The UNCTAD World Investment Report 2025 is now available (also here), offering some valuable insights. This post is a graphical summary.

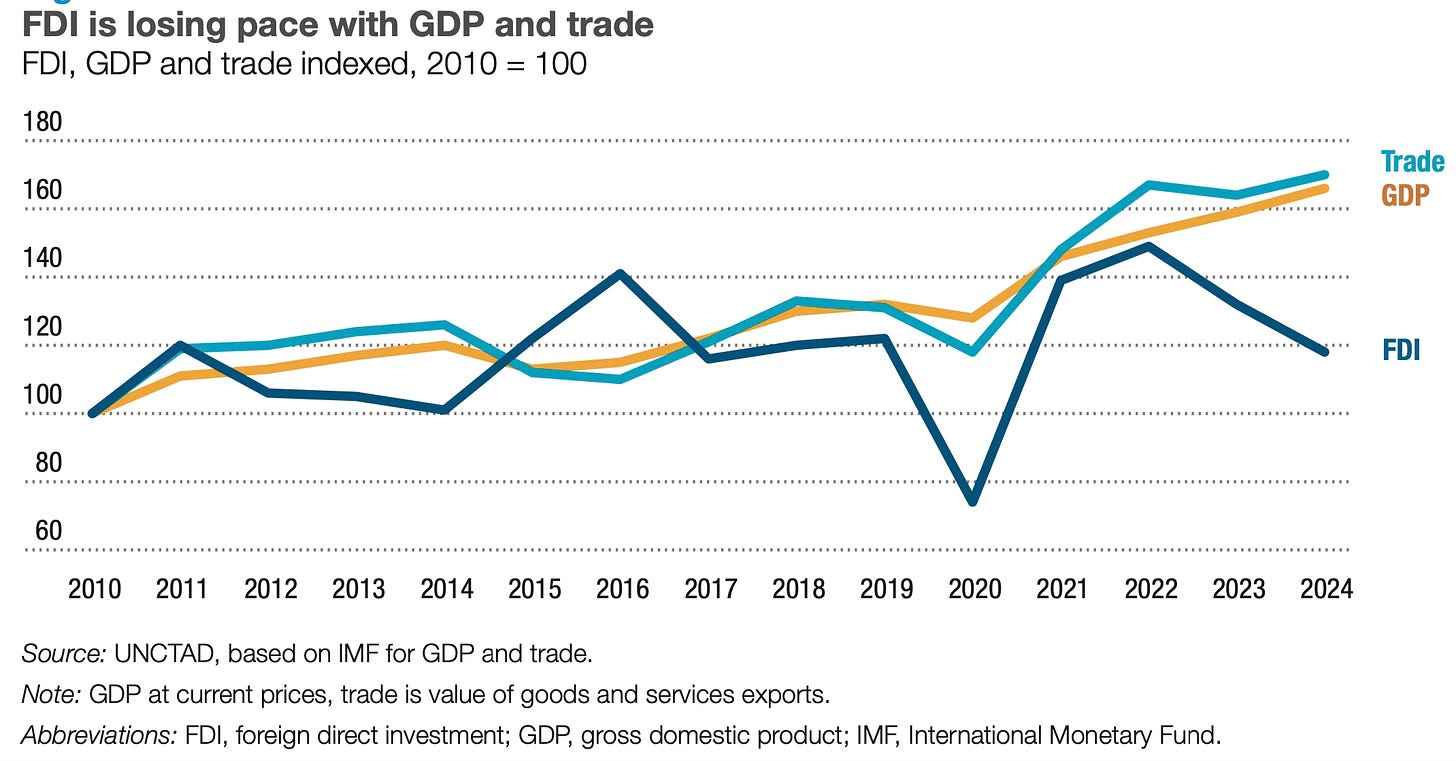

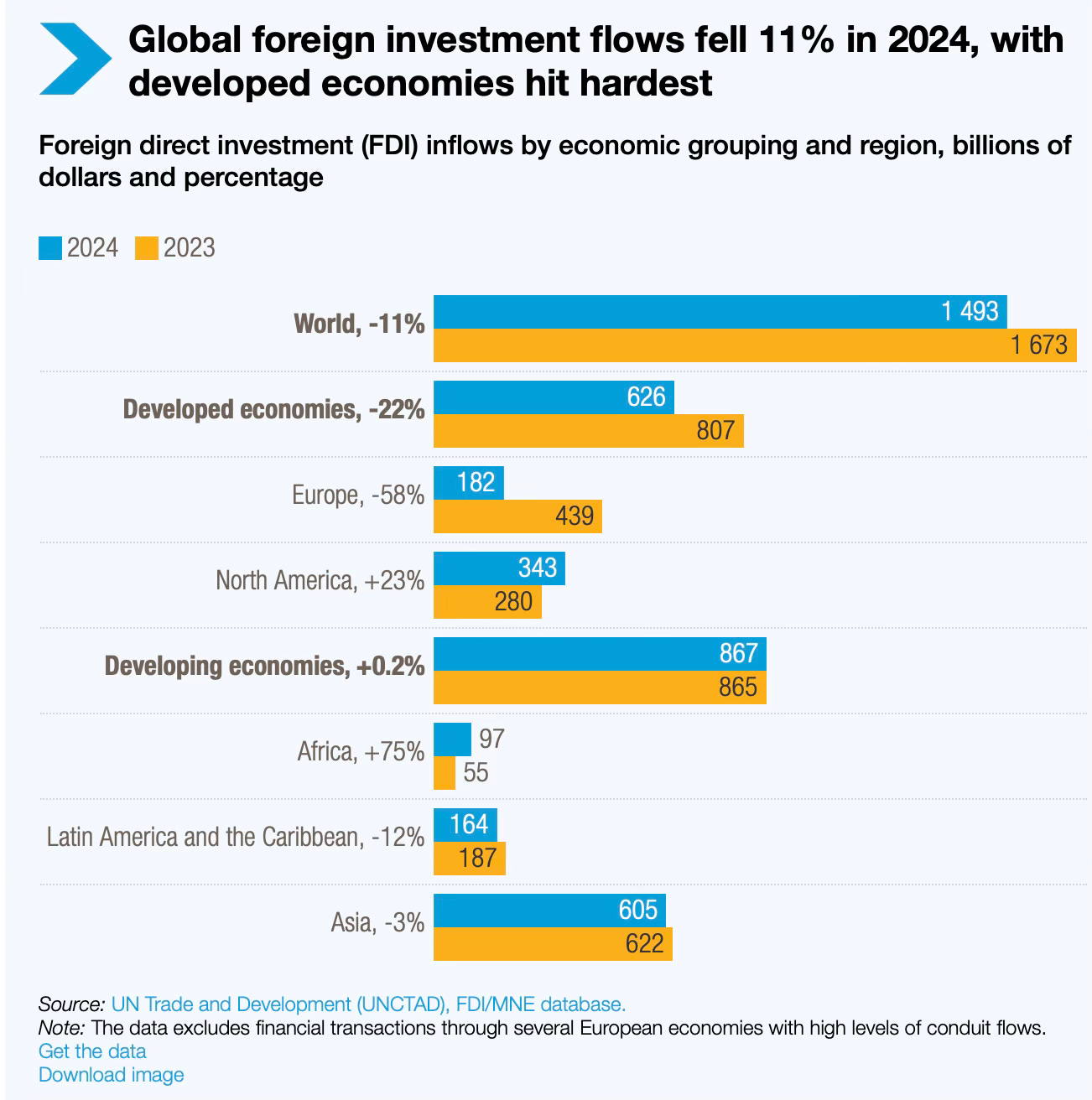

1. Since the pandemic, FDI has been on a declining trend both in absolute and relative terms. Global FDI flows declined by 11% in 2024, the second consecutive year of decline, and the investment outlook for 2025 is deeply negative.

