Deepening of the non-financial corporate bond market has been the big endeavour of financial market reforms in India. I have blogged here and here, pointing to the limits to bond market financing of infrastructure sectors.

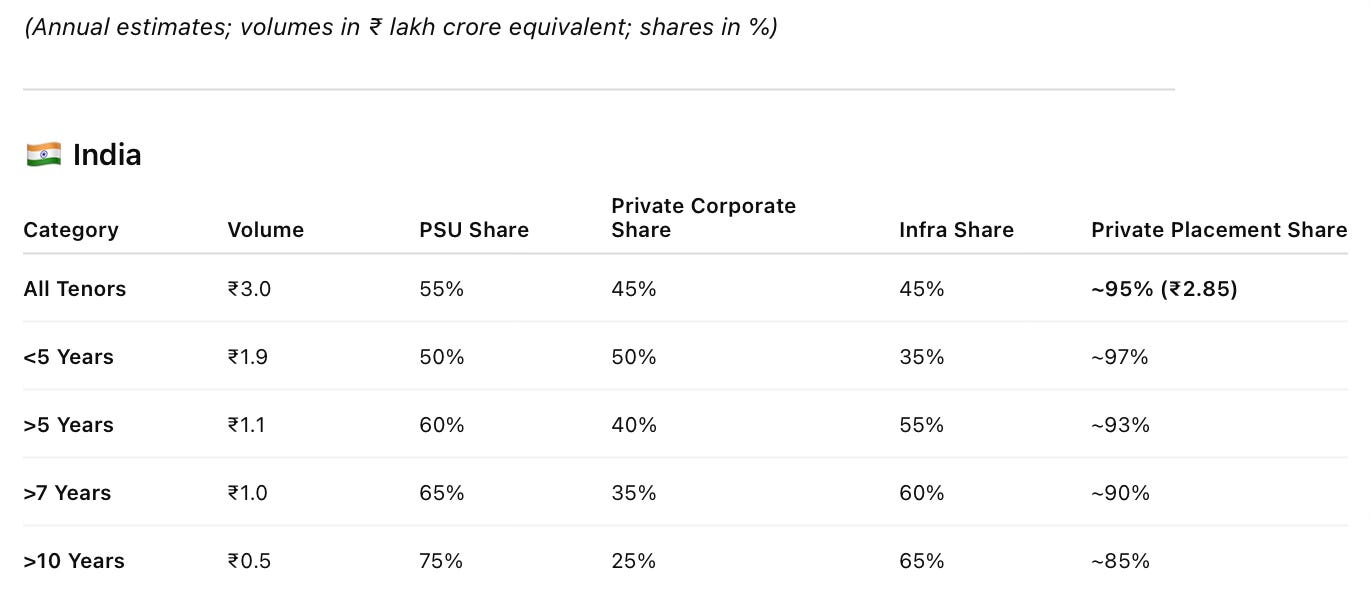

In the absence of readily available longitudinal data, I ran some queries on ChatGPT to estimate the landscape of India’s non-financial bond markets, issued by public sector units and private corporates, across different bond tenors, the respective shares of infrastructure and private placements in each tenor category, and comparison across countries. The data used are from RBI/SEBI, SIFMA (the US), AFME/ECB (Europe), and BIS/Brazilian Central Bank.

