1. Some snippets about the Dharavi redevelopment project master plan that has been approved by Maharashtra government.

The Dharavi redevelopment is being carried out by Dharavi Redevelopment Project Private Limited (DRPPL)—a special purpose vehicle that is a joint venture between the state government’s Slum Rehabilitation Authority (SRA) and the Adani Properties Private Limited (APPL). The DRPPL is now called the Navbharat Mega Developers Private Limited (NMDPL), in which APPL holds 80 per cent stake while the remaining 20 per cent is with the SRA... According to official estimates, a total of 72,000 tenements will be constructed for rehabilitation, which includes 49,832 residential units for eligible slum dwellers, 8,700 renewal units for residents with valid tenure,12,458 commercial/industrial units and 1,010 commercial renewal units. According to the master plan, out of the total net usable area of 108.99 hectares available for development, 47.20 hectares is for rehabilitation of Dharavi tenants, 10.88 hectares for additional facilities such as museums, hostels and community halls, 2.96 hectares for utility and the remaining 47.95 hectares is land that will be developed for market sale by the SPV NMDPL. The total estimated cost of the project is Rs 95,790 crore... the special purpose vehicle that is undertaking the Dharavi redevelopment on the 251.24 hectares of Dharavi Notified Area... it needs to construct 72,000 housing and commercial units on 47.20 hectares. According to the special purpose vehicle, only those who occupy ground floor structures will be eligible for rehabilitation

“In Dharavi, there are one lakh ground-floor structures, whose residents are eligible for rehabilitation. Apart from that, there are at least 1.5-2 lakh tenants who reside on the second and third floors. If only 72,000 units are there for eligible tenants, are they going to declare the remaining 30,000 tenants ineligible for rehabilitation? Is their survey accurate? Have they completed the survey?,” said Rajendra Korde, president of Dharavi Redevelopment Samiti.

See also this on exemptions and concessions sought by NMDPL, which has also been allotted 541 Acres outside the city.

2. Andy Haldane suggests that countries should shed the focus on GDP and instead focus on what he feels citizens value, intergenerational or social mobility.

Based on surveys of citizens, academic Carol Graham’s research suggests upward mobility is more important to public satisfaction than income. For example, poorer communities and countries, where prospects have improved significantly relative to earlier generations, are happier than richer places where generational prospects have faltered or fallen. In short, generational journeys matter more than GDP destinations. When it comes to wellbeing, then, social mobility trumps national income. Lasting societal success relies more on unlocking opportunity than on maximising output...The American dream has, for many, died. Surveys suggest only around a quarter of Americans now believe “the American dream holds true”. As recently as 2010, it was more than half. The “Opportunity Atlas” constructed by economist Raj Chetty suggests these perceptions accurately reflect a new reality in which social mobility has stalled, or is in retreat, across many parts of the US over the past half-century. UK measures of social mobility suggest a similar stalling or retreat. The average person today in their twenties and early thirties is earning less than their parents at an equivalent age, after accounting for inflation. Many are less likely to own homes than their grandparents and some than their great-grandparents. For them, the opportunity escalator has stalled or is in reverse...GDP measures everything except that which is worthwhile. These words of Robert F Kennedy in 1968 are even truer now than then. Stalled social mobility has blocked the only reliable road to sustained wellbeing and growth.

3. Apparently, 478 unicorns were created in the US in 2021, about 31% of all VC-backed unicorns ever created. It came on the back of "the combination of low interest rates, abundant capital, sugar-high valuations and the rush to digital platforms during the Covid lockdown was the industry’s happy hour".

The football stadium is the linchpin. Clubs are building new stadiums or refurbishing existing homes to target fans with the money to splash on high-end hospitality. They are also competing to host the world’s most famous singers and bands to squeeze additional revenue out of their infrastructure. The money helps clubs to buy top players and pay their multimillion-pound salaries. But Wagner and the other wealthy owners buying into England’s favourite sport want to convince the government that new stadiums can also be the catalyst for broader urban regeneration and economic growth... Local politicians are also considering setting up an urban development corporation — a tool first used in the city in the 1980s, intended to fast-track planning — across part of that area. Birmingham and Manchester are considering similar vehicles, headed up by metro mayors, to fast track their own football-led regeneration schemes...

One of the most controversial proposals for stadium-led regeneration is in Manchester. Sir Jim Ratcliffe, the Monaco-based billionaire co-owner of Manchester United, is making the case for building a “Wembley of the North” — referring to the £750mn national stadium in London that was built with private and public funding and boosted the local area through investment in roads, rail and routes for pedestrians. Ratcliffe argues that a new 100,000-seat stadium can “be the catalyst for social and economic renewal of the Old Trafford area”. The project’s cheerleaders have requested more than £200mn in June’s spending review to unlock development around the stadium. The funds would ostensibly pay to remove an adjacent freight terminal to open up space for the new stadium.