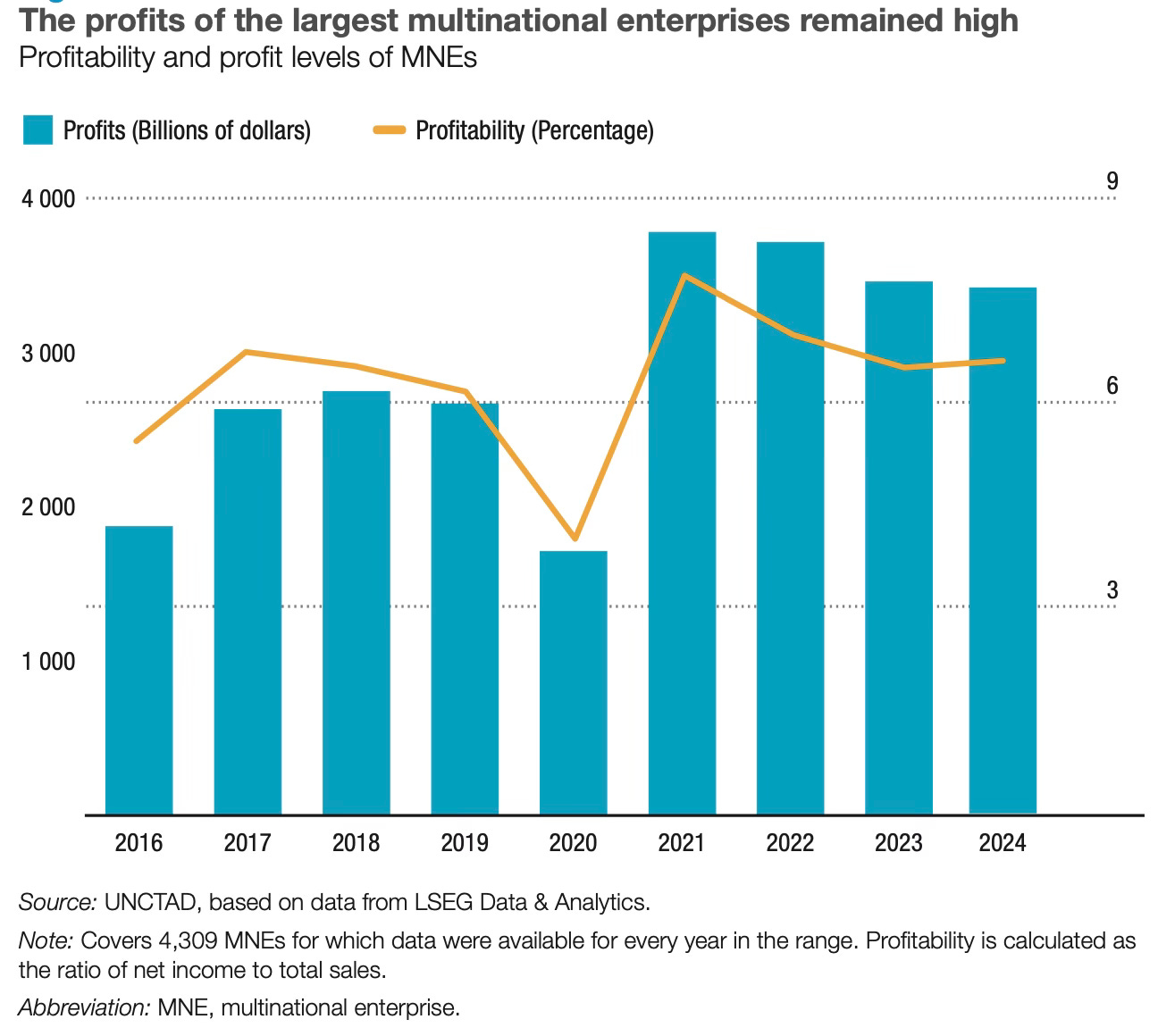

2. Also, since the pandemic, the profits of the largest multinational corporations has risen sharply.

3. Inflows have slowed down across regions, including in the most dynamic parts of East Asia. The one exception was Africa which registered a 75% increase to reach $97 billion, accounting for 6% of global FDI and 11% of FDI to developing countries.

India’s FDI inflows have been on a continuously declining trend from $64.1 bn in 2020 to $27.6 bn in 2024, whereas outflows have risen from $11.1 bn to $23.8 bn in the same period.

However thanks the surge in FDI inflows since the mid-2000s, India’s stock of FDI has risen from just $16.4 bn in 2000 to $205.6 bn in 2010 and $547.6 bn in 2024.