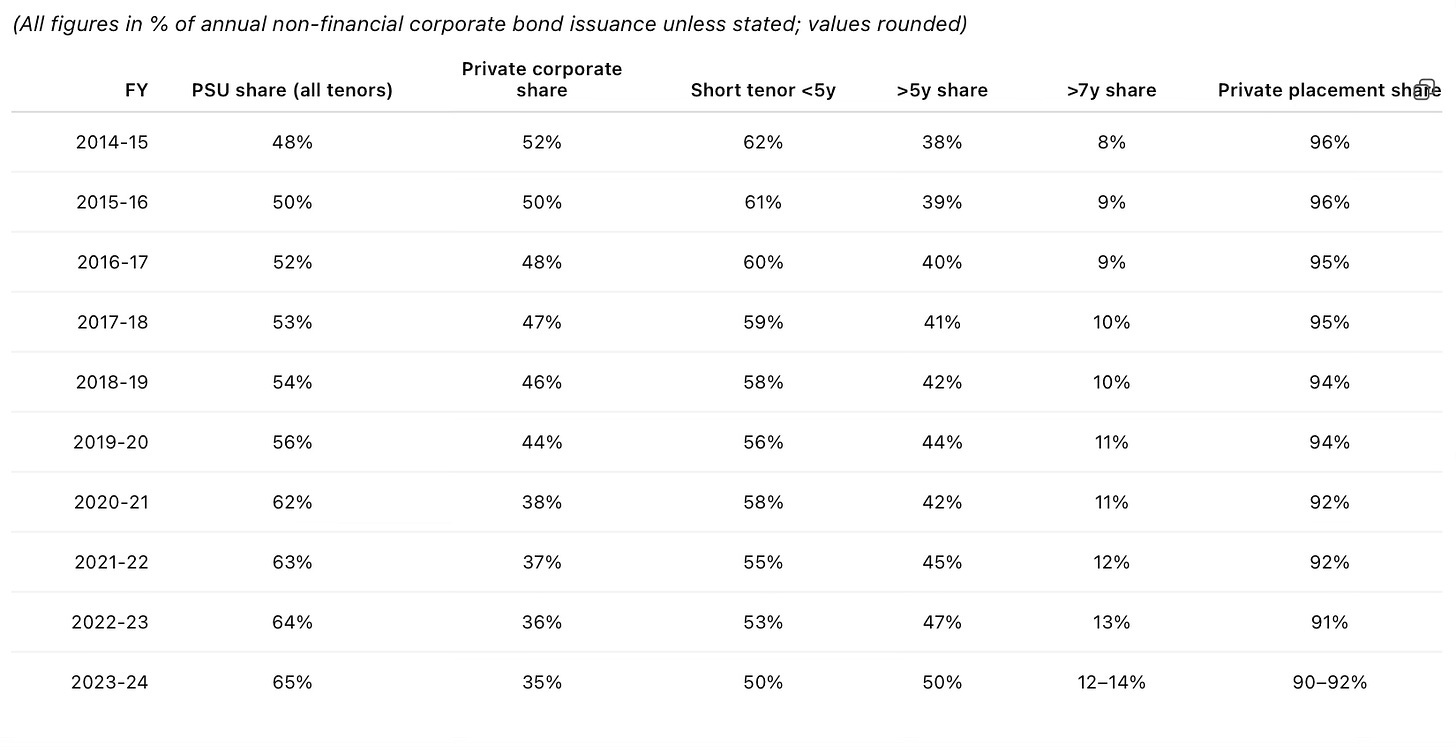

India’s bond market is dominated by private placement, skewed towards the short tenor, and issuance by the PSUs. A positive feature is the high share of infrastructure issuances.

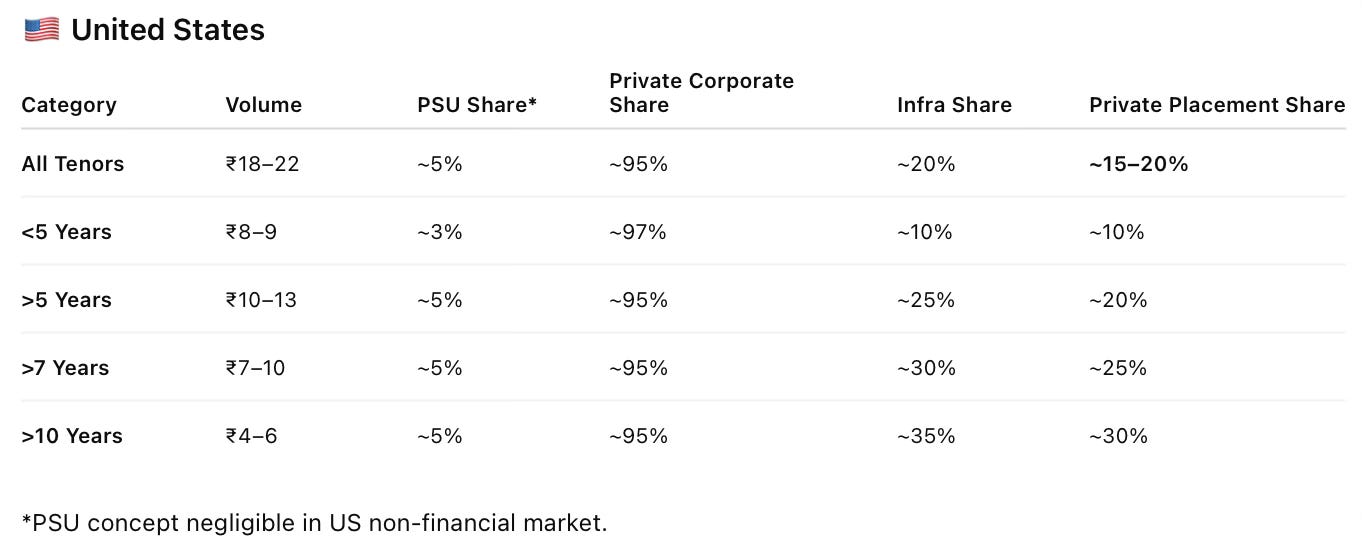

The same result for the US showed up as below. The US corporate bond market is mostly through public placement, dominated by private corporates, and with the majority in longer tenors. The volume below is in Rs lakh crores.

