Good MGI analysis of the prevalence of superstar effects in firms, sectors, and cities.

For firms,

For firms, we analyze nearly 6,000 of the world’s largest public and private firms, each with annual revenues greater than $1 billion, that together make up 65 percent of global corporate pretax earnings. In this group, economic profit is distributed along a power curve, with the top 10 percent of firms capturing 80 percent of economic profit among companies with annual revenues greater than $1 billion. We label companies in this top 10 percent as superstar firms. The middle 80 percent of firms record near-zero economic profit in aggregate, while the bottom 10 percent destroys as much value as the top 10 percent creates. The top 1 percent by economic profit, the highest economic-value- creating firms in our sample, account for 36 percent of all economic profit for companies with annual revenues greater than $1 billion... Today’s superstar firms have 1.6 times more economic profit on average than superstar firms 20 years ago. Today’s bottom-decile firms have 1.5 times more economic loss on average than their counterparts 20 years ago, with one-fifth of them (a growing share) unable to generate enough pretax earnings to sustain interest payments on their debt... In each of the past two decades (corresponding to a business cycle), nearly 50 percent of all superstar firms fell out of the top 10 percent during the business cycle and when they fell, 40 percent fell to the bottom 10 percent. The top 1 percent is also contestable, with two-thirds being new entrants to this top rank in the last cycle... Superstar firms from emerging economies, for instance, have a higher churn rate of 60 percent compared with 40 percent for firms from developed economies. Overall, after adjusting for the growth of M&A activity since the 1990s, we find no evidence of an economy- wide reduction in churn over time; in other words, contestability has remained about the same... The sector and geographic diversity of firms in the top 10 percent and the top 1 percent by economic profit is greater today than 20 years ago. The 575 superstar firms in our analysis exhibit widely acknowledged markers of successful firms: they include 315 of the world’s 500 largest firms by market capitalization, 230 of the world’s 500 most valuable brands, 188 of the world’s 500 best employers (as rated by their employees), and 53 of the world’s 100 most innovative companies.

About sectors,

For sectors, we analyze 24 sectors of the global economy that encompass all private- sector business establishments. We find that 70 percent of gains in gross value added and gross operating surplus have accrued to establishments in just a handful of sectors over the past 20 years. This is in contrast to previous decades, in which gains were spread over a wider range of sectors. While the superstar effect is not as strong for sectors as it is for firms, what we have identified as superstar sectors over the past 20 years include financial services, professional services, real estate, and two smaller (in gross value-added and gross operating-surplus terms) but rapidly gaining sectors: pharmaceuticals and medical products, and internet, media, and software. The shift in global surplus to today’s superstar sectors amounted to nearly $3 trillion in 2017 alone across the G-20 countries... In addition to global superstar sectors, we also identify regional superstar sectors where the dynamics are more localized: for example, regional superstar sectors include automobile and machinery production in China, Germany, Japan, and Korea; construction in China, India, and the United States; hospitality services in France, Italy, and the United Kingdom; and recently, natural resource production in the United States and Canada. Today’s superstar sectors share one or more of the following attributes: fewer fixed capital and labor inputs, more intangible inputs, and higher levels of digital adoption and regulatory oversight than other sectors. With the exception of real estate, superstar sectors are two to three times more skill-intensive than sectors declining in share of income in the G-20 countries. In addition, superstar sectors tend to have relatively higher R&D intensity and lower capital and labor intensity than other sectors. The higher returns in superstar sectors accrue more to corporate surplus rather than labor, flowing to intangible capital such as software, patents, and brands.

And cities,

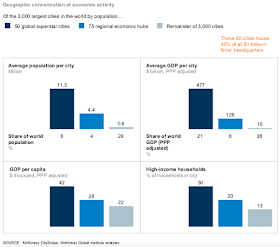

For cities, we analyze 3,000 of the world’s largest cities, each with a population of at least 150,000 and $125 million GDP (adjusted for purchasing power parity), that together account for 67 percent of world GDP. Fifty cities are superstars by our definition, among them Boston, Frankfurt, London, Manila, Mexico City, Mumbai, New York, Sydney, Sao Paulo, Tianjin, and Wuhan. The 50 cities account for 8 percent of global population, 21 percent of world GDP, 37 percent of urban high-income households, and 45 percent of headquarters of firms with more than $1 billion in annual revenue. The average GDP per capita in these cities is 45 percent higher than that of peers in the same region and income group, and the gap has grown over the past decade. Emerging-market superstar cities have increased their contribution to global GDP by 30 to 40 percent in the past decade while advanced-economy superstar cities have increased their share of global GDP by 20 to 30 percent. Over the past decade, we find a 25 percent churn rate among superstar cities... Of the 50 superstar cities, 31 are ranked among the most globally integrated cities, 27 among the world’s 50 most innovative cities, 26 among the world’s top 50 financial centers, and 23 among the world’s 50 “digitally smartest” cities. Twenty-two are national and regional capitals, while 22 are among the world’s largest container ports.

And the interaction among the three,

We find linkages between firms, sectors, and cities that may be reinforcing superstar status and that raise the question of whether a “superstar ecosystem” exists. For example, superstar sectors generate surplus mostly to corporations rather than to labor, driving a geographically concentrated wealth effect in superstar cities with a disproportionate share of asset management activity and high-income-household investors. Labor gains from superstar sectors are also concentrated in narrow geographic footprints within countries, often in superstar cities and accrue mostly to high-skill workers.