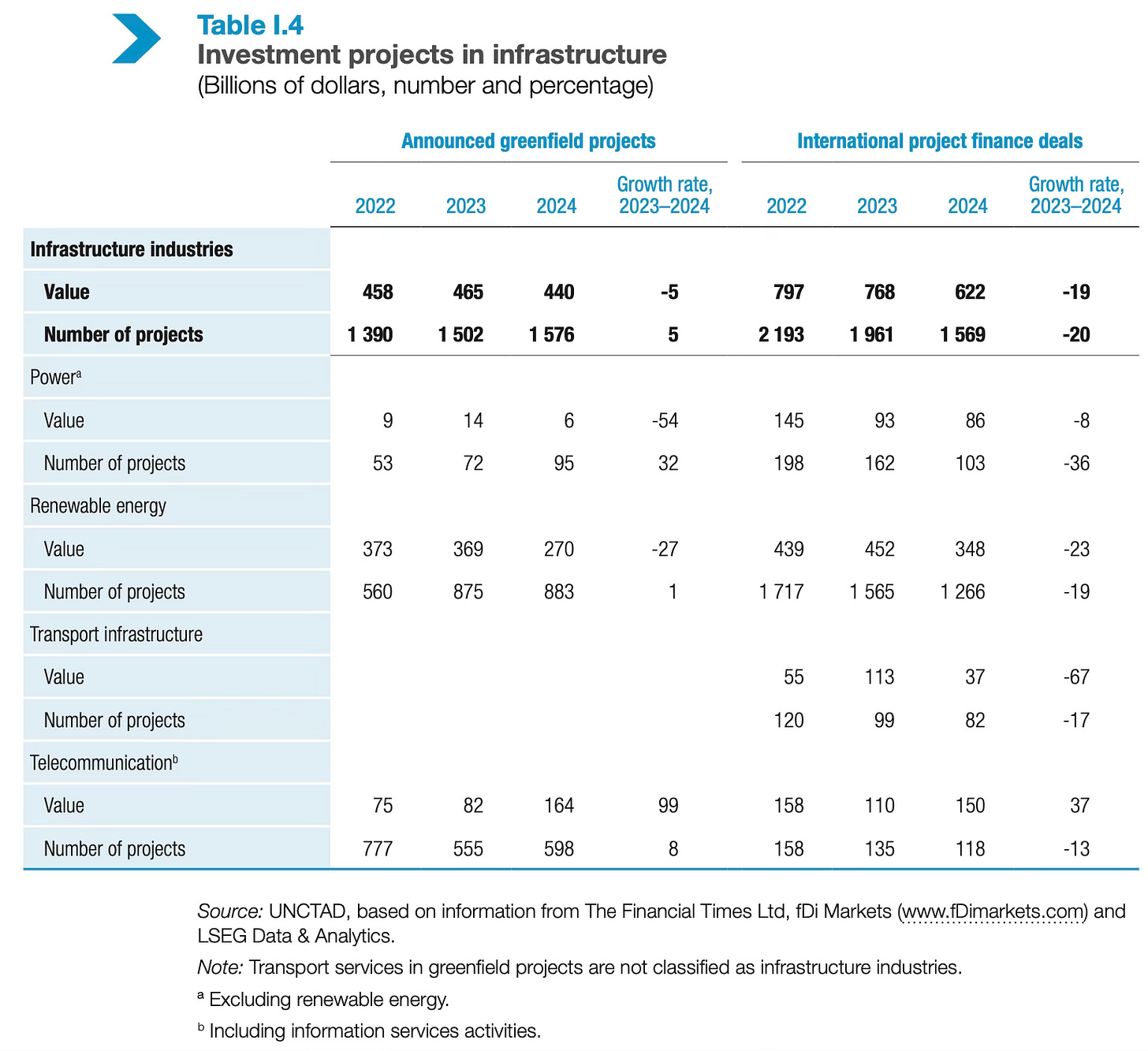

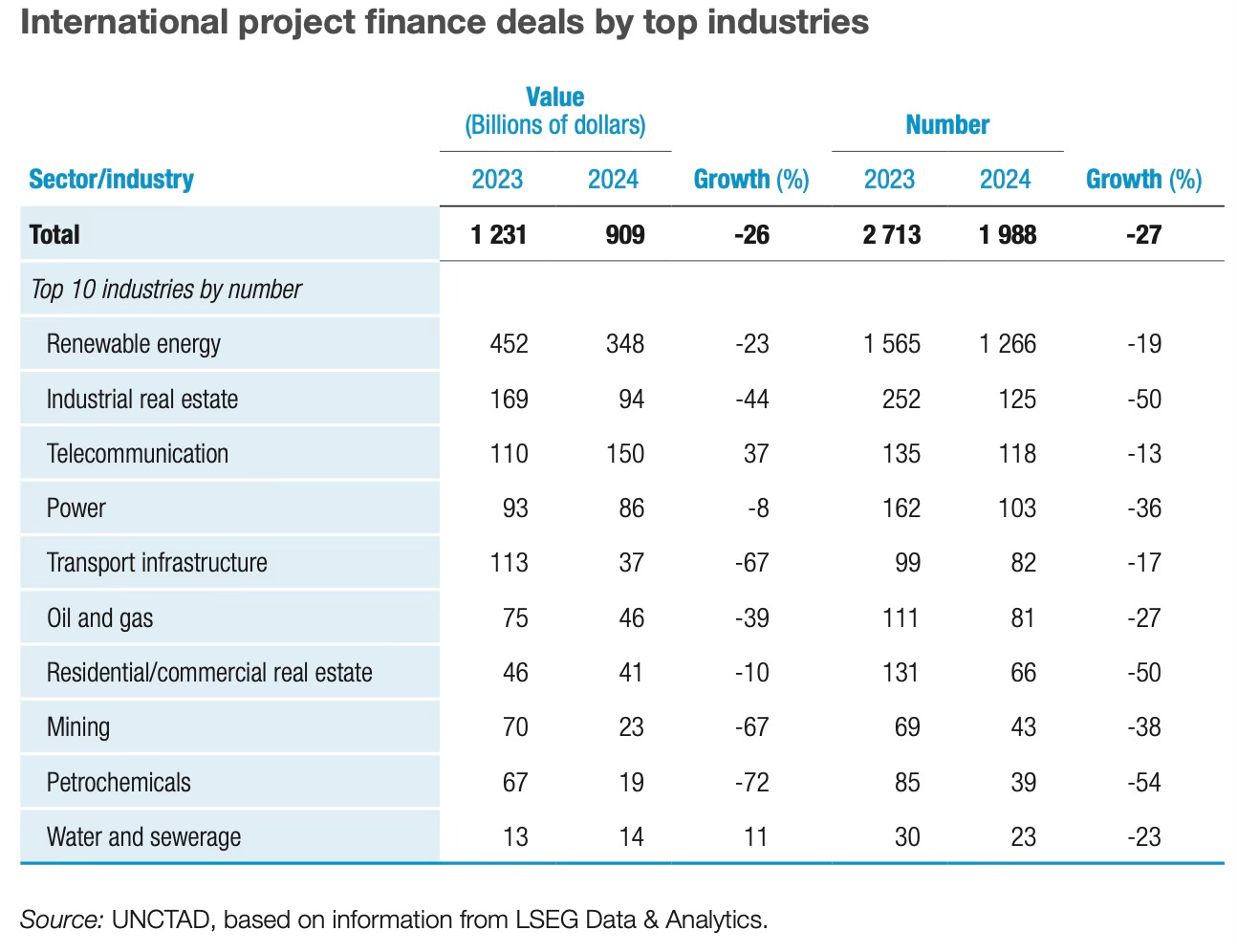

4. Infrastructure sector project investments have declined sharply both in value and volume, including in renewable energy sectors.

The only sector with positive performance is the digital industries. Project numbers in digital services, platforms and e-commerce rose by 17 per cent and aggregate values doubled.

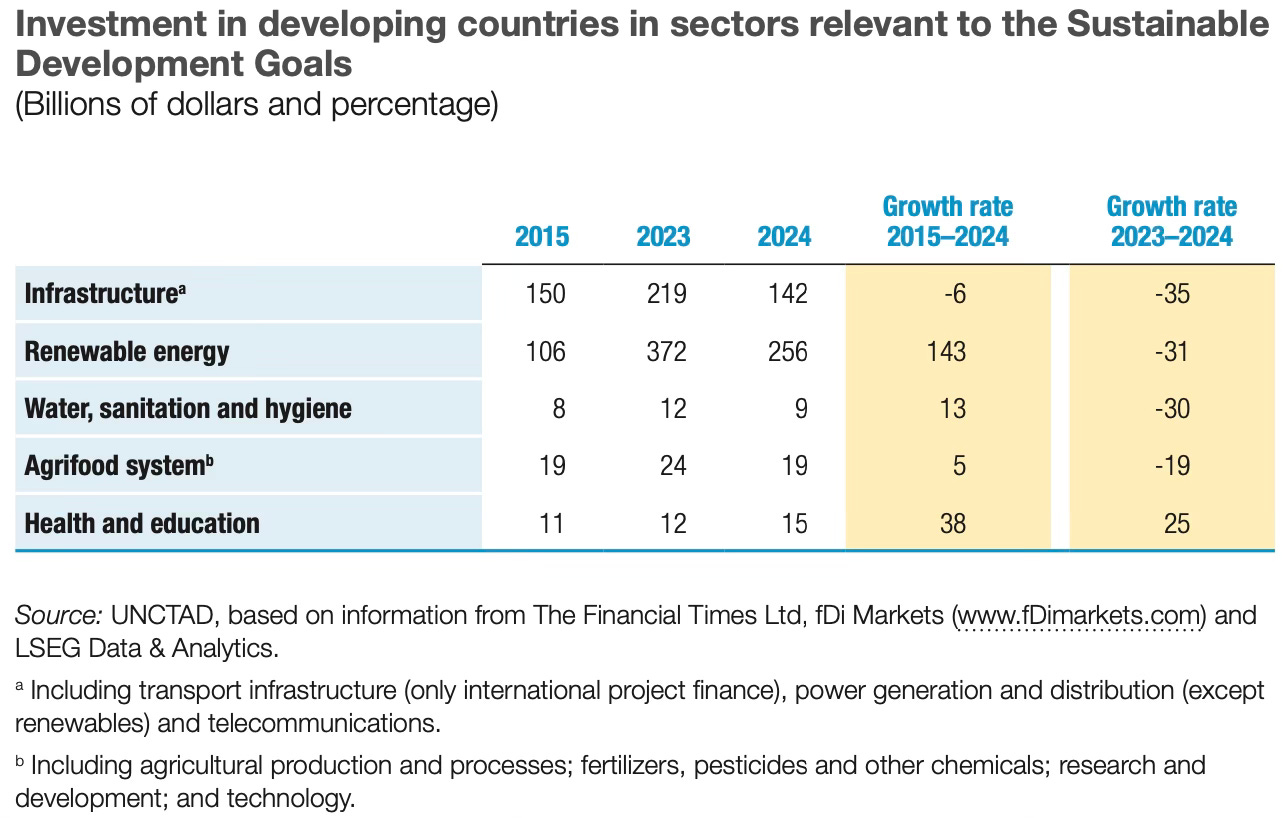

5. Investments in SDG related sectors in developing countries have remained stuck at low levels since the SDGs were accepted, with the only exception being renewable energy where too there was sharp decline in 2024.

6. International Project Finance (IPF) flows, which are tinvolve multiple investors and significant debt, and constitute a major part of the SDG financing, slumped by 26%, again the second year running, impacting infrastructure and SDG projects. The declines were consistently high across sectors in both value and number, with telecommunications (part of the digital economy) being the only exception.

IPF investments declined in Asia by 43% by value and in India by 37%. The report writes that the declines are “affecting emerging markets more severely, due to higher risk perceptions and elevated capital costs, with negative implications for investment in infrastructure and the energy transition.”

