This is the latest post on my evolving thoughts on the Indian economy. I'll have two posts on this. The first will focus on the expectations about the trajectory of economic growth going forward and the second on some emerging trends in the quality of economic growth.

In Can India Grow, we had argued that India does not possess the capital foundations to sustain high rates of growth for long periods. It does not have the physical infrastructure, human resources, financial capital, and institutional capabilities to grow in the 7-9% ranges without engendering serious distortions and overheating. The last such episode of high growth in the 2003-11 period required nearly a decade for companies to deleverage and for banks to overcome their bad assets. While some commentators have since come forth with similar views citing aggregate demand etc, I think we were the earliest to put forth a clear case for lowering expectations and targeting a 5-6% economic growth rate.

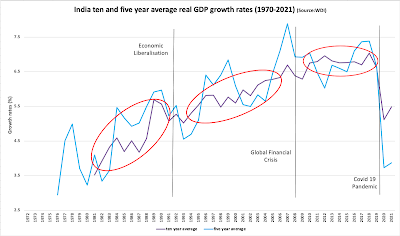

In this context, if we examine the country's real GDP growth rates since 1972, it reveals some interesting insights (a friend pointed me to this).

The average GDP growth rates for the five decades from seventies were 2.8%, 5.7%, 5.8%, 6.3%, and 6.6%. Strikingly, out of 41 such periods, there has been only one ten-year period, 2009-18, when the average growth rate touched 7%. Even on a five-year average, there has been only six five-year periods out of 46 such periods over the 1972-2021 when the average growth rate touched 7%.

Further, the growth trends have been progressively flatlining over time. The higher growth rates over the last two decades are amplified by the pent-up growth spurt in the nineties post-liberalisation and the very high growth of 2003-11 (especially the the overheating in the later half of this period). The business as usual potential growth rate today may therefore be closer to 6%. This tallies perfectly with the IMF's latest projection of India's current potential output.

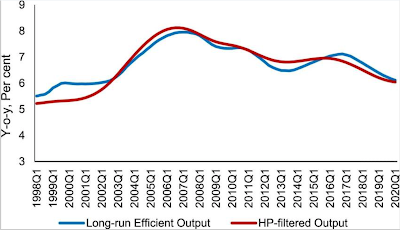

In a recent paper, two RBI economists, Saurabh Sharma and Harendra Behera, used a DSGE model to figure out India's potential output and output gap. They write,

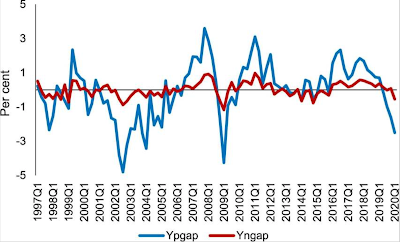

The results suggest that a combined deceleration in neutral and investment-specific technology growth post 2016, brought down the potential growth to around 6 per cent in 2020Q1. The output gap also witnessed a persistent decline since 2018Q1, primarily due to weak demand and a rise in investment adjustment costs reflecting heightened stress in the investment and financial sectors... We find that the long-run efficient output is a better estimate of potential output... According to this estimate, potential growth in India witnessed a sustained increase from 2002 to 2007, and remained subdued thereafter... We also find that the sudden uptick (2002 onwards) in potential growth is mainly driven by neutral growth.

Underlining the point made earlier, they highlight the overheating that happened in two spells over 2006-08 and 2010-12.

A 6% baseline growth for the next three decades would be extraordinary. Underlining this point, as Ruchir Sharma has written, there are only six countries which have grown at 5% for four decades - Taiwan, Japan, South Korea, Singapore, Malaysia, and China. As the data shows, India has become the seventh. But just two have done it for five decades in a row - South Korea and Taiwan. Given that China looks certain to fall short, India could become just the third. It could go one better and strive to become the only country to grow at 5% for seven decades in a row. This would be exceptional at a time when developed countries will struggle to grow at even 2%.

Sustained high growth rates demand that there is adequate supply and demand-sides to support it. Both are not as easy to expand rapidly as imagined. For example, in construction, it would mean upstream capacity expansion in cement, steel, and bitumen (and the risk capital to make the investments; incremental credit expansion by lenders); ancillary requirements like sand mining, metal crushers, ready mix concrete plants, centering materials supply etc; local factors like skilled labour of lathe operators, road-benders, masons, and so on; regulatory system which can expedite clearances and permissions; demand-side for private construction (like residential housing and commercial property); and the fiscal strength to support public investments. A too rapid growth will invariably drive up signatures of overheating - high inflation, property bubbles and land valuations, spike in wages, environmental damage, clogged infrastructure like traffic congestions and water scarcity etc. The same applies to other sectors too.

So what should economic policy making in India target? India should strive to maintain macroeconomic stability so that it can target a baseline growth of 5-6% for the next three decades, and grab emergent opportunities, especially ride global tailwinds, to episodically increment growth by 1-2 percentage points. We should simultaneously use the growth to build the capital foundations - increase domestic savings, deepen financial inclusion, develop robust financial intermediation systems, expand physical infrastructure, prioritise human capacity development, and develop and strengthen state capabilities.

Fortunately, a feature of macroeconomic policy making in recent years has been the commitment to fiscal consolidation and transparency in its budget accounting. It is therefore not at all surprising that the country has so far weathered well the supply and demand shocks from the pandemic and the Ukraine invasion. It has been pragmatic enough in times of crisis to expand and focus on the quality of expenditures. It's essential that it continue to stay the course.

But where it could change stance would be to eschew high growth claims and exhortations, and lower expectations based on realistic understanding of the country's potential output growth rate. Under-promise and over-deliver could be sound economics and sounder politics.

No comments:

Post a Comment