1. Good NYT oped about Mexico's President Claudia Sheinbaum, perhaps the most popular leader currently among all electoral democracies.

2. Starbucks runs into rough weather in its India growth plans. The same story of the large consumption class not turning out as expected.

Starbucks has sharply slowed its ambitious expansion in India as hard-pressed middle-class consumers cut spending at the coffee chain’s stores. The US company announced in January last year it would nearly triple its Indian outlets to 1,000 by 2028, but in the last three months of 2024, it opened just over half the 30 targeted for the quarter... Starbucks, which currently has 473 outlets in 74 Indian cities, opened only a net 16 stores in the three months through December, down from a post-pandemic peak and quarterly record of 29 in the January-March period last year.

3. Trump's irreversible destruction of trust in America.

One of the great advantages that the US has over China or Russia is that it has a global network of allies, created over the long term. Countries like Japan, Germany, Australia, Canada and Britain have often had doubts about the wisdom of particular US policies. But they have stuck with America because they believed, in the last resort, that their alliances were based on a firm bedrock of shared interests and values. The tariff war launched by the US — combined with the often hostile language of the Trump administration — has shaken that trust to the core. Mark Carney, the new prime minister of Canada, says that the US is “no longer a reliable partner”. Friedrich Merz, the next chancellor of Germany, has called for Europe to “achieve independence” from America. Anthony Albanese, the Australian prime minister, says the Trump administration’s tariffs on Australia are “not the act of a friend”.

4. Gideon Rachman compares Trump's approach to global markets as that of a "mob boss".

There is a distinct whiff of Don Corleone in Donald Trump’s approach to trade and diplomacy. Like a movie mob boss, Trump knows how to switch between menace and magnanimity. Treat him with respect and he might invite you to his house, where you can mingle with his family. But the menace never disappears. As Trump once explained to Bob Woodward, he believes that “real power is — I don’t even want to use the word — fear.” Back in the Oval Office, Trump has employed fear and threats as a tactic for shaking down some of America’s top law firms and Ivy League universities. Like respectable members of the professional classes, unexpectedly threatened by the mob, Trump’s targets paid up quickly in the hope that all the unpleasantness would swiftly go away. Law firms like Paul Weiss and Skadden Arps agreed to do pro bono work for the administration to avoid being targeted by Trump’s executive orders.

He argues that this approach has limitations when faced with tariffs and sovereign countries.

Trump’s assumption seems to have been that if he punched America’s trade partners hard enough, they would have no option but to make a deal. His son, Eric, urged targeted countries to see sense and to quickly buy off his dad. “I wouldn’t want to be the last country that tries to negotiate a trade deal with @realDonaldTrump,” he wrote. “The first to negotiate will win — the last will absolutely lose,” he continued. “I have seen this movie my entire life.” But the real world and the global economy turn out to be much more complex than the movies that Eric Trump was brought up on. The White House has started a trade war with every major trading nation simultaneously. It has also taken an axe to the supply chains of many of the world’s leading multinationals. There are simply too many actors involved for Trump’s mob boss tactics to work. There are all the investors who have rushed to sell their shares, causing stock markets to tank. There are the manufacturers who simply cannot do business under the conditions created by Trump — and who are shutting down production lines. And, as for Chinese President Xi Jinping’s mob, they have decided to fire back rather than buckle. This is getting extremely messy... Trump’s approach to America’s allies is to treat them like errant members of a protection racket. Some of them have fallen behind on their payments to Nato? They better fix that fast or, says Trump, he will encourage Russia to do “whatever the hell they want”...Trump treats Russian leader Vladimir Putin and Xi Jinping as if they are the heads of rival mafia families. There will be times when the families clash. Some foot soldiers and bystanders might get hurt. But, in the end, the goal is to reach a deal so that everybody can go back to making money. Geopolitical theorists might rationalise a carve-up like this as the division of the world into rival spheres of influence. But, it also resembles an agreement between different mafia families, to give each other a free hand on their own turf. The local godfather is then free to push around the smaller players in the neighbourhood — such as Taiwan, Ukraine or Canada — without comment from the rivals.