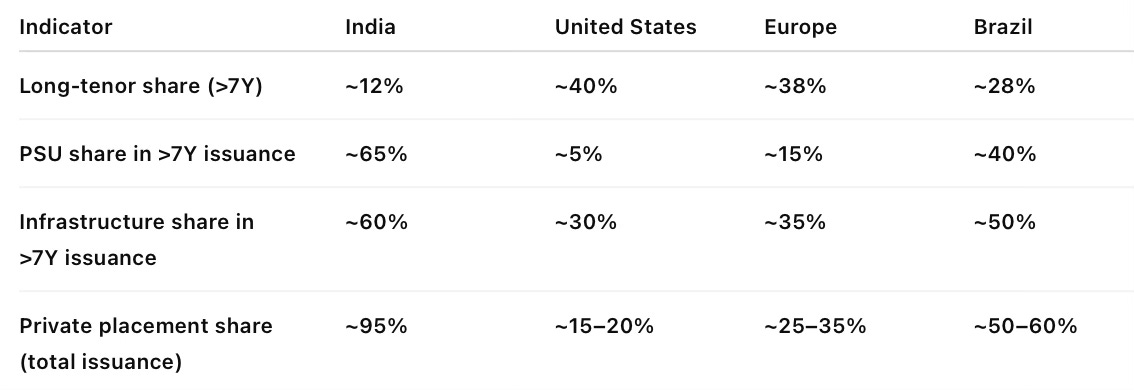

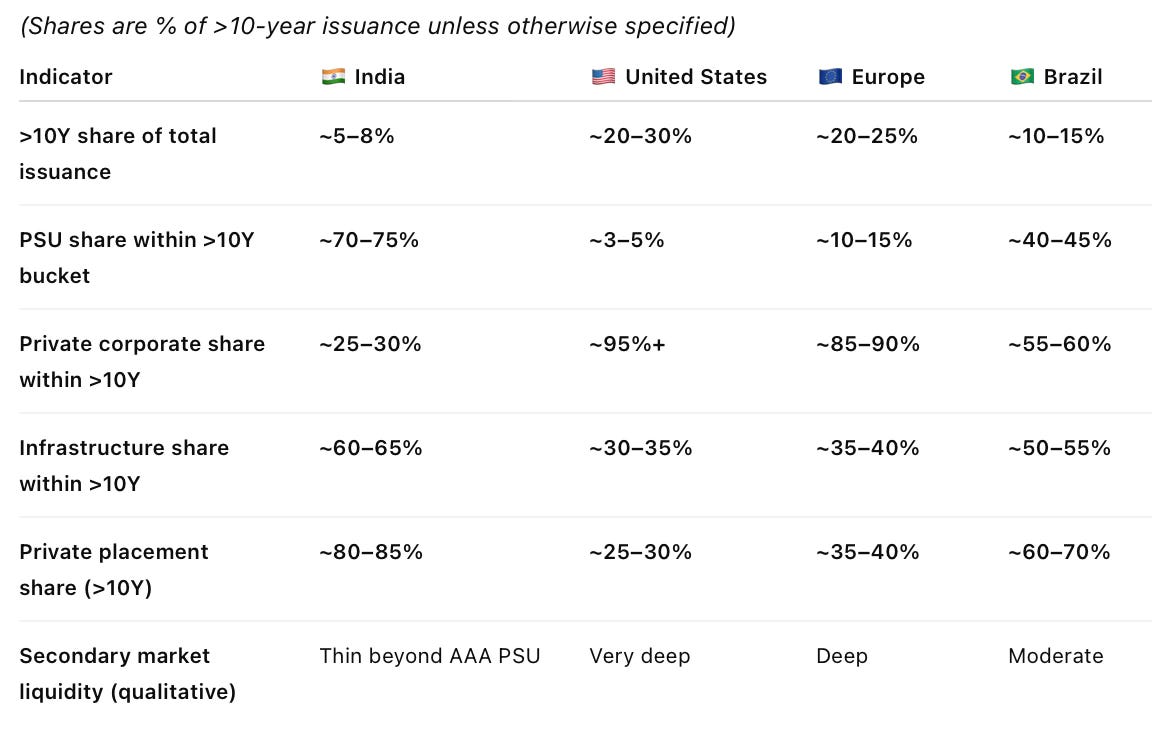

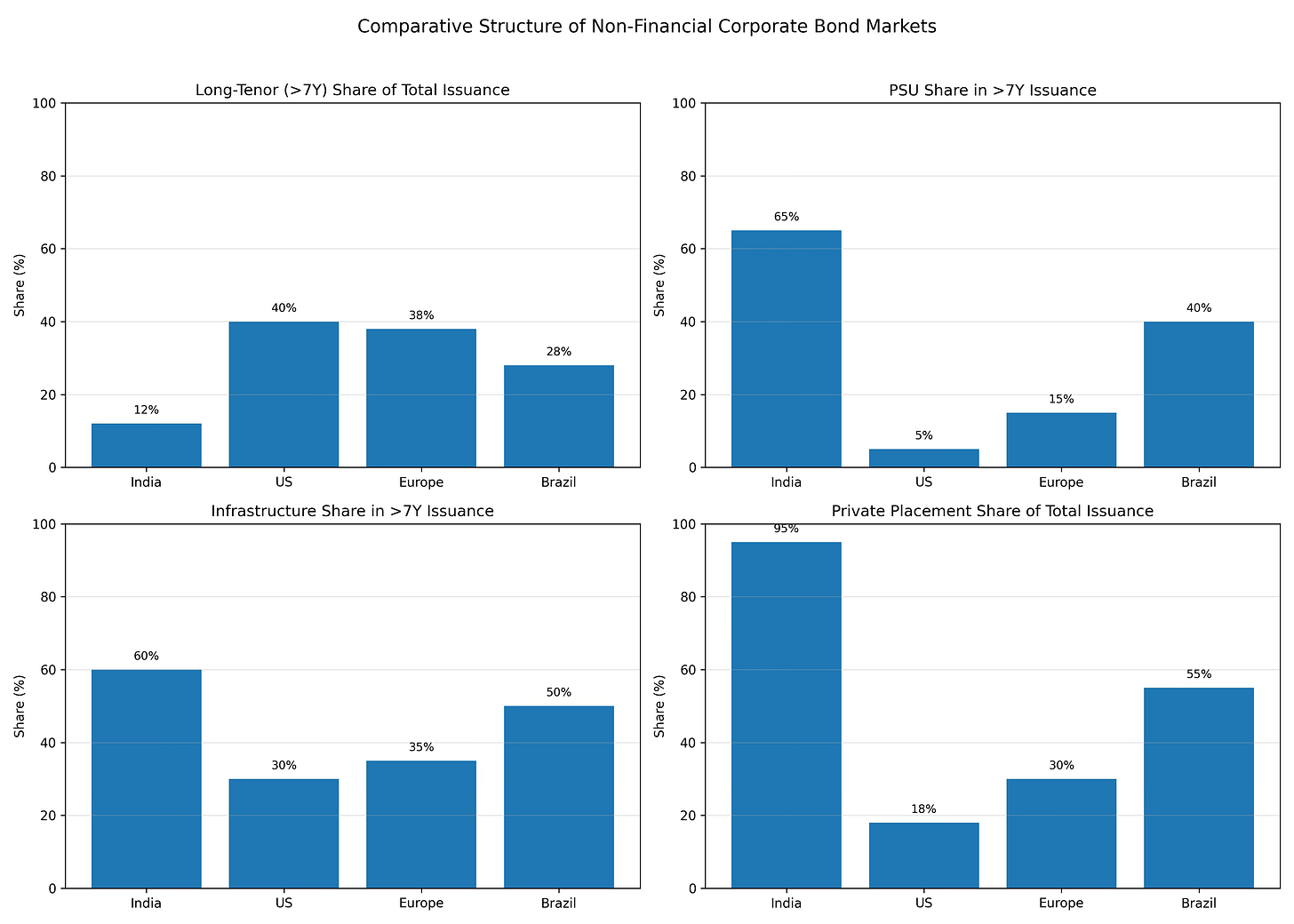

The table below compares across India, the US, Europe (including the UK), and Brazil. India stands out for its dominance in private placements, a high share of public-sector issuance, and a very low share of long-tenor bonds. The private placement market is dominated by AAA and AA bond issuances, thereby squeezing out the vast majority of potential issuers. All three trends must reverse to deepen and broaden the bond markets.

