1. Sobering tale of Qantas, Australian national carrier, as it pursued profit maximisation at the cost of all else,

Founded in 1920 and nationalized in 1947, the carrier was slowly privatized in the 1990s, and only 51 percent of shares in it must be held by Australians, while the rest may be held by offshore investors. Still, the Sydney-based airline is critical to the ordinary functioning of Australian life, operating 61 percent of domestic flights...Australians bemoan that its flights are unreliable and expensive. They are aghast at how government protectionism has made Qantas by far the biggest airline in Australia and pushed up the price of travel. They are stunned by allegations that it sold tickets for flights it never intended to fly. They cannot square how Qantas unfairly laid off hundreds of workers, then handed out enormous paychecks to its chief executive and board directors... finding that Qantas illegally outsourced the jobs of nearly 1,700 baggage handlers during the pandemic, in part to prevent union action... Now, as the baying for blood intensifies, labor unions and lawmakers are calling on the company’s board to resign en masse. The anger is personal for Australians, who feel profound ownership over the carrier that bills itself as “the spirit of Australia”... Qantas is rooted in Australian aviation history and long enjoyed a reputation for safety and comfort... signing up for a Qantas frequent flier account is a rite of passage for many. The recent scandals, which many Australians see as betrayals, sting acutely...Qantas may be scrambling to apologize — but its balance books are in exceptional health. Last month, it posted a record annual profit of 2.47 billion Australian dollars, about $1.6 billion, as well as multimillion-dollar bonuses for the previous chief executive, Alan Joyce, and other top brass, and a share buyback program of 500 million Australian dollars. Those blockbuster results have come at a cost, with the pursuit of short-term profits above all else tarnishing the brand in some customers’ eyes, said Angus Aitken, a Sydney-based stockbroker and the founder of Aitken Mount Capital Partners. “Profitability is one thing, but you also have to look after your clients.”

2. As interest rates go up and the economic growth slows down, private equity firms are seeing their buyout deals dry up and instead private debt deals are on the rise. Buoyed by the higher interest rates, PE firms are competing with deposit taking banks to make corporate loans.

Apollo’s private credit unit now manages more than $400bn, dwarfing the $100bn in assets under management in its buyout division, historically the cornerstone of the group’s business.

3. A now viral scathing essay by Garrison Lovely on how it feels to be working at McKinsey,

What does McKinsey do? Generally, it deploys teams of sleep-deprived, overeducated young people to solve tough problems for organizations—typically for-profit businesses, though the firm also serves many governmentsand large nonprofit organizations. If you’re a CEO who wants help evaluating whether to enter a new market or lay off thousands of employees, you might hire McKinsey. McKinsey made the prescient decision to avoid credit for its work, keeping its client and project lists secret. In practice, this has insulated the company from the disasters it was party to, such as the collapse of Enron... McKinsey was an amoral institution willing to do almost anything for almost anyone who will pay them.

According to mining expert Paul Gait, if you look at the number of labour hours it takes to mine and refine a tonne of copper, it has fallen rapidly and consistently over much of civilised history. At the time of the Roman Empire the price of a tonne of pure copper was equivalent to roughly 40 years of the average wage: forty years of work. By 1800 this had fallen to six years per tonne. In the following 200 years to the early twenty-first century it dropped to just 0.06 years (or 21 days) per tonne.

The average internal combustion engine car contains about a mile of copper wire. The average electric car contains three or four times more. Then there’s the many tonnes of copper we will need for all the wind turbines, solar panels and other grid infrastructure you need if you’re relying ever more on power – copper for the circuitry inside them, for the windings in generators and transformers and, most of all, for the thick, shielded cabling taking power from one place to another. All told, according to some estimates the green energy transition will necessitate us doubling the total amount of copper we use each year from around 25 million to more than 50 million tonnes.

5. India's tourism market is increasingly dominated by domestic tourists.

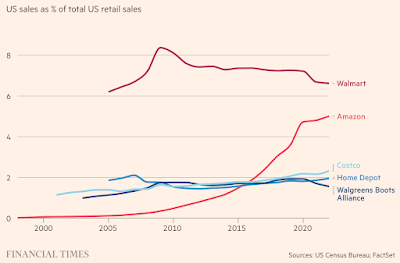

The landmark lawsuit... accused the $1.3tn ecommerce giant of increasing fees to sellers on its marketplace so that it extracts nearly half of every dollar of revenue made by many sellers. The FTC also alleged that Amazon punishes sellers that discount heavily by making them “effectively invisible” in its search results and forcing vendors to use its “costly” logistics network. “Most sellers must now pay for advertising to reach Amazon’s massive base of online shoppers, while shoppers consequently face less relevant search results and are steered toward more expensive products,” according to the complaint, filed in federal court in Seattle... “Our complaint lays out how Amazon has used a set of punitive and coercive tactics to unlawfully maintain its monopolies,” Lina Khan said in a statement... The heavily redacted complaint detailed ways in which it said Amazon built up and maintained both an “online superstore” attracting hundreds of millions of shoppers, and an “online marketplace” where other vendors could sell their products, creating a behemoth of goods and data that would-be rivals could not match... To maintain this alleged monopoly, the FTC said Amazon used a “sophisticated surveillance network of web crawlers” that monitored whether Amazon sellers were offering their products cheaper on other sites, and punished sellers who did so... The lawsuit also alluded to an Amazon pricing system internally codenamed “Project Nessie”, which the FTC said had boosted the company’s profits.

The novelty of this anti-trust action is that it deviates from the standard of consumer welfare, and directly takes on the issue of market structure and competition, both of which courts in the US have so far refused to entertain. To this extent, this will be an effort at redefining the paradigm on anti-trust actions in the US.

