Several indicators suggest a sustained decrease of traffic into, within and around the congestion zone. MTA data shows a 13 per cent drop in vehicles entering the central business district in March against a historical average, plus faster movement through the bridges and tunnels that are often snarled with traffic. This is supported by data from analytics firm INRIX that also shows minimal changes on Manhattan bridges outside the zone. On the funding side, the $500mn that the MTA anticipates raising this year from securities ahead of a big bond issue has provided investment for projects including signal upgrades, station elevators and a line extension.

This is corroborated by the findings of researchers in a new working paper who used Google Maps Traffic Trends data. They found speed increases for traffic into and inside the zone, without negative effects on local roads (spillover effects).

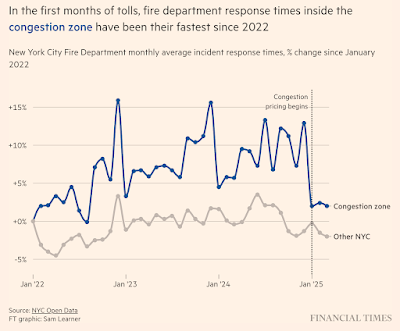

This has also meant shorter response times for emergency service vehicles.The share of domestic content in the output of US-based manufacturers dropped from 65 per cent in 1997 to 52 per cent in 2023. This decline was most pronounced during the period between 1997 and 2008, coinciding with the peak years of globalisation, when offshoring production to lower-cost economies became the dominant corporate strategy... India’s share of domestic value addition in its gross exports of manufactured goods (as a percentage of gross exports) has declined sharply from 88.2 per cent in 1995 to 63.3 per cent in 2012, before rising to 73 per cent in 2020.

According to Bain & Company’s Global Private Equity Report, distributions as a percentage of net asset value have fallen from an average of 29 per cent in the period from 2014 to 2017 to only 11 per cent today. PitchBook estimates there are more than 12,000 US portfolio companies — around seven-to-eight years of inventory at the observed pace of exits. This is much higher than the five-and-a-half-year median exit time they’ve observed across the industry to date.

5. Cory Doctrow offers a negotiating strategy for other countries while negotiating with the Trump reciprocal tariffs. He points to the intellectual property law called "anticircumvention", which prohinit tampering with or bypassing software locks that control access to copyrighted works.

The first of these laws was Section 1201 of America’s Digital Millennium Copyright Act, which Bill Clinton signed in 1998. Under DMCA 1201, it’s a felony (punishable by a five-year sentence or a $500,000 fine) to provide someone with a tool or information to get around a digital lock, even if no copyrights are violated. Anticircumvention laws are the reason no one can sell you a “jailbreaking” tool so your printer is able to recognise and use cheaper, generic ink cartridges. It’s why farmers couldn’t repair their own John Deere tractors until recently and why people who use powered wheelchairs can’t fix their vehicles, even down to minor adjustments like customising the steering handling. These laws were made in the US... The US trade representative has lobbied — overtly in treaty negotiations; covertly as foreign legislatures debated their IP laws — for America’s trading partners to enact their own versions.The quid pro quo: countries that passed such laws got tariff-free access to American markets. Canada enacted its anticircumvention law, Bill C-11, in 2012, after the ministers responsible dismissed 6,138 opposing comments on the grounds that they were the “babyish” views of “radical extremists”. Mexico enacted its version in the summer of 2020 in order to fulfil its obligations under the US-Mexico-Canada Agreement... Why should every peso that a Mexican iPhone owner pays to a Mexican app creator make a round trip through California and come home 30 centavos lighter? Why accept that for every 1,000 rupees someone pays in-app to India’s Dainik Bhaskar newspaper, the paper only gets 700 rupees? After all, if an Indian tech company makes its own app store, it could charge competitive fees that lure away all of Apple’s best Indian app maker customers. And why shouldn’t every mechanic in the world offer a one-price unlock of all the subscription features and software upgrades for every Tesla model... Monopolistic US companies have spent the first quarter of this century extracting trillions of dollars from consumers all over the world, insulated from competition by anticircumvention laws that they lobby to maintain. From printer ink to ventilator repairs, they have been able to pursue monopoly pricing, secure in the knowledge that no one would undercut them with cheaper and/or better add-ons, marketplaces, software, consumables and service offerings.