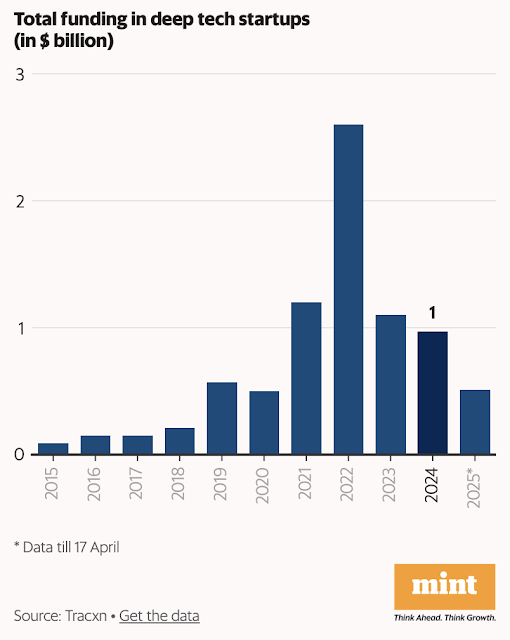

5. Contrary to popular narrative, India's deep tech innovation funding is limited.

In 2008, China established the state-owned Commercial Aircraft Corporation of China, or COMAC, with the goal of putting a single-aisle commercial jet into service by 2016. Development of the plane has been slow. The company, which occupies a large expanse of newly built hangars and design studios in Shanghai, suffered delays despite extensive assistance from American and European companies. Its plane, the C919, did not go into commercial service until 2023... At least 40 percent of the C919 is made by companies in the United States and other countries in the West... The C919 is similar to an Airbus A320, a popular single-aisle jet made by the European aviation manufacturer. It also competes with the Boeing 737... the C919 also depends on engines and other key components controlled by the United States... COMAC had put only 16 C919s into service by the start of this year, but is now ramping up production and has amassed close to 1,000 orders... China has shared limited information about the plane, which only mainland China and Hong Kong have approved for use...General Electric in particular has played a central role on the C919. It has worked with a Chinese military contractor to supply avionics computers for navigation, communication and controls. And a GE joint venture with Safran Aircraft Engines of France supplies the plane’s jet engines... Less than two years after COMAC was founded, when the C919 was still a distant dream, General Electric agreed to a partnership with the Aviation Industry Corporation of China, or AVIC, a leading Chinese defense contractor. General Electric shared its most advanced commercial avionics with AVIC for the C919, the same state-of-the-art system it had just developed for Boeing’s 787 Dreamliner jet. General Electric and AVIC worked together on equipping the C919 with an advanced computer core processing system. AVIC has also developed China’s most advanced bombers and its latest stealth fighter jets. It does much of its production in Xi’an, the hub of China’s military aircraft manufacturing industry.

8. NYT has an article on the one topic that should have attracted more attention, the impact of job losses from US tariffs on the Chinese economy and society. Estimates point to job losses in the range of 6-9 million in China with reduced exports to the US.

9. President Trump monetises the presidency for the private benefit of him and his family, normalising activities that would have been scandalous in any other times. A sample.

After dinner at Mar-a-Lago, Jeff Bezos agreed to finance a promotional film about Melania Trump that will reportedly put $28 million directly in her pocket.. The Trumps... have done more to monetize the presidency than anyone who has ever occupied the White House. The scale and the scope of the presidential mercantilism has been breathtaking. The Trump family and its business partners have collected $320 million in fees from a new cryptocurrency, brokered overseas real estate deals worth billions of dollars and is opening an exclusive club in Washington called the Executive Branch charging $500,000 apiece to join, all in the past few months alone. Just last week, Qatar handed over a luxury jet meant for Mr. Trump’s use not just in his official capacity but also for his presidential library after he leaves office. Experts have valued plane, formally donated to the Air Force, at $200 million, more than all of the foreign gifts bestowed on all previous American presidents combined. And Mr. Trump hosted an exclusive dinner at his Virginia club for 220 investors in the $TRUMP cryptocurrency that he started days before taking office in January. Access was openly sold based on how much money they chipped in — not to a campaign account but to a business that benefits Mr. Trump personally... The money Mr. Trump’s family is now bringing in from the Middle East is going into their personal accounts through a variety of ventures.

This is an interesting observation about the lack of public outrage.