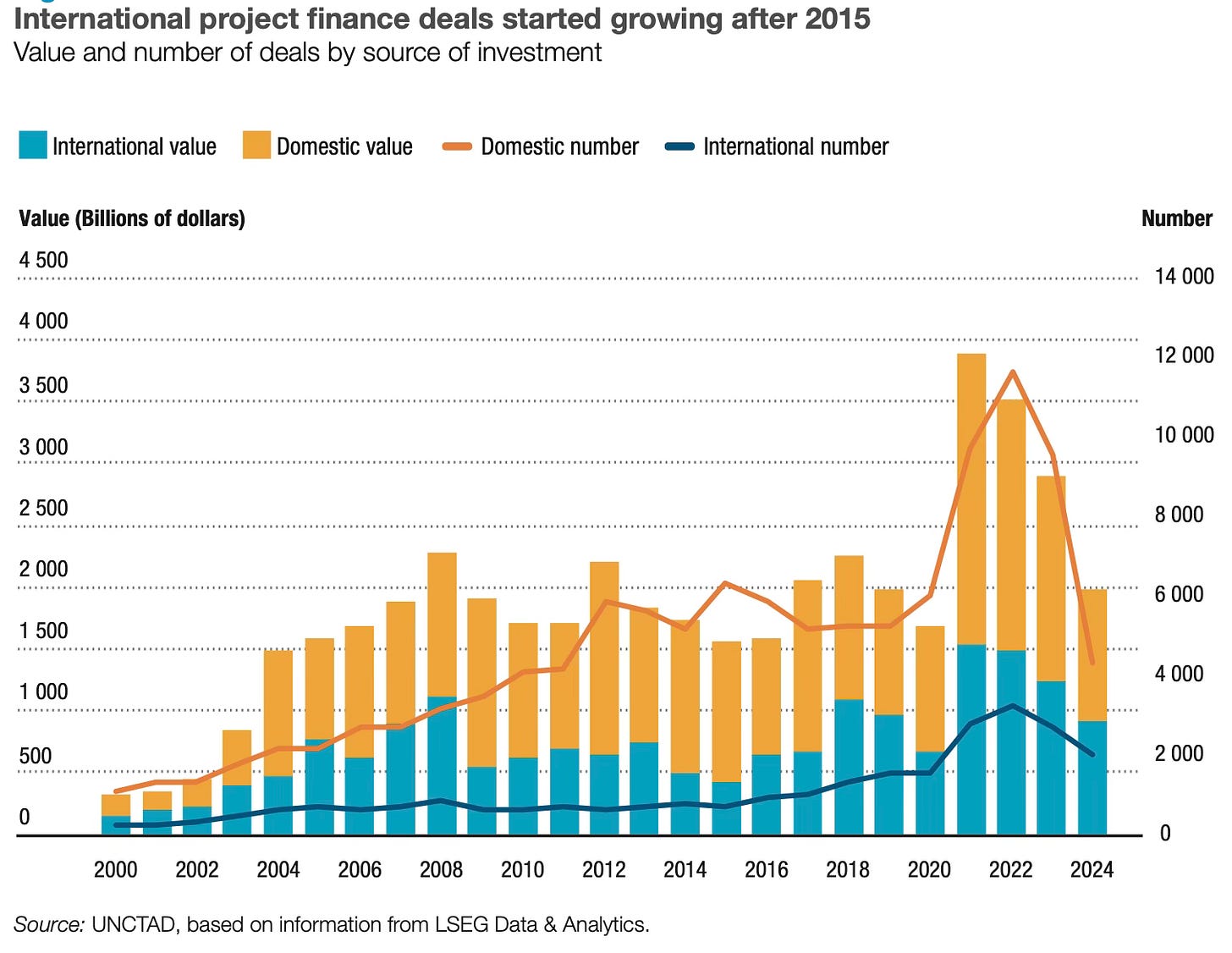

7. On a longer time frame, IPF has been on a declining trend since 2021. More appropriately, it can be said that IPF flows are back to their normal levels after the brief post-pandemic surge.

The global IPF market consists of domestically sponsored deals (where national governments, utilities, infrastructure companies and investment funds act as the project sponsors and equity owners) and internationally sponsored deals (where the equity owners include one or more foreign investors). Over the last two decades, internationally sponsored deals have accounted for about 20 per cent of project numbers but about 40 per cent of project values. The growth of IPF can be traced to the mid-20th century, when large-scale infrastructure projects – particularly in the energy and transportation sectors – began attracting cross-border investment. Over time, especially during the 2000s, financial innovations, risk mitigation instruments and evolving regulatory frameworks contributed to the expansion of IPF… Following the post- pandemic surge, international project numbers declined. In developing countries – and especially in LDCs – the downturn began earlier, coinciding with the pandemic onset. Recovery packages in advanced economies diverted investment towards lower-risk markets. This trend was intensified in the last two years by rising interest rates, global policy uncertainty and growing investor concerns about debt distress in many lower-income countries.

8. Among projects financed by an international sponsor in LDCs, more than two-fifths had government equity participation.

Even among developing countries, the worst impacted in terms of both domestic and international project finance flows since the pandemic have been the least developed countries (LDCs).