5. A peek into China's ultra-competitive and dynamic EV market.

From cars with roof-fitted drones to free self-driving software and five-minute battery charges, the rapid pace of electric vehicle innovation by China’s BYD is powering what some analysts believe is the most intense period of competition in the car industry... sales in China, the world’s biggest EV market, are forecast to rise about 20 per cent to 12.5mn cars this year. As EVs start to outsell cars with internal combustion engines, 78 per cent of those sales are being soaked up by just 10 companies, including 27 per cent solely by BYD, according to HSBC data. That leaves about 52 car brands fighting for the remaining 22 per cent of the Chinese market, including more than 30 marques that produce fewer than 30,000 cars a year and might soon face oblivion, according to Yuqian Ding, a Beijing-based analyst with HSBC. With a new car model released on average every two days in China, keeping pace with cutting-edge technology — such as assisted driving functions and the latest infotainment systems — has become crucial for survival as the market inevitably consolidates... Features such as automatic highway lane changing and automated parking were already becoming commonplace in China. But local carmakers are also increasingly developing more sophisticated autonomous driving software earlier than many analysts forecast, thanks to the help of AI-based large language models.

In 1913 the value of exported goods made up 14 percent of the world economy. By 1933, shattered by World War I and the Great Depression, it had slumped to 6 percent, and it did not recover until the 1970s. The backlash propelled the rise of right-wing authoritarian and fascist movements that promised to reverse or seize control of the forces of globalism. It ended in a catastrophic world war.

7. Challenges for iPhone manufacturing due to the Trump tariffs.

iPhone assembly is currently done in mainland China by companies such as Taiwan’s Foxconn and Pegatron and to a lesser extent in India, where Tata is building capacity as an Apple supplier. It is the final step in a vast chain of Apple suppliers, most of which are currently based in Asia. There are 387 individual parts involved in final assembly of an iPhone 16, according to market research group TechInsights, which include chips, circuit boards, batteries, wires, lenses, screens and metal and plastic parts. Apple’s most recent public supplier list, which covers the 2023 fiscal year, shows the 187 companies responsible for 98 per cent of the company’s direct spend that year. Of these companies, 169 had a manufacturing presence in mainland China and Taiwan.

Apple's efforts to relocate manufacturing to the US raises several questions. Given the reality of globalised supply chains, tariffs by the US on imports from Vietnam, Taiwan etc., not to mention China, would naturally make it impossible for US manufacturing to be competitive. Then there's the cost.

It would probably cost Apple “several billions” of dollars to shift even a portion of its iPhone supply chain to the US, according to estimates by Morgan Stanley analysts. Wedbush analyst Dan Ives estimated it would take Apple three years and $30bn to move just 10 per cent of its supply chain from Asia to the US. “This is a company that has embedded itself in China and south-east Asia for decades, now seemingly looking at the prospect of being forced to change the entire way in which they think about building and pricing an iPhone,” says Erik Woodring, analyst at Morgan Stanley. The pressure comes despite Apple pledging in February to hire 20,000 staff as part of a $500bn US spending plan for the next four years that includes a new facility manufacturing servers for artificial intelligence in Texas. The fact that Apple does not currently run its own manufacturing facilities, but outsources them to Asia-based companies it has spent two decades and billions of dollars nurturing with specialist equipment, adds an additional layer of complexity.

8. This week saw the mother of all U-turns by President Trump on reciprocal tariffs, when he put them on hold for 90 days to negotiate deals with all trade partners except China (with who he ratcheted the tariffs to 125%) after having firmly ruled out any reversal on multiple occasions.

Trump’s announcement, with the blue-chip S&P 500 closing up 9.5 per cent and the Nasdaq Composite surging more than 12 per cent. It was the best day for the S&P 500 since 2008 and the strongest for the Nasdaq since 2001. The massive rally in stocks added about $4.3tn to the market value of the S&P 500, according to Financial Times calculations based on FactSet data. The gains reversed some of the heavy losses for US stocks since Trump announced his wide-ranging tariffs a week ago.

The Bond markets did their bit to force the Trump reversal. While the stock markets unravelled in the face of tariffs, it was expected that the bond markets would in line with theory respond upwards. However, the opposite happened as the bond markets too tanked amidst signs of poor demand in a Treasury auction. A possible reason is the unwinding of "basis trades" (involving leveraged bets, often up to 100 times, so as to profit from the convergence between the futures price and the bond price) by hedge funds that had to exit US Treasuries in large volumes.

Another factor driving the reversal was the push back from the plutocrats. Paul Krugman is spot on here.