Matt Stoller has a very good article that illustrates how the free-shipping of Prime Consumers is a Click-Bait and consumers pay a hidden tax that's borne by the retailers selling on Amazon and passed on to consumers. The article is a good summary of Amazon's business model now.

In 2022, Amazon CEO Andy Jassy said this explicitly, “small and medium sized” sellers use Amazon not because of the “eCommerce software” Amazon provides but “because they get access to a few hundred million customers.” There are extremely high switching costs to move from one online superstore to another, so this is a business with significant barriers to entry. Indeed, this barrier to entry is baked into the very structure of Amazon Prime and its free shipping, which was created, Jeff Bezos said, “to draw a moat around our best customers”... Amazon’s strategy is to use Prime to build, extend, and fortify barriers to entry. One result of Prime is that Amazon now has an overwhelming monopoly share of online shoppers. And online shoppers aren’t the customer, but the product that Amazon brokers to third-party sellers, who must either pay Amazon what it demands or lose access to the market. As one seller put it, "We have nowhere else to go and Amazon knows it."

Once it achieved monopoly power, Amazon squeezed on price through fees to third-party sellers. As a third-party seller, you pay fees for listing on Amazon; for using Amazon’s warehouse services, known as Fulfillment by Amazon (FBA); and for advertising services. If you don’t pay, you don’t get put in a place on the site where consumers click. "Advertised products on Amazon,” reads the complaint, “are 46 times more likely to be clicked on when compared with products that are not advertised." And these fees have all increased steadily over the years. At this point, the price Amazon charges these third party sellers has grown to nearly 50% of its revenue. It is this money, estimated at $123 billion in total last year, that pays for “free” shipping, as well as its video service, its music service, Twitch, and everything else that comes bundled with Prime. These third-party sellers in turn raise their prices to consumers, aka you and me, and then send that money back to Amazon in the form of fees. It’s basically money laundering.

Apart from network effects, there's one more reason why Amazon's sellers cannot also sell at lower price on another platform,

Today, Amazon tells sellers that if it detects a lower price for their products on any other online store, they will be punished, which is to say, their ability to get their products onto a place on the Amazon website where customers click will go away. The net effect, as Amazon itself wrote, is that "prices will go up"... It is able to block third-party sellers from going elsewhere, and therefore also stop potential rivals from gaining share.

This is an FT long read on the FTC's case against Amazon. This is Lina Khan's famous 2017 paper on Amazon.

The article points to an important point that highlights why this would a hard challenge for FTC

If the FTC wants to impose tough sanctions on Amazon, it will have to also persuade the public that a company whose services so many people find incredibly convenient and efficient is actually harming their interests. “You just could not be going after a more popular corporation,” says David Balto, a former policy director at the FTC. A win for the FTC could mean that consumers end up facing “higher prices and weaker services” on Amazon, he adds. “Consumers aren’t going to be happy with that . . . Ultimately, the consumer is sovereign at Amazon, and what [the regulator is] condemning are things that are responses to consumer demand.”

9. Bain Capital reports of declining returns of South East Asian conglomerates.

There is no free trade or comparative advantage theory that's relevant here. The question that European policy makers should be asking is whether it wants to protect its domestic EV industry or not. If so, it has no choice but to level the playing field and either itself heavily subsidise its EV makers or impose meaningful enough trade restrictions. In the absence of the former, the latter, howsoever much it is against the orthodoxy, is inevitable. It's a strategic choice in national interest (as different from purely commercial or economic choice) to limit Chinese imports.

The problem is that trade restrictions alone is not sufficient to prop up the European EV industry. It would require complementary measures, especially urgency and vision from European car makers to catch up and create world-class EVs. Unlike developing countries, European countries are better placed to catch up.

So I'm not sure what's the tree that Beattie is barking up!

11. The surging sales of obesity drugs Ozempic and Wegovy, manufactured by Danish company Novo-Nordisk, threatens to distort the country's economy. This has drawn comparisons with the fate of Finland following Nokia's spectacular rise and fall.

Ozempic, a diabetes treatment that celebrities take to lose weight, and Wegovy, an anti-obesity medication, have propelled Novo Nordisk to become Europe’s most valuable company and single-handedly stopped Denmark from falling into recession. At $410bn, Novo Nordisk’s market capitalisation is now larger than Denmark’s annual GDP of $400bn last year, raising concerns among officials and business figures that the country’s fortunes have become too closely tied to a single company. “The way that we look at it is that in Denmark we have a two-speed economy: the pharmaceutical industry — and the rest,” said Thomas Harr, chief economist at Denmark’s central bank. “The risk is that you think the economy is performing better than it is.”

After it found success during the first wave of mass adoption of mobile phones, handset maker Nokia’s profits collapsed from the 2000s onwards after the release of Apple’s iPhone. At its peak, the company provided a quarter of Finland’s corporate tax revenues and accounted for 4 per cent of GDP. With that sharply reduced, the Nordic economy struggled to grow at all during the 2010s... Denmark’s economy expanded by 1.7 per cent in the first half of this year compared with the same period in 2022. But stripping out the pharmaceutical sector — which is dominated by Novo Nordisk — GDP would have fallen by 0.3 per cent.

He has been compared in the Israeli press to a “weather vane” blowing with the wind... Elkin, the former Likud minister, believes that Netanyahu’s sole governing ideology is his own survival. “He began with a worldview that said, ‘I’m the best leader for Israel at this time,’” Elkin says. “Slowly it morphed into a worldview that said, ‘The worst thing that can happen to Israel is if I stop leading it, and therefore my survival justifies anything.’ From there, you quickly reach a worldview of ‘The state is me.’ He believes in it wholeheartedly.”