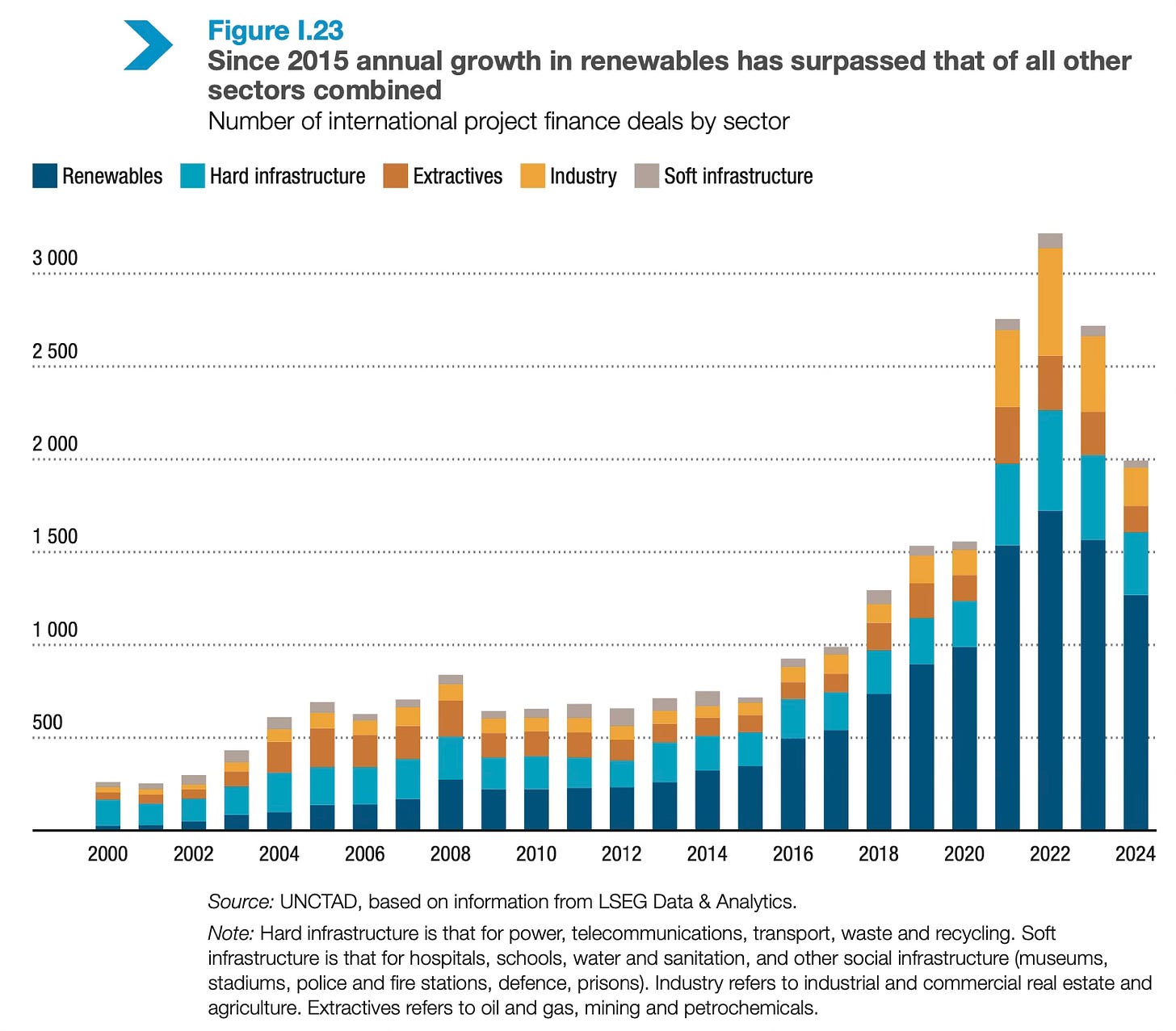

9. Renewables and hard infrastructure make up most of the IPF flows, and soft infrastructure is negligible.

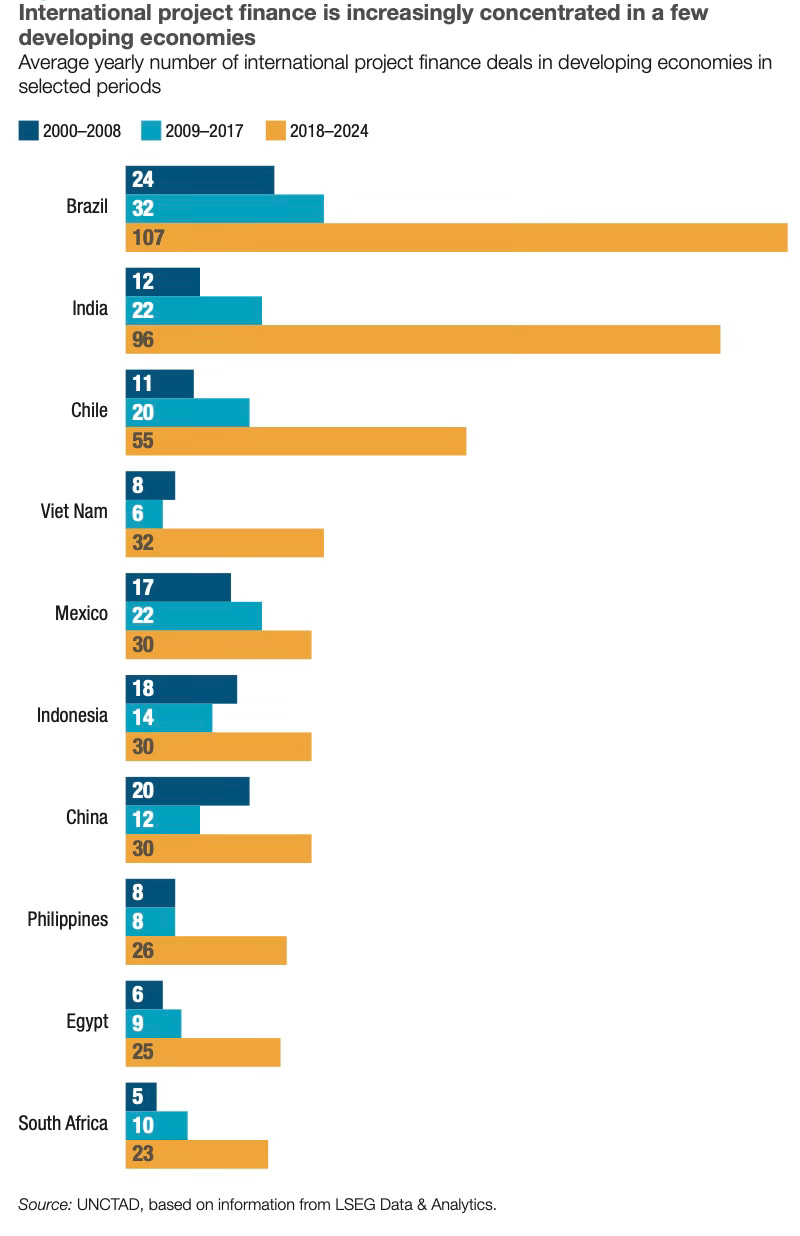

10. IPF flows into developing countries are concentrated in a few of them. India has been a standout beneficiary in the 2018-24 period.

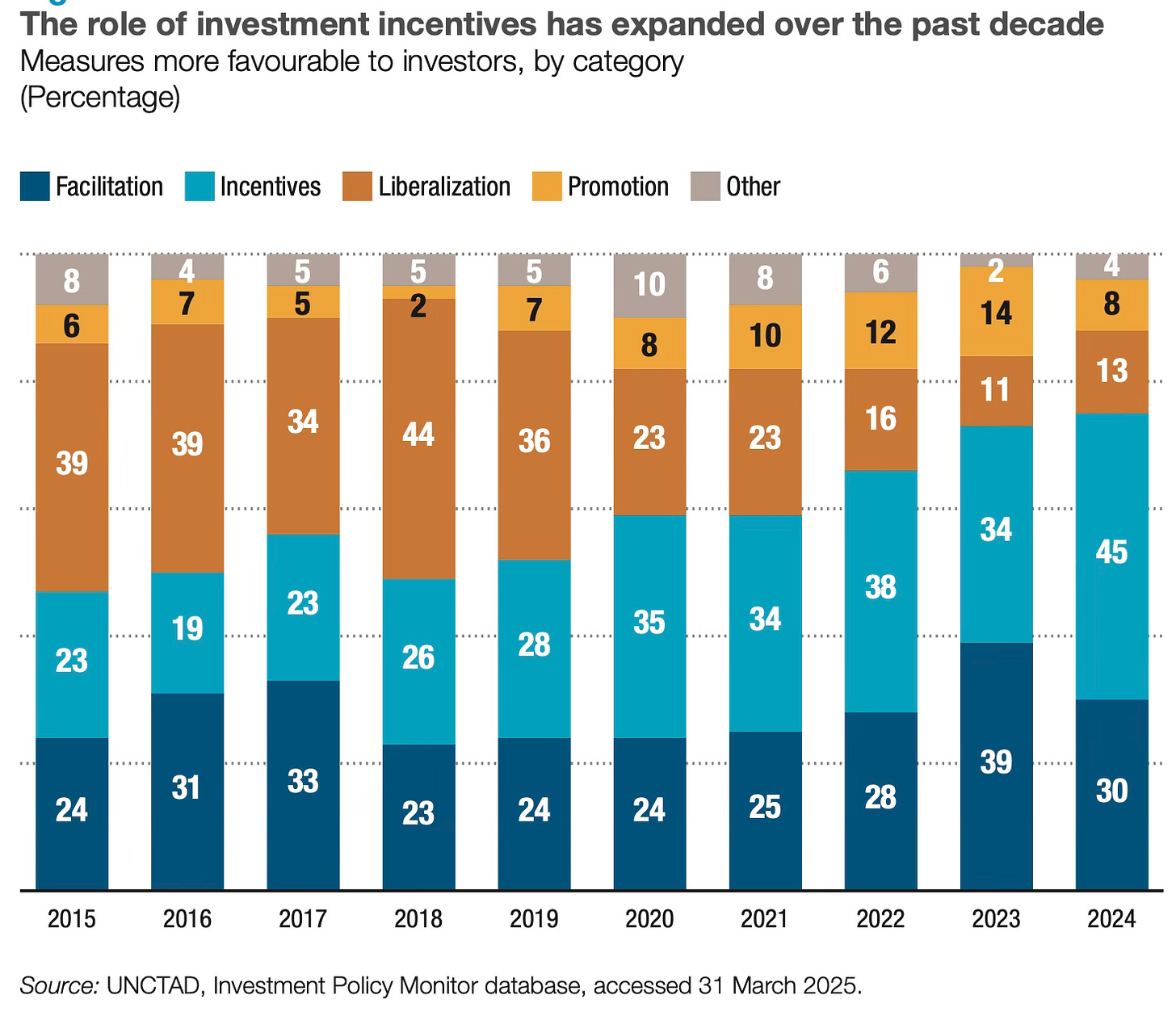

11. Competition among countries to attract investment has increased sharply since the pandemic, with fiscal and financial incentives making up an increasing and dominant share.

12. Even among incentives, financial incentives are rising in share.

This trend is disturbing also since it creates the possibility of a destructive competition for incentives among countries, especially developing countries.