9. Elon Musk and DOGE conflicts of interest.

Job cuts at the US traffic safety regulator instigated by Elon Musk’s so-called Department of Government Efficiency disproportionately hit staff assessing self-driving risks, hampering oversight of technology on which the world’s richest man has staked the future of Tesla. Of roughly 30 National Highway Traffic Safety Administration workers dismissed in February as part of Musk’s campaign to shrink the federal workforce, many were in the “office of vehicle automation safety”... The NHTSA, which has been a thorn in Tesla’s side for years, has eight active investigations into the company after receiving — and publishing — more than 10,000 complaints from members of the public. Morale at the agency, which has ordered dozens of Tesla recalls and delayed the rollout of the group’s self-driving and driver-assistance software, has plunged following Doge’s opening salvo of job cuts, according to current and former NHTSA staff...Musk has promised customers and investors that Tesla will launch a driverless ride-hailing service in Austin, Texas by June and start production of a fleet of autonomous “cybercabs” next year. To do so, Tesla needs an exemption from the NHTSA to operate a non-standard driverless vehicle on American roads because Musk’s cybercabs have neither pedals nor a steering wheel... After a spate of incidents, the NHTSA in 2021 introduced a standing general order that requires carmakers to report within 24 hours any serious accidents involving vehicles equipped with advanced driver assistance or automated driving systems. Enforcing the order has been a vital tool for the agency to launch investigations into Tesla and other carmakers because there is no federal regulatory framework to govern cars not under human control. It was critical for a recall of 2mn Teslas in December 2023 for an update that would force drivers to pay attention when its autopilot assistance software was engaged.

10. Costs of Brexit

A variety of studies by the National Institute of Economic and Social Research, the Economics Observatory and the Centre for Economic Reform suggest that by 2022, business investment would have been 10-12.4 per cent higher but for Brexit. Former Bank of England Monetary Policy Committee member Jonathan Haskel said lost investment had already cost the UK £29bn. Other studies are less downbeat — the strength of UK service industries has softened the impact — but all point in one direction. The Office for Budget Responsibility continues to predict a 4 per cent permanent hit to UK productivity and a 15 per cent long-run fall in exports and imports. Even a more hopeful recent report by the LSE’s Centre for Economic Performance found that 16,400 businesses had simply stopped exporting to the EU after 2021.

11. Big Law deserves the Trump treatment. The decision by Paul Weiss, a storied US Law firm, to cut a deal with the US Government has saved it from an executive order by President Trump that in effect banned it from appearing in federal courts and cases over claims that its work on progressive causes undermined the judicial system.

Paul Weiss is not the only firm to have been targeted by the Trump administration, and judges have since frozen critical parts of similar orders against Jenner & Block, WilmerHale and Perkins Coie for being illegal. But rather than litigate, Karp cut a deal with Trump that cancelled the executive order in exchange for concessions including $40mn worth of pro bono legal services on issues important to the president... Skadden Arps, an arch-rival to Paul Weiss for many of its corporate clients, reached a deal with Trump to offer $100mn worth of pro bono services to avoid being hit by an executive order. And this week, the deals kept apace. On Tuesday and Wednesday, Willkie Farr & Gallagher and Milbank, respectively, reached similar agreements to the one Skadden struck, meaning four major firms have now forged deals with the White House. In the Willkie and Milbank deals, the firms agreed to perform $100mn worth of pro bono legal services to Trump’s pet causes... some such as Perkins Coie, Jenner & Block and WilmerHale have resisted.... “No one is willing to go on the record because everyone’s concerned. I don’t want to pop my head up because you don’t know how it’s going to get smacked. But that’s very different from saying we don’t support what was done.” Another corporate adviser is more blunt: “It was a mafia-like shakedown . . . There was no choice. Do you have a choice whether to pay the mob?”

... While a large number of small and medium-sized firms are willing to support Perkins Coie in its legal effort to fight sanctions imposed by the Trump administration, the Financial Times revealed at the weekend that not one of the 20 top law firms in the US — most of which have large dealmaking businesses — has so far given their “unconditional support” to the effort... Shortly after Trump targeted Perkins Coie and Covington, Karp contacted the heads of several law firms to try to organise support for them. The response was almost non-existent, and also failed to materialise when the White House issued an executive order against Paul Weiss. “Disappointingly, far from support, we learned that certain other firms were seeking to exploit our vulnerabilities by aggressively soliciting our clients and recruiting our attorneys,” he wrote in the email to employees of the firm after he reached a deal with Trump... Some clients warned the firm’s partners that unless the matter was resolved swiftly, they would move their business elsewhere... During the meeting at the Oval Office, in a move that was not expected by Karp, the president patched in on speaker Robert Giuffra, the co-chair of rival firm Sullivan & Cromwell and a Trump donor, to help hammer out a truce. Karp swallowed his pride and agreed to the terms imposed by Trump...