6. Fascinating story about Disco Corp, a 87-year-old Japanese company with 7000 employees and $20.8 bn revenues that makes about three-fourths of all machinese used globally to cut, ground and dice semiconductors and has been run on pure free market pricinples.

Disco is a business unlike any other. Since 2011, it has conducted a radical experiment to operate a blue-chip company on purely free-market principles. Nobody has a boss. Superiors cannot tell juniors what to do. Each day, employees choose whatever tasks they want. They can quit or join a different team at their own volition. Within this state of perfect freedom, most of their decisions will be guided by Will, as Disco’s internal currency is known. Employees earn Will by doing tasks. They barter and compete at auction with their colleagues for the right to do those tasks. They are fined Will for actions that might cost the company, or compromise their productivity. Their Will balance determines the size of their bonus paid every three months. The Will system, as it functions today, is the brainchild of Disco’s chief executive, 59-year-old Kazuma Sekiya, who sees his unorthodox management plan as fundamental to the company’s culture and success...

The Will system works like this. Sales of Disco’s machines generate Will. For each ¥1bn (£5.2mn) of revenue Disco accrues, approximately 400mn Will is typically generated for the sales staff to channel down through the company. They use that Will to reward or incentivise other employees to do tasks that support them. For example, they might pay Will to the manufacturing team to produce new machines for them to sell, pass on a stream of royalties in Will to the research team, or offer a tributary gift to their colleagues in HR for paying their salaries (in yen). Further down the food chain, the exchange of Will can be negotiated informally between employees in return for other tasks, paid for upfront, after completion or however the two parties agree is best. Disco also has an auction system for tasks, which works by dynamic pricing. The fewer people able or willing to do a task, the more Will has to be offered. If someone is desperate to do a certain job, or learn skills from a particular virtuoso, they might offer to pay Will for the privilege. Disco now has a team of eight employees who manage the Will system. They oversee a framework of 772 penalty and 337 reward items. About 187 of these payments and rewards are used regularly.The purchasing department fines people who write the wrong address on letters and packages, for example. The communications team has Will subtracted for negative articles that are published about the company. For Disco employees, Will dictates almost everything they do. Each member of staff starts the month with a negative Will balance, which they must strive to get above zero — an “existence cost”, so to speak. The system assumes employees are an inherent drag on the company until they prove otherwise. And the more senior you get at Disco, the greater your cost to the company is assumed to be.

7. Which developed country has had the most impressive economy since 1990?

This performance has helped the country maintain a AAA rating since 2003. The article is a good long read and examines the reasons for this economic perfornance.

Mining grew to become one of the country’s largest exports, accounting for 12.2 per cent of GDP in 2024, according to Australia’s central bank. For the past three decades, Chinese demand for iron ore and copper, and Japan and South Korea’s hunger for natural gas and coal, have been the key drivers of economic growth... Australia’s lopsided economy, says Chris Bradley, director of the McKinsey Global Institute. The effects of what he calls a “productivity crisis” have been partly masked by the mining boom, high levels of immigration and increased state expenditure, according to a report he co-authored and published in December... “There is no greater beneficiary of the rise in China than Australia,” says Richardson... Whereas average productivity grew more than 1.5 per cent annually between 1993 and 2016, it has not grown since and has been falling since 2022. GDP per capita is down from 2.5 per cent between 1993 and 2007 to negative 1 per cent in the past two years.

8. Huawei has done several extraordinary things. But what it's attempting to do now is even more so and these efforts have accelerated since the US imposed sanctions in 2019.

Huawei is involved in projects that aim to develop alternatives to technology from chip designer Nvidia, equipment maker ASML, memory-chip maker SK Hynix, and contract manufacturer Taiwan Semiconductor Manufacturing Company.