How does the table look for tenor greater than 10 years?

Putting all of them together, we get the following charts. Brazil does a very good job of mobilising long-term infrastructure funds, in absolute value (see latter tables).

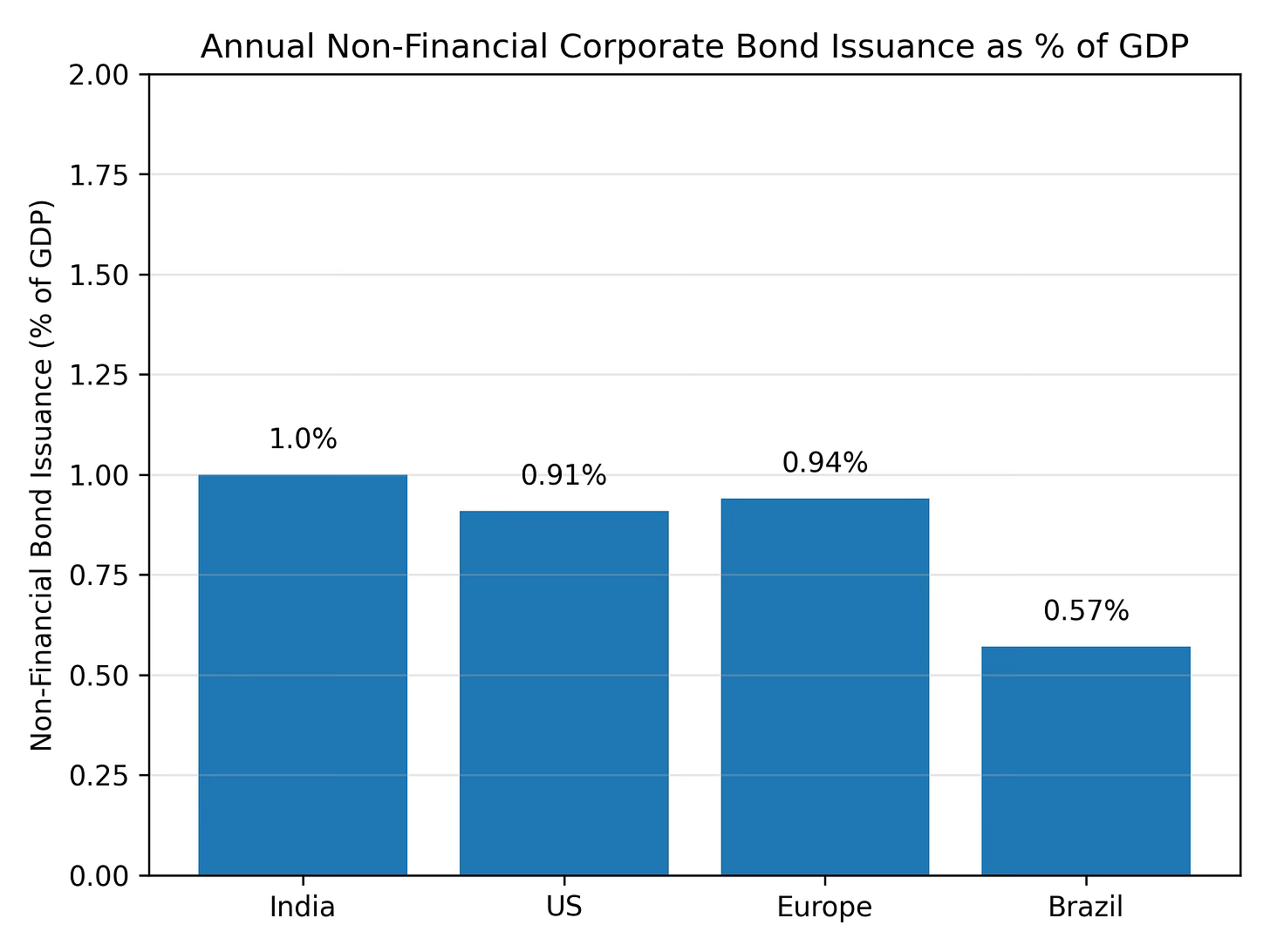

As a percentage of GDP, India does well in non-financial corporate bond issuance. Its challenge, as aforementioned, is with maturity depth and structural composition.