Paul Rosenzweig, who was a senior counsel to Ken Starr’s investigation of President Bill Clinton and later served in the George W. Bush administration, said the lack of uproar over Mr. Trump’s ethical norm-busting has made him wonder whether longstanding assumptions about public desire for honest government were wrong all along. “Either the general public never cared about this,” he said, or “the public did care about it but no longer does.” He concluded that the answer is that “80 percent, the public never cared” and “20 percent, we are overwhelmed and exhausted.” “Outrage hasn’t died,” Mr. Rosenzweig added. “It was always just a figment of elite imagination.”

10. India's private fixed capital formation has been stagnant at about 25% for more than a decade.

The California Environmental Quality Act (CEQA) was passed in 1970, a law that grants standing to all 40mn residents of California to sue any project they want, public or private. The suits can be anonymous. By one estimate, only 13 per cent of CEQA lawsuits are launched by environmental organisations; the rest are filed by business competitors, Nimby neighbours or labour unions. It is less an environmental law than a tool for extortion. In one recent case, the University of California at Berkeley wanted to add a few thousand students to their student body; the school’s upper middle class neighbours sued under CEQA on the grounds that the extra students would in effect constitute an environmental pollutant. A judge agreed, and the school’s expansion was blocked. While it is usually conservatives who complain about excessive permitting, it was progressives who initially backed CEQA because they didn’t trust the government to enforce its own rules. This has led to the ironic result that building renewable energy infrastructure is being blocked by environmental regulations like CEQA that make it very hard to do things such as construct transmission lines or offshore wind farms.

And the big, beautiful bill adds to this. Gilliant Tett writes

But what investors should also fret about, if they care about the state of Treasuries or are a non-American entity holding US assets, is a clause buried in the bowels of this behemoth called section 899. This would enable the US Treasury to impose penalties on “applicable persons” from “discriminatory foreign countries” by increasing US federal income tax and withholding rates by up to 20 percentage points on their US investments, on a variable scale. It might thus be viewed as a novel “revenge tax” (as some lawyers call it) that Trump could use to bully friends and foes alike in trade negotiations.

12. The US is powering ahead on AI.

In 2024, private expenditure in AI grew to $109bn, nearly 12 times China’s $9.3bn and 24 times the UK’s $4.5bn, according to Stanford University research. US-based institutions produced 40 “notable AI models, significantly surpassing China’s 15 and Europe’s . . . three”, according to the Stanford researchers.

13. Switzerland's paradox of a strong currency with rising exports.

The world’s richest major economy has both a strong currency and a strong manufacturing base. The Swiss franc has been the top-performing currency over the past 50 years, 25 years, 10 years and five years. It is near the top even over the past year when some of the more beleaguered currencies have staged a comeback against the dollar. Nothing can compare for durable strength. Yet Switzerland also defies the assumption that a strong currency will undermine a nation’s trading prowess by making its exports uncompetitive. Its exports have risen and are near historic highs both as a share of Swiss GDP (75 per cent), and as a share of global exports (near 2 per cent). The global conversation has become unduly obsessed with currency valuations, which are just one of the factors that shape a nation’s competitive position. Like Germany and Japan in their heydays, Switzerland has gained a reputation for goods and services of such high quality that the rest of the world is willing to pay a currency premium for the “Made in Switzerland” label...It generates more than $100 in GDP per hour worked — that’s more productive than any of the other 20 largest economies. Its decentralised political and economic system encourages the rise of small enterprises, which account for over 99 per cent of Swiss companies. It also has a large share of globally competitive businesses in sectors from pharmaceuticals to luxury goods. Harvard’s Growth Lab ranks Switzerland number one among major economies for the “complexity” of its exports, a measure of the advanced skills needed to produce them. And its exports range from chocolates and watches to medicines and chemicals — belying the notion that strong currencies kill factories. At 18 per cent of GDP, its manufacturing sector is one of the largest among developed economies. Over half its exports are “high-tech” — more than double the US level. Since advanced goods are more expensive, this has helped Switzerland keep its current account in surplus, averaging more than 4 per cent of GDP since the early 1980s.

14. Trump Always Chickens Out (TACO) is the new buzz phrase. This is the finding of research by Jeremy Shapiro of the European Council on Foreign Relations.

Trump enjoys issuing blood-curdling threats of the use of force. But he very rarely follows through... Looking at Trump’s two periods in office, Shapiro finds 22 occasions so far in which he has threatened the use of force — but only two in which he has actually followed through. There have been 25 actual uses of force — mainly limited strikes against terrorist groups such as Isis or al-Qaeda. But only on two occasions were they preceded by a presidential threat. Surveying the record, Shapiro comes to a clear conclusion: “Trump uses threats and force much like a playground bully: while large and outwardly powerful, he actually fears the use of force in any situation even vaguely resembling a fair fight . . . Actual violence only occurs against much weaker foes that have no hope of striking back.”

