I have written several times on the Indian private sector. This post will try to summarise a few things.

Naushad Forbes has several educative op-eds in Business Standard on the topic, including one where he helpfully outlines a benchmarking exercise for Indian firms.

I’ll draw on two sets of data from his opeds.

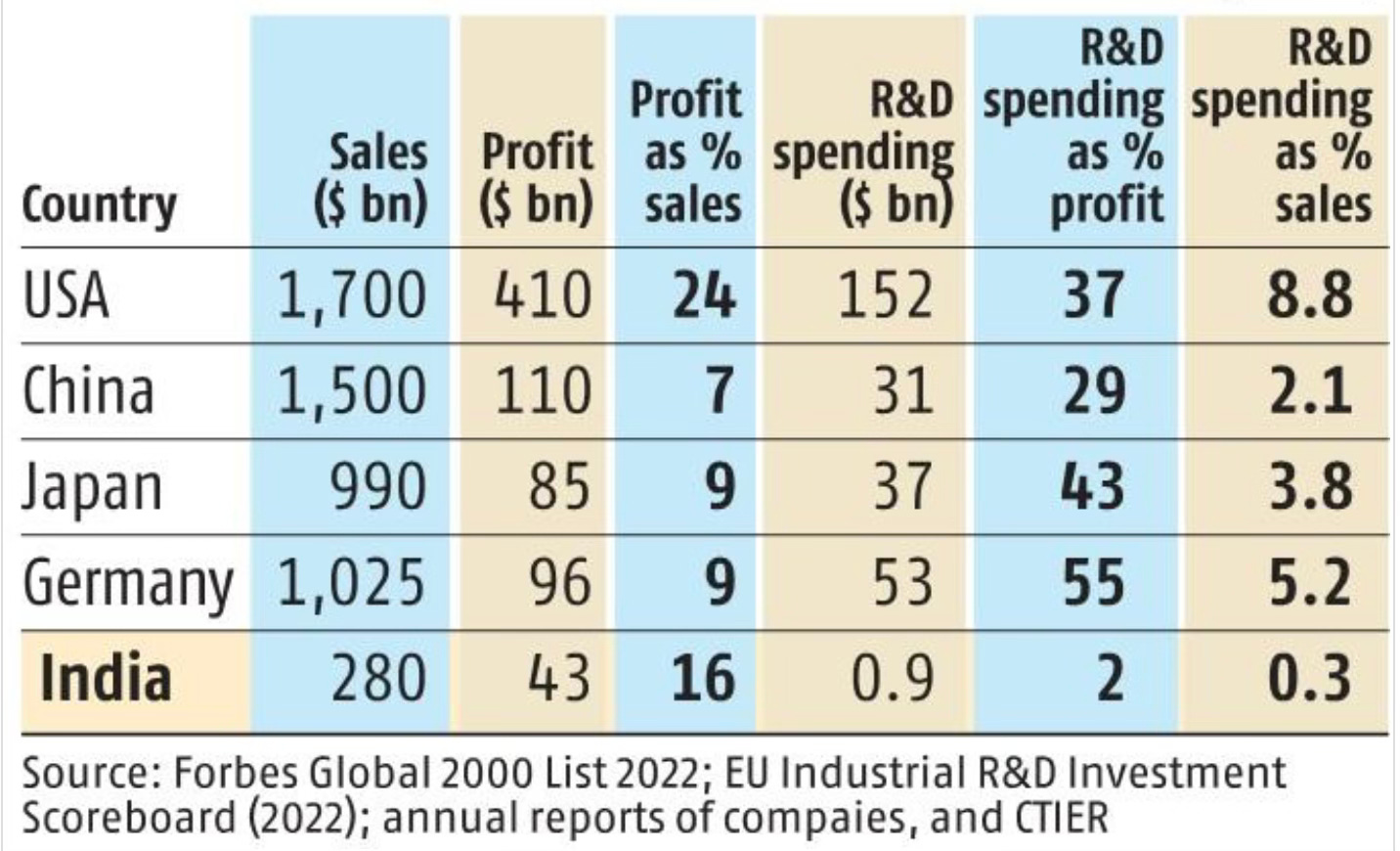

One, the comparison of the R&D expenditures of the top ten profitable non-financial firms of the world’s five largest economies in 2021 shows that despite having the second highest profits as a percentage of sales, nearly double those of China, Japan, and Germany, the Indian companies spend an abysmally low share of profits and sales on R&D.