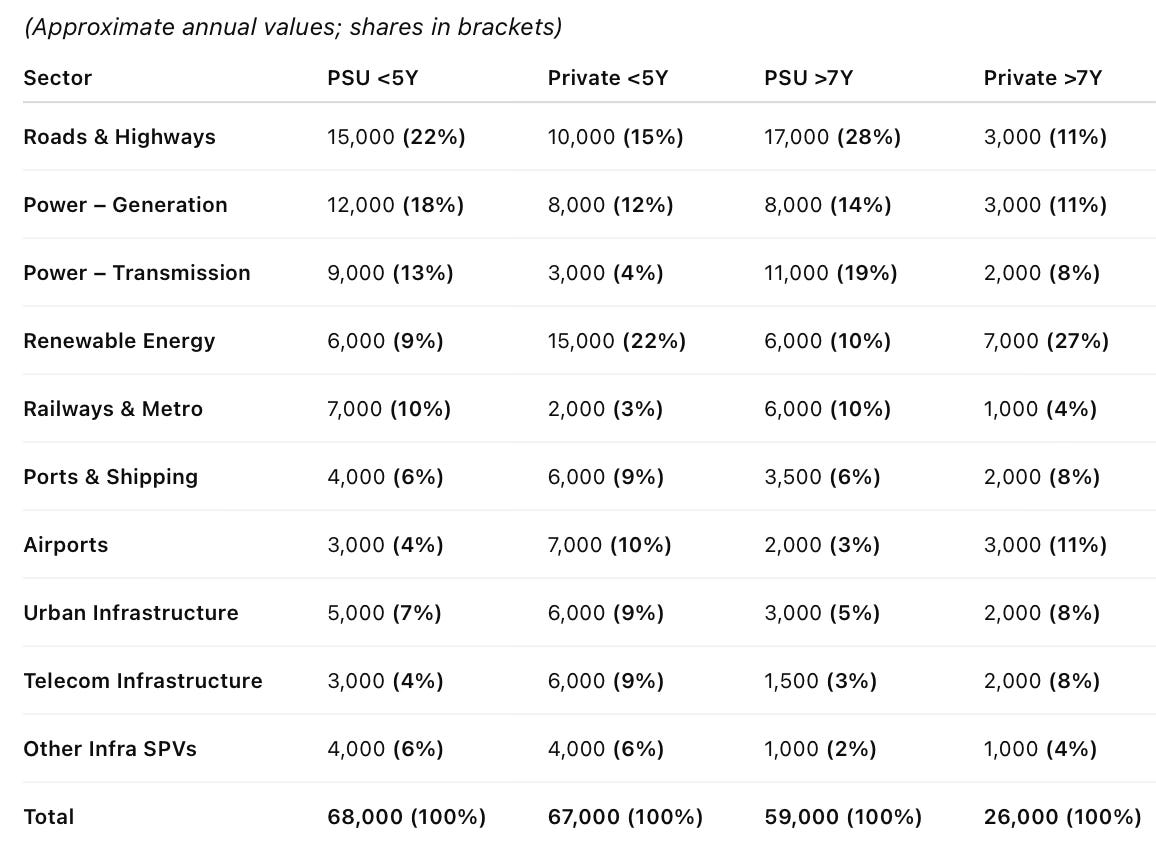

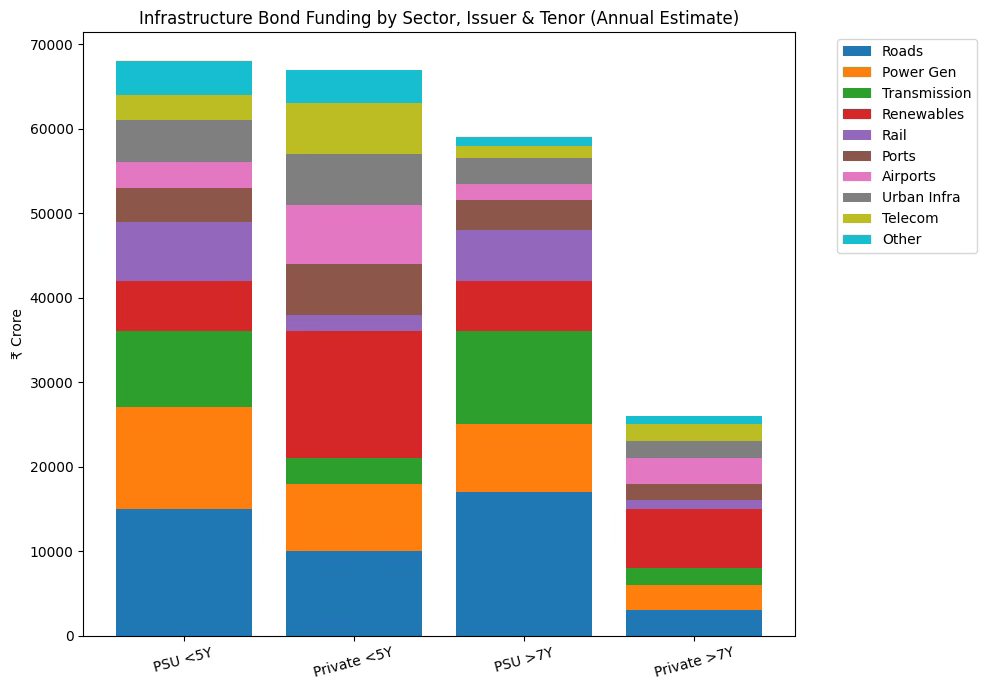

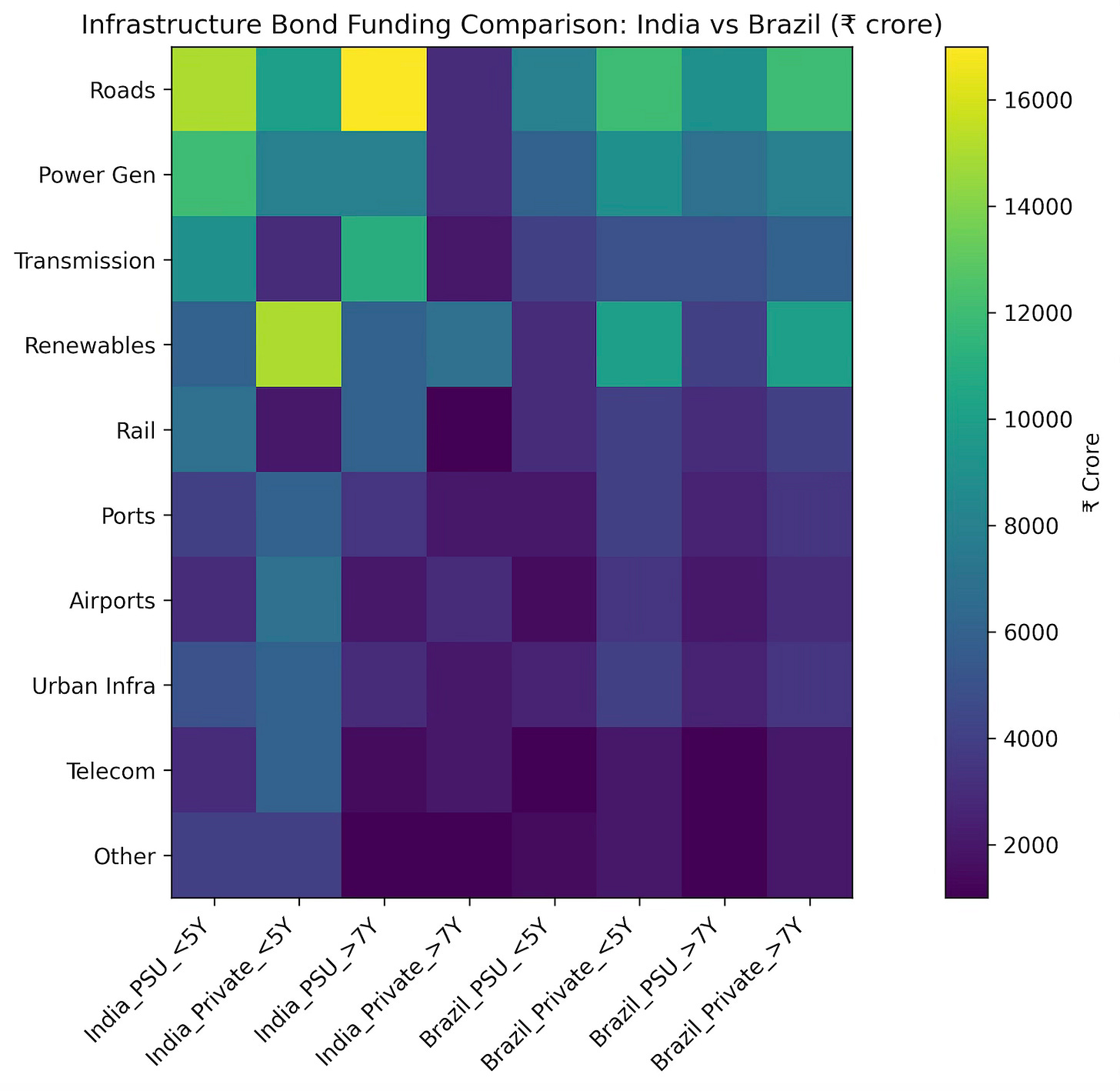

The total infrastructure sector bond raising is estimated in the range of Rs 2.2-2.4 lakh Cr, of which about Rs 1.3-1.4 lakh Cr is with tenor less than 5 years (55% raised by PSUs), and Rs 80,000-90,000 Cr with tenor more than 7 years (65% by PSUs). The table below has the approximate values in Rs crore.

Below is the graphical representation of the estimates.

As can be seen, the usual suspects - roads, power generation (thermal and renewables), power transmission, railways, ports, and airports - make up most of the bond issuance.

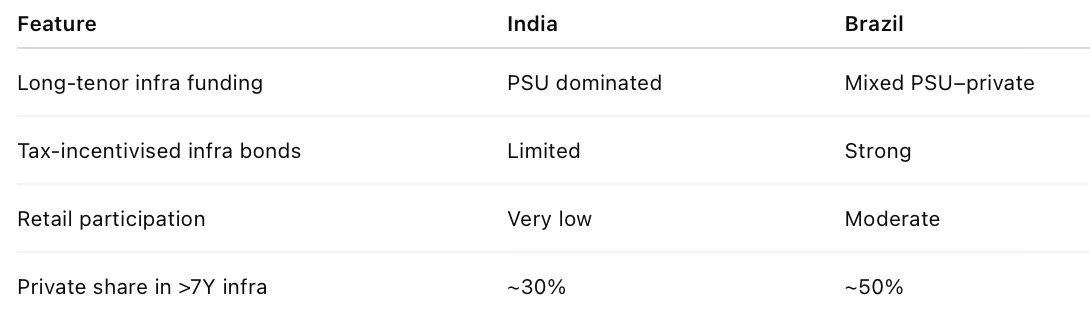

A comparison with Brazil is instructive. Brazil has managed to develop a deeper and broader market for private corporate bond raising, including in infrastructure. In 2011, it introduced the “Debêntures Incentivadas” (Infrastructure Debentures) to finance infrastructure projects. It offers tax exemption on interest income, is mostly issued for 7-15 years, and is used in transport, energy, sanitation, and renewables.

This is a summary of the comparison of the infrastructure bond markets in India and Brazil.