“The spinning wheel represents to me the hope of the masses. The masses lost their freedom, such as it was, with the loss of the charkha. The charkha supplemented the agriculture of the villagers and gave it dignity. It was the friend and the solace of the widow. It kept the villagers from idleness. The charkha included all the anterior and posterior industries — ginning, carding, warping, sizing, dyeing, and weaving. These, in their turn, kept the village carpenter and the blacksmith busy. The charkha enabled the seven hundred thousand villages to become self-contained. With the exit of the charkha went the other village industries, such as the oil press. Nothing took the place of these industries. Therefore, the villagers were drained of their varied occupations, creative talent, and what little wealth they brought them.”

Outsourcing has been led by US corporations; they are the masters of moving the capital-intensive manufacturing piece overseas to China and white-collar services to India. The only reason to offshore is to lower costs. Given a choice, it is always easier to have your employees and manufacturing next to you. Offshoring brings complexity to supply chains and is only done if costs can be brought down by 15-20 per cent at a minimum. If the endgame of these tariffs is to bring more manufacturing back to the US, it will affect corporate margins, as it is more expensive to do the job in the US — the reason it was offshored in the first place. Every company cannot pass on the higher costs. US corporate margins are near all-time highs, with return on equity above 16 per cent; both will go lower in the coming years.

This reduction in corporate margins can be seen in two related perspectives. In the first place, these inflated margins were the result of externalisation of the costs of supply chain resilience and national security. The tariffs and trade war with China is now forcing an internalisation of these costs. And that's a good thing.

11. DOGE may have failed, and Musk may be on his way out, but he may have clinched Starlink's biggest business opportunity.

Trump’s “Golden Dome”, which aims to replicate Israel’s “Iron Dome” for all of the US, could be one of the biggest taxpayer outlays since Ronald Reagan’s strategic defence initiative, better known as “Star Wars”. In dollar terms Trump’s dome may even rival Nasa’s Project Apollo, which cost $280bn in today’s money. Since the missile shield would need to rely on swarms of satellites, Musk’s SpaceX would be the largest beneficiary. The company has formed a Golden Dome consortium with Palantir and Anduril, which are run by his Big Tech friends. Musk’s lasting impact on Washington may thus be to divert a big chunk of US taxpayer money to his empire. As leaving gifts go, this one would be very nice. Whether it would enhance US national security is someone else’s problem. Ditto on whether Golden Dome contracts qualify as waste, fraud or abuse. When only one company can fulfil the project’s biggest functions, there is little prospect of an open bidding process.

12. The definitive graphic on China's continuously rising trade dominance.

“China has surpluses, not just with the US, not just with Europe, but with 172 economies in the world,” Bert Hofman, a former Beijing-based country director for China at the World Bank, told a meeting of the Foreign Correspondents’ Club of China. “And if you have surpluses with 172 economies in the world, that’s not a great soft power position.”

As also this

China was the subject of 198 trade investigations by WTO members over alleged dumping or illegal subsidies last year, double the tally of the previous year and accounting for nearly half of all measures reported to the global trade body, according to research by Peking University economics professor Lu Feng. More than half of the trade cases against China last year were initiated by developing countries, including India, Brazil and Turkey. Even close partner Russia has pushed back on China’s car exports.

13. One area where China is chronically dependent on US suppliers is in the aeroplane manufacturing industry.

With China’s three big state-owned airlines already flying 17 C919s and Comac expecting to build at least 30 more of the single-aisle aircraft this year, the tensions between Washington and Beijing are highlighting how Chinese companies can be heavily dependent on US companies in their supply chains. The C919, which made its maiden commercial flight in China in 2023, has 48 major suppliers from the US, 26 from Europe and 14 from China, according to Bank of America analyst Ron Epstein...For most western aircraft components for the jet, there are no domestic alternatives readily available, analysts say, meaning the US “can [halt] Comac in its tracks anytime it wants”, said Richard Aboulafia, managing director of AeroDynamic Advisory. One of the most crucial parts of the C919, its LEAP-1C engine, is built by CFM International, a joint venture between the US group GE Aerospace and French manufacturer Safran. While China has been developing a domestic alternative, the CJ-1000A, it is still being tested and is “not ready yet”, said Dan Taylor, head of consulting at aviation consultancy IBA... But if the US, at some point, decides to restrict exports of key components to China and “if China stops buying aircraft components from the US, the C919 programme is halted or dead”, Epstein said.