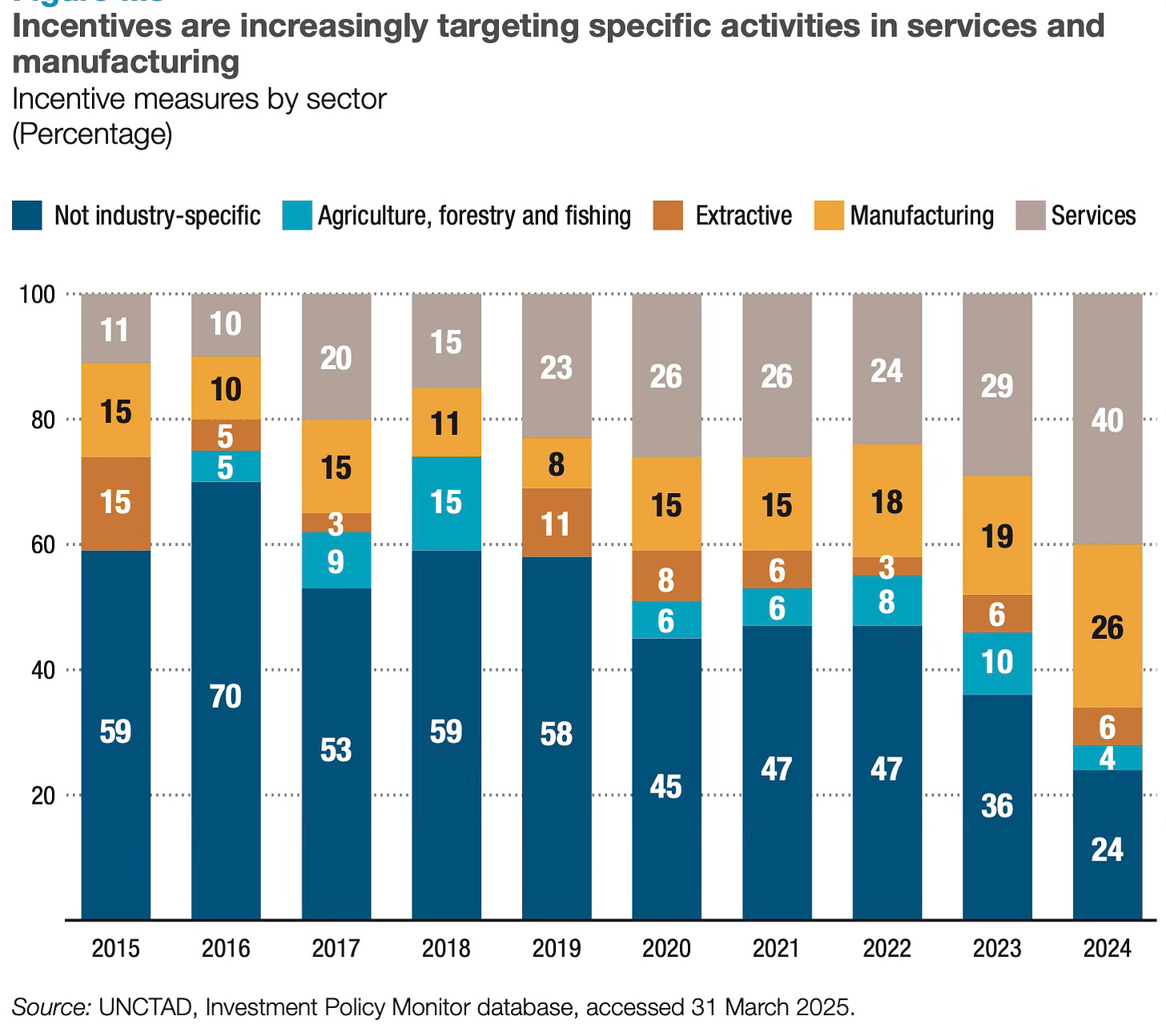

13. The sectoral distribution of incentives has shifted over the decade from “broad, cross-sectoral measures to more targeted, sector-specific ones. Before 2020, cross-cutting incentives – such as horizontal tax breaks and general investment incentives – accounted for more than half of all incentives. However, by 2024, their share had dropped to less than a quarter of all incentives introduced globally.”

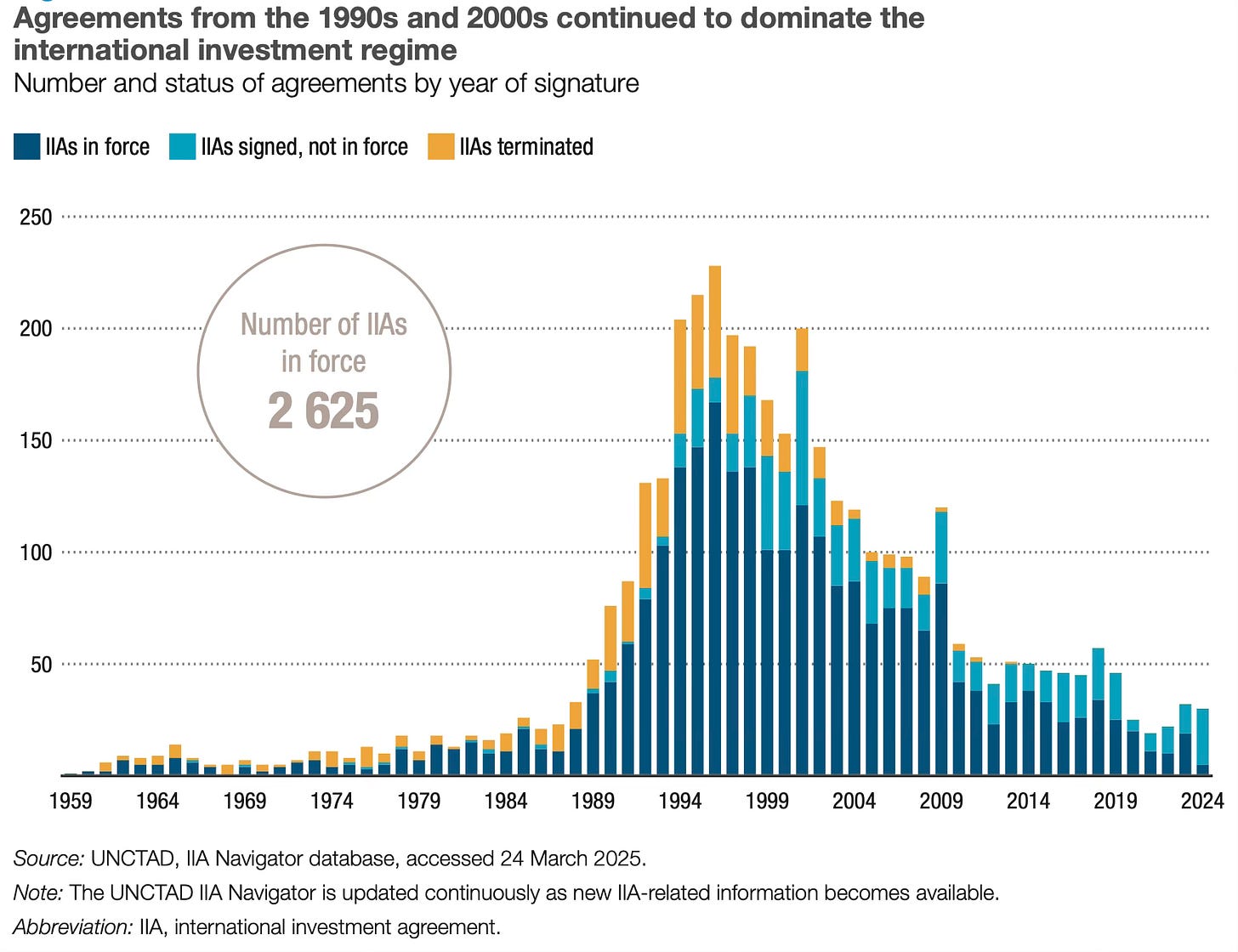

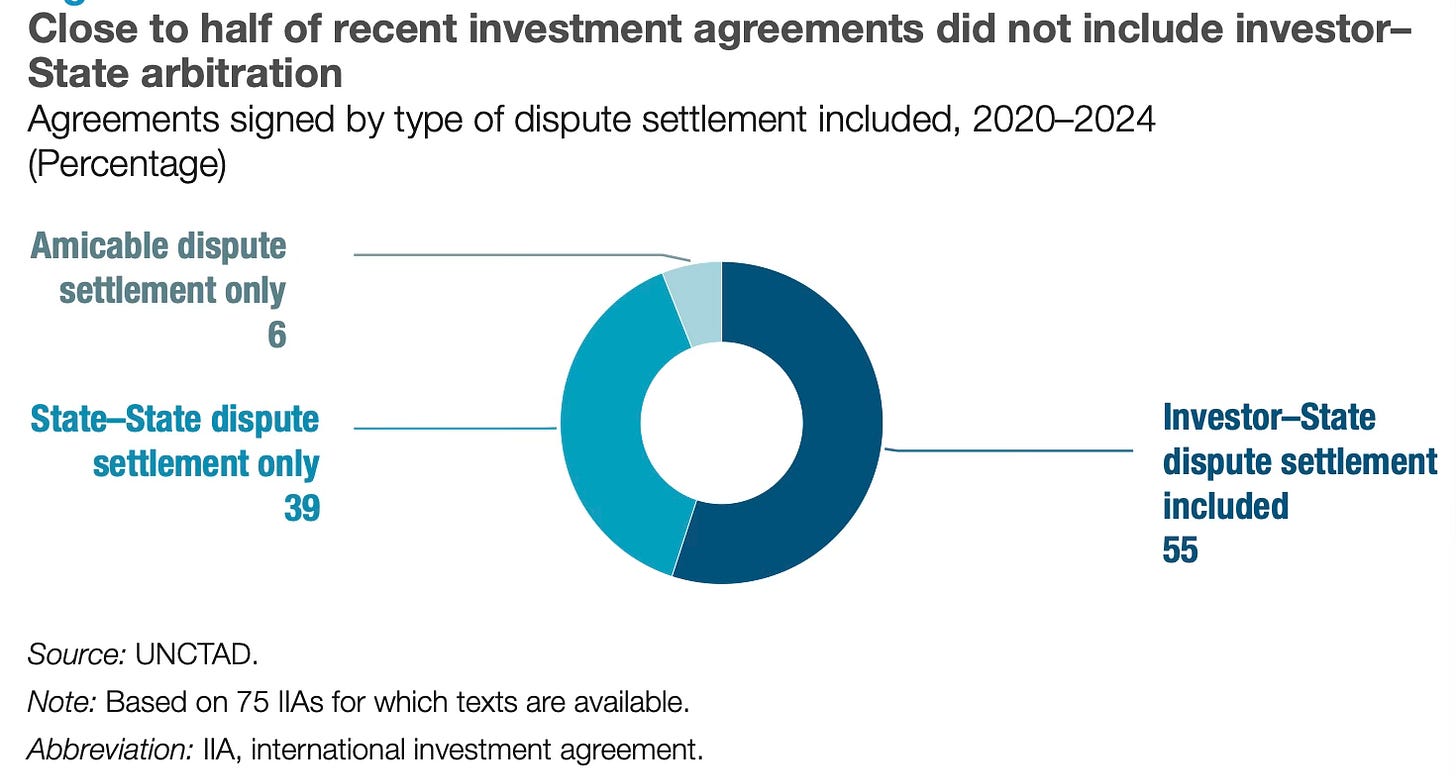

14. An important direction of investment policy has been the decline of international investment agreements (IIAs) and reduced reliance on investor-state dispute settlement (ISDS). Older IIAs are allowed to die with few replacements.