Paul Weiss is one of a handful of firms that has created a thriving free-agent market for lawyers. Partners a decade ago would make perhaps $3mn or $4mn a year and would enjoy lifetime employment and generous pensions. With the growth of private equity firms, hard-knuckled hedge funds and a regular churn of multibillion-dollar corporate acquisitions, a small set of lawyers now command eight-figure pay packages and have no reluctance about jumping firms for the highest bidder... today’s lavishly paid top talent are less likely to display allegiance... One lawyer who has gone up against Paul Weiss put it more bluntly: “There’s too much fucking money. When a Big Law partnership is $2mn a year, people can have some principles because the fall isn’t so bad.” The calculation changes entirely, the person says, “when they are making $20mn a year”. Under Karp’s leadership, the firm has often been a ruthless advocate for the powerful. Its biggest clients include Apollo Global Management and Goldman Sachs, while it has also represented members of the Sackler family, who founded Purdue Pharma, the pharmaceutical behemoth that has been accused by prosecutors of stoking the US opioid crisis. Indeed, one of the considerations for the firm was its stable of private equity clients, many of whom are Republicans. As one partner puts it, if the firm only acted for clients whose ethics they agreed with then they would have no clients.

Arizona is experimenting with a reform to break the stranglehold of Big Law.

Since 2021, Arizona has been dishing out law licences under an “alternative business structure” programme that allows non-lawyers to own and run law firms. In February, the state’s Supreme Court issued a licence to global accounting firm KPMG, which plans to challenge major law firms for low-margin, high-volume work such as reviewing contracts. It’s a notable departure from previous practice, whereby state regulators restricted ownership of law firms to practising lawyers and strictly forbade non-lawyers from sharing in the fees or profits from legal work... The state has already granted over 100 other ABS permits to businesses that range from a unit of cut-price legal adviser Rocket Lawyer to Axiom, a nationwide staffing company that rents out lawyers on demand, like an Uber. Texas, Utah and Washington are considering similar systems. Together, these add up to a significant shifting of the ground underneath the feet of traditional law firms in the US, and the list will soon be swelled by more accounting and wealth management firms of national renown, according to advisers working on those applications. Arizona’s initiative follows liberalisation of law firm ownership in the UK and other countries, and is turbocharging innovation in the business of law across the US, with entrepreneurs and investors already testing the limits of existing state bar rules... the UK, which opened up its legal sector to outsiders in 2011. Law firms there are permitted to accept outside investment or float on the stock exchange, while non-law firms can also add legal practices to their offerings.