Indian firms invest 0.3% of GDP in in-house R&D, compared to a world average of 1.5%.

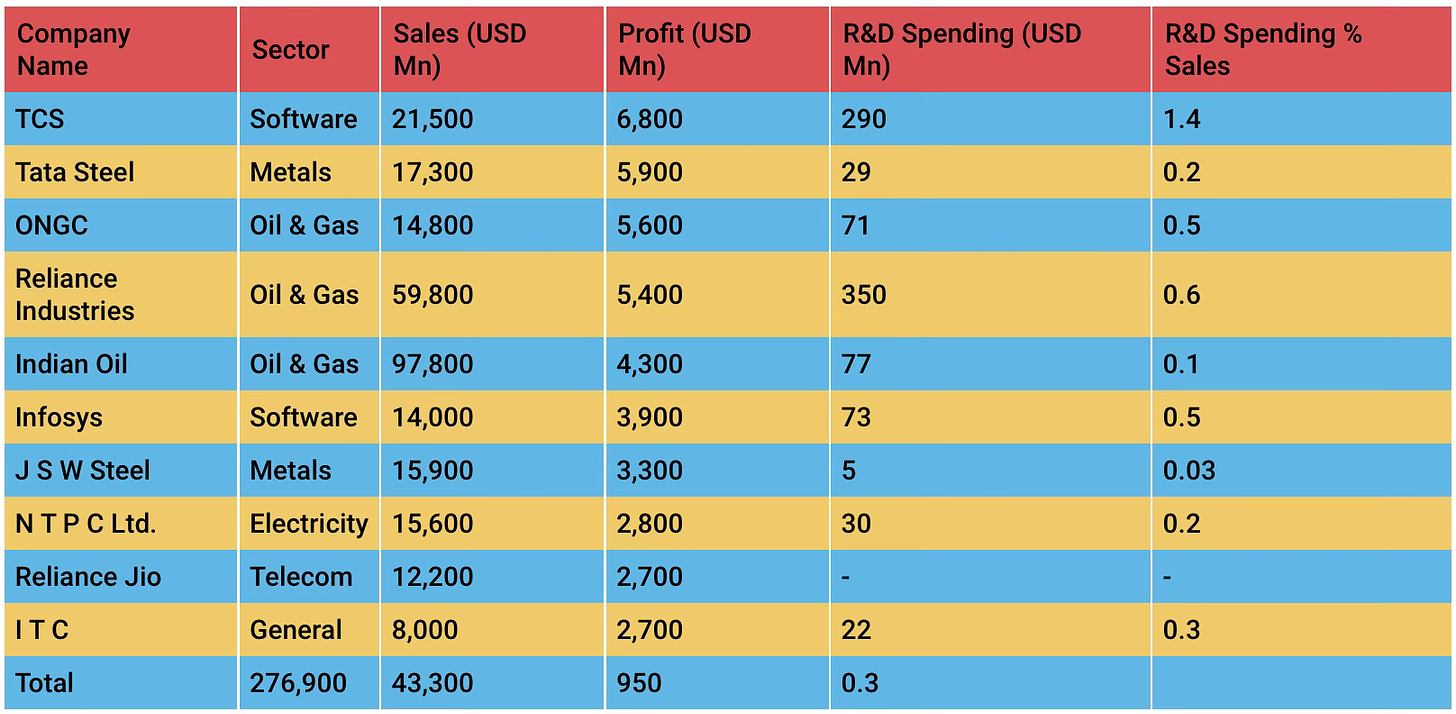

This is the R&D spending in 2021 of India’s top 10 non-financial firms. It’s abysmally low, even for the IT firms. Despite a total sales of $276.9 bn and profits of $43.3 bn, their total R&D spending was not even a billion dollars (just $0.95 bn).