15. The sharp increase in international arbitration cases (ISDS cases reached 1401 at end of 2024, with the bulk arising the last 15 years) has led to a decline in IIAs relying on ISDS protection in the form of arbitration. About 60 per cent of all ISDS cases involved damages claims of $100 million and higher, including 143 cases in which investors sought more than $1 billion.

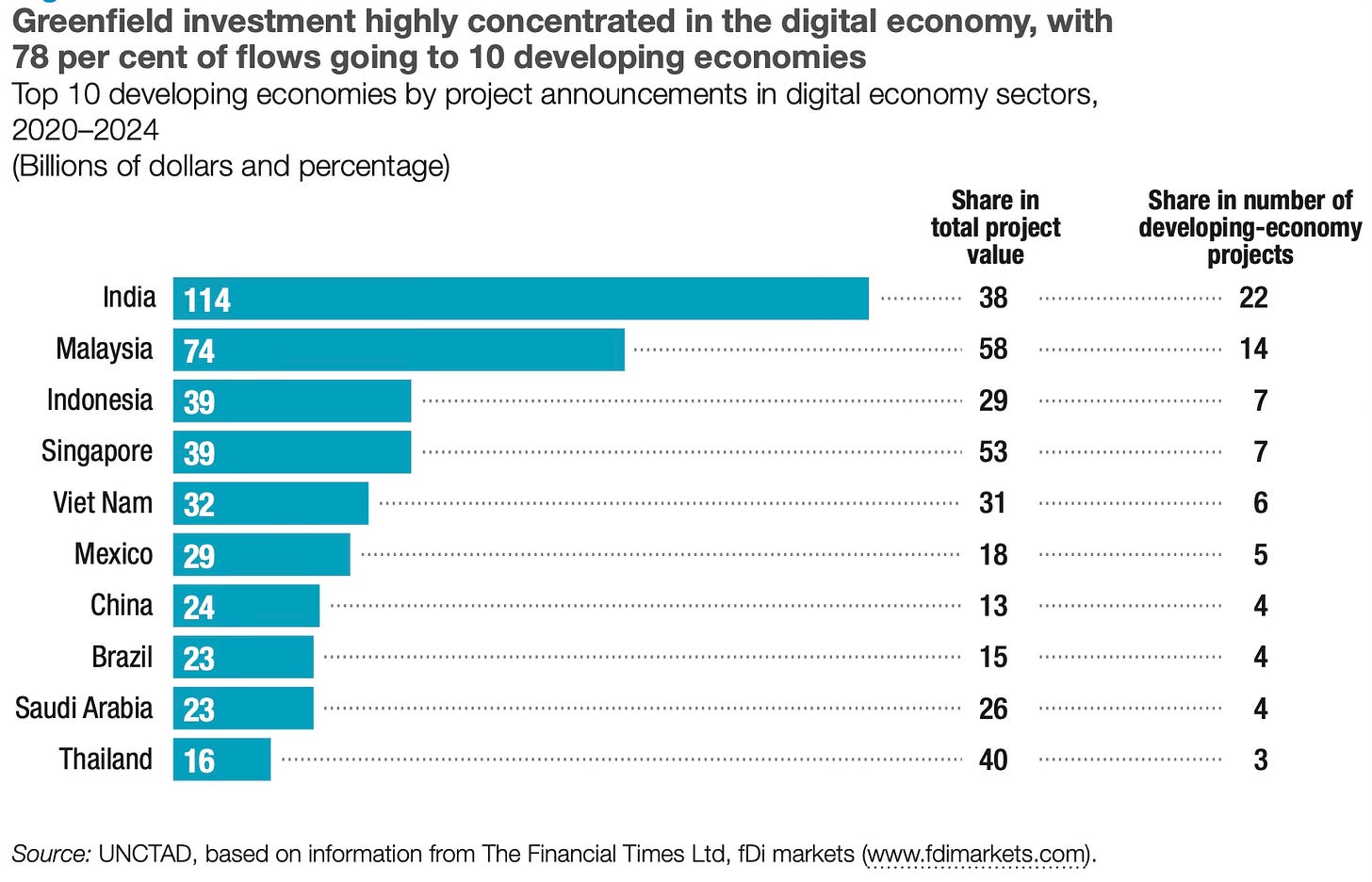

16. The digital economy is the one area where investments have been rising, and India has been the largest recipient of greenfield investments.

India has become the largest recipient of FDI among developing countries in specific digital economy segments like data centres, digital services, fintech, and ICT manufacturing.