14. In an important event, Foxconn has struck a deal to manufacture electric vehicles for Mitsubishi Motors of Japan. Foxtron, its EV subsidiary, will develop and produce a Mitsubishi vehicle for Australian and New Zealand markets. In an industry where in-house manufacturing has been the norm, this outsourcing model is a potential turning point for the industry.

15. Alaska Sovereign Wealth Fund

In 1980, Alaskan leaders created the Alaska Permanent Fund to invest 25 per cent of the state’s revenue from North Slope oil. Each year the fund, which began with less than $1mn and now has around $80bn of assets, pays out a dividend to every Alaskan resident.

In the old days, retailers released just two main collections a year, Spring/Summer and Autumn/Winter. For decades, most chains have outsourced manufacturing to lower-cost factories in the far east with the clothes arriving up to six months later. Zara went against conventional wisdom by sourcing a lot of its clothes closer to home and changing products much more frequently. That meant it could respond much faster to the latest trends and drop new items into stores every week. Just over half of its clothes are made in Spain, Portugal, Morocco and Turkey. There's a factory doing small production runs on site at HQ, with another seven nearby, which it also owns. As a result, it can turn around products in a matter of weeks. More basic fashion staples are produced with longer lead times in countries like Vietnam and Bangladesh... Every piece of clothing is packaged and despatched from its distribution centres in Spain, as well as one in the Netherlands...CEO Mr Maceiras says, "It's something that allows us to make the right decision in the last possible minute, in order to assess properly the appetite from our customers, in order to adapt our fashion proposition to the profile of our customers in different locations." In other words, getting the right products to the right shops. At HQ, product managers then receive real-time data on how clothes are selling in stores worldwide, and – crucially – feedback from customers, which is then shared with designers and buyers, who can adjust the ranges along the season according to demand. Unlike some other High Street rivals, it only discounts when it stages its twice-yearly sales.

18. Amidst all the talk of the impact of the tariffs on the world economy, here's the impact of GFC and Covid 19 for perspective.

The GFC caused world economic growth to fall from 2.7 per cent in 2008 to minus 0.4 per cent in 2009, a decline of 3.1 percentage points. The Covid crisis saw global growth fall from 2.9 per cent in 2019 to minus 2.7 per cent in 2020, a drop of 5.6 percentage points... The International Monetary Fund (IMF) sees global economic growth slowing from 3.3 per cent last year to 2.8 per cent this year — a deceleration of 0.5 percentage points... The drop in global growth of 0.5 percentage points projected on account of the tariff shock seems piffling in comparison.

19. Muted salary and wage growth of India Inc's 457 listed companies that have declared their results for Q4 FY25

The combined salary & wage expenses of the country’s listed companies grew just 4.8 per cent in the January-March quarter of 2025 (Q4FY25) over a year earlier — in single digits for a fifth straight quarter, and the slowest rate in at least 17 quarters. For comparison, these companies’ combined salary & wage expenses had increased 6.1 per cent year-on-year in the same quarter of FY24 and 5.1 per cent in Q3FY25... The share of salary & wage expenses in Indian companies’ net sales declined to 12 per cent in Q4FY25 — against 12.14 per cent last year, and a five-year average of 12.6 per cent...

The combined net sales (gross interest income in case of lenders) of the 457 companies in our sample was up 6.4 per cent Y-o-Y in Q4FY25 — the slowest growth rate in six quarters. Their revenue is now set to grow at a single-digit rate for an eighth consecutive quarter —since the quarter ended June 2023. These companies’ combined net profit (adjusted for exceptional gains & losses) were up 6.7 per cent Y-o-Y at around ₹2.24 trillion in Q4FY25 — a decline from 7.1 per cent in Q3FY25, but an improvement from 6.4 per cent in Q4FY24... A slowdown in India Inc’s salary & wage expenses was led in the past by IT services companies like Tata Consultancy Services, Infosys and Wipro, the current round of rationalisation is led by BFSI, which has faced a slowdown in growth and margin pressures in recent quarters. Companies in the IT services and BFSI sectors are the biggest employers in the listed space, accounting for 48 per cent and around 30 per cent of the salary & wage expenses of all companies in our sample.

No comments:

Post a Comment