What does it tell about the country’s private sector when its top corporates don’t feel the need to invest in R&D despite enjoying very high profitability, much higher than counterparts in countries like even Japan or Germany?

Sample this from 2021 data

The most telling comparison is that each of the top seven (global) firms invests more than all of India (every firm, university and government laboratory put together). And even firms #24 (Honda), #25 (Qualcomm) and #26 (Bosch) each invest more in R&D than all Indian industry combined at over $7 billion each.

Take the second exhibit, which compares the R&D spending of the top 2500 global firms. India has just 23 firms in the full list, with 10 in the pharmaceuticals and biotechnology sectors.

We have no presence in six of the top 10 industries that invest in R&D: Technology hardware, electronics, construction, health care, general industrials, and industrial engineering. Where Indian firms are present, they invest less in R&D than the world average. In auto, the four Indian firms (Tata Motors, M&M, Bajaj, TVS) that figure in the top 2,500 R&D investors spend 3.8 per cent of their global turnover on R&D, which drops to just over 1 per cent without Tata Motors’ JLR subsidiary in the UK. The world average for auto is 4.8 per cent. In software, the top Indian firms (TCS, Infosys, HCL) invest 1 per cent of turnover in R&D, compared to a top 2,500 average of 14 per cent. In pharmaceuticals, the top five Indian firms invest 6 per cent of sales in R&D. This is less than the world average of 17 per cent, but higher than any other industrial sector in India. The problem is that our pharmaceutical firms are relatively small. The average turnover of our five largest pharmaceutical companies (Sun, DRL, Aurobindo, Lupin, Cipla), at $3 billion, is a fraction of the $45 billion average of the top 20 pharmaceutical firms worldwide. Our top five firms invest an average of $200 million in R&D, compared to an international top 20 average of $7 billion.

There are several reasons offered for Indian companies’ failure to invest in R&D. They include cultural factors, smaller sizes, low margins (due to the price-sensitive market), lack of export focus, and so on. There’s perhaps a part of all in the explanation, and more.

It’s surprising that even sectors like pharmaceuticals and software, where Indian firms enjoyed a head start, have struggled to invest in R&D. The pharma companies have failed to capitalise on their early start and expand to become at least global-scale contract manufacturers of APIs (or bulk drugs), besides having had limited success in moving up the value chain to formulations and nothing to show on drugs discovery.

The case of India’s software firms is intriguing. As I blogged here, despite achieving global scale, Indian software firms have been unable to transition from being manpower services outsourcing firms to becoming software product companies. Besides, they have not been able to make breakthroughs in cutting-edge technology segments like cloud computing, robotics, data analytics, AI, IoT etc. The R&D spending as a share of sales of even the top Indian IT firms lags by orders of magnitude.

They appear to have become captives to their own successes in the lower-value manpower services segment and have not exhibited the courage and vision to breakout and aspire to move up the value chain. They have been unable to capitalise on their scale and invest in R&D. Their very low R&D spending (less than 1%, compared to the global average of around 10%) is a reflection of their lack of ambition and an important cause for their failure to innovate.

I had written sometime back on India’s entrepreneurship deficit. While data is not available, it’s most likely that even the new-age technology sector firms like those in e-commerce and digital platforms’ spending on R&D is only a small proportion of their global peers.

