the tunnel structure is built up starting from the bottom. With the top-down method, by contrast, the tunnel is excavated only partway down, and then the roof of the tunnel is built using the existing soil as a vertical support. Once the roof is in place, the rest of the tunnel is then excavated below it. With top-down construction, the surface can be completely restored after the roof has been built; with bottom-up, the top of the excavation will often be covered with temporary decking to allow use of the surface while tunnel construction is taking place.

This about the respective speeds and economics of different tunneling technologies

Brunel’s non-mechanized shield tunneled under the Thames at the glacial pace of eight feet per week. By the early 1900s, Price mechanized shields were achieving excavation rates of nearly 200 feet per week. And by the 1970s, TBMs were achieving rates of 1,400 feet per week in soft ground, and 1,900 feet per week in rock... As TBMs got faster, they also got cheaper, and became increasingly competitive with cut and cover. When a TBM was used to bore some of the tunnels on the Bay Area Rapid Transit (BART) project in the 1960s, its costs were just 40 percent higher on average than the cut and cover sections, a far cry from the eight-times cost difference on the New York Subway... Depending on the nature of the project and how disruptive surface construction would be, TBMs in some cases began to be cheaper than cut and cover...

TBMs have high fixed costs (in the form of the time, effort, and expense to buy the machine and get it set up) but low operational costs: once they are up and running, the marginal cost of additional excavation is low. TBMs are thus often particularly economical on large tunneling projects where the fixed costs of the machine can be thinly spread. When Madrid built 60 miles of underground tunnel when constructing its metro in the late 1990s and early 2000s, it achieved a famously low cost of €42 million per kilometer (about $73 million per kilometer in 2023 dollars) using TBMs. And the recent extension of the L11 line in Madrid, which adds another 4.3 miles to the metro system, likewise found that excavation with TBMs would be cheaper than cut and cover.

3. As I have blogged on numerous occasions, arguably the biggest challenge to urban growth is housing affordability in the larger cities. Given the limited extent of vacant lands remaining, there’s no alternative to radical changes to urban planning rules to create the conditions that allow for incentives and market forces to increase the supply of housing from brownfield properties.

Ben Hopkinton and Sam Dumitriu have a series of posts on increasing housing supply in London where prices have risen sharply and the average floor space has declined. In the first post they propose upzoning in the brownfield locations around transit stations. They point to Paris, Madrid, and Milan having areas twice as dense as the densest parts of London and some of the best-connected parts of London being built at extremely low densities. They propose permissions for additional floors on the older properties (pre-1919 ones), and adoption of New Zealand’s 2020 plan of automatic approval for six floors in properties that are within walking distance of city centres, commercial hubs, and transit stops.

In the second post, they propose building on some of London’s several Golf courses, those that are well-connected or centrally located. They point to some very interesting facts about Golf courses.

If all of London’s golf courses were a borough, they would be its 15th largest – roughly the size of Brent… London’s 95 golf courses (excluding driving ranges and courses with fewer than 9 holes) take almost as much land as all other sporting activities combined. There are also a further 74 golf courses just outside London too. More of London is dedicated to golf than to football, despite the fact that many times more Londoners play football than play golf on a regular basis. A large proportion of London’s golf courses are publicly-owned. In fact, if London’s publicly owned golf courses were a borough, they would be larger than Hammersmith and Fulham. Yet councils get little in return as they lease them to golf clubs on the cheap. For instance, one golf course pays just £13,500 in rent to Enfield council for 39 hectares. That’s £3,000 less than it costs to rent a one bed flat in Enfield.

The third post proposes the rezoning of industrial sites and localities that are well connected. The last post proposes policies to encourage the renewal of older areas, specifically old public housing estates.

The ideas raised in the four posts are universal and applicable to cities worldwide. Affordable housing policies must work on similar urban planning reforms to create the conditions for increasing housing supply.