12. US corporate profits are at record highs.

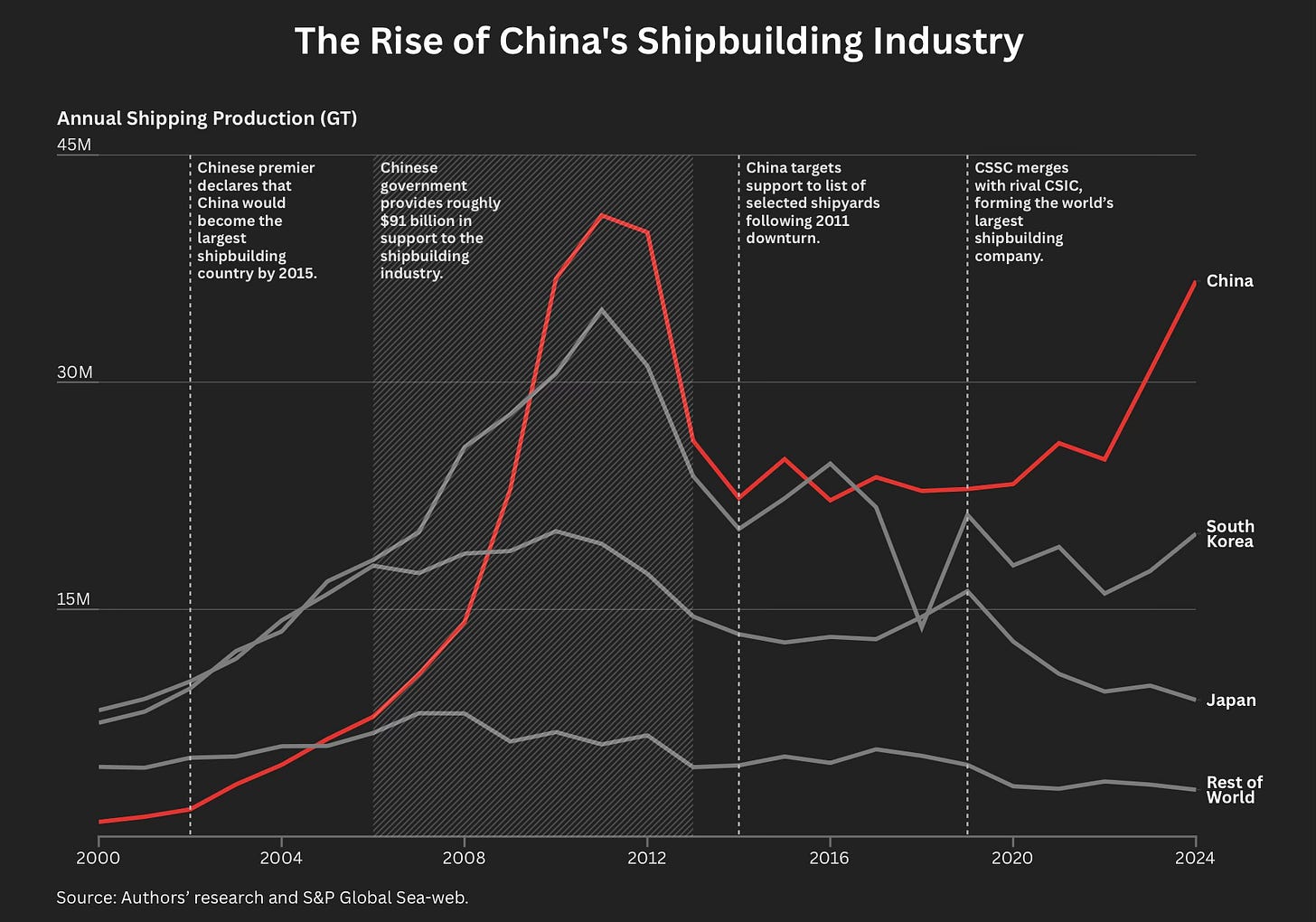

Shipyards across the United States built just five large ocean-going merchant vessels in 2024, combining to a volume of 76,000 gross tons (GT). In the same year, just one Chinese shipbuilder, the state-owned China State Shipbuilding Corporation (CSSC), delivered over 250 ships, adding up to a staggering 14 million GT. That is more vessels by tonnage than the entire U.S. shipbuilding industry has produced since the end of World War II combined. When adding in the rest of China’s shipyards, the scale of the challenge before the United States and its allies becomes impossible to ignore… China’s rise in the global commercial shipbuilding industry has been extraordinary. The country’s market share surged from a mere 5 percent of the world total in 2000 to over 53 percent in 2024. South Korea and Japan, the only two other prominent players in the industry, have seen their combined share slip from 74 percent to 42 percent over the same period.

There’s an important strategic dimension to shipbuilding industry, especially the way China has structured its industry.

Many of the shipyards that support China’s commercial production also produce warships for the Chinese navy. The ability to leverage dual-use technologies, infrastructure, and materials for both commercial and naval shipbuilding provides cost savings and strategic benefits. In peacetime, orders for merchant ships sustain demand that keeps dual-use production lines humming, and during economic downturns naval ship orders can help offset downswings in commercial markets. In wartime, commercial production lines can be converted to naval production, rapidly scaling up the ability to churn out and repair warships.

The article describes how a tightly interlocked web of private and state-owned shipbuilders has enabled China to build this dual-use industrial complex. Foreign buyers have been central to building and sustaining this Chinese industry at such scale.

Foreign firms—many of which are based in countries with close defense relationships with the United States—are pouring billions of dollars of ship orders and transferring key technologies to China’s military industrial base. As a result, they are inadvertently bolstering China’s naval modernization… Between 2019 and 2024, foreign firms (outside of China and Hong Kong) purchased over 70 percent of all ships produced in China. Despite the visible ties between China’s Tier 1 shipyards and China’s navy, foreign buyers have ordered heavily from these yards. Between 2019 and 2024, foreign firms purchased 305 commercial vessels from Tier 1 shipyards alone, collectively bringing in tens of billions of dollars in revenue and pushing China’s naval yards further into the forefront of the global commercial shipbuilding market… Taken together, the hundreds of orders placed by foreign companies into Chinese shipyards have amounted to a massive injection of funds. According to China’s national shipbuilding industry association, the country’s commercial ship exports brought in a staggering $43 billion in 2024.

No comments:

Post a Comment