In this context, it’s also useful to look at the requirements for firm innovation. Mr Forbes also points to some microeconomic research on firm behaviour and when they innovate. In one paper, Philippe Aghion, Antonin Bergeaud, and John Van Reenen examined the impact of labour regulation on innovation and found:

We exploit the threshold in labor market regulations in France which means that when a firm reaches 50 employees, costs increase substantially. We show theoretically and empirically that the prospect of these regulatory costs discourages firms just below the threshold from innovating (as measured by patent counts). This relationship emerges when looking nonparametrically at patent density around the regulatory threshold and also in a parametric exercise where we examine the heterogeneous response of firms to exogenous market size shocks (from export market growth). On average, firms innovate more when they experience a positive market size shock, but this relationship significantly weakens when a firm is just below the regulatory threshold. Using information on citations we also show suggestive evidence (consistent with our model) that regulation deters radical innovation much less than incremental innovation. This suggests that with size-dependent regulation, companies innovate less, but if they do try to innovate, they “swing for the fence”.

Aghion and co-authors (also this) analysed the data of French firms’ exports for the 1995-2012 period and found that exports are associated with an increase in patent filings, but only from those firms with higher average quality patents and in the case of destination countries at intermediate stages of development.

Another paper uses data from French manufactured goods exporters on their innovation responses (in terms of patent applications) to demand shocks in their destination markets.

Our first finding is that on average firms respond to a positive export demand shock by innovating more. In other words, we find a significant market size effect of export demand shocks on French firms’ innovation… Our second finding is that the innovation response to a positive export demand shock takes 2 to 5 years to materialize, highlighting the time required to innovate. In contrast, the demand shock raises contemporaneous sales and employment for all firms, without any notable differences between high and low-productivity firms... Our third finding is that the impact of a positive export demand shock on innovation is entirely driven by French firms with above-median productivity levels (in an initial period prior to the demand shocks). This heterogeneous response could simply reflect the fact that the demand shock only affects the most productive firms… We find that in contrast to what we observe for innovation, there is no heterogeneous response of sales or employment to a demand shock for low versus high-productivity firms. Thus, similar demand shocks only lead to future innovation responses by relatively more productive firms.

Some takeaways from all this microeconomic research are that only firms above a certain productivity level and size threshold might have the incentive to innovate to reach the technology frontier; only firms above a certain productivity level can benefit from exports; and export benefits accrue only when exporting to countries at intermediate stages of development.

This assumes importance for the design of Make in India and the production-linked incentive (PLI) scheme. It highlights the importance of exports and that too to more advanced countries as an essential requirement for domestic firms to reap the productivity benefits.

One of the things that public policy could promote in this regard is to incentivise Indian firms to operate at the technology frontier. One way to achieve this is to encourage making in India for the global markets. As Joe Studwell writes, the North East Asian economies and their companies became globally competitive market leaders by pursuing the policies of export competition coupled with the elimination of the uncompetitive.

In conclusion, it may not be incorrect to argue that corporate India suffers from a culture where innovation and R&D investments are not valued appropriately. It appears to have become entrapped in a culture that prioritises cost-cutting over all else, including minimising innovation and R&D spending, to boost the bottom line. In this culture, companies do just enough to sell more and investments with long-term benefits like R&D get marginalised. Given this, whatever little R&D happens is in the form of jugaad, and not the industrial-scale research and development undertaken by globally competitive firms.

It might be the case that the massive and deeply price-sensitive Indian market is a major factor in the emergence of this culture. The massive market means that by and large Indian corporates have realised that they can sustain themselves by merely serving the large domestic market. The low margins in the mass market segments discourage foreign firms, thereby shutting off foreign competition and the one big compulsion for domestic firms to innovate. This is perhaps a curse of the large and price-sensitive market.

Unless it can break out of this culture, all other efforts will remain futile. Any effort by the government will only be tinkering at the margins. It’s time for India’s corporate leaders to seize the initiative and resolve to create 5-10 world-beating innovating companies over the next five years. As a start, they could begin to benchmark as proposed by Mr Forbes and own up the agenda.

No comments:

Post a Comment