What have been the trends over the past ten years? Disturbingly, the share of private corporates in bond issuance has been falling, declining from over half to about a third. This may have been due to the focus on public capital expenditures through NHAI, Railways, PFC/REC. The share of long tenor bonds (>7 years) has risen only slightly from 8% to about 13-14%. Private placement route has remained stubbornly in the 90-92% range.

Given all the above, what are the policy takeaways?

Policy actions are required on at least three fronts. One, prioritised efforts to expand public placement, thereby ushering in greater liquidity and deeper markets. A practical intermediate pathway would be to promote the listing of existing privately placed bonds.

Second, diversify the issuer base away from PSUs by encouraging private infrastructure developers to issue long-term bonds by offering policy support through credit enhancement schemes, partial guarantee mechanisms, takeout financing, etc. The DFIs (NIIF, IIFCL, and NaBFID) should have a specific mandate to derisk infrastructure finance instruments.

Third, increase the tenor of bonds by expanding the use of partial credit guarantees, first-loss facilities, and blended finance models. This should also be complemented by demand-side measures to expand the pool of long-term buyers like pension funds, retirement savings accounts, and insurance funds.

On all these, the policy actions will be in the form of numerous small steps to simplify disclosures, documentation, listing requirements, listing processes, standardisation of bond structures, improvements on rating transparency, and so on. It must be complemented with initiatives like credit enhancements and guarantees, increasing the proportion allocated to long-term bonds for pension funds and insurers, revisiting risk-weights on long-term bonds, etc.

For references, I blogged here that India could take the lead in demonstrating how DFIs can work on both the demand and supply sides to de-risk infrastructure projects and crowd in long-term capital, respectively. I blogged here on how to reduce the cost of capital for foreign investments in the infrastructure sector, here on how to revise the credit rating framework in general, and here on de-risking and lowering the cost of capital of bank loans and de-risking the use of guarantees to crowd-in bank financing. All of these ideas are consolidated in this long paper.

No comments:

Post a Comment