This post is the latest on the status of infrastructure fund raising from the private market (closed-end funds excluding hedge funds investing in the primary and secondary markets in PE, VC, real estate, natural resources, infrastructure, and private debt). The last update is here.

Private markets have enjoyed a boom since the global financial crisis on the back of the long period of ultra-low interest rates that suited such investment strategies. But now that appears a bygone era. Private capital raising is already beginning to reflect the expected trend and has been on the decline. And infrastructure forms a tiny share of the private market. And within infrastructure too, private funds aimed at Asia form a tiny share, for which India competes with others including China, Japan, and South Korea. And within this tiny share renewables, transportation, and telecommunications takes up almost everything.

This should be a cautionary note for policy makers to calibrate expectations on the likely envelope of private capital aimed at infrastructure. Outside of renewables generation, highways, airports, ports, and telecommunications, private markets are unlikely to contribute anything meaningful enough to infrastructure financing.

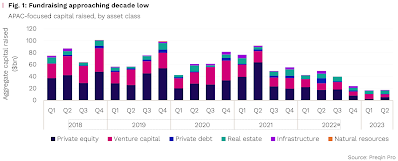

The latest Preqin quarterly report of Q2 2023 points to a sharp decline in fund raising since the first quarter of 2022. Even before then, the fund raising has remained stable and low.

The trends in infrastructure mimic the broader private capital market, with the decline pronounced and continuous since mid-2021. As can be seen, infrastructure has been and continues to remain a very small share of the global private capital inflows.

An MGI report on global private markets fund raising (pdf here) points to a declining or stagnating trend over the 2017-22 period, except in North America.

Private equity (including VC) formed 65% of all privately held assets under management (AUM), and infrastructure and natural resources formed just 10% with $1.273 trillion of AUM. Of this too, Asia contributed just $118 billion. In simple terms, infrastructure and natural resources AUM in Asia was just 1% of the $11.7 trillion worth of private market AUM in H1 2022!

This is a snapshot of the fund raising from private markets in 2022.

Infrastructure and natural resources fund raising is concentrated in North America and Europe. The amounts raised in Asia have been stuck below $10 bn for several years. Asia made up just 5% of the total of $158 bn raised in 2022. Worse still, infrastructure and natural resources funds mobilisation growth has declined over the 2017-22 period.

And almost all these funds, even in Europe and N America, have been flowing into transportation, telecommunications, and power generation (conventional and renewable).

For all the hype, renewable energy funds have declined last year and have been stagnant for a few years.

The report categorises infrastructure assets into super-core, core, and core-plus. Super-core assets, like regulated utilities and contracted as availability-based PPPs, are the lowest risk and lowest return. Core assets - non regulated oil pipelines, toll highways, airports, ports, OFC networks, telecom towers etc - are relatively low risk and low return. Core-plus assets carry more risks and offer higher returns.

Infrastructure assets have generated the highest total shareholder return (TSR) among alternative assets

However, TSR from infrastructure has been declining over the years as the pipeline of assets that can generate stable and reasonably high enough returns has dried up.

Even as the pipeline of renewable energy assets grows, the risks with existing conventional energy assets increase and their returns decline.

On

ESG investing, the AUM has undoubtedly been on the rise, though it remains very small.

In the broader category of climate tech PE investments, of which explicit ESG investments are only one group, renewables generation and EV-related transportation investments have been dominant. It's encouraging that water, agriculture, and waste management related investments made up the next three categories.

This is important given the prevailing public policy priorities of chasing municipal bonds, InvITs, unlisted infrastructure funds, foreign capital etc. A disproportionate amount of time and effort is being spent on these instruments and channels of questionable value at the cost of more important ones.

1. Banks will remain the major source of infrastructure finance for the foreseeable future. Therefore strategies that address the risks faced by banks like maturity transformation (takeout financing, syndication etc), risk pooling (pooled financing), and risk mitigation (credit guarantees, loss buffers etc) should be encouraged. Public policy and DFIs should prioritise this.

2. Municipalities and para-statal entities in India generally have very low debt exposures, Given their role in creating long-term revenues generating infrastructure assets, it's only natural that they use leverage optimally. One way to do this is to use

project finance approach to crowd-in bank and other debt for revenue generating assets (mass transit, water, sewerage, solid waste etc). This can be a powerful strategy to expand the envelope of bank financing going into areas like municipal infrastructure without engendering many of the distortions that are common with leverage.

3. Given the local currency revenues, there's an inherent and undiversifiable (without making the asset financing itself uncompetitive) risk associated with foreign financing of infrastructure assets. The focus of infrastructure finance policies should be on domestic sources.

4. Greenfield investments carry large construction risks that cannot be controlled and therefore find fewer investors. It therefore makes greater sense to

construct with cheaper public finance and off-load construction risks to attract private investments into operating assets whose commercial risks are also better known. The national monetisation pipeline therefore assumes greater significance for private participation in infrastructure.

In conclusion, given the end of monetary accommodation in developed countries and the resultant higher interest rate regime and the generally lower returns from infrastructure, private market inflows into infrastructure are unlikely to rise significantly and could more likely stagnate or even decline. Public policy should be cognisant of this likelihood and revise its priorities.

No comments:

Post a Comment