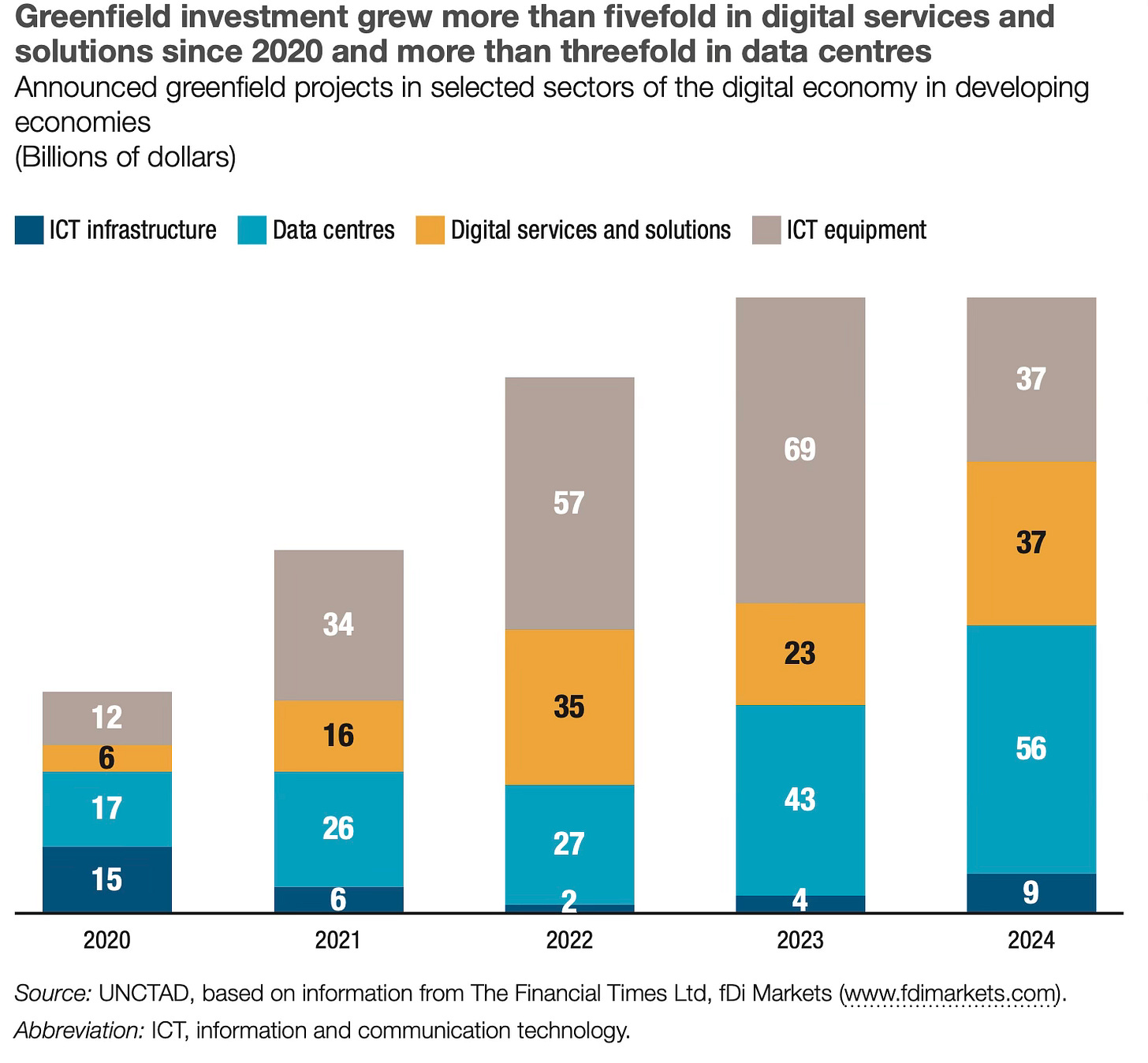

17. Data centres have emerged as the largest FDI destinations in the digital economy.

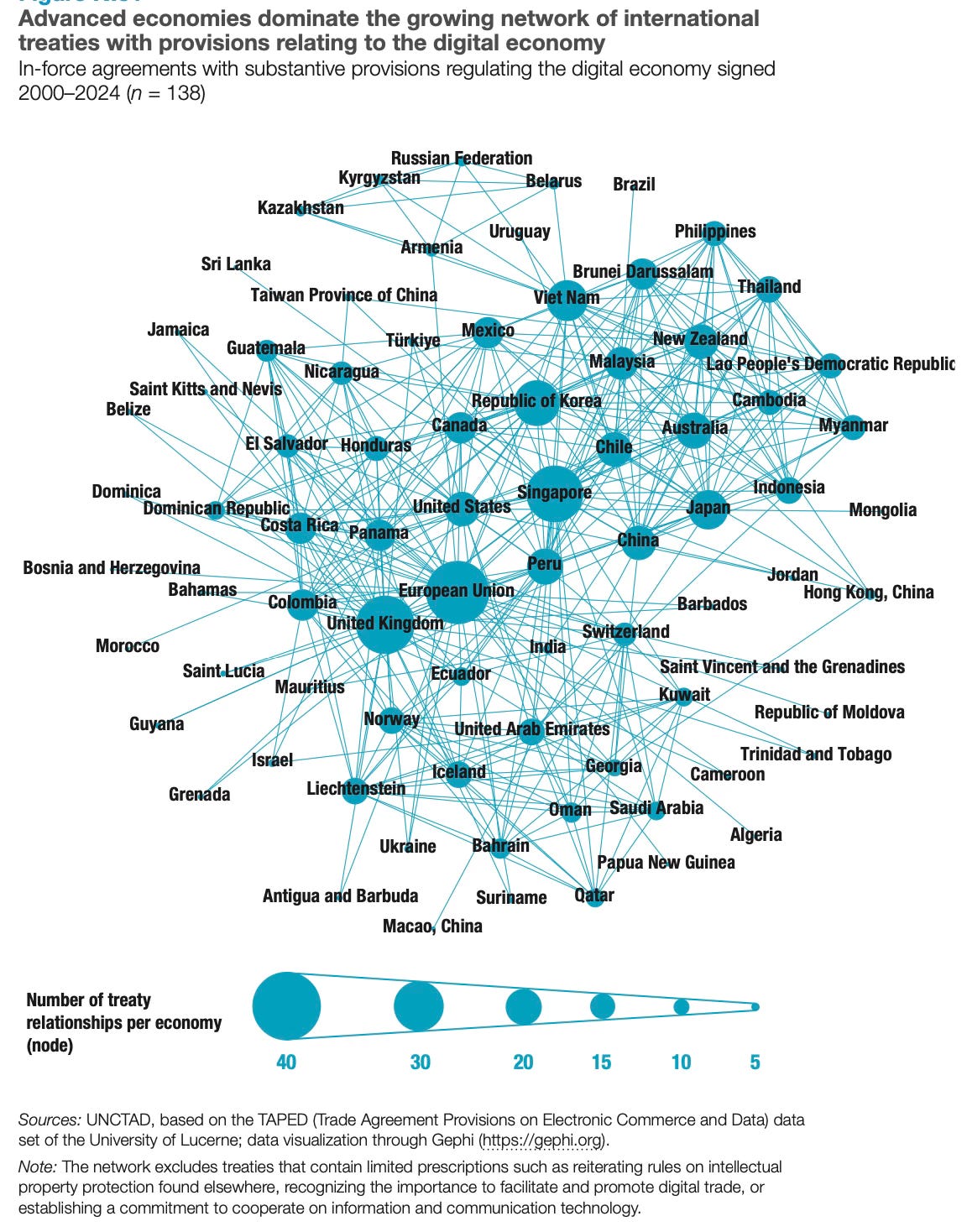

18. Graphic on the network of international treaties relating to the digital economy. Interestingly, like with the global value chains, India seems to be less connected here too.

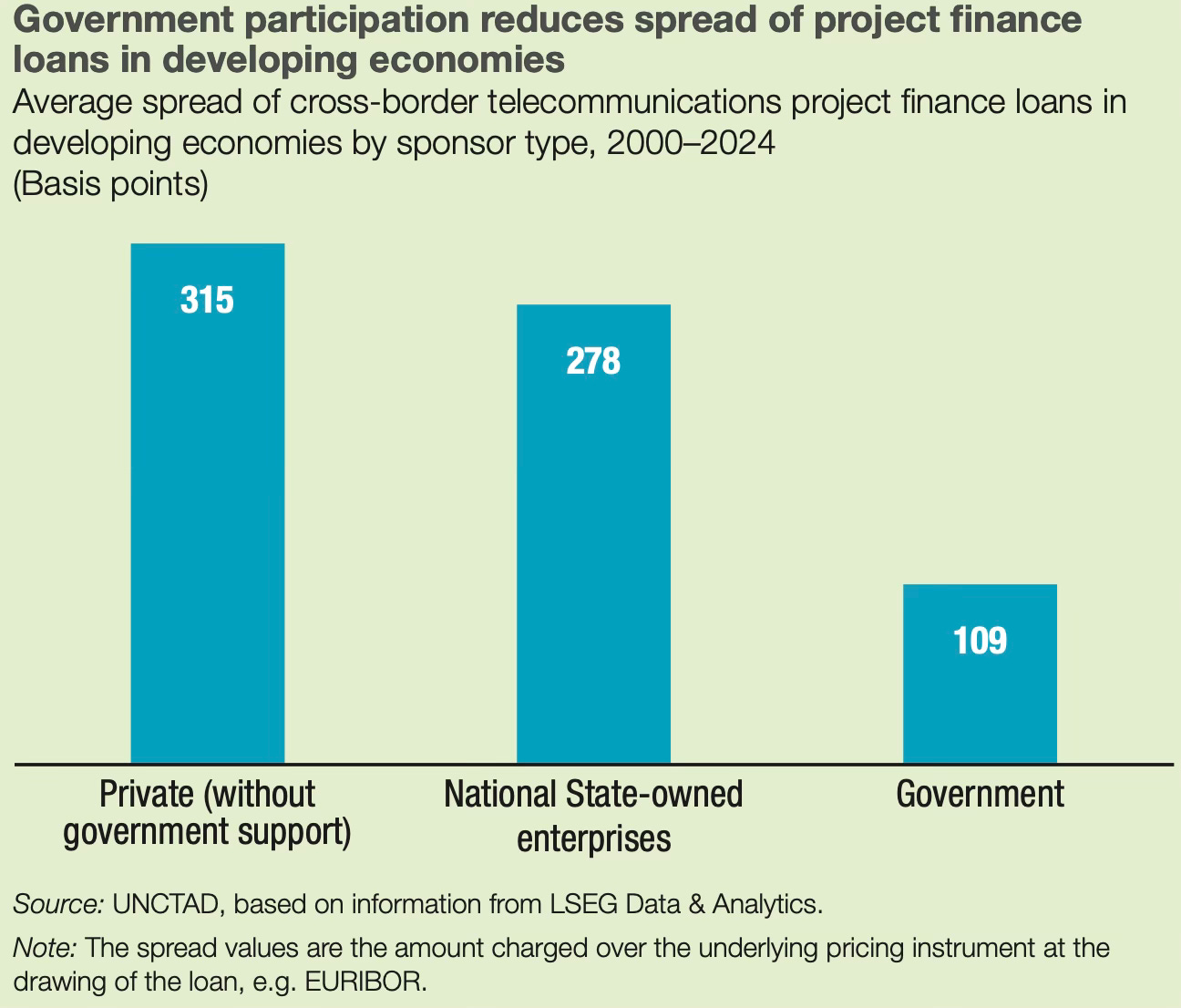

19. Finally, projects executed by State-owned companies are associated with marginally smaller loan spreads, and projects receiving government sponsorship secure loans with spreads that are 200 basis points lower than those of private companies that lack government or development bank.

No comments:

Post a Comment