The narrative of government failure is trumpeted by anti-system politicians and amplified by their supposed adversary, the media. The journalistic maxim says, “If it bleeds, it leads.” The corollary is that if somebody stops the bleeding, the story stops being a story. And if politicians make such an efficient early intervention that a disaster never happens, it never becomes a story in the first place. Take the US bailout of banks in 2008/09, which arguably prevented the financial crisis from spiralling... The moment a societal problem is ameliorated, it is practically forgotten.

16. The challenge with reshoring manufacturing to the US in sectors like textiles and footwear.

There just aren’t enough workers. American factories are already struggling to fill around 500,000 manufacturing jobs, according to estimates by Wells Fargo economists... Mr. Trump’s crackdown on immigration has made things worse. Factory jobs moved overseas to countries, like Vietnam, that had growing populations and young people looking for jobs to pull themselves out of poverty... Mass production in America is tough. A sewing machine operator earns $4,000 a month in Los Angeles, compared with $500 in Vietnam.

17. Indebtedness in the developed world is spooking the bond markets.

At the heart of the global economy, long-term yields in the $29tn US Treasuries market have topped 5 per cent in recent weeks, close to the levels reached in 2023 — when investors feared interest rates would have to stay higher for longer to contain inflation — and before that their highest since the financial crisis. This is taking place just as a tax and spending bill that could add more than $2tn to America’s debt makes its way through Congress... France’s debt burden was described as a “sword of Damocles” last year by then prime minister Michel Barnier. Europe’s third-largest economy is expected to spend €62bn on debt interest this year, roughly equivalent to combined spending on defence and education, excluding pensions. In the UK, 30-year government borrowing costs reached their highest levels since 1998 this year amid investor concerns over the growing debt pile and ministers’ lack of headroom against their self-imposed fiscal rules. Even Germany, a historically reticent borrower with much lower debt levels, is planning to increase Bund issuance. In Japan, where the central bank’s ultra-loose monetary policy kept long-dated yields below 1 per cent for years, a brutal sell-off has taken them to record highs. The 30-year yield on Japanese government bonds is hovering around 3 per cent.

This has come on the back of record sovereign debt issuance after the pandemic.

18. Finally, the epic fallout between Donald Trump and Elon Musk was always on the cards. The US government is itself now finding out the perils of relying on Musk in particular and on one individual in general, as the example of NASA's reliance on SpaceX shows. A more powerful latent enemy who could inflict greater pain on Musk is Steve Bannon.

Some observations. One, Elon's firms will feel squeezed in multiple ways, and Tesla, Starlink and Space X will be the biggest impacted. Two, the competitors to these firms will get a leg up. Kuiper in particular will be a big beneficiary. Three, will this be the beginning of the end of Musk's China relationship? Four, what message does this send to governments worldwide who had been rolling out the red carpet to Musk's companies? Finally, we may have seen Peak Musk, and the decline could be very steep and terminal if a few things play out.

Given his drug addiction and other skeletons, in normal times it would have been a safe bet that if the US Government put its mind to it, Musk could come out of all this seriously damaged and diminished. But it's also possible in these times that the plutocrats and moneyed influencers in the Trump coalition could get both people together for a compromise to keep the gravy train running.

Anyways, last word to Paul Krugman, whose verdict on the public spat is spot on.

Musk believes that he delivered the presidency to Trump, and may well be right. He gave Trump and his allies a lot of money; he helped Trump regain confidence after his disastrous debate; he brought in the bro vote. And Musk clearly believes that this entitles him to receive special favors from the White House — not policies he likes in general, but contracts and specific actions that benefit him personally. He even seems to have imagined that he was effectively co-president. That is, he simply assumed that U.S. policy was for sale, and thought he had bought it. Trump, for his part, hasn’t responded by saying “How dare you suggest such a thing?” Instead, he has threatened retaliation — again, not in the form of general policies Musk won’t like but in the form of specific actions aimed to hurt Musk’s bottom line...The point is that both men start from the presumption that the U.S. government is an entirely corrupt enterprise, with the president in a position to hand out personal favors or engage in personal acts of vengeance. And everyone takes it for granted that both men are right. Musk’s only mistake was in underestimating the depths of Trump’s lack of principles, imagining that he was the kind of corrupt politician who stays bought, as opposed to a guy who always breaks his promises the moment it seems expedient to do so. In short, we no longer have rule of law, just rule by the Leader’s whims. We have abandoned everything America was supposed to stand for.

No comments